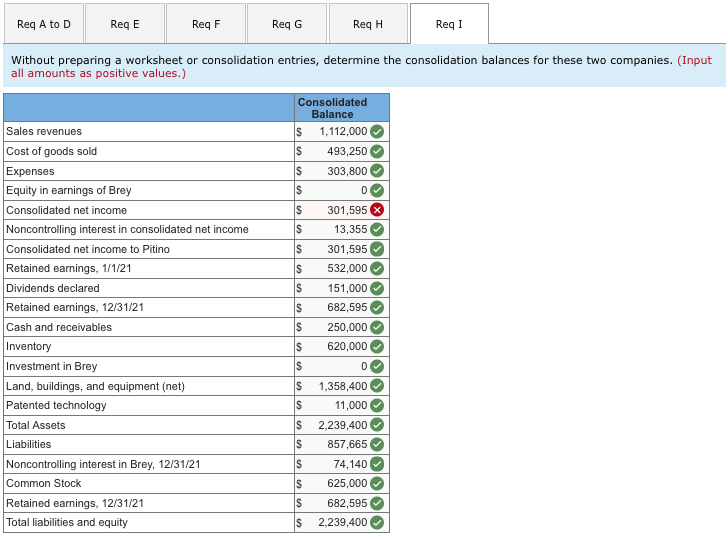

Can someone tell me why my answer is wrong/what the correct answer is?

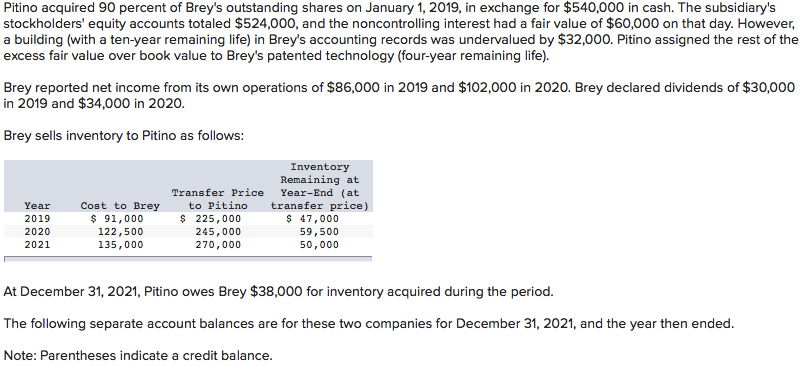

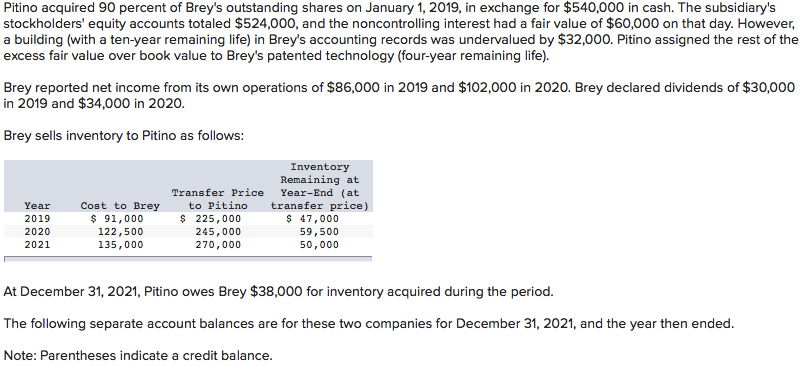

Pitino acquired 90 percent of Brey's outstanding shares on January 1, 2019, in exchange for $540,000 in cash. The subsidiary's stockholders' equity accounts totaled $524,000, and the noncontrolling interest had a fair value of $60,000 on that day. However, a building (with a ten-year remaining life) in Brey's accounting records was undervalued by $32,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (four-year remaining life).

