Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this question, please? the solution is already posted but I don't understand part 2? why 6000 was added to the

Can someone help me with this question, please? the solution is already posted but I don't understand part 2? why 6000 was added to the 35,000 in the " 35,000 +(6000 x 0.30) when 6000 was a loss? does that mean it is always added regardless if its a gain or loss? what if it were a 6000 gain instead of 6000 loss? would it still be added to the 35,000? Please help and thanks in advance!

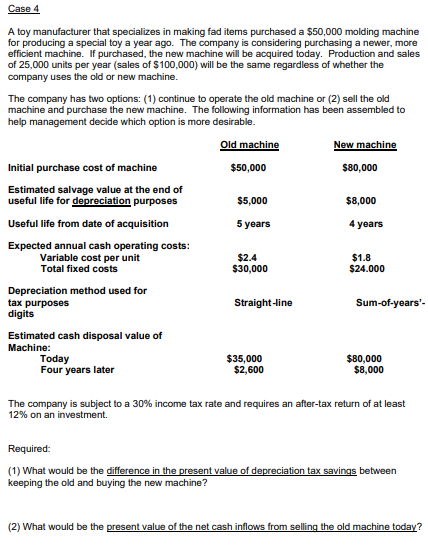

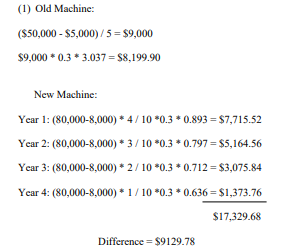

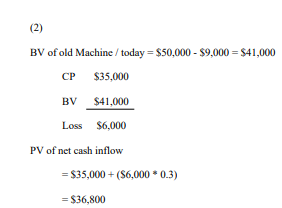

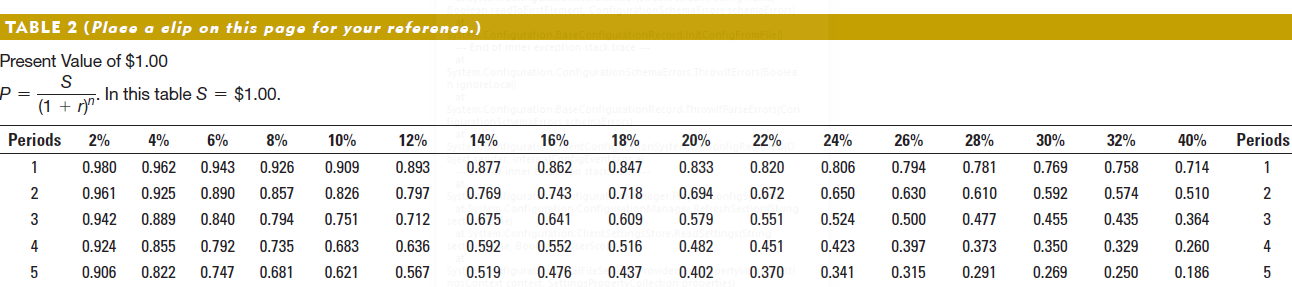

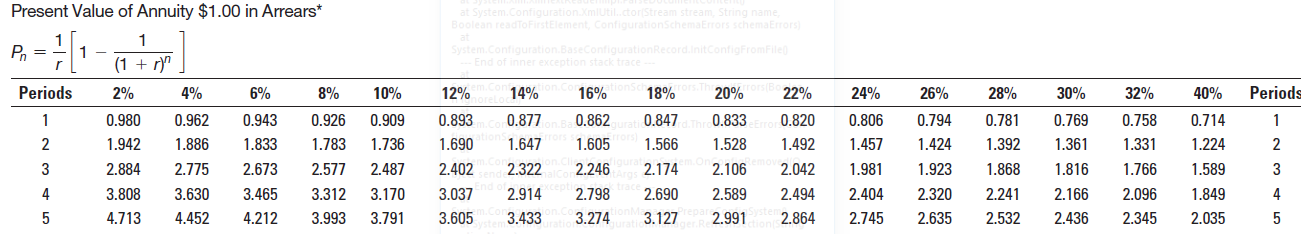

Case 4 A toy manufacturer that specializes in making fad items purchased a $50.000 molding machine for producing a special toy a year ago. The company is considering purchasing a newer, more officient machine. If purchased, the new machine will be acquired today. Production and sales of 25.000 units per year (sales of $100,000) will be the same regardless of whether the company uses the old or new machine The company has two options: (1) continue to operate the old machine or (2) sell the old machine and purchase the new machine. The following information has been assembled to help management decide which option is more desirable. Old machine New machine Initial purchase cost of machine $50,000 $80,000 Estimated salvage value at the end of useful life for depreciation purposes $5,000 $8,000 Useful life from date of acquisition 5 years 4 years Expected annual cash operating costs: Variable cost per unit Total fixed costs $2.4 $30,000 $1.8 $24.000 Depreciation method used for tax purposes digits Straight-line Sum-of-years'. Estimated cash disposal value of Machine: Today Four years later $35,000 $2,600 $80,000 $8,000 The company is subject to a 30% income tax rate and requires an after-tax return of at least 12% on an investment. Required: (1) What would be the difference in the present value of depreciation tax savings