is the attached done correctly?

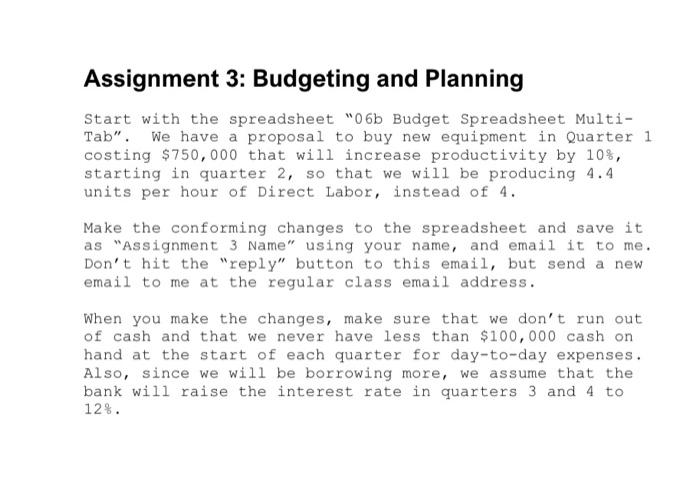

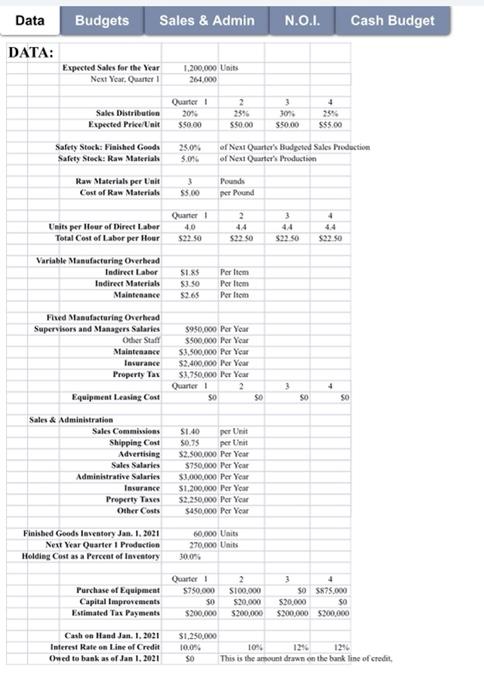

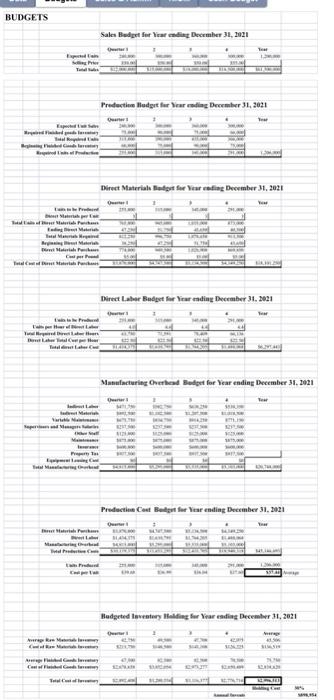

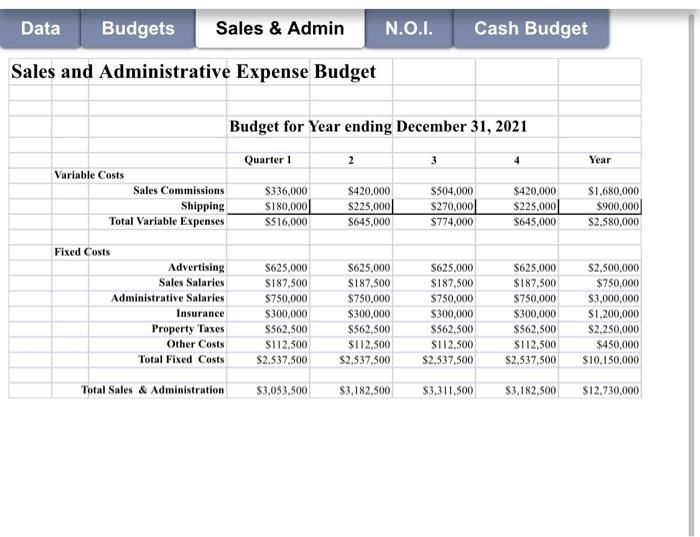

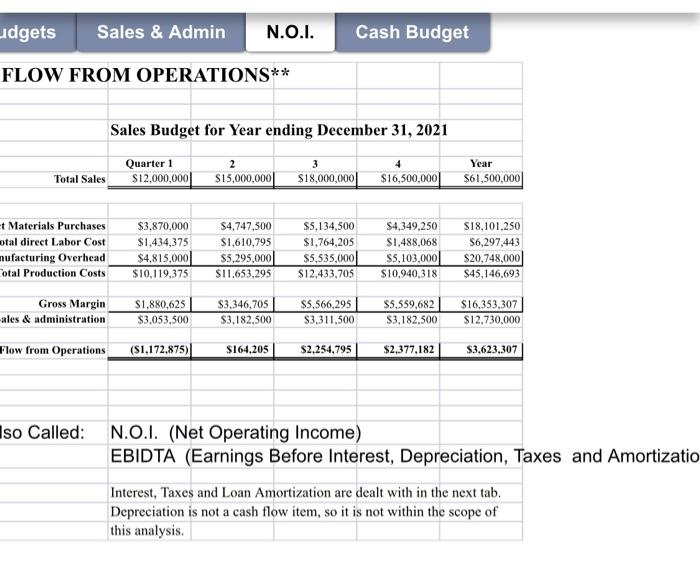

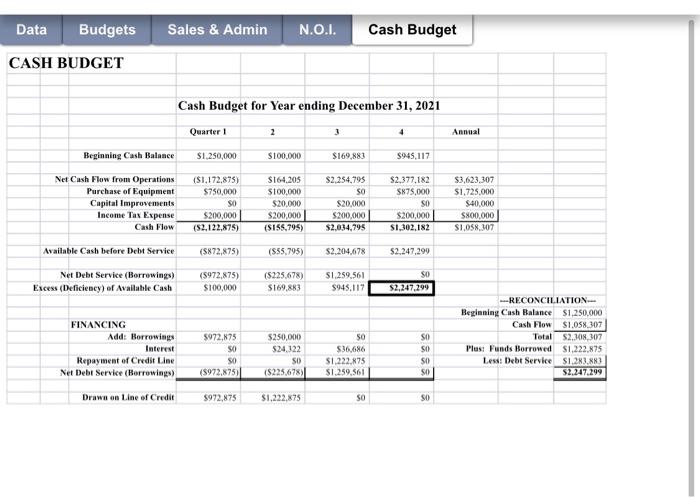

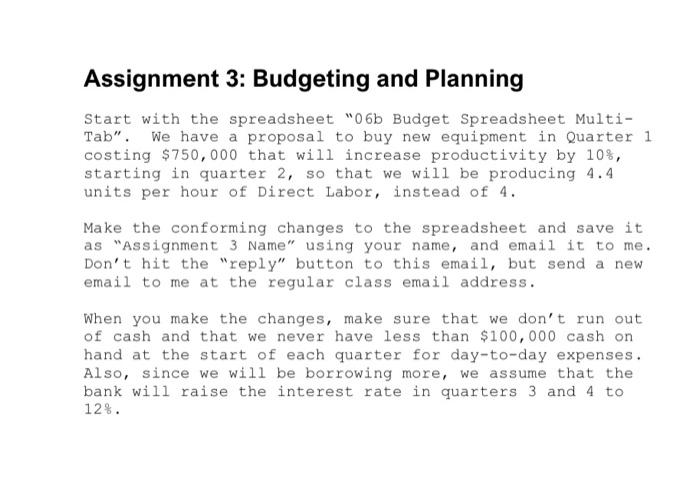

Assignment 3: Budgeting and Planning Start with the spreadsheet "06b Budget Spreadsheet Multi- Tab". We have a proposal to buy new equipment in Quarter 1 costing $750,000 that will increase productivity by 10%, starting in quarter 2, so that we will be producing 4.4 units per hour of Direct Labor, instead of 4. Make the conforming changes to the spreadsheet and save it as "Assignment 3 Name" using your name, and email it to me. Don't hit the "reply" button to this email, but send a new email to me at the regular class email address. When you make the changes, make sure that we don't run out of cash and that we never have less than $100,000 cash on hand at the start of each quarter for day-to-day expenses. Also, since we will be borrowing more, we assume that the bank will raise the interest rate in quarters 3 and 4 to 12%. Data Budgets Sales & Admin N.O.I. Cash Budget DATA: Expected Sales for the Year Next Year Quarter 1.200,000 Units 264.000 2 Sales Distribution Expected Price Unit Quarter 1 20% 550.00 3 300 $50,00 $50,00 S$5.00 Safety Stock: Finished Goods Safety Stock: Raw Materials 25.0% 5.0 of Next Quarter's Budgeted Sales Production of Next Quarter's Production 3 Raw Materials per Unit Cost of Raw Materials 55.00 Pounds Pound Quarter ! 2 44 $2250 3 44 Units per leur of Direct Laber Total Cost of Labor per Hour 4 4.4 $22.50 $22.50 $22.50 Variable Manufacturing Overhead Indirect Labor Indirect Materials Maintenance SIXS $3.50 $2.65 Per frem Per im Per som Fixed Manufacturing Overhead Supervisors and Manager Salaries Other Stall Maintenance lavurance Property Tax $950,000 Per You $500.000 Per Year $3.500,000 Per You $2,400,000 Per You $1,750,000 Per Year Quarter 1 2 SO 3 + Equipment Leasing Cost SO SO so Sales & Administration Sales Commissions Shipping Cart Advertising Sales Salaries Administrative Salaries Insurance Property Taxes Other Costs S1.40 Ut 50.75 pert $2.500.000 Per Year $750,000 Per Your $1.000.000 Per Year $1,200,000 Per You $2,250,000 Per Year $450,000 Per Year Finished Goods Inventory Jan. 1. 