Answered step by step

Verified Expert Solution

Question

1 Approved Answer

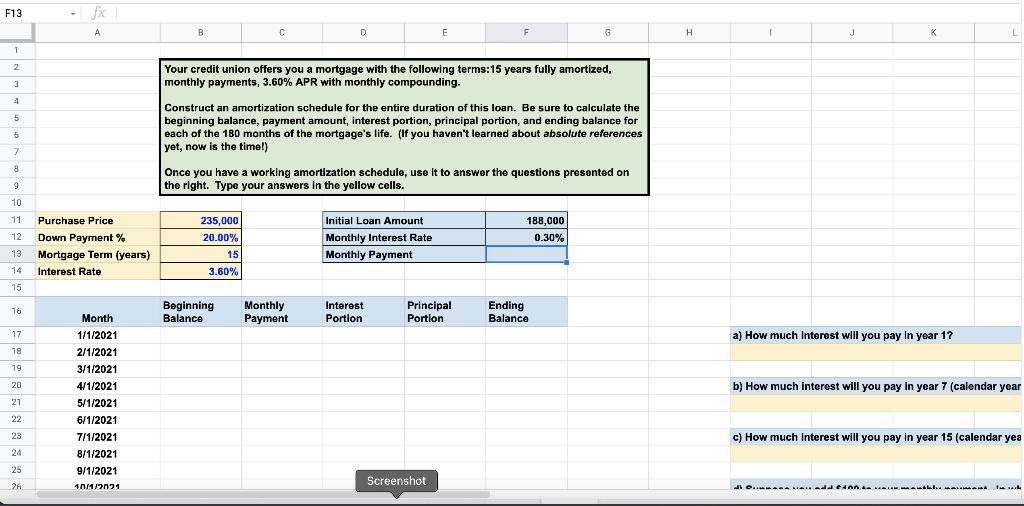

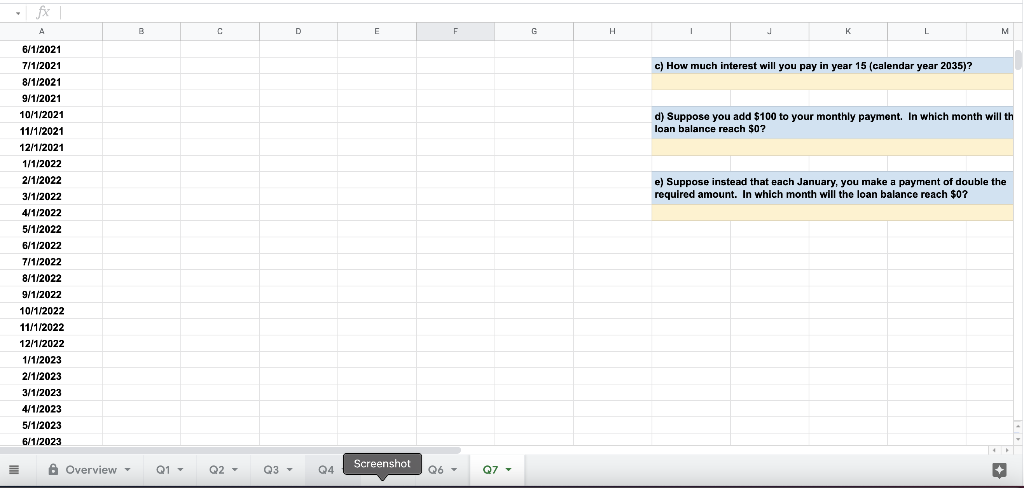

Can someone please help with this project? Please use the same columns used in the pictures and PLEASE show formulas used. Also need assistance with

Can someone please help with this project? Please use the same columns used in the pictures and PLEASE show formulas used. Also need assistance with calculating the monthly payment

