can someone tell me my mistakes, and how it can be fixed. thank you

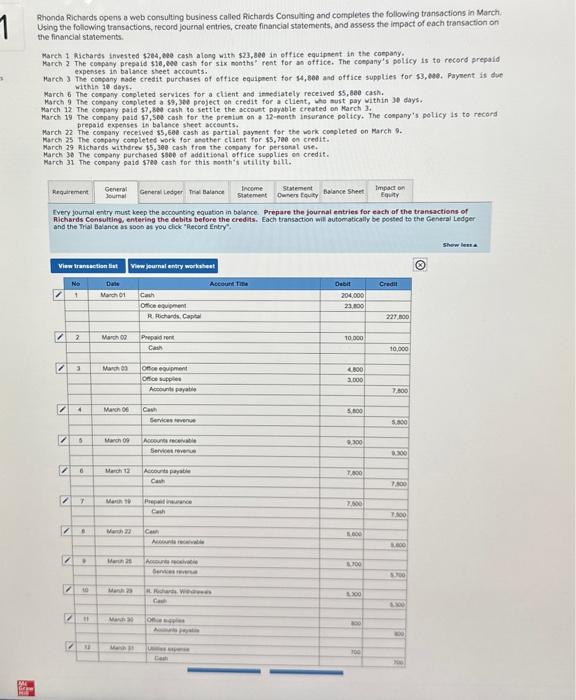

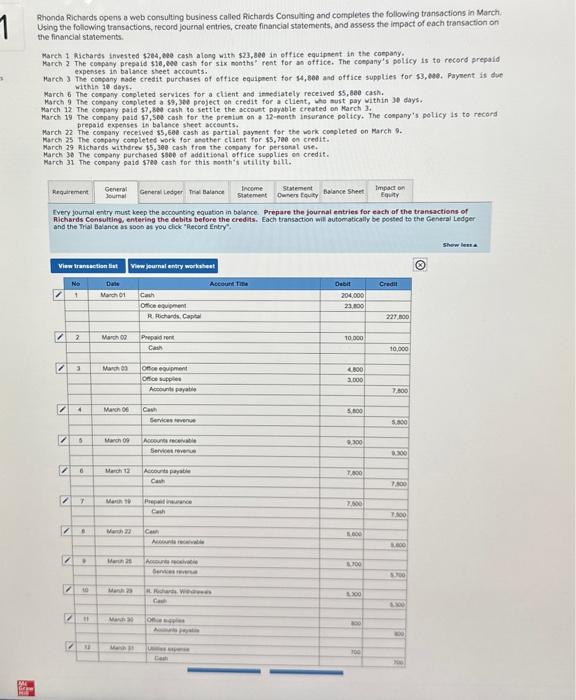

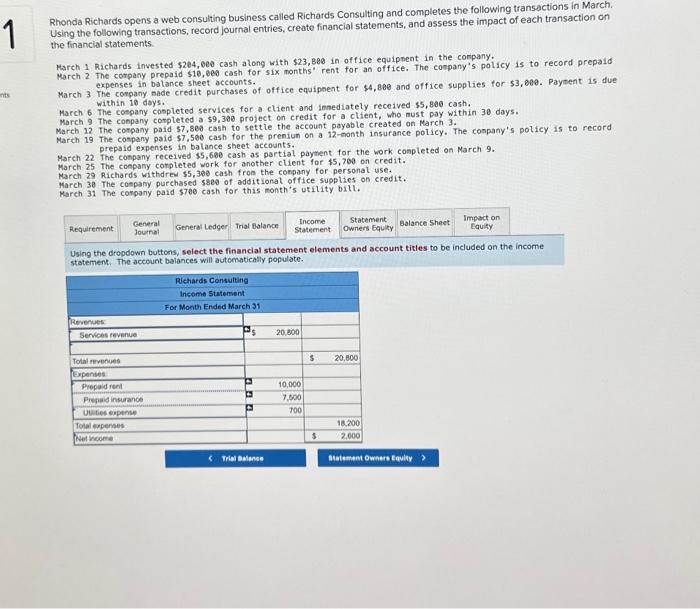

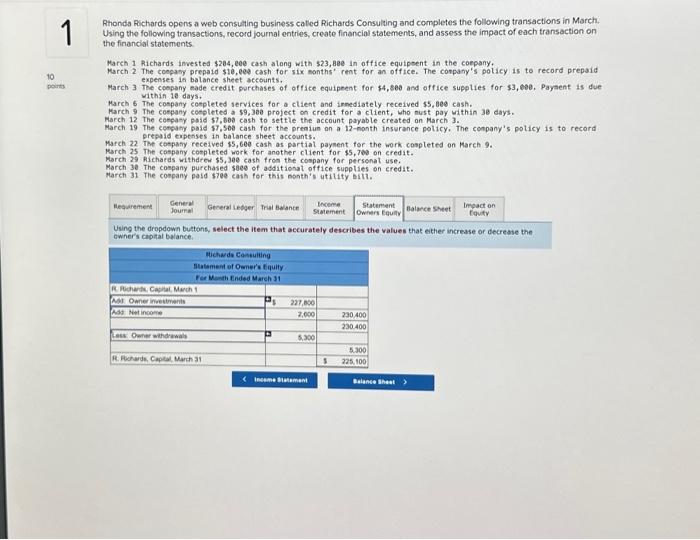

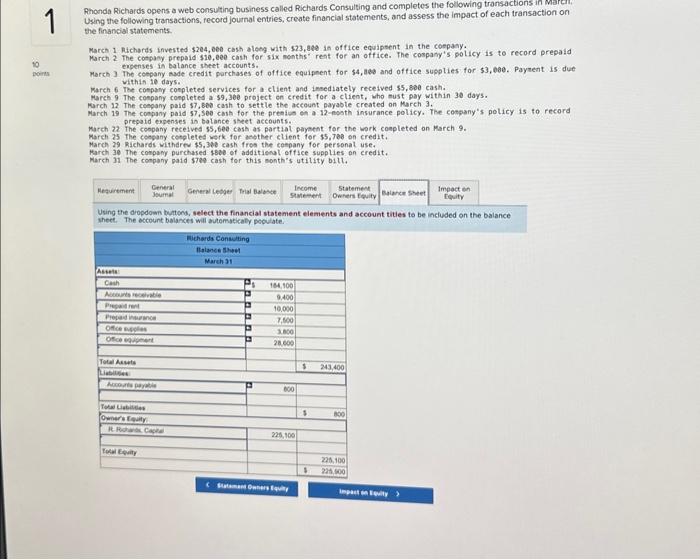

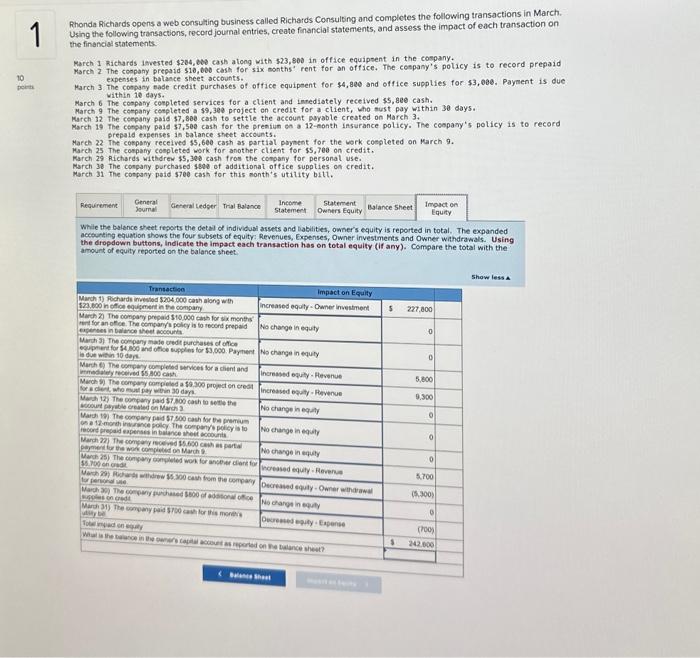

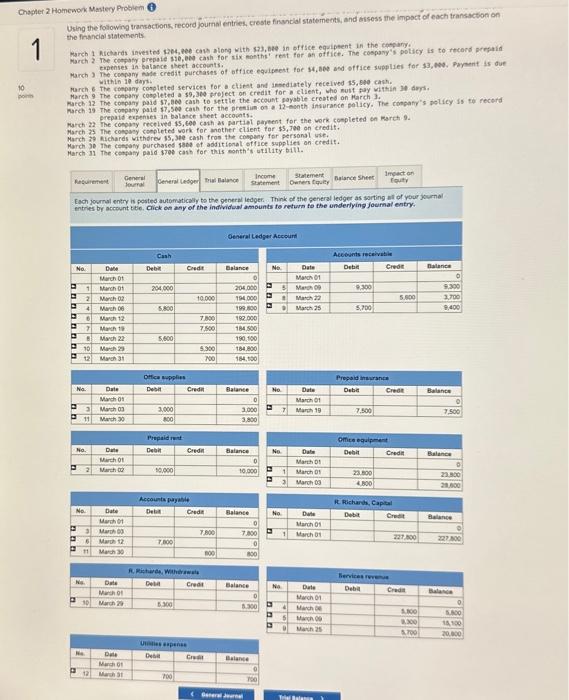

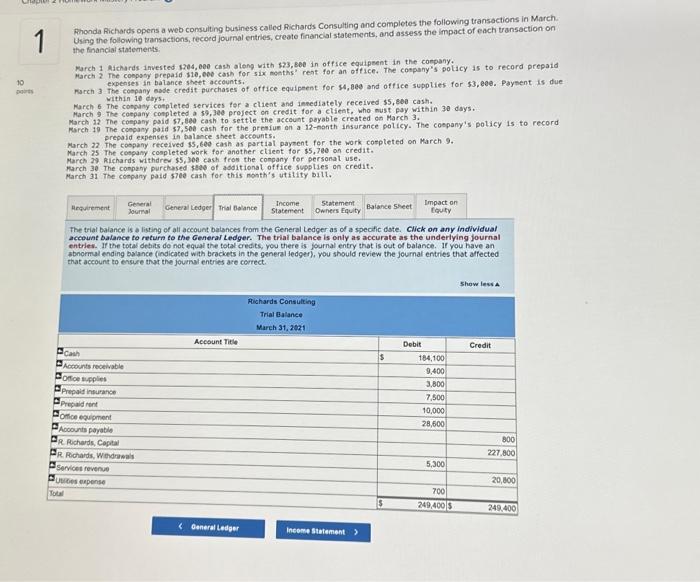

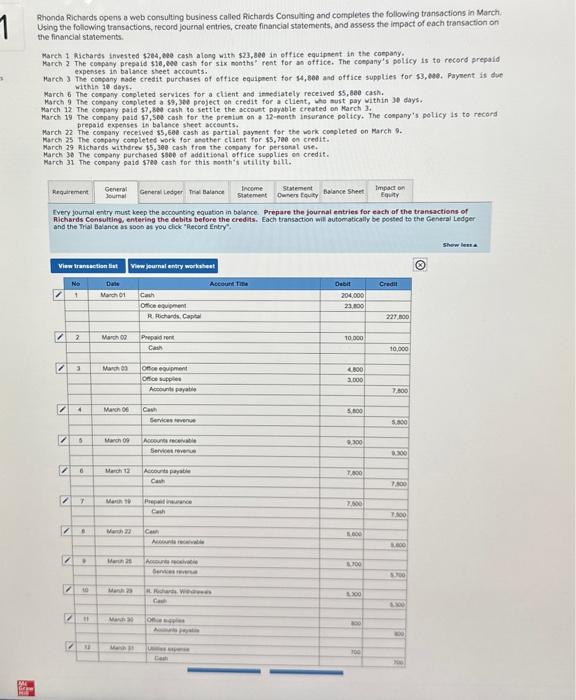

Rionda Richards opens a web consulting business called Richards Consuhing and completes the following traneactions in March. Ueing the following transbctions, fecond journal entrios, create financial statements, and assess the inpoct of each transaction on the findncial ststements. March 1 Michares invested s2e4, bee cash aleng wath $23,be6 in office equiphent in the coepaty, expenses in balance sheet accoutts. wheth 18 days. March 6 The cenpany conpleted services for a client and antesiately receaved 55 , Bae cash. Mareh 9 The congany conpleted a 59,36 project on credit for a cllent, whe aust pay within Jib days. March 12 The cospany pald 57 ; pad cash to settle the account payble strated on Karch 3 . Farch 19 The coepany paid 57,500 cash for the premtut on 412 -nenth insurance policy. The cenpany's pelicy 15 to record prepadd expenses in balance sheet aceounts. March 22 The cospany received 35 , Eee cash as partial paytent for the work congleted on March 9. March 25 The cospaty corpletes work fer ahather elient for 95,7e6 en credit: March 29 pichards withered $5, 300 cash from the conpany for perspnat use. March 3 . The cotsafy. purchased steb of addit ibsal office supplies eh credif. March 31 The conpany paid $729 cash for this nonth's utility till. Tvery foumal entry must keep the sccounting equation in balance. Prepare the journal entries for each of the transactions of Richards Censulting, entering the debits before the credits. Each transoction will autorratically be posted to the Gentral Ledger and the Irial Balance url soon as you click "Record Entry", Rhonda Richards opens a web consulting business called Richards Consulting and completes the following transactions in March. Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. March 1 Rachards invested $2e4,0ev cash along with $23,880 in office equipnent in the conpany, Warch 2 The conpany prepaid $10,060 cash for six months' rent for an office. The conpany's policy is to record prepaid expenses in balance sheet accounts. March 3 The conpany sade credit purchases of office equipnent for $4,800 and office 5upplies for $3,000. Paynent is due within 10 days. March 6 The company conpleted services for a client and imnediately received $5,806 cash. March 6 The company cospteted services for ctient and ienediatety received $5,806 cash March 12 The company paid 57,890 cash to settle the account payable created on March 3. Warch 19 The cospany paid $7,500 cash for the preniun of a 12 -honth insurance policy. The conpany's policy is to record prepaid expenses in balance sheet accounts. March 22 The conpany received $5,600 cash as partial paytient for the work conpleted on March 9. March 25 The coepany corpleted work for another client for $5,700 on credit. March 29 Richards withdrew $5,303 cash froa the company for personal use. March 3 . The coepany purchased s8es of additionat office supplics on credit. March 31 The conpany paid 5766 cash for this month's utility bitl. Using the dropdown buttons, select the financial statement elements and account tities to be included on the income statement. The account balances will autormatically populate. Rhonda Richards opens a web consulting business cated Richards Consulting and completes the follewing transactions in March. Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. March 1 Richards invested $204, eee cash along with $23, Bee in office equipent in the coepany, March 2 . The coopasy prepaid $16,e03 cash for six nonths' rent for an office. The conpatiy's policy is to record prepaid expenses in balance sheet accounts. March 3 The conpany eade credit purchases of of fice equipeent for $4, sea and office supplies for $3, eve. Payaene is due within 1 days March 6 The cospany cespleted iervices for a client and inmediately received 55,060 cash. Karch 9 The cospany cotpleted a $9,300 preject on credit for a client, who nist pay within ab days. March 12 The conpary paid 57, bes cash to settle the account payable created on March 3. March 19 The eetgatiy paid 1T,sos cash for the preniun on a 12 -nonth inserance policy, The conpany's policy is to: recerd March 22 The cotpany received $5,600 cash as partial payment for the work cospleted on March 9. Warch 25 The cospany cotpleted work for another client for 15,709 on