can this be done in full

this is all the informaon provided.

depreciation is in the notes

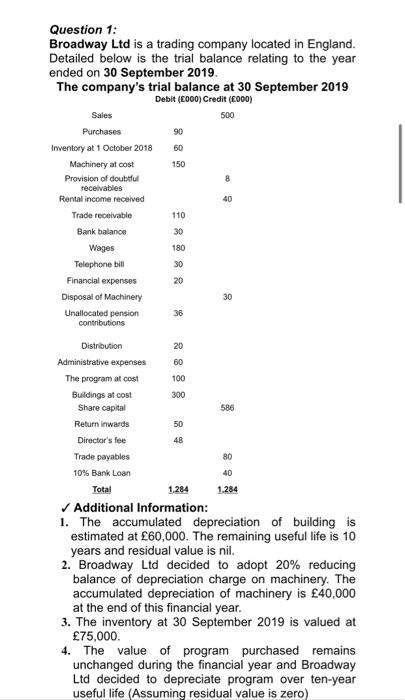

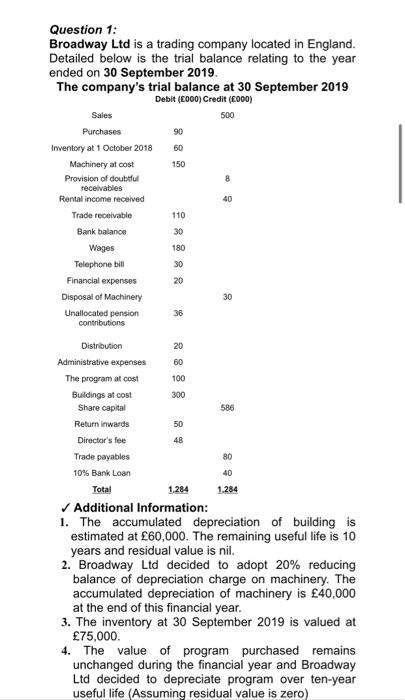

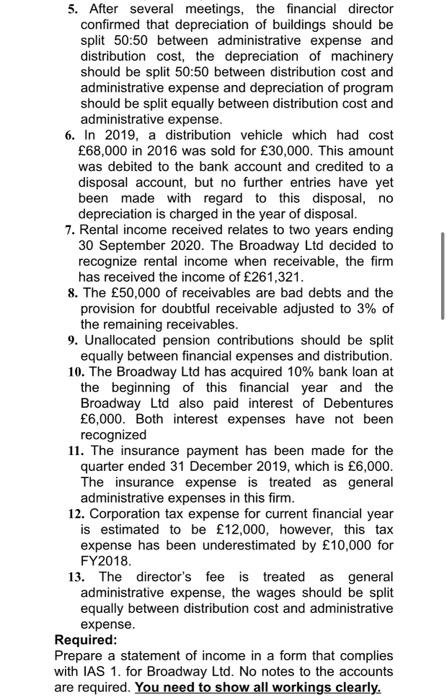

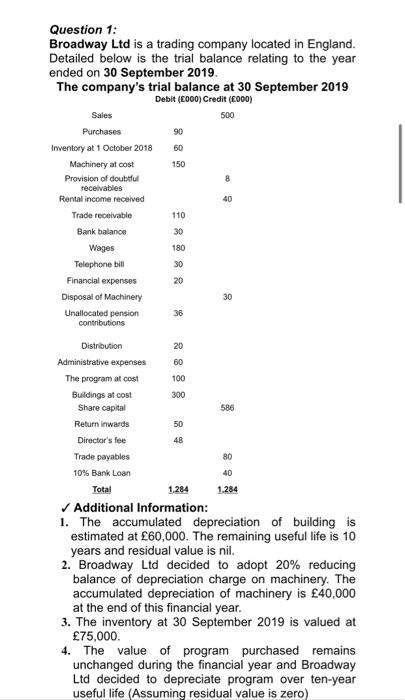

Question 1: Broadway Ltd is a trading company located in England. Detailed below is the trial balance relating to the year ended on 30 September 2019. The company's trial balance at 30 September 2019 Debit (E000) Credit (E000) Sales 500 Purchases 90 Inventory at 1 October 2018 60 Machinery at cost 150 Provision of doubtful receivables Rental income received Trade receivable 110 Bank balance 30 Wages 180 Telephone bill Financial expenses 20 Disposal of Machinery 30 Unallocated pension 36 contributions 8 40 30 20 60 50 48 40 Distribution Administrative expenses The program at cost 100 Buildings at cost 300 Share capital 586 Return inwards Director's fee Trade payables 80 10% Bank Loan Total 1284 1.284 Additional Information: 1. The accumulated depreciation of building is estimated at 60,000. The remaining useful life is 10 years and residual value is nil. 2. Broadway Ltd decided to adopt 20% reducing balance of depreciation charge on machinery. The accumulated depreciation of machinery is 40,000 at the end of this financial year. 3. The inventory at 30 September 2019 is valued at 75,000 4. The value of program purchased remains unchanged during the financial year and Broadway Ltd decided to depreciate program over ten-year useful life (Assuming residual value is zero) 5. After several meetings, the financial director confirmed that depreciation of buildings should be split 50:50 between administrative expense and distribution cost, the depreciation of machinery should be split 50:50 between distribution cost and administrative expense and depreciation of program should be split equally between distribution cost and administrative expense. 6. In 2019, a distribution vehicle which had cost 68,000 in 2016 was sold for 30,000. This amount was debited to the bank account and credited to a disposal account, but no further entries have yet been made with regard to this disposal, no depreciation is charged in the year of disposal. 7. Rental income received relates to two years ending 30 September 2020. The Broadway Ltd decided to recognize rental income when receivable, the firm has received the income of 261,321. 8. The 50,000 of receivables are bad debts and the provision for doubtful receivable adjusted to 3% of the remaining receivables. 9. Unallocated pension contributions should be split equally between financial expenses and distribution. 10. The Broadway Ltd has acquired 10% bank loan at the beginning of this financial year and the Broadway Ltd also paid interest of Debentures 6,000. Both interest expenses have not been recognized 11. The insurance payment has been made for the quarter ended 31 December 2019, which is 6,000. The insurance expense is treated as general administrative expenses in this firm. 12. Corporation tax expense for current financial year is estimated to be 12,000, however, this tax expense has been underestimated by 10,000 for FY2018. 13. The director's fee is treated as general administrative expense, the wages should be split equally between distribution cost and administrative expense. Required: Prepare a statement of income in a form that complies with IAS 1. for Broadway Ltd. No notes to the accounts are required. You need to show all workings clearly