can someone help solve the last 5 adjusting entries?

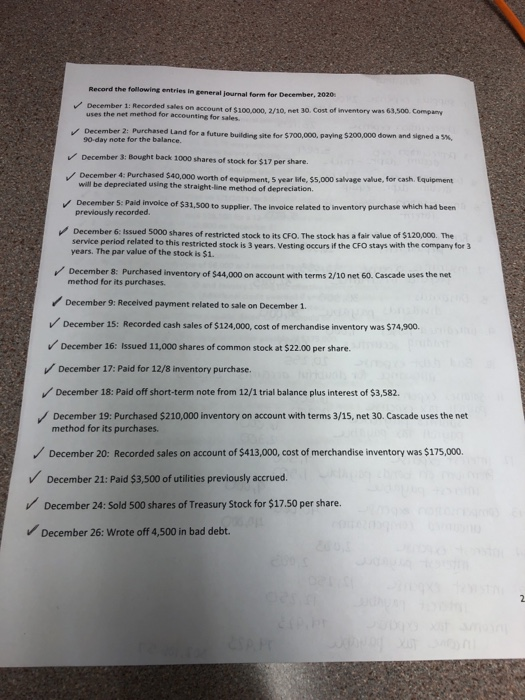

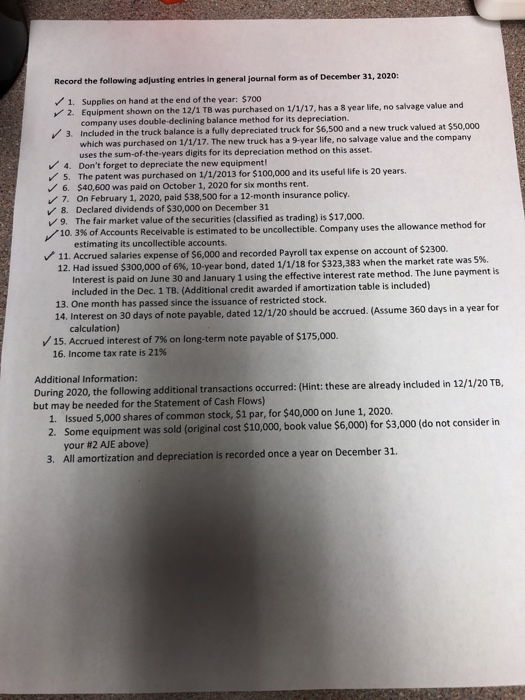

Record the following adjusting entries in general Journal form as of December 31, 2020: 1. Supplies on hand at the end of the year: $700 2. Equipment shown on the 12/1 TB was purchased on 1/1/17, has a 8 year life, no salvage value and company uses double-declining balance method for its depreciation. 3. Included in the truck balance is a fully depreciated truck for $6,500 and a new truck valued at $50,000 which was purchased on 1/1/17. The new truck has a 9-year life, no salvage value and the company uses the sum-of-the-years digits for its depreciation method on this asset. 4. Don't forget to depreciate the new equipment! 5. The patent was purchased on 1/1/2013 for $100,000 and its useful life is 20 years. 6. $40,600 was paid on October 1, 2020 for six months rent. 7. On February 1, 2020, paid $38,500 for a 12-month insurance policy. 8. Declared dividends of $30,000 on December 31 9. The fair market value of the securities (classified as trading) is $17,000. 10.3% of Accounts Receivable is estimated to be uncollectible. Company uses the allowance method for estimating its uncollectible accounts. 11. Accrued salaries expense of $6,000 and recorded Payroll tax expense on account of $2300 12. Had issued $300,000 of 6%, 10-year bond, dated 1/1/18 for $323,383 when the market rate was 5%. Interest is paid on June 30 and January 1 using the effective interest rate method. The June payment is included in the Dec. 1 TB. (Additional credit awarded if amortization table is included) 13. One month has passed since the issuance of restricted stock. 14. Interest on 30 days of note payable, dated 12/1/20 should be accrued. (Assume 360 days in a year for calculation) 15. Accrued interest of 7% on long-term note payable of $175,000 16. Income tax rate is 21% Additional Information: During 2020, the following additional transactions occurred: (Hint: these are already included in 12/1/20 TB, but may be needed for the Statement of Cash Flows) 1. Issued 5,000 shares of common stock, $1 par, for $40,000 on June 1, 2020. 2. Some equipment was sold (original cost $10,000, book value $6,000) for $3,000 (do not consider in your #2 AJE above) 3. All amortization and depreciation is recorded once a year on December 31. Record the following entries in general journal form for December, 2020 December 1: Recorded sales on account of $100.000, 2/10, net 30. Cost of inventory was 63,500. Company uses the net method for accounting for sales December 2: Purchased Land for a future building site for $700,000, paying $200,000 down and signed a 5% 90-day note for the balance. December 3: Bought back 1000 shares of stock for $17 per share. December 4: Purchased $40,000 worth of equipment, 5 year life, 55,000 salvage value, for cash. Equipment will be depreciated using the straight-line method of depreciation December 5: Paid invoice of $31,500 to supplier. The invoice related to inventory purchase which had been previously recorded. December 6: Issued 5000 shares of restricted stock to its CFO. The stock has a fair value of $120,000. The service period related to this restricted stock is 3 years. Vesting occurs if the CFO stays with the company for 3 years. The par value of the stock is $1. December 8: Purchased inventory of $44,000 on account with terms 2/10 net 60. Cascade uses the net method for its purchases. December 9: Received payment related to sale on December 1. December 15: Recorded cash sales of $124,000, cost of merchandise inventory was $74,900 December 16: Issued 11,000 shares of common stock at $22.00 per share. December 17: Paid for 12/8 inventory purchase. December 18: Paid off short-term note from 12/1 trial balance plus interest of $3,582. December 19: Purchased $210,000 inventory on account with terms 3/15, net 30. Cascade uses the net method for its purchases. December 20: Recorded sales on account of $413,000, cost of merchandise inventory was $175,000 December 21: Paid $3,500 of utilities previously accrued. December 24: Sold 500 shares of Treasury Stock for $17.50 per share. December 26: Wrote off 4,500 in bad debt. 2

can someone help solve the last 5 adjusting entries?

can someone help solve the last 5 adjusting entries?