Can someone please explain how to answer question (f ).

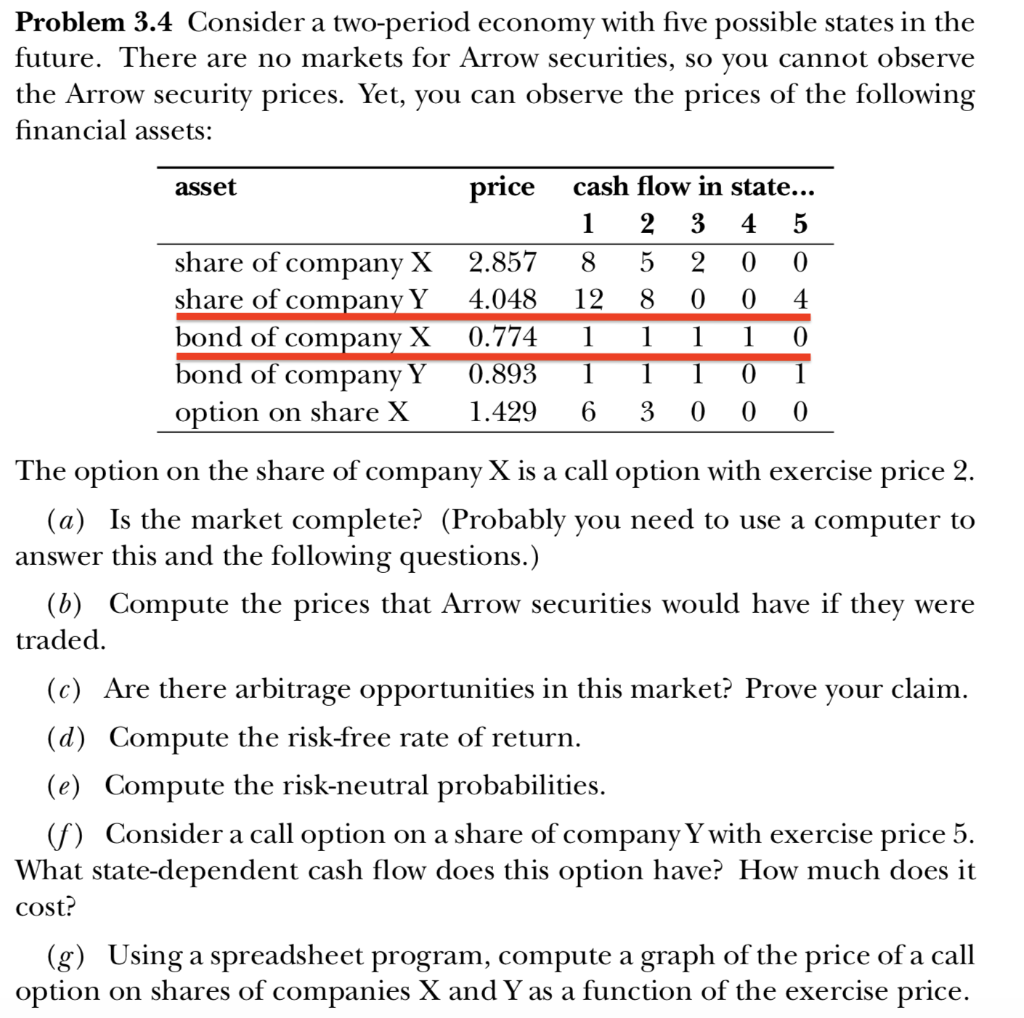

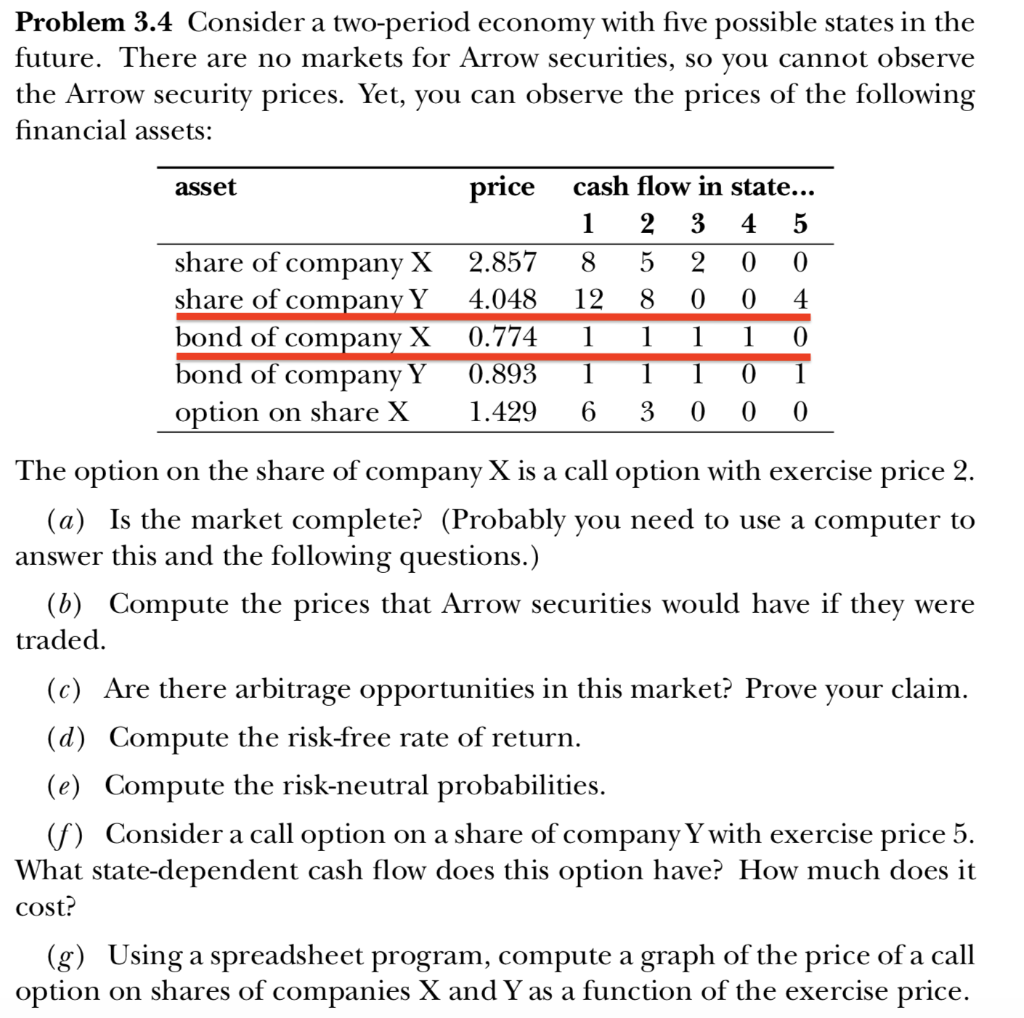

Problem 3.4 Consider a two-period economy with five possible states in the future. There are no markets for Arrow securities, so you cannot observe the Arrow security prices. Yet, you can observe the prices of the following financial assets: asset price cash flow in state... 1 2 3 4 5 share of company X 2.857 8 5 2 0 0 share of company Y 4.048 12 8 0 0 4 bond of company X 0.774 1 1 1 1 0 bond of company Y 0.893 1 1 1 0 1 option on share X 1.429 6 3 0 0 0 The option on the share of company X is a call option with exercise price 2. (a) Is the market complete? (Probably you need to use a computer to answer this and the following questions.) (b) Compute the prices that Arrow securities would have if they were traded. (c) Are there arbitrage opportunities in this market? Prove your claim. (d) Compute the risk-free rate of return. (e) Compute the risk-neutral probabilities. (f) Consider a call option on a share of company Y with exercise price 5. What state-dependent cash flow does this option have? How much does it cost? (g) Using a spreadsheet program, compute a graph of the price of a call option on shares of companies X and Y as a function of the exercise price. Problem 3.4 Consider a two-period economy with five possible states in the future. There are no markets for Arrow securities, so you cannot observe the Arrow security prices. Yet, you can observe the prices of the following financial assets: asset price cash flow in state... 1 2 3 4 5 share of company X 2.857 8 5 2 0 0 share of company Y 4.048 12 8 0 0 4 bond of company X 0.774 1 1 1 1 0 bond of company Y 0.893 1 1 1 0 1 option on share X 1.429 6 3 0 0 0 The option on the share of company X is a call option with exercise price 2. (a) Is the market complete? (Probably you need to use a computer to answer this and the following questions.) (b) Compute the prices that Arrow securities would have if they were traded. (c) Are there arbitrage opportunities in this market? Prove your claim. (d) Compute the risk-free rate of return. (e) Compute the risk-neutral probabilities. (f) Consider a call option on a share of company Y with exercise price 5. What state-dependent cash flow does this option have? How much does it cost? (g) Using a spreadsheet program, compute a graph of the price of a call option on shares of companies X and Y as a function of the exercise price