Answered step by step

Verified Expert Solution

Question

1 Approved Answer

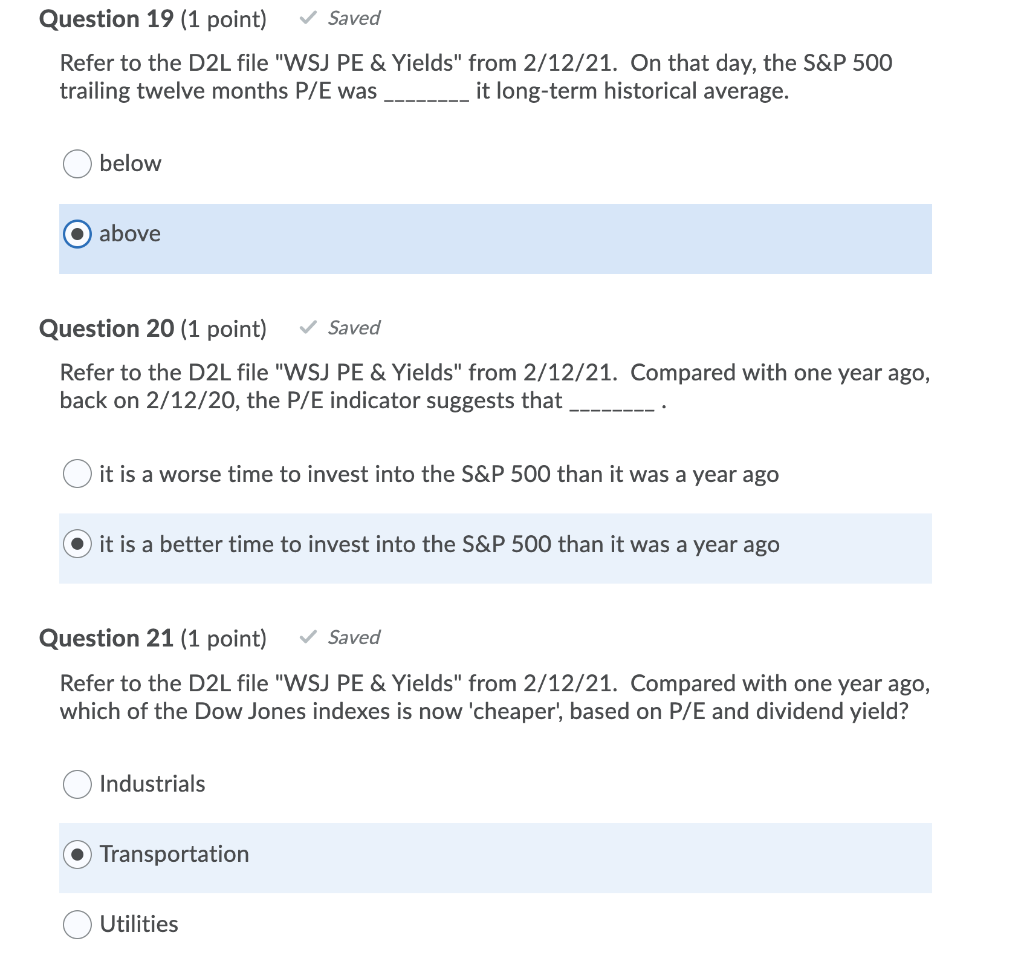

Can someone please helps me to check these three questions Question 19 (1 point) Saved Refer to the D2L file WSJ PE & Yields from

