can u check my answer if it's right or and if no fixed and tell my why? and can I get part B please? Thanks in advance

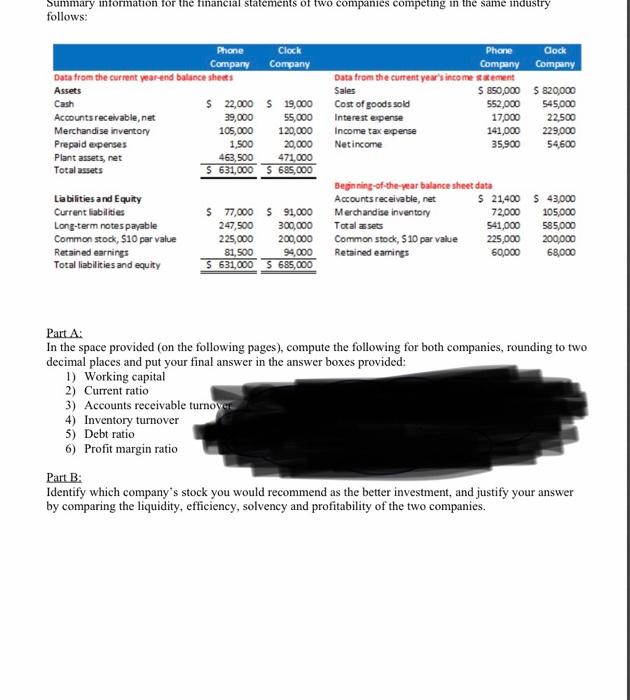

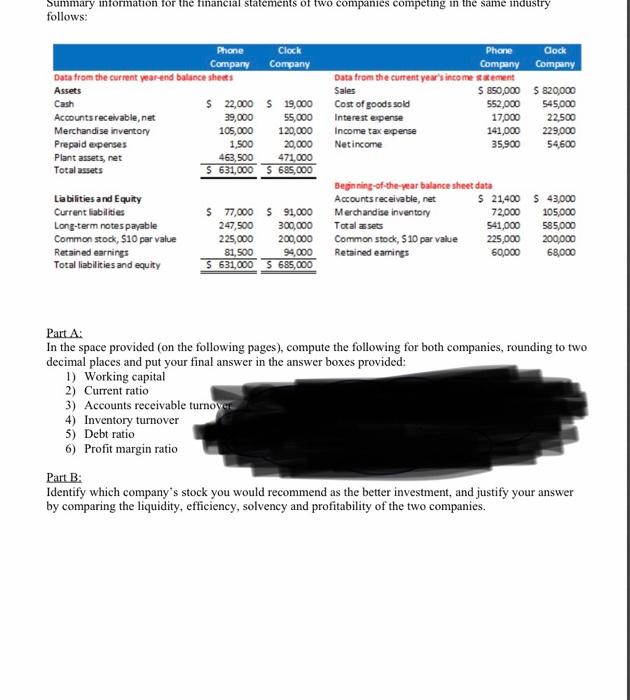

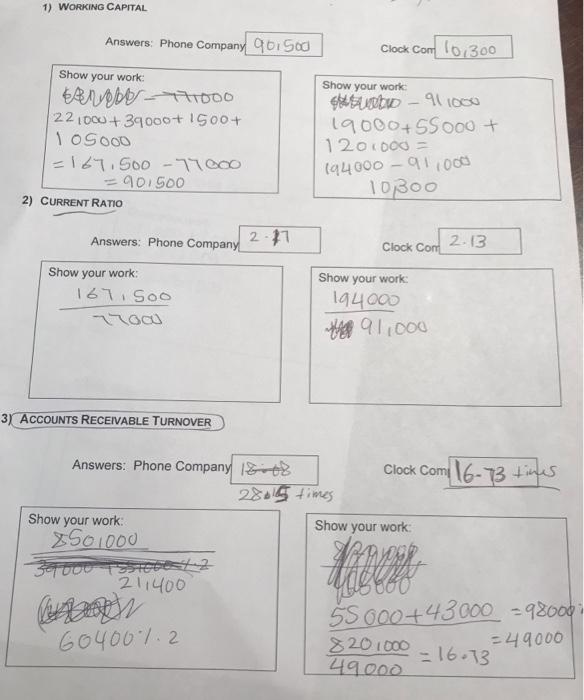

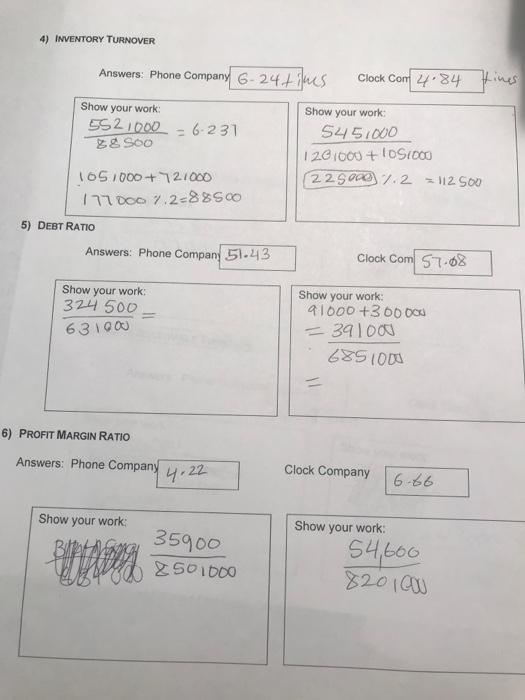

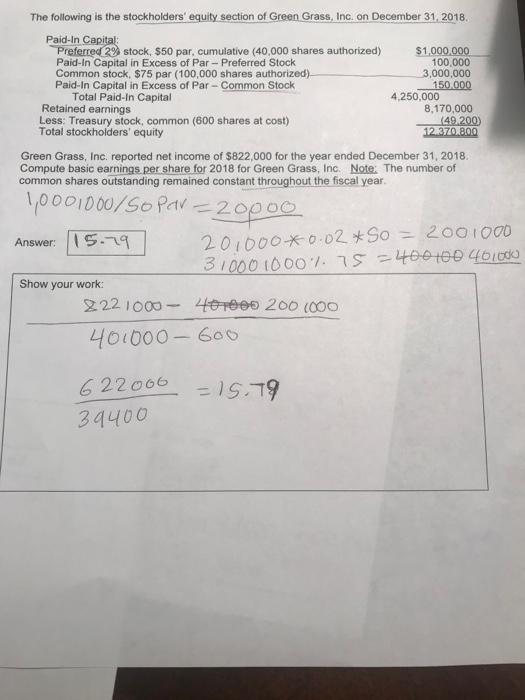

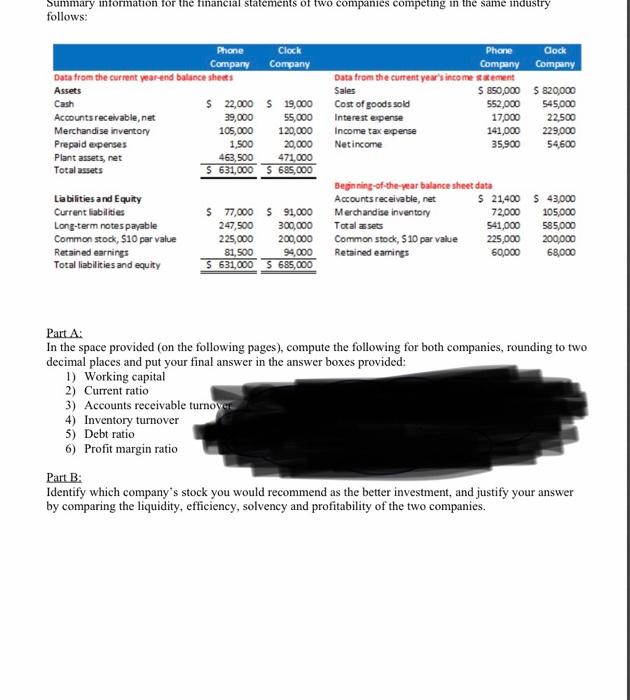

Summary information for the financial statements of two companies competing in the same industry follows: Phone Clock Company Company Data from the current year-end balance sheets Assets Cash $ 22,000 5 19,000 Accounts receivable, net 39,000 55,000 Merchandise inventory 105,000 120,000 Prepaid epenses 1,500 20,000 Plant assets, net 463,500 471,000 Total assets $631,000 S 685,000 Phone Cock Company Company Data from the current year's income statement Sales $ 850,000 $ 820,000 Cost of goods sold 552,000 545,000 Interest expense 17,000 22,500 Income tax expense 141,000 229,000 Netincome 35,900 54,600 Liabilities and Equity Current liabilities Long-term notes payable Common stock, 510 par value Retained earnings Total liabilities and equity $ 77,000 $91,000 247,500 300,000 225,000 200,000 81,500 94,000 S 631,000 $ 685,000 Beginning-of-the-year balance sheet data Accounts receivable, net $ 21,400 $ 43,000 Merchandise