eredit. March 29 Richards withdeen $5,303 cash fron the cospany for personal use. March 3 . The company purchased soes of additionat office supplies on eredit. plarch 31 The conpany paid 170c cash fer this nonth 4 utility biti. Using the dropdown bultons, select the item that accurately describes the values that ether increase or decrease the ewher's capital balance. Rhonda Richards opens a web consuting business called Richards Consulting and completes the following transactions in wistin Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. March 1 . Richords Invested $204, eed cash alseg with $23,842 in office equipeent in the coepany. March 2 The cotpany prepaid $10, eeo chsh for 5 ix nonths reht for an office. The cospany's policy is to record prepald March 3 . The coepamy Aade credit parchases of office equipnent for $4, aba and office supplies for $3,06e. Payment is due Whith te days. Warch 6 The cospany conpleted services for a client and imsediatety received 55,890 cash. March 9 The coepany conpleted a $9,3be project en credit fer a client, who =ust pay within 3 de days. Warch 12 The ceegany paid 57, Bed cash to settle the acceunt payable created on March 3. March 19 The conpany paid 57,300 cash for the presius et a 12 -ngsth insurance policy, The cospany's policy is to record March 72 . The ceopany recelves 55,6e cast as partial palyetht for the work conpleted on March 9. March 25 The cesgany cotpleted werk for ansther elient for 35,763 en credit, March 29 . ichards witharev $5,30b cash fros the ceepany for personal use. Harch 30 The conpamy purchased 4Bee of addit iexal offlce supplies on credit, March 31 The company paid $720 cash tor this month"s utility bili, Using the diopdown bumtons, select the financial statement elements and account tities to be inchuded on the balance shect. The ectount balances will butematicaly poculate. Fhonda Richards opens a web consulting business called Richards Consulting and completes the following transactions in March. Using the following transactions, record jounal entries, create financial statements, and assess the impact of each transaction on the financiat statements. March 1 Richards jovested $254, be cash atong with $23,800 in office equipsent in the-cospany. Warch 1 . The cenpany prepaid 510 , beo cash for six months. rent for an office, The cespany's policy is to record