Can someone please helps me to check these three questions

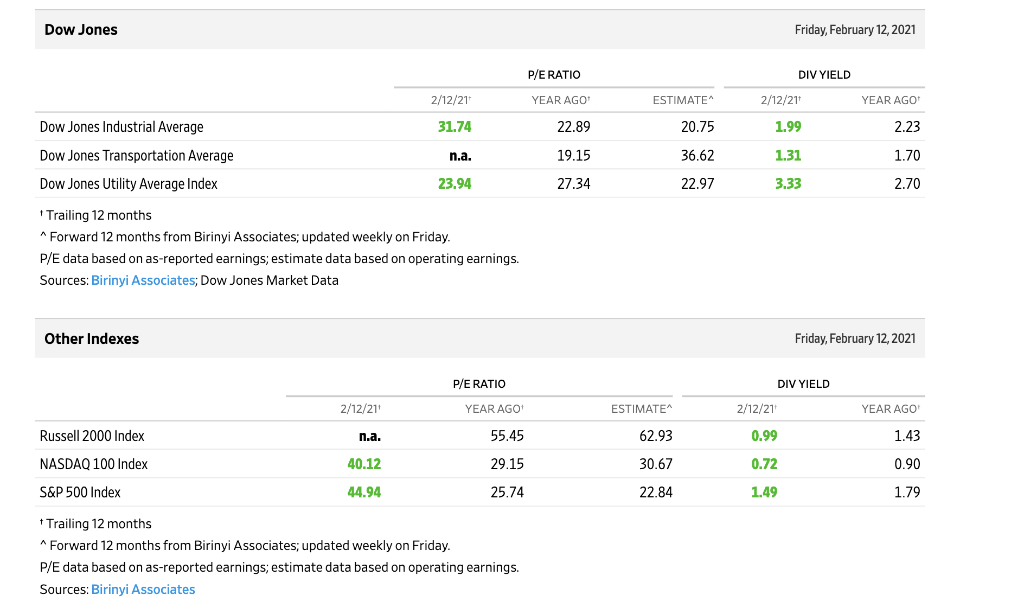

Question 19 (1 point) Saved Refer to the D2L file "WSJ PE & Yields" from 2/12/21. On that day, the S&P 500 trailing twelve months P/E was it long-term historical average. below O above Question 20 (1 point) Saved Refer to the D2L file "WSJ PE & Yields" from 2/12/21. Compared with one year ago, back on 2/12/20, the P/E indicator suggests that it is a worse time to invest into the S&P 500 than it was a year ago it is a better time to invest into the S&P 500 than it was a year ago Question 21 (1 point) Saved Refer to the D2L file "WSJ PE & Yields" from 2/12/21. Compared with one year ago, which of the Dow Jones indexes is now 'cheaper', based on P/E and dividend yield? Industrials Transportation Utilities Dow Jones Friday, February 12, 2021 P/E RATIO DIV YIELD 2/12/21 YEAR AGO ESTIMATE 2/12/21 YEAR AGO 22.89 20.75 1.99 2.23 19.15 36.62 1.31 1.70 27.34 22.97 3.33 2.70 Dow Jones Industrial Average 31.74 Dow Jones Transportation Average n.a. Dow Jones Utility Average Index 23.94 Trailing 12 months *Forward 12 months from Birinyi Associates; updated weekly on Friday. P/E data based on as-reported earnings; estimate data based on operating earnings. Sources: Birinyi Associates; Dow Jones Market Data Other Indexes Friday, February 12, 2021 P/E RATIO DIV YIELD 2/12/21 YEAR AGO ESTIMATE 2/12/21 YEAR AGO Russell 2000 Index n.a. 55.45 62.93 0.99 1.43 NASDAQ 100 Index 40.12 29.15 30.67 0.72 0.90 S&P 500 Index 44.94 25.74 22.84 1.49 1.79 * Trailing 12 months Forward 12 months from Birinyi Associates, updated weekly on Friday. P/E data based on as-reported earnings; estimate data based on operating earnings. Sources: Birinyi Associates Question 19 (1 point) Saved Refer to the D2L file "WSJ PE & Yields" from 2/12/21. On that day, the S&P 500 trailing twelve months P/E was it long-term historical average. below O above Question 20 (1 point) Saved Refer to the D2L file "WSJ PE & Yields" from 2/12/21. Compared with one year ago, back on 2/12/20, the P/E indicator suggests that it is a worse time to invest into the S&P 500 than it was a year ago it is a better time to invest into the S&P 500 than it was a year ago Question 21 (1 point) Saved Refer to the D2L file "WSJ PE & Yields" from 2/12/21. Compared with one year ago, which of the Dow Jones indexes is now 'cheaper', based on P/E and dividend yield? Industrials Transportation Utilities Dow Jones Friday, February 12, 2021 P/E RATIO DIV YIELD 2/12/21 YEAR AGO ESTIMATE 2/12/21 YEAR AGO 22.89 20.75 1.99 2.23 19.15 36.62 1.31 1.70 27.34 22.97 3.33 2.70 Dow Jones Industrial Average 31.74 Dow Jones Transportation Average n.a. Dow Jones Utility Average Index 23.94 Trailing 12 months *Forward 12 months from Birinyi Associates; updated weekly on Friday. P/E data based on as-reported earnings; estimate data based on operating earnings. Sources: Birinyi Associates; Dow Jones Market Data Other Indexes Friday, February 12, 2021 P/E RATIO DIV YIELD 2/12/21 YEAR AGO ESTIMATE 2/12/21 YEAR AGO Russell 2000 Index n.a. 55.45 62.93 0.99 1.43 NASDAQ 100 Index 40.12 29.15 30.67 0.72 0.90 S&P 500 Index 44.94 25.74 22.84 1.49 1.79 * Trailing 12 months Forward 12 months from Birinyi Associates, updated weekly on Friday. P/E data based on as-reported earnings; estimate data based on operating earnings. Sources: Birinyi AssociatesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started