Question

Can someone please answer this? It is one question with 2 parts You are working in the M&A advisory group at Deloitte, and have just

Can someone please answer this? It is one question with 2 parts

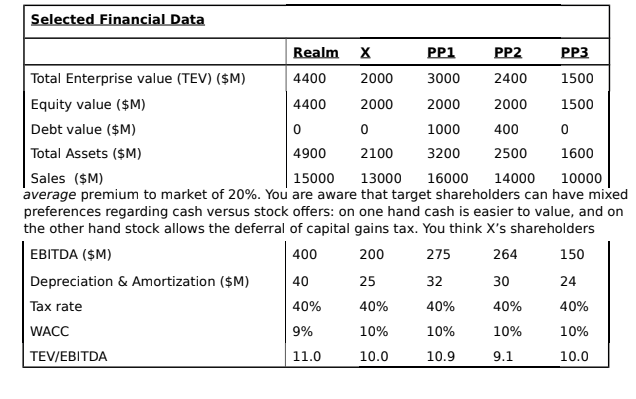

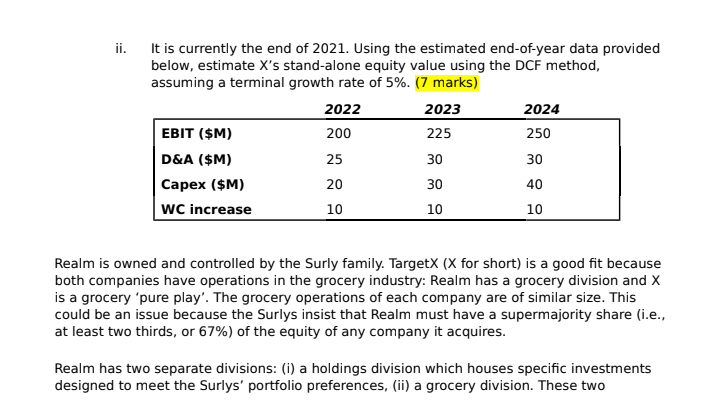

You are working in the M&A advisory group at Deloitte, and have just learned that TargetX is in play i.e., is an active candidate for acquisition. This is exciting as one of your clients (Realm corporation) has been looking to acquire such a company. Realm is owned and controlled by the Surly family. TargetX (X for short) is a good fit because both companies have operations in the grocery industry: Realm has a grocery division and X is a grocery pure play. The grocery operations of each company are of similar size. This could be an issue because the Surlys insist that Realm must have a supermajority share (i.e., at least two thirds, or 67%) of the equity of any company it acquires. Realm has two separate divisions: (i) a holdings division which houses specific investments designed to meet the Surlys portfolio preferences, (ii) a grocery division. These two divisions are roughly equal in size -- each division, for example, contributes equally to Realms total EBITDA. Both Realm and X have a single class of shares outstanding and neither has any debt. In Realms case, the zero debt level reflects the Surlys preference for no debt in their portfolio holdings division. The Surlys are not averse to levering their grocery operations, which they would be willing to lever to a target ratio of 25%. You are aware that X could be an attractive target for other firms in the grocery industry, and that moving quickly may be important. You have access to the following data relating to Realm and the remaining pure play (PP) companies in the grocery industry.

*Currently (the end of 2021), X has 100M shares outstanding, trading at $20/share.

You first want to estimate the Xs value to Realm and determine whether a successful offer is possible. If it is, you will need to decide how much to offer and in what form (stock versus cash). You are aware of previous (precedent) transactions in the sector, which closed at an would accept a mix. You also recognize the possibility of a competing bid. You estimate that PP2 poses the greatest threat. You believe Realm would have an edge in a bidding war, however, because PP2 can only generate half of the synergies that Realm can generate. Answer the following questions.

i. Estimate Xs stand-alone equity value using the TEV/EBITDA multiple method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started