Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please help me figure out where im ging wrong on qustion 2 amd 3 and than how to do 4 please. sorry i

can someone please help me figure out where im ging wrong on qustion 2 amd 3 and than how to do 4 please.

sorry i didnt relize that i cropped it out.

i uploaded all the photos again so non of them are blurry.

these are the complete qustion and better qulity photos. there is nothing else to the qustions.

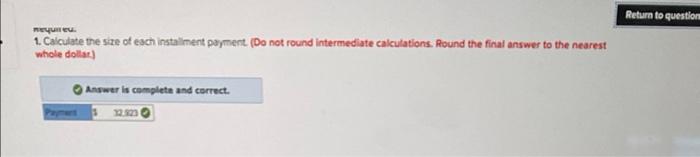

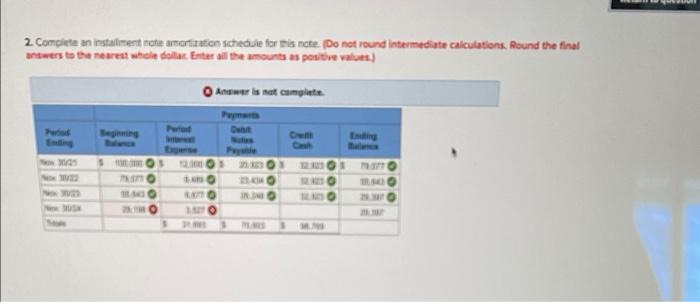

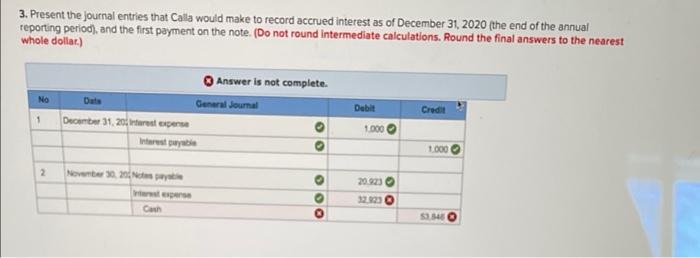

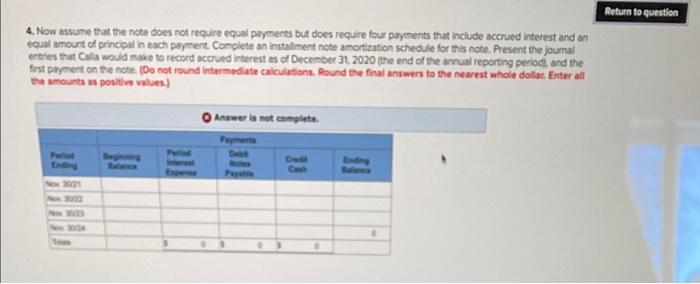

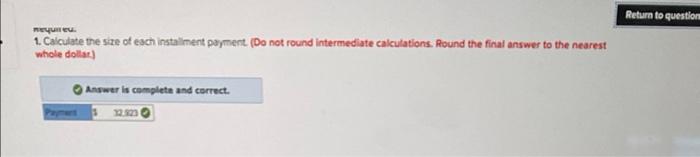

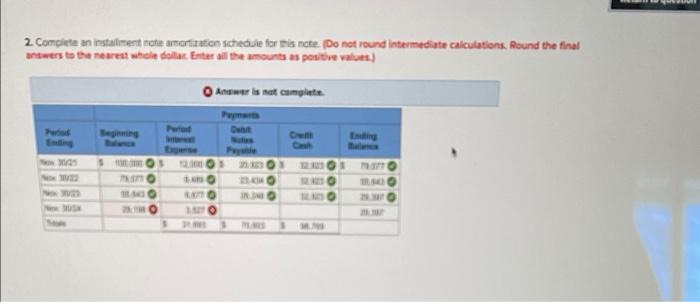

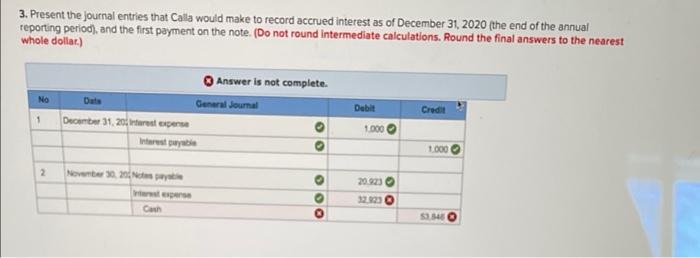

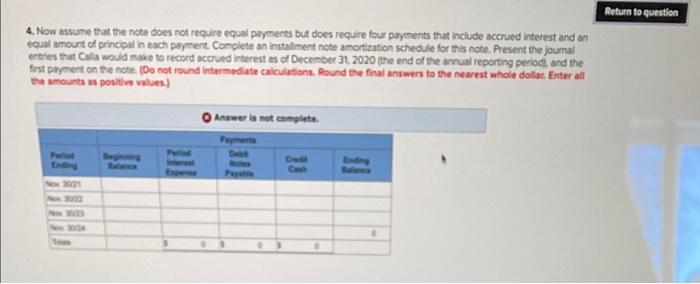

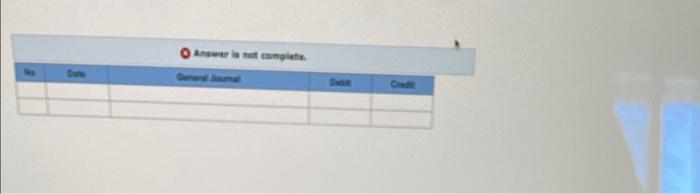

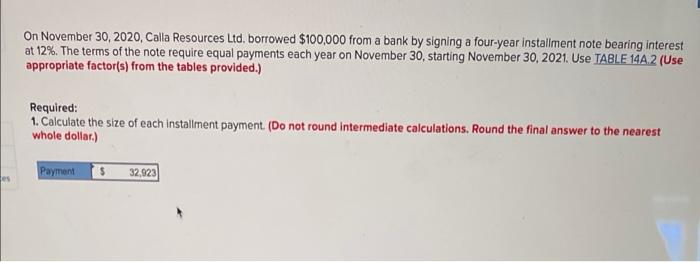

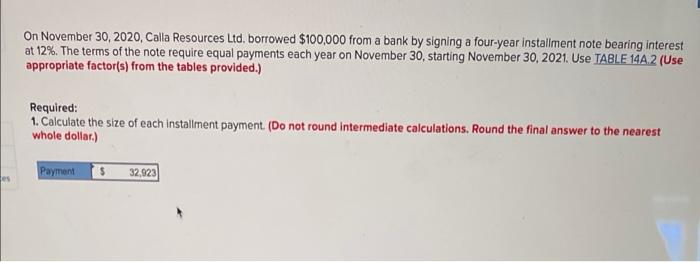

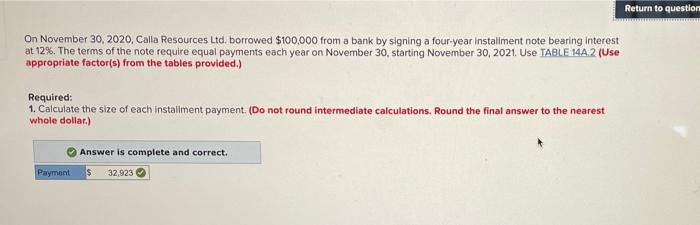

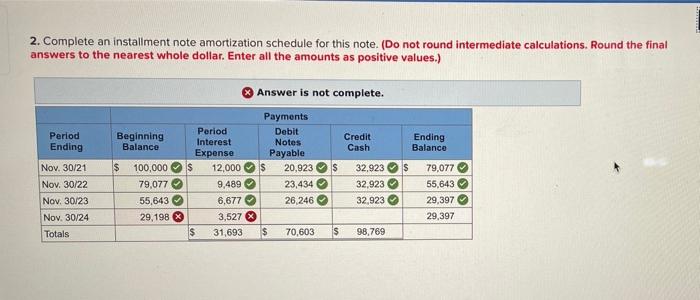

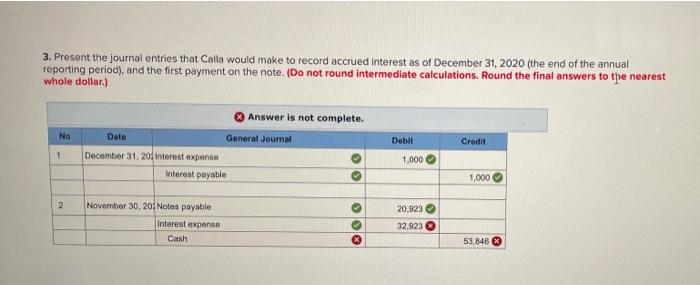

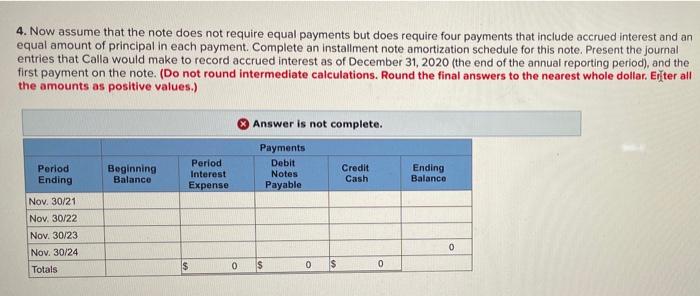

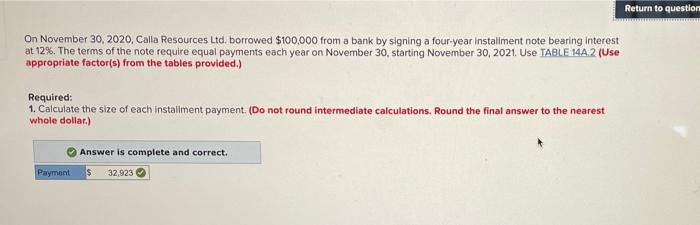

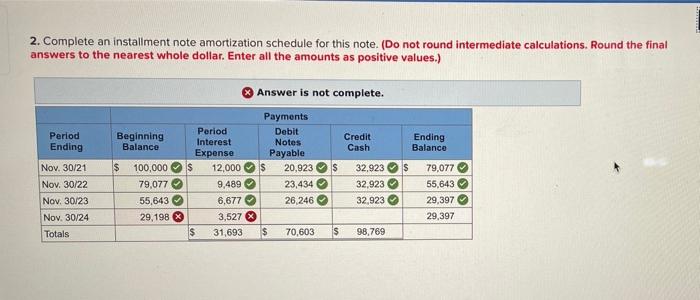

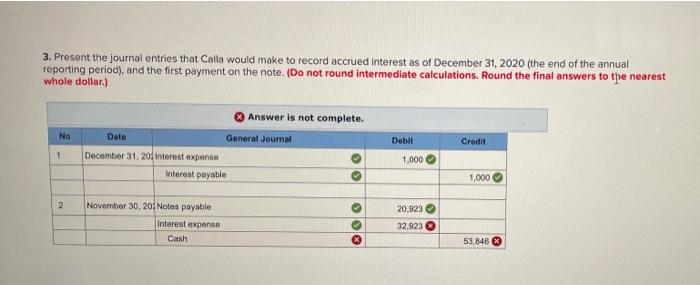

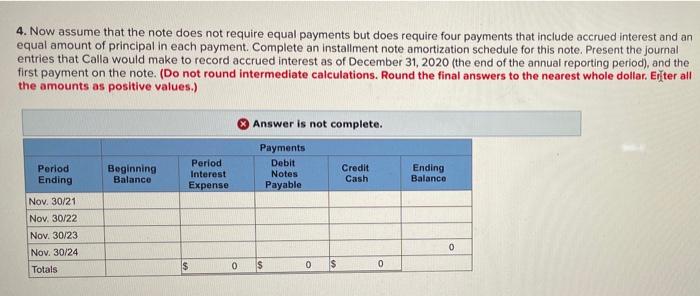

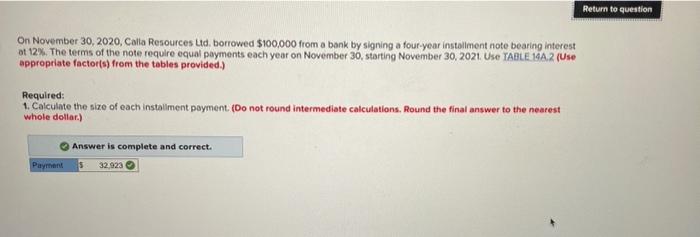