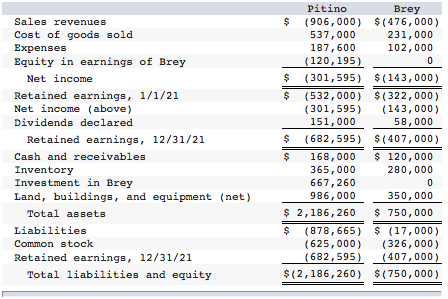

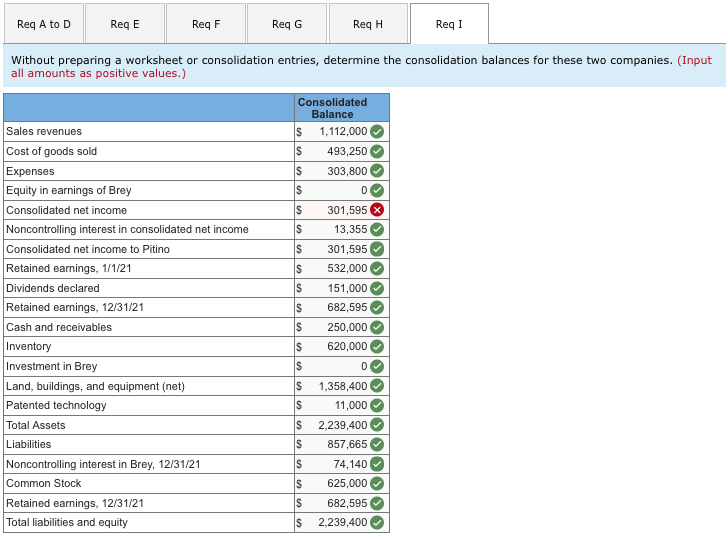

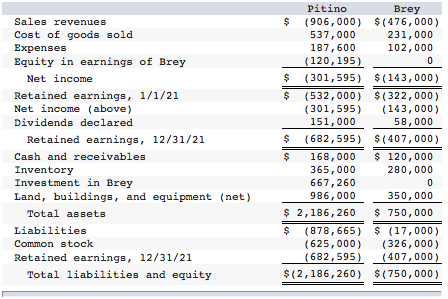

Pitino acquired 90 percent of Brey's outstanding shares on January 1, 2019, in exchange for $540,000 in cash. The subsidiary's stockholders' equity accounts totaled $524,000, and the noncontrolling interest had a fair value of $60,000 on that day. However, a building (with a ten-year remaining life) in Brey's accounting records was undervalued by $32,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (four-year remaining life). Brey reported net income from its own operations of $86,000 in 2019 and $102,000 in 2020. Brey declared dividends of $30,000 in 2019 and $34,000 in 2020. Brey sells inventory to Pitino as follows: Year 2019 2020 2021 Cost to Brey $ 91,000 122,500 135,000 Inventory Remaining at Transfer Price Year-End (at to Pitino transfer price) $ 225,000 $ 47,000 245,000 59,500 270,000 50,000 At December 31, 2021, Pitino owes Brey $38,000 for inventory acquired during the period. The following separate account balances are for these two companies for December 31, 2021, and the year then ended. Note: Parentheses indicate a credit balance. ur ur Sales revenues Cost of goods sold Expenses Equity in earnings of Brey Net income Retained earnings, 1/1/21 Net income (above) Dividends declared Retained earnings, 12/31/21 Cash and receivables Inventory Investment in Brey Land, buildings, and equipment (net) Total assets Liabilities Common stock Retained earnings, 12/31/21 Total liabilities and equity Pitino Brey (906,000) $ ( 476,000) 537,000 231,000 187,600 102,000 (120,195) 0 (301,595) $(143,000) $ (532,000) $ (322,000) (301,595) (143, 000) 151,000 58,000 $ (682,595) $(407,000) $ 168,000 $ 120,000 365,000 280,000 667, 260 0 986,000 350,000 $ 2,186,260 $ 750,000 $ (878,665) $ (17,000) (625,000) (326,000) (682,595) (407,000) $(2,186,260) $(750,000) Req A to D Req E ReqF Req G ReqH ReqI Without preparing a worksheet or consolidation entries, determine the consolidation balances for these two companies. (Input all amounts as positive values.) 0 % O Sales revenues Cost of goods sold Expenses Equity in earnings of Brey Consolidated net income Noncontrolling interest in consolidated net income Consolidated net income to Pitino Retained earnings, 1/1/21 Dividends declared Retained earnings, 12/31/21 Cash and receivables Inventory Investment in Brey Land, buildings, and equipment (net) Patented technology Total Assets Liabilities Noncontrolling interest in Brey, 12/31/21 Common Stock Retained earnings, 12/31/21 Total liabilities and equity Consolidated Balance S 1,112,000 S 493,250 S 303,800 S 0 S 301,595 S 13,355 S 301,595 S 532,000 S 151,000 S 682,595 S 250,000 S 620,000 S 0 S 1,358,400 S 11,000 S 2,239,400 S 857,665 S 74,140 S 625,000 S 682,595 S 2,239,400 0000 O OOOO