F13 fx A D E H K 1 1 2 4 Your credit union offers you a mortgage with the following terms:15 years fully amortized, monthly payments, 3.60% APR with monthly compounding. Construct an amortization schedule for the entire duration of this loan. Be sure to calculate the beginning balance, payment amount interest portion, principal portion, and ending balance for each of the 180 months of the mortgage's life. (If you haven't learned about absolute references yet, now is the time!) 5 6 7 8 Once you have a working amortization schedule, use it to answer the questions presented on the right. Type your answers in the yellow cells. 9 10 11 188,000 0.30% 12 Purchase Price Down Payment % Mortgage Term (years) Interest Rate 235,000 20.00% 15 3.60% Initial Loan Amount Monthly Interest Rate Monthly Payment 13 15 16 Beginning Balance Monthly Payment Interest Portion Principal Portion Ending Balance 17 a) How much Interest will you pay In yoar 1? 18 19 20 b) How much interest will you pay in year 7 (calendar year 21 Month 1/1/2021 2/1/2021 3/1/2021 4/1/2021 5/1/2021 6/1/2021 7/1/2021 8/1/2021 9/1/2021 10/1/2021 22 23 c) How much interest will you pay in year 15 (calendar yea 24 25 Screenshot 26 I..... a...denn wa... fx | D E F H K L M c) How much interest will you pay in year 15 (calendar year 2035)? d) Suppose you add $100 to your monthly payment. In which month will th loan balance reach $0? e) Suppose instead that each January, you make a payment of double the required amount. In which month will the loan balance reach $0? 6/1/2021 7/1/2021 8/1/2021 9/1/2021 10/1/2021 11/1/2021 12/1/2021 1/1/2022 2/1/2022 3/1/2022 4/1/2022 5/1/2022 6/1/2022 7/1/2022 8/1/2022 - 9/1/2022 10/1/2022 wees 11/1/2022 acce 12/1/2022 1/1/2023 2/1/2023 3/1/2023 4/1/2023 5/1/2023 6/1/2023 Screenshot Overview - Q1 Q2 Q3 Q4 Q6 - Q7 F13 fx A D E H K 1 1 2 4 Your credit union offers you a mortgage with the following terms:15 years fully amortized, monthly payments, 3.60% APR with monthly compounding. Construct an amortization schedule for the entire duration of this loan. Be sure to calculate the beginning balance, payment amount interest portion, principal portion, and ending balance for each of the 180 months of the mortgage's life. (If you haven't learned about absolute references yet, now is the time!) 5 6 7 8 Once you have a working amortization schedule, use it to answer the questions presented on the right. Type your answers in the yellow cells. 9 10 11 188,000 0.30% 12 Purchase Price Down Payment % Mortgage Term (years) Interest Rate 235,000 20.00% 15 3.60% Initial Loan Amount Monthly Interest Rate Monthly Payment 13 15 16 Beginning Balance Monthly Payment Interest Portion Principal Portion Ending Balance 17 a) How much Interest will you pay In yoar 1? 18 19 20 b) How much interest will you pay in year 7 (calendar year 21 Month 1/1/2021 2/1/2021 3/1/2021 4/1/2021 5/1/2021 6/1/2021 7/1/2021 8/1/2021 9/1/2021 10/1/2021 22 23 c) How much interest will you pay in year 15 (calendar yea 24 25 Screenshot 26 I..... a...denn wa... fx | D E F H K L M c) How much interest will you pay in year 15 (calendar year 2035)? d) Suppose you add $100 to your monthly payment. In which month will th loan balance reach $0? e) Suppose instead that each January, you make a payment of double the required amount. In which month will the loan balance reach $0? 6/1/2021 7/1/2021 8/1/2021 9/1/2021 10/1/2021 11/1/2021 12/1/2021 1/1/2022 2/1/2022 3/1/2022 4/1/2022 5/1/2022 6/1/2022 7/1/2022 8/1/2022 - 9/1/2022 10/1/2022 wees 11/1/2022 acce 12/1/2022 1/1/2023 2/1/2023 3/1/2023 4/1/2023 5/1/2023 6/1/2023 Screenshot Overview - Q1 Q2 Q3 Q4 Q6 - Q7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started