Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone tell how to do this steps Chapter 2 Customizing QuickBooks and the Chant of Accounts 2.45 EXERCISE 2.4: WEB QUEST When setting up

can someone tell how to do this steps

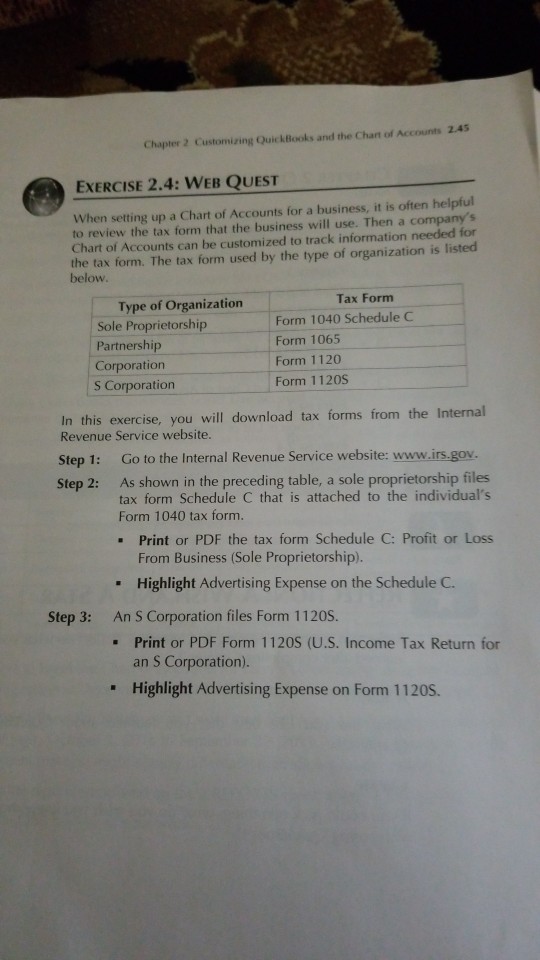

Chapter 2 Customizing QuickBooks and the Chant of Accounts 2.45 EXERCISE 2.4: WEB QUEST When setting up a Chart of Accounts for a business, it is often helpful to review the tax form that the business will use. Then a company's Chart of Accounts can be customized to track information needed for the tax form. The tax form used by the type of organization is listed below Type of Organization Sole Proprietorship Partnership Corporation S Corporation Tax Form Form 1040 Schedule C Form 1065 Form 1120 Form 1120S In this exercise, you will download tax forms from the Internal Revenue Service website. Step 1: Go to the Internal Revenue Service website: www.irs.gov. Step 2: As shown in the preceding table, a sole proprietorship files tax form Schedule C that is attached to the individual's Form 1040 tax form. -Print or PDF the tax form Schedule C: Profit or Loss From Business (Sole Proprietorship). . Highlight Advertising Expense on the Schedule C An S Corporation files Form 1120S. Step 3: Print or PDF Form 1120S (U.S. Income Tax Return for an S Corporation) Highlight Advertising Expense on Form 1120SStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started