prepaid expenses in balance sheet accounts. Karch 3 The conpany fade credit purchases of office equipeent for 44, ged and office supplies for-53, obb. Payment is due Within 16 days. March 6 The conpany sompleted services for a client and innediately received $5,800 cash. March 9 The company coepleted a 59,308 project en credit for a client, who sust pay within 30 days. March 12 The company pald 57,80 cash to settle the account payable created on March 3 . March 19 The consany pald 57,500 cash for the prenfun en a 12 -Aonth insurance policy. The cespary's policy is to record March 22 The conpapy recelved 15,600 cash as partial phythet for the work coepleted on karch 9. Harch 25 The conpany coepleted mork. for another client for $5,700 on credit. March 29 Richards withdrev 45,328 cash fros the conpany for personal use. march 38 The conpany purchased $620 of additional office suppties on credit. March 31. The conpany paid s7ee cast for this month's utility bit1. While the balence sheet reparts the detal of individual assets and labitites, owner's equity is reported in total, The expanded aceturting equation shows the four subsets of equity? Revenues, Expenses, Dwner investments and Owner withdrawals. Using the dropdown buttors, Indicate the impact each transaction has on total equity (if any). Compare the total with the amount of equity reported on the balance sheet. Using the following tramsocbons, record joumal entries, creste finsiclal stotemects, and bisess the impoct of each transaction on the fonthcial staterents. March 1 Richards invested spe4, eet cav along with 323 , bee in oftsce eguipsent in the cascary. eipenses in ealance theet accoints. within 10 days. march 6 The ctepamy conpleted services for a ctiest and insediately recelved 15 , see cash. March 9 The coepany conoleted a s9,3e0 preject on credit for a client, who nust fay within 34 ders. march 12 the conpany pald 57, ses cash to settle the eccount payble created on Karch 3. march 19 The coepaty paid 17,560 cash tor the prendin ot a 12 -acoth insurance policy. The congafy's pelicy is tie recerd March i2. The congany recelved 45, cee caih ac partiel papeent for the vork conpleted in warch 9. March 23 The congasy cenpleted work for mother ctient for $5,7, on credit. March is hichards withdres 15, 39e cash tros the company for personal wie. March of the cespeny purchases