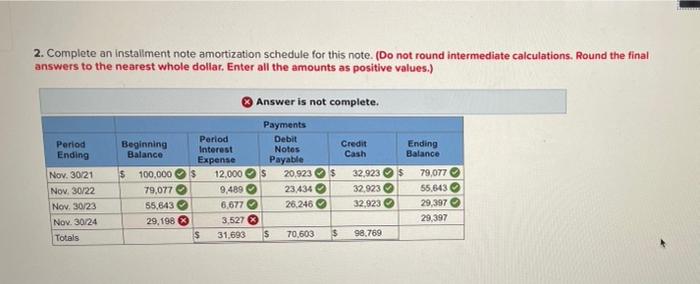

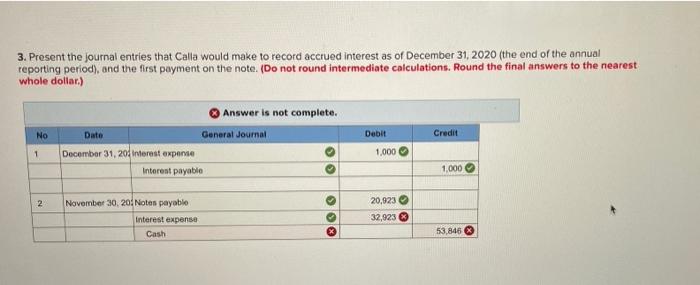

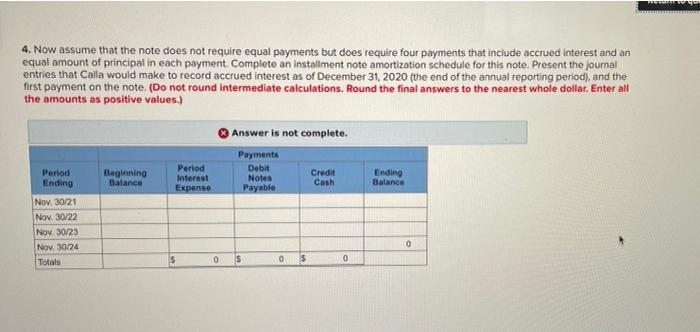

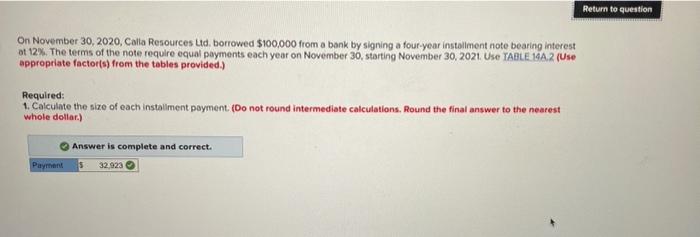

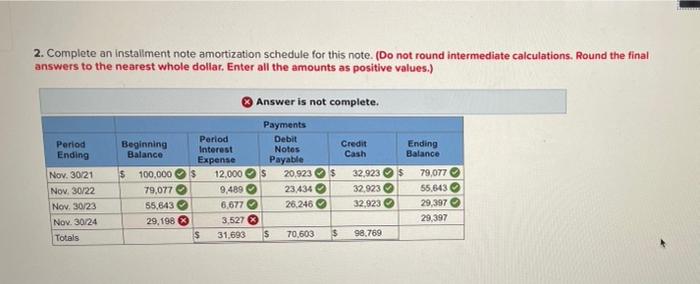

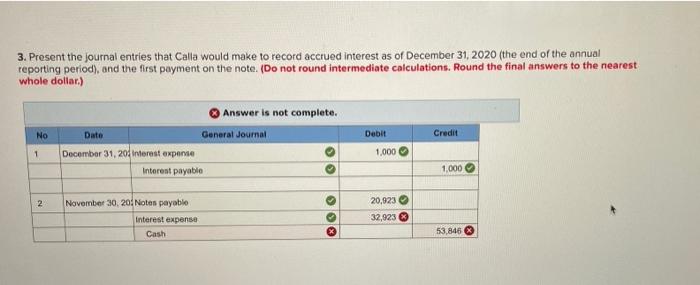

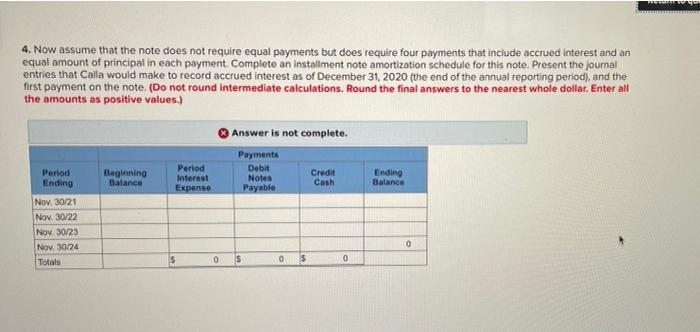

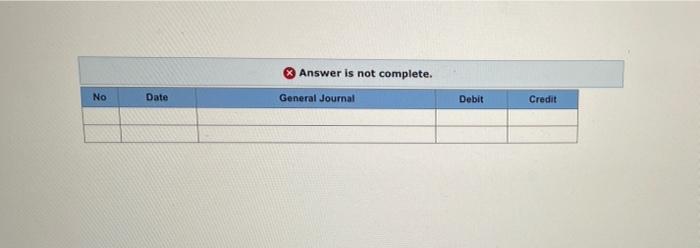

Return to question REY 1. Calculate the size of each installment payment (Do not round intermediate calculations. Round the final answer to the nearest whole dollar) Answer is complete and correct. 2. Complete an instaliment note amortization schedule for his note. (Do not round intermediate calculations. Round the final answers to the nearest while dollar. Enter all the amounts us positive values) Answer is not complete SOS OS 1 3. Present the journal entries that Calla would make to record accrued interest as of December 31, 2020 (the end of the annual reporting period), and the first payment on the note. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Answer is not complete General Journal No Du Debit Credit 1 December 31, 20 1.000 Wrestle 1 000 2 Now we 20.923 OOO Con Return to question 4. Now assume that the note does not require equal payments but does require four payments that include accrued interest and an