Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help out The management of Hearth and Home provides you with the following projections of net sales (in 000's) for the next three

Can someone help out

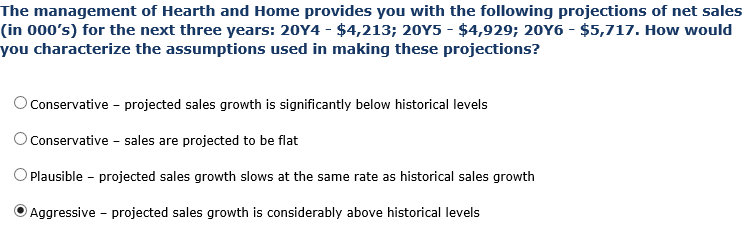

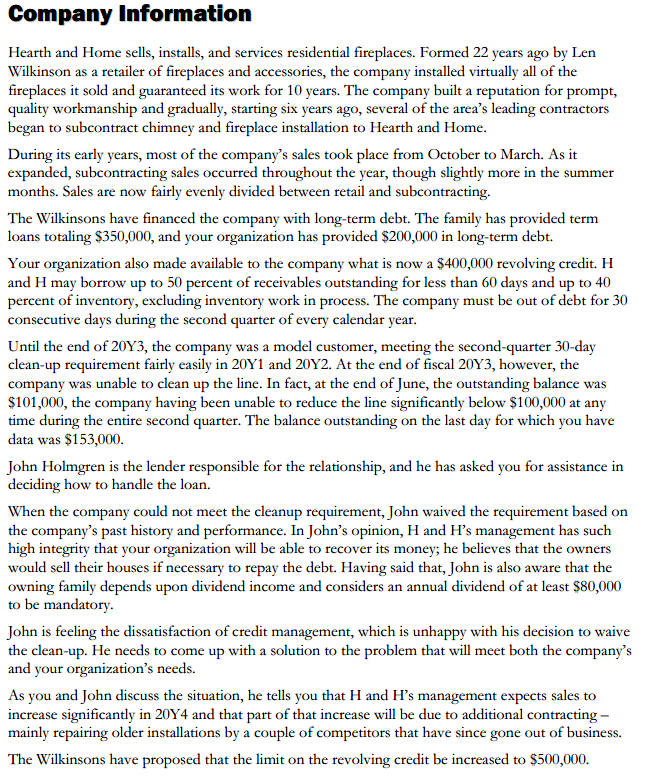

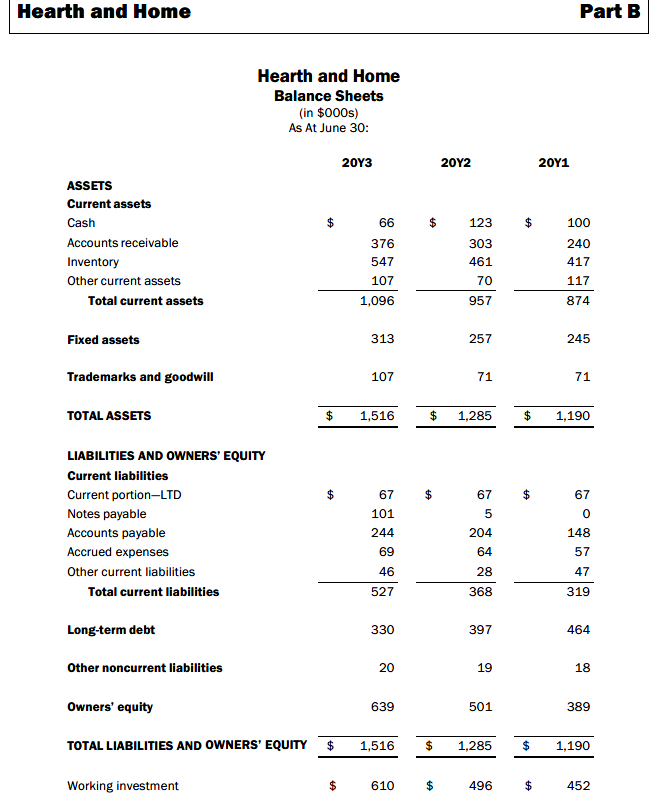

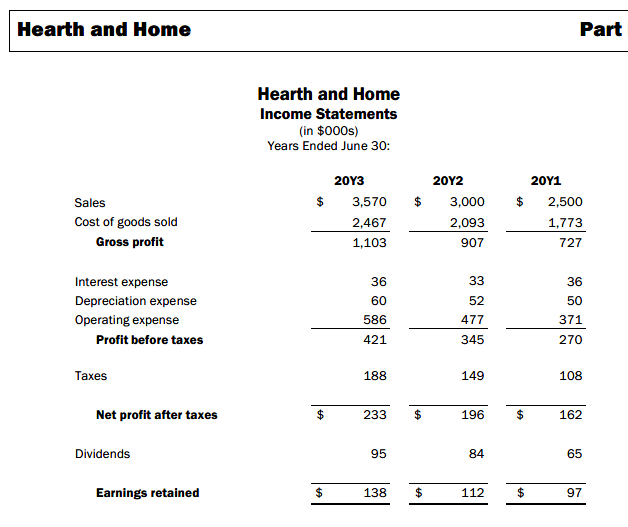

The management of Hearth and Home provides you with the following projections of net sales (in 000's) for the next three years: 2044 - $4,213; 2015 - $4,929; 2016 - $5,717. How would you characterize the assumptions used in making these projections? O Conservative - projected sales growth is significantly below historical levels O Conservative - sales are projected to be flat O Plausible - projected sales growth slows at the same rate as historical sales growth O Aggressive - projected sales growth is considerably above historical levels Company Information Hearth and Home sells, installs, and services residential fireplaces. Formed 22 years ago by Len Wilkinson as a retailer of fireplaces and accessories, the company installed virtually all of the fireplaces it sold and guaranteed its work for 10 years. The company built a reputation for prompt, quality workmanship and gradually, starting six years ago, several of the area's leading contractors began to subcontract chimney and fireplace installation to Hearth and Home. During its early years, most of the company's sales took place from October to March. As it expanded, subcontracting sales occurred throughout the year, though slightly more in the summer months. Sales are now fairly evenly divided between retail and subcontracting. The Wilkinsons have financed the company with long-term debt. The family has provided term loans totaling $350,000, and your organization has provided $200,000 in long-term debt. Your organization also made available to the company what is now a $400,000 revolving credit. H and H may borrow up to 50 percent of receivables outstanding for less than 60 days and up to 40 percent of inventory, excluding inventory work in process. The company must be out of debt for 30 consecutive days during the second quarter of every calendar year. Until the end of 20Y3, the company was a model customer, meeting the second-quarter 30-day clean-up requirement fairly easily in 20Y1 and 2072. At the end of fiscal 20Y3, however, the company was unable to clean up the line. In fact, at the end of June, the outstanding balance was $101,000, the company having been unable to reduce the line significantly below $100,000 at any time during the entire second quarter. The balance outstanding on the last day for which you have data was $153,000. John Holmgren is the lender responsible for the relationship, and he has asked you for assistance in deciding how to handle the loan. When the company could not meet the cleanup requirement, John waived the requirement based on the company's past history and performance. In John's opinion, H and H's management has such high integrity that your organization will be able to recover its money; he believes that the owners would sell their houses if necessary to repay the debt. Having said that, John is also aware that the owning family depends upon dividend