Can you answer question 3b, 3c, 3d, 3e please?

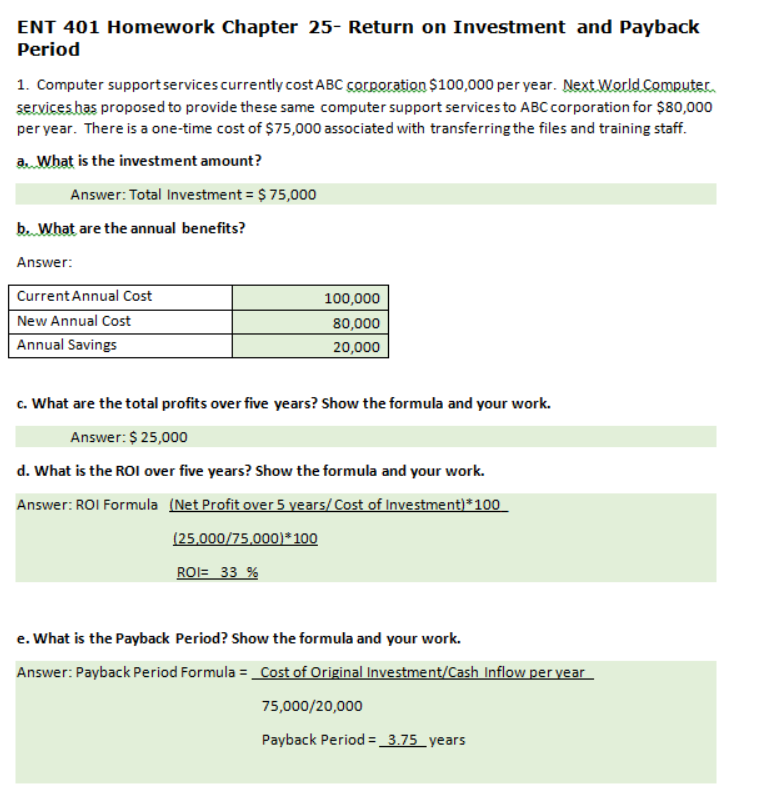

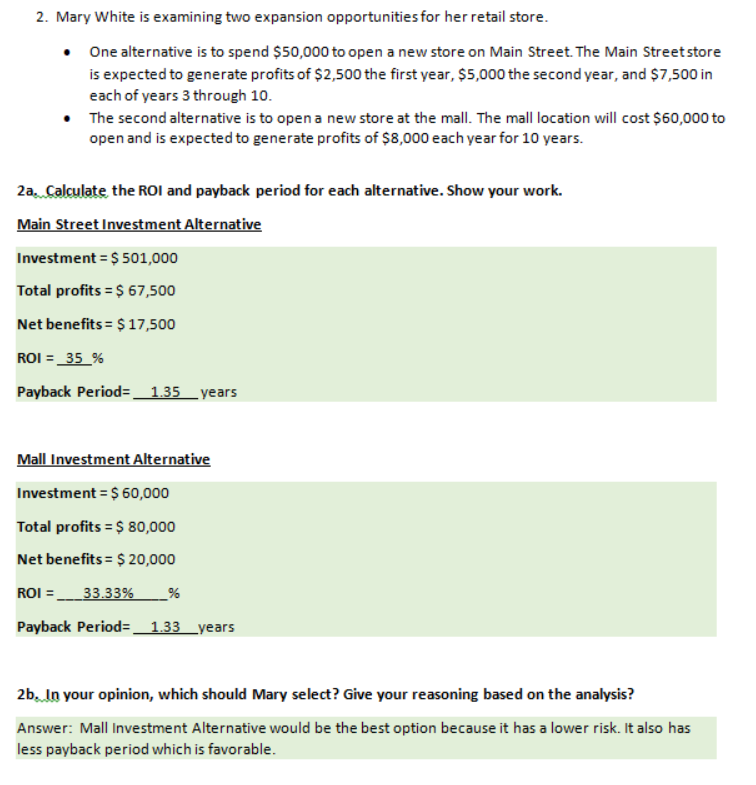

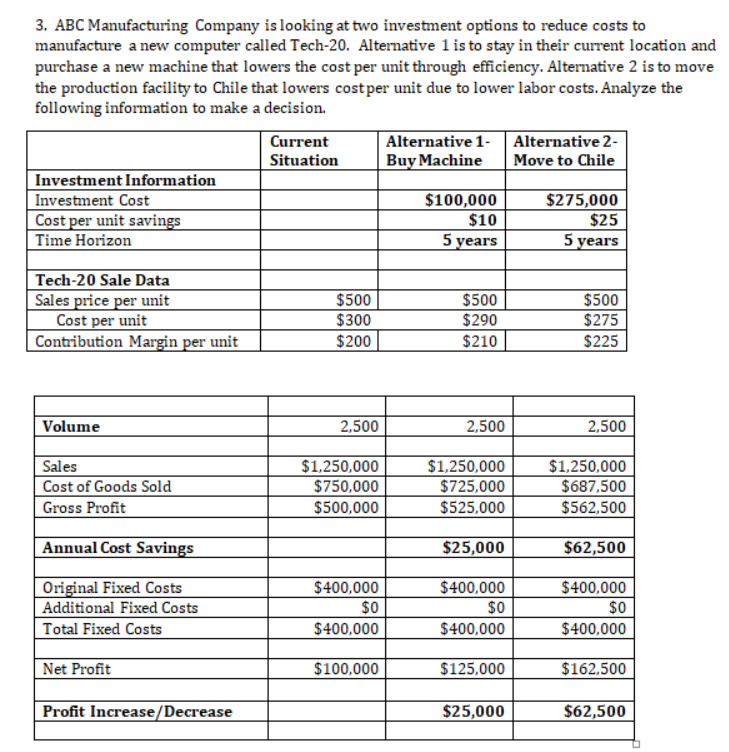