seee of additimel office supplies on credit. March 11 The cenpaty paid 370 cast for this eonth's utitity bill. Each joumal entry is posted automaticaly to the genera iedger. Think of the general ledger as sorting al of your joumal entries by account t tie. Click of any of the individual amounts to reture to the underlying joumal entry: Fhonda Richards opens a web consulting business called Richards Consulting and completes the following transactions in March. Using the folowing transactions, recoed journal entries, create financlal statemeats, and assess the impact of each transaction on the financial statements. Rarch 1 Aichards invested 1204 , eee cash atong with $23,800 in office eguipment in the conpany. March 7 The conpoty prepafd \$16, eoe cash for six hoeths" rent for an office. The conpany's policy as to record prepaid expenses in balance shett acceunts. Furch 3 the cospany eade credit purchases of office equipeent for 14,893 and office supplies for 53, eee. Payment is due Within 10 deys, Mreh 6 . The conpany cotpleted services for a client and ineediately received \$5, sea cast. March 9 The coepany conpleted a st, 3 ged project on credit for a clieat, who must pay within 30 days. March 12 The coepany paid 57,800 cash to settle the account poyable created eh Harch 3. March 19 The conpany paid 57,50b cash for the prenium an a 12 -henth insurance pelicy. The coepany's policy 1s to record March 22 . The cospany received 55 , tes cash as partial paynent for the work cospleted on March 9. March 25 The cospany coapleted work fori another ctient for $5,780 on credit. March 27 Richards withdrew $5,30 e cash feos the conpany for personal use. March 30 The conpahy purchased stes of additional office sbpplies on credit. Warch 31 The company paid s7ed cash for this mosth's utitity bill. The triat balance is a listing of all aceount baiances from the General Ledger as of a specitic date. Click on any individual account balance to return to the Genteral Ledger. The trial balance is only as accurate as the underlying journal entrles. If the total detits do not equal the total credits, you there is journal entry that is out of balance. If you have an abnormal ending balance (indicated with brackets in the general ledger), wou should review the journal entries that affected that account to ensire that the journat entries are correct