income and considers an annual dividend of at least $80,000 to be mandatory. John is feeling the dissatisfaction of credit management, which is unhappy with his decision to waive the clean-up. He needs to come up with a solution to the problem that will meet both the company's and your organization's needs. As you and John discuss the situation, he tells you that H and H's management expects sales to increase significantly in 20Y4 and that part of that increase will be due to additional contracting - mainly repairing older installations by a couple of competitors that have since gone out of business. The Wilkinsons have proposed that the limit on the revolving credit be increased to $500,000. Hearth and Home Part B Hearth and Home Balance Sheets (in $000s) As At June 30: 20Y3 20Y2 20Y1 $ $ ASSETS Current assets Cash Accounts receivable Inventory Other current assets Total current assets 66 376 547 107 1,096 123 303 461 100 240 417 957 Fixed assets 313 257 245 Trademarks and goodwill 107 71 TOTAL ASSETS $ 1,516 $ 1,285 $ 1,190 67 $ 67 LIABILITIES AND OWNERS' EQUITY Current liabilities Current portion-LTD Notes payable Accounts payable Accrued expenses Other current liabilities Total current liabilities 368 Long-term debt 397 Other noncurrent liabilities Owners' equity 501 TOTAL LIABILITIES AND OWNERS' EQUITY $ 1,516 $ 1,285 $ 1,190 Working investment $ 610 $ 496 $ 452 Hearth and Home Part Hearth and Home Income Statements (in $000s) Years Ended June 30: $ $ 20Y2 3,000 $ Sales Cost of goods sold Gross profit 20Y3 3,570 2,467 1,103 20Y1 2,500 1,773 727 2,093 907 Interest expense Depreciation expense Operating expense Profit before taxes 36 60 586 421 371 270 345 Taxes 188 149 108 Net profit after taxes 233 196 162 Dividends 95 84 Earnings retained $ 138 $ 112 $ 97 The management of Hearth and Home provides you with the following projections of net sales (in 000's) for the next three years: 2044 - $4,213; 2015 - $4,929; 2016 - $5,717. How would you characterize the assumptions used in making these projections? O Conservative - projected sales growth is significantly below historical levels O Conservative - sales are projected to be flat O Plausible - projected sales growth slows at the same rate as historical sales growth O Aggressive - projected sales growth is considerably above historical levels Company Information Hearth and Home sells, installs, and services residential fireplaces. Formed 22 years ago by Len Wilkinson as a retailer of fireplaces and accessories, the company installed virtually all of the fireplaces it sold and guaranteed its work for 10 years. The company built a reputation for prompt, quality workmanship and gradually, starting six years ago, several of the area's leading contractors began to subcontract chimney and fireplace installation to Hearth and Home. During its early years, most of the company's sales took place from October to March. As it expanded, subcontracting sales occurred throughout the year, though slightly more in the summer months. Sales are now fairly evenly divided between retail and subcontracting. The Wilkinsons have financed the company with long-term debt. The family has provided term loans totaling $350,000, and your organization has provided $200,000 in long-term