Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone tell me thees step solution Investors require a 12% rate of return for a share of company XYZ. Over the past 5 years,

can someone tell me thees step solution

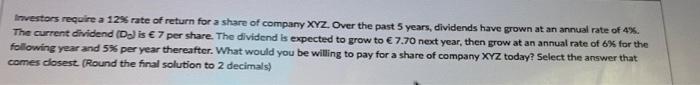

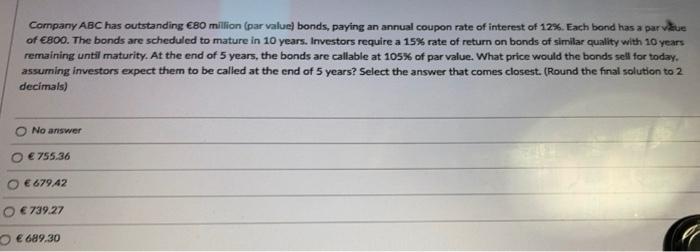

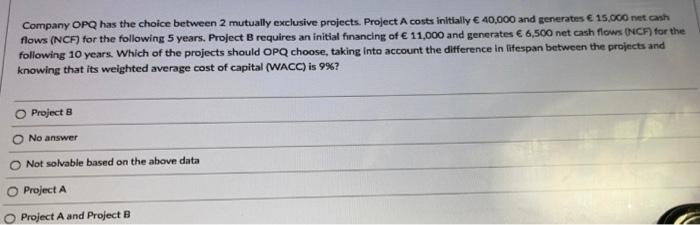

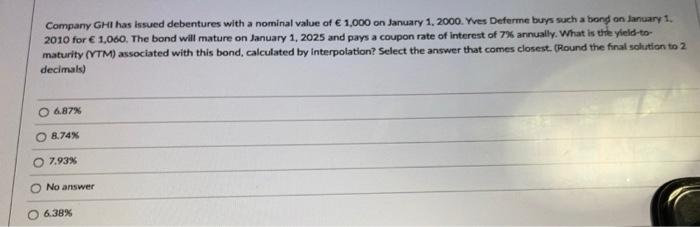

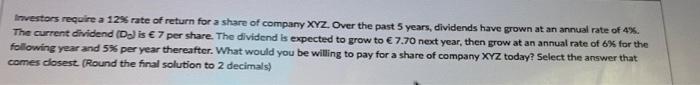

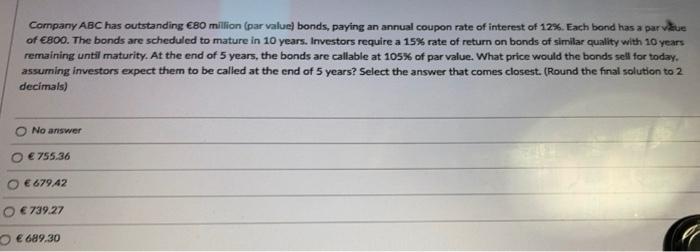

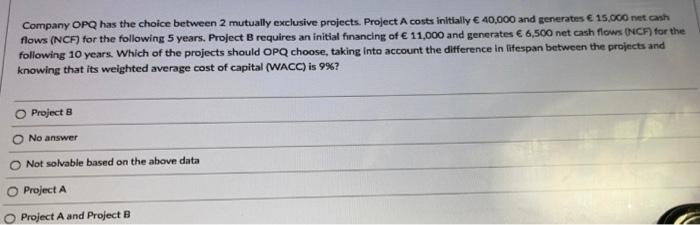

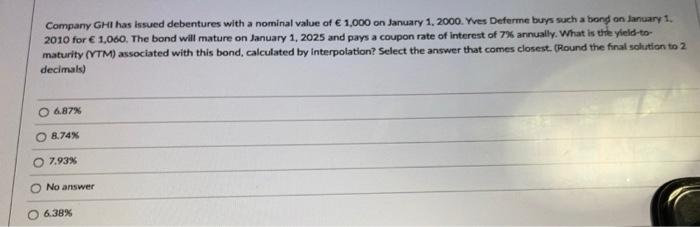

Investors require a 12% rate of return for a share of company XYZ. Over the past 5 years, dividends have grown at an annual rate of 4%. The current dividend (D) is 7 per share. The dividend is expected to grow to 7.70 next year, then grow at an annual rate of 6% for the following year and 5% per year thereafter. What would you be willing to pay for a share of company XYZ today? Select the answer that comes closest (Round the final solution to 2 decimals) Company ABC has outstanding 80 million (par value) bonds, paying an annual coupon rate of interest of 12%. Each bond has a parvue of 800. The bonds are scheduled to mature in 10 years. Investors require a 15% rate of return on bonds of similar quality with 10 years remaining until maturity. At the end of 5 years, the bands are callable at 105% of par value. What price would the bonds sell for today. assuming investors expect them to be called at the end of 5 years? Select the answer that comes closest. (Round the final solution to 2 decimals) No answer O 755.36 679.42 739.27 689.30 Company OPQ has the choice between 2 mutually exclusive projects Project A costs initially 40,000 and generates 15.000 net cash flows (NCF) for the following 5 years. Project B requires an initial financing of 11,000 and generates 6,500 net cash flows (NC) for the following 10 years. Which of the projects should OPQ choose, taking into account the difference in lifespan between the projects and knowing that its weighted average cost of capital (WACC) is 9%? Project B No answer Not solvable based on the above data Project A Project A and Project B Company GHI has issued debentures with a nominal value of 1,000 on January 1, 2000. Yves Deferme buys such a bond on January 1 2010 for 1,060. The bond will mature on January 1, 2025 and pays a coupon rate of interest of 7% annually. What is the yield-to- maturity (TM) associated with this bond, calculated by interpolation? Select the answer that comes closest. (Round the final schution to 2 decimals) 6.87% 8.74% 7.93% No answer 6.38%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started