2021 Next Year Quarter 1 Production Holding Cost as a Percent of lovestory 60.000 Units 270.000 Units 30.09 Purchase of Equipment Capital Improvements Estimated Tax Payments Quarter S750.000 50 $200,000 2 SI00.000 $20,000 $200,000 3 50 $875.000 $20.000 $0 $200,000 $200,000 Cash on Hand Jan. 1. 2021 Interest Rate on Line of Credit Oned to bank as of Jan 1.2021 $1,250,000 10.0% 10 1296 SO This is the amount drawn on the bank line of credit BUDGETS Sales Budget for learning December 31, 2021 Production Badget for leading December 31, 2021 Tap Tuled Direct Materials for learfing December 31, 2021 tial Materiale natural Direct Labor Budget for vinar ting December 31, 2021 Yudha tail (ta- THE Manufacturing Chad Borg for ver ending December 31, 2021 w Septem for at Production Cost Belget for lear ending December 31, 2021 IS . Budgeted lovestory Welding for Year ending December 31, 2021 ARM co Cars Se Data Budgets Sales & Admin N.O.I. Cash Budget Sales and Administrative Expense Budget Budget for Year ending December 31, 2021 Quarter 1 2 3 4 Year Variable Costs Sales Commissions Shipping Total Variable Expenses $336,000 $180,000 $516,000 $420,000 $225,000 $645,000 $504,000 $270,000 $774,000 $420,000 $225,000 S645.000 $1,680,000 $900,000 $2,580,000 Fixed Costs Advertising Sales Salaries Administrative Salaries Insurance Property Taxes Other Costs Total Fixed Costs S625.000 $187,500 $750,000 $300,000 $562,500 S112.500 $2.537,500 S625.000 $187.500 $750,000 $300,000 $562,500 $112,500 $2,537.500 S625.000 $187.500 $750,000 $300,000 $562.500 S112.500 $2.537,500 $625,000 $187.500 $750,000 $300,000 $562,500 S112,500 S2.537.500 $2,500,000 $750,000 $3,000,000 $1,200,000 $2.250,000 $450,000 S10.150.000 Total Sales & Administration $3,053,500 53,182,500 $3,311,500 $3,182,500 $12,730,000 udgets Sales & Admin N.O.I. Cash