Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please help show me how to do this on excel?!? I got stuck with the excel functions and I can't figure it out.

can someone please help show me how to do this on excel?!? I got stuck with the excel functions and I can't figure it out. Thank you so much

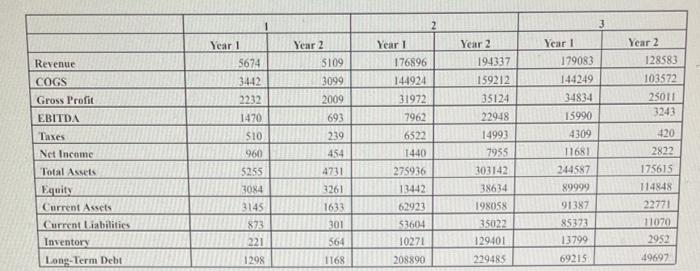

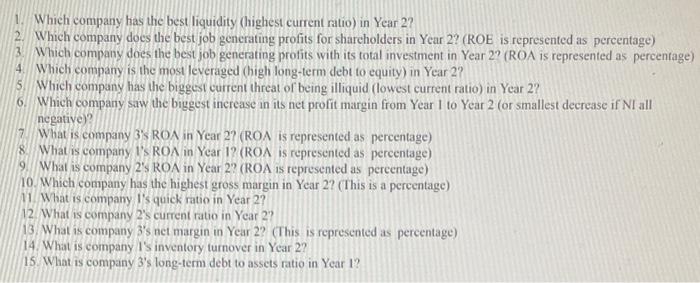

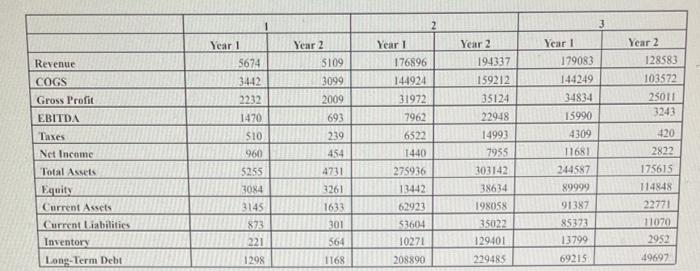

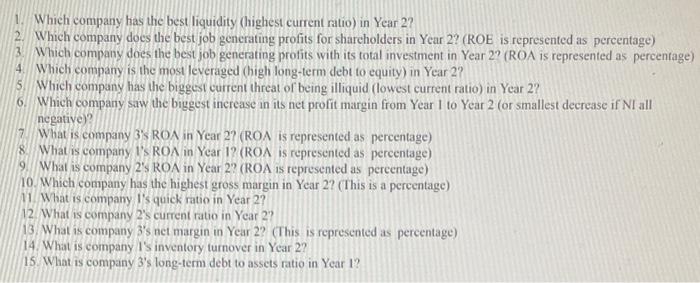

1. Which company has the best liquidity (highest current ritio) in Year 2? 2. Which company does the best job generating profits for sharcholders in Year 2 ? (ROE is represented as percentage) 3. Which company does the best job generating profits with its total investment in Year 2? (ROA is represented as percentage) 4. Which company is the most leveraged (high long-term debt to equity) in Year 2 ? 5. Which company has the biggest current threat of being illiquid (lowest current ratio) in Year 2 ? 6. Which company saw the biggest increase in its net profit margin from Year 1 to Year 2 (or smallest decrease if NI all negative)? 7. What is company 3; ROA in Year 2 ? (ROA is represented as percentage) 8. What is company is ROA in Year 1 ? (ROA is represented as percentage) 9. What is company 2's ROA in Year 2? (ROA is represented as pereentage) 10. Which company has the highest gross margin in Year 2? (This is a percentage) 11. What is company i's quick ratio in Year 2? 12. What is company 2's current ratio in Year 2? 13. What is company 3 's net margin in Year 2? (This is represented as percentage) 14. What is company I's inventory turnover in Year 2? 15. What is company 3's long-term debt to assets ratio in Year 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started