between keeping the old and buying the new machine? (2) What would be the present value of the net cash inflows from selling the old machine today? (1) Old Machine: ($50,000 - $5,000)/5 = $9,000 $9,000 * 0.3 * 3.037 = $8,199.90 New Machine: Year 1: (80,000-8,000) * 4/10 *0.3 +0.893 = $7,715.52 Year 2: (80,000-8,000) * 3/10 *0.3 * 0.797 = $5,164.56 Year 3: (80,000-8,000) * 2/10 *0.3 * 0.712 = $3,075.84 Year 4: (80,000-8,000) * 1/10 *0.3 * 0.636 = $1,373.76 $17,329.68 Difference = $9129.78 BV of old Machine /today = $50,000 - $9,000 = $41,000 CP $35,000 BV $41,000 Loss $6,000 PV of net cash inflow = $35,000 + ($6,000 * 0.3) = $36,800 P- S TABLE 2 (Placo a clip on this page for your reference.) Present Value of $1.00 P = a + on. In this table S = $1.00. Periods 2% 4% 6% 8% 10% 12% 14% 16% 1 0.980 0.962 0.943 0.926 0.909 0.893 0.877 0.862 2 0.961 0.925 0.890 0.857 0.826 0.797 0.7690.743 3 0.942 0.889 0.840 0.794 0.751 0.712 0.675 0.641 4 0.924 0.855 0.792 0.735 0.683 0.636 0.592 0.552 0.906 0.822 0.747 0.681 0.621 0.567 0.519 0.476 18% 0.847 0.718 0.609 0.516 0.437 20% 0.833 0.694 0.579 0.482 de 0.402 22% 0.820 0.672 0.551 0.451 0.370 24% 0.806 0.650 0.524 0.423 0.341 26% 0.794 0.630 0.500 0.397 0.315 28% 0.781 0.610 0.477 0.373 0.291 30% 0.769 0.592 0.455 0.350 0.269 32% 0.758 0.574 0.435 0.329 0.250 40% 0.714 0.510 0.364 0.260 0.186 Periods 1 2 3 4 Present Value of Annuity $1.00 in Arrears* 1 1 1 Pa = +1 -11 to Periods Periods 2% 0.980 1.942 2.884 3.808 4.713 2 3 4 4% 0.962 1.886 2.775 3.630 4.452 6% 0.943 1.833 2.673 3.465 4.212 8% 0.926 1.783 2.577 3.312 3.993 10% 0.909 1.736 2.487 3.170 3.791 12% 14% 16% in 18% s. 20% 22% 24% 26% 0.8930.877.0.862 ura 0.847.0.8330.820 0.806 0.794 1.690 1.647 1.605 1.566 1.528 1.492 1.4571.424 2.402 2.322 2.246 2.174 2.106 2.0421.981 1.923 3.037 2.914 2.798 2.690 2.5892.494 2.404 2.320 3.605 3.433 3.274 3.127 2.991 2.864 2.745 2.635 28% 0.781 1.392 1.868 2.241 2.532 30% 0.769 1.361 1.816 2.166 2.436 32% 40% 0.758 0.714 1.3311.224 1.766 1.589 2.096 1.849 2.345 2.035 2 3 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started