Budget FLOW FROM OPERATIONS** Sales Budget for Year ending December 31, 2021 Quarter 1 $12,000,000 2 $15,000,000 3 $18,000,000 Year $61,500,000 Total Sales $16,500,000 t Materials Purchases otal direct Labor Cost nufacturing Overhead Cotal Production Costs $3.870,000 $1,434,375 $4,815,000 $10,119,375 $4,747,500 $1,610,795 $5,295,000 $11.653,295 $5,134,500 $1,764,205 $5,535,000 $12,433,705 S4,349.250 $1.488,068 $5,103,000 $10,940,318 $18,101,250 $6,297,443 $20,748,000 $45,146,693 Gross Margin ales & administration S1,880,625 $3.053,500 $3,346,705 $3,182,500 $5,566,295 $3,311,500 $5,559,682 3.182.500 $16,353,307 $12.730,000 Flow from Operations (S1,172.875) $164.205 $2,254,795 $2,377,182 $3,623,307 Iso Called: N.O.I. (Net Operating Income) EBIDTA (Earnings Before Interest, Depreciation, Taxes and Amortizatio Interest, Taxes and Loan Amortization are dealt with in the next tab. Depreciation is not a cash flow item, so it is not within the scope of this analysis. Data Budgets Sales & Admin N.O.I. Cash Budget CASH BUDGET Cash Budget for Year ending December 31, 2021 Quarter 1 4 Annual Beginning Cash Balance $1,250,000 $100,000 $169,883 $945,117 Net Cash Flow from Operations Purchase of Equipment Capital Improvements Income Tax Expense Cash Flow ($1,172.875) $750,000 SO $200,000 (52,122,875) S164.205 $100.000 $20,000 $200,000 (S155.795) $2,254,795 SO $20,000 $200,000 $2.034,795 $2.377.182 S875,000 SO $200,000 S1,302,182 $3,623.307 $1.725,000 $40.000 $800,000 SI OSN,107 Available Cash before Debt Service (5872,875) (555,795) $2.204,678 52.247.299 Net Debt Service (Borrowings) Excess (Deficiency) of Available Cash (5972,875) $100,000 ($225,678) $169,883 $1.259.561 $945.117 SO $2,247.299 FINANCING Add: Borrowings Interest Repayment of Credit Line Net Debt Service (Borrowings) $972.875 SO SO ($972.875 $250,000 $24.322 SO ($225,678) SO $36,686 $1,222,875 $1,259,561 SSS --RECONCILIATION Beginning Cash Balance $1,250,000 Cash Flow S1.058 307 Total $2,308,407 Plus: Funds Borrowed $1,222,875 Less: Debt Service S1,283.883 $2,247209 50 $972,875 Drawn on Line of Credit $1,222,875 SO SO