Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me with these? I'd like to see all of the steps used to arrive at each answer. Will rate the best

Can someone please help me with these? I'd like to see all of the steps used to arrive at each answer. Will rate the best response. Thank you!

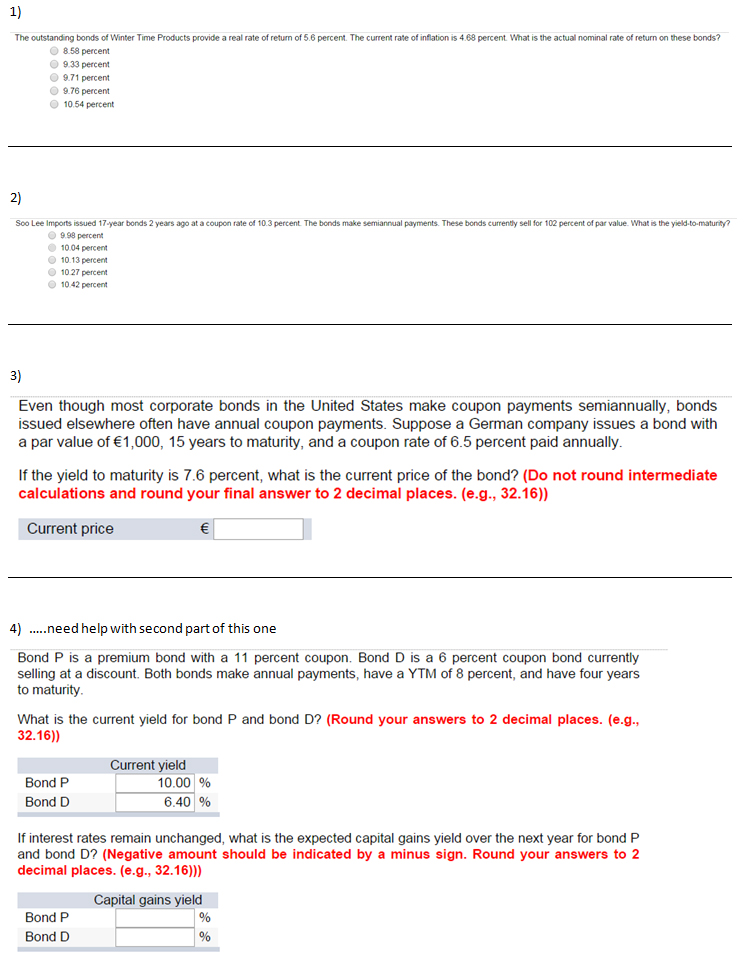

The outstanding bonds of Winter Time Products provide a real rate of return of 5.6 percent The current rate of inflation is 4 68 percent What is the actual nominal rate of return on these bonds 8 58 percent 9 33 percent 9 71 percent 976 percent 10 54 percent Soo Lee Import* owed 17-year bools 2 years ago at a coupon rate of 10 3 percent The bonds make semiannual payments These bonds currently sell for 102 percent of par value. What is the yield-to-maturity? 998percent 10 04 percent 10 13 percent 1027percent 10 42 percent Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of epsilon 1,000, 15 years to maturity, and a coupon rate of 6.5 percent paid annually. If the yield to maturity is 7.6 percent, what is the current price of the bond? (Do not round intermediate calculations and round your final answer to 2 decimal places, (e.g., 32.16)) need help with second part of this one Bond P is a premium bond with a 11 percent coupon. Bond D is a 6 percent coupon bond currently selling at a discount. Both bonds make annual payments, have a YTM of 8 percent, and have four years to maturity. What is the current yield for bond P and bond D? (Round your answers to 2 decimal places, (e.g., 32.16)) If interest rates remain unchanged, what is the expected capital gains yield over the next year for bond P and bond D? (Negative amount should be indicated by a minus sign. Round your answers to 2 decimal places, (e.g., 32.16)))Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started