equal amount of principal in each payment. Complete an installment note amortization schedule for this note. Present the journal entries that all would make to record accrued interest as of December 31 2020 Mhe end of the annual reporting period, and the first payment on the note. Do not round Intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values) Answer is not complete kortage On November 30, 2020, Calla Resources Ltd, borrowed $100,000 from a bank by signing a four-year installment note bearing interest at 12%. The terms of the note require equal payments each year on November 30, starting November 30, 2021. Use TABLE 14A 2 (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the size of each installment payment. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Payment 32,923 Return to question On November 30, 2020, Calle Resources Ltd, borrowed $100,000 from a bank by signing a four-year installment note bearing interest at 12%. The terms of the note require equal payments each year on November 30, starting November 30, 2021. Use TABLE 144.2 (Use appropriate factor(s) from the tables provided) Required: 1. Calculate the size of each installment payment. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Answer is complete and correct. Payment 32.923 2. Complete an installment note amortization schedule for this note. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Period Ending Answer is not complete. Payments Beginning Period Debit Credit Interest Notes Balance Ending Cash Balance Expense Payable $ 100,000 $ 12,000 $ 20.923$ 32.923S 79,077 79,077 9,489 23,434 32,923 55,643 55,643 6,677 26,246 32,923 29,397 29,198 % 3,527 29,397 $ 31,693 $ 70,603 is 98,769 Nov. 30/21 Nov. 30/22 Nov. 30/23 Nov. 30/24 Totals 3. Present the journal entries that Calla would make to record accrued interest as of December 31, 2020 (the end of the annual reporting period), and the first payment on the note. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Answer is not complete. No Debit Credit 1 Date General Journal December 31.20 Interest expense Interest payable 1,000 1.000 2 November 30, 20 Notes payable Interest expense Cash 20.923 32,923 53,846 4. Now assume that the note does not require equal payments but does require four payments that include accrued interest and an equal amount of principal in each payment. Complete an installment note amortization schedule for this note. Present the journal entries that Calla would make to record accrued interest as of December 31, 2020 (the end of the annual reporting period), and the first payment on the note. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Eiter all the amounts as positive values.) Answer is not complete. Payments Debit Credit Notes Cash Payable Period Ending Beginning Balance Period Interest Expense Ending Balance Nov. 30/21 Nov. 30/22 Nov. 30/23 Nov. 30/24 Totals 0 $ 0 $ 0 $ 0 Return to question On November 30, 2020, Colla Resources Ltd, borrowed $100,000 from a bank by signing a four-year installment note bearing interest ot 12%. The terms of the note require equal payments each year on November 30, starting November 30, 2021. Use TABLE 1942 (Use appropriate factor(s) from the tables provided) Required: 1. Calculate the size of each installment payment (Do not round intermediate calculations, Round the final answer to the nearest whole dollar) Answer is complete and correct. Payment 32.923 2. Complete an installment note amortization schedule for this note. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Period Ending Answer is not complete. Payments Period Beginning Debit Credit Interest Balance Ending Notes Cash Expense Balance Payable $ 100,000 $ 12,000 $ 20.923$ 32.923$ 79,077 79,077 9,489 23434 32.923 55,643 55,643 6.677 26.246 32.923 29,397 29, 1983 3,5273 29,397 $ 31,693 70.603 $ 98.769 Nov. 30/21 Nov. 30/22 Nov. 30/23 Nov. 30/24 Totals 3. Present the journal entries that Calla would make to record accrued interest as of December 31, 2020 (the end of the annual reporting period), and the first payment on the note. (Do not round Intermediate calculations. Round the final answers to the nearest whole dollar) Answer is not complete. No Date General Journal Credit Debit 1,000 1 December 31, 20 interest expense Interest payable 1,000 2 November 30, 20 Notes payablo Interest expense 20,923 32,923 * O Cash 53,846 4. Now assume that the note does not require equal payments but does require four payments that include accrued interest and an equal amount of principal in each payment. Complete an installment note amortization schedule for this note. Present the journal entries that Calla would make to record accrued interest as of December 31, 2020 (the end of the annual reporting period), and the first payment on the note (Do not round Intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Answer is not complete. Beginning Balance Period Interest Expense Payments Debit Notes Payable Credit Cash Ending Balance Period Ending Nov. 30/21 Nov. 30/22 Nov. 30/23 Nov. 30/24 Totals $ 0 $ 0 $ 0 Answer is not complete. No Date General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started