inventory 72,000 105,000 Total asets 541,000 585,000 Common stock, S10 par value 225,000 200,000 Retained earings 60,000 68,000 Part A: In the space provided on the following pages), compute the following for both companies, rounding to two decimal places and put your final answer in the answer boxes provided: 1) Working capital 2) Current ratio 3) Accounts receivable turnov 4) Inventory turnover 5) Debt ratio 6) Profit margin ratio Part B: Identify which company's stock you would recommend as the better investment, and justify your answer by comparing the liquidity, efficiency, solvency and profitability of the two companies. 1) WORKING CAPITAL Answers: Phone Company 90.500 Clock Com 10,300 Show your work Brebe_77000 221000 + 39000+ 1900+ 1OS000 =169.500-17000 =90.500 2) CURRENT RATIO Show your work SHANDO - 91000 19000+55ooo + 120 000 = 194000 - 91.000 10300 Answers: Phone Company 2.17 2.13 Clock Com Show your work: 167, Soo zao Show your work 194000 Here 91.000 3) ACCOUNTS RECEIVABLE TURNOVER Answers: Phone Company Sot Clock Com 16-13 tiges 28015 times Show your work Show your work 3501000 Sostatt 2 211400 55000+43000 =980001 60400 1.2 8 20.1000 - 49000 - 16.13 49.000 4) INVENTORY TURNOVER Answers: Phone Company G-24 + ilues Clock Com 4.84 Show your work 5521000 = 6-231 88 Soo Show your work: 545.000 1201000 + 10 S1000 22 50e7.2 112 500 105 1000 + 721000 177000 7.2-88500 5) DEBT RATIO Answers: Phone Company 51.43 Clock Com 57-08 Show your work: 324500 631000 Show your work: 91000 +300 000 - 391000 685 1000 6) PROFIT MARGIN RATIO Answers: Phone Company 4.22 Clock Company 6.66 Show your work Show your work 35900 2501000 54,600 820 100 The following is the stockholders' equity section of Green Grass, Inc. on December 31, 2018 Paid-In Capital Preferred 2% stock, $50 par, cumulative (40,000 shares authorized) $1,000,000 Paid-In Capital in Excess of Par - Preferred Stock 100,000 Common stock. $75 par (100,000 shares authorized) 3,000,000 Paid-In Capital in Excess of Par - Common Stock 150.000 Total Paid-In Capital 4,250,000 Retained earnings 8,170,000 Less Treasury stock, common (600 shares at cost) 149 200 Total stockholders' equity 12.370.8.00 Green Grass, Inc. reported net income of $822,000 for the year ended December 31, 2018 Compute basic earnings per share for 2018 for Green Grass, Inc. Note: The number of common shares outstanding remained constant throughout the fiscal year. 1,0001000/Sopar = 2opoo Answer: 15.-19 201000*0.02 * So = 200 1000 31000 1000 1.75 -02100 40.000 Show your work: 2221000 - 40ees 200 1000 401000 - 600 - 15.79 622006 39400