debt. Your organization also made available to the company what is now a $400,000 revolving credit. H and H may borrow up to 50 percent of receivables outstanding for less than 60 days and up to 40 percent of inventory, excluding inventory work in process. The company must be out of debt for 30 consecutive days during the second quarter of every calendar year. Until the end of 20Y3, the company was a model customer, meeting the second-quarter 30-day clean-up requirement fairly easily in 20Y1 and 2072. At the end of fiscal 20Y3, however, the company was unable to clean up the line. In fact, at the end of June, the outstanding balance was $101,000, the company having been unable to reduce the line significantly below $100,000 at any time during the entire second quarter. The balance outstanding on the last day for which you have data was $153,000. John Holmgren is the lender responsible for the relationship, and he has asked you for assistance in deciding how to handle the loan. When the company could not meet the cleanup requirement, John waived the requirement based on the company's past history and performance. In John's opinion, H and H's management has such high integrity that your organization will be able to recover its money; he believes that the owners would sell their houses if necessary to repay the debt. Having said that, John is also aware that the owning family depends upon dividend income and considers an annual dividend of at least $80,000 to be mandatory. John is feeling the dissatisfaction of credit management, which is unhappy with his decision to waive the clean-up. He needs to come up with a solution to the problem that will meet both the company's and your organization's needs. As you and John discuss the situation, he tells you that H and H's management expects sales to increase significantly in 20Y4 and that part of that increase will be due to additional contracting - mainly repairing older installations by a couple of competitors that have since gone out of business. The Wilkinsons have proposed that the limit on the revolving credit be increased to $500,000. Hearth and Home Part B Hearth and Home Balance Sheets (in $000s) As At June 30: 20Y3 20Y2 20Y1 $ $ ASSETS Current assets Cash Accounts receivable Inventory Other current assets Total current assets 66 376 547 107 1,096 123 303 461 100 240 417 957 Fixed assets 313 257 245 Trademarks and goodwill 107 71 TOTAL ASSETS $ 1,516 $ 1,285 $ 1,190 67 $ 67 LIABILITIES AND OWNERS' EQUITY Current liabilities Current portion-LTD Notes payable Accounts payable Accrued expenses Other current liabilities Total current liabilities 368 Long-term debt 397 Other noncurrent liabilities Owners' equity 501 TOTAL LIABILITIES AND OWNERS' EQUITY $ 1,516 $ 1,285 $ 1,190 Working investment $ 610 $ 496 $ 452 Hearth and Home Part Hearth and Home Income Statements (in $000s) Years Ended June 30: $ $ 20Y2 3,000 $ Sales Cost of goods sold Gross profit 20Y3 3,570 2,467 1,103 20Y1 2,500 1,773 727 2,093 907 Interest expense Depreciation expense Operating expense Profit before taxes 36 60 586 421 371 270 345 Taxes 188 149 108 Net profit after taxes 233 196 162 Dividends 95 84 Earnings retained $ 138 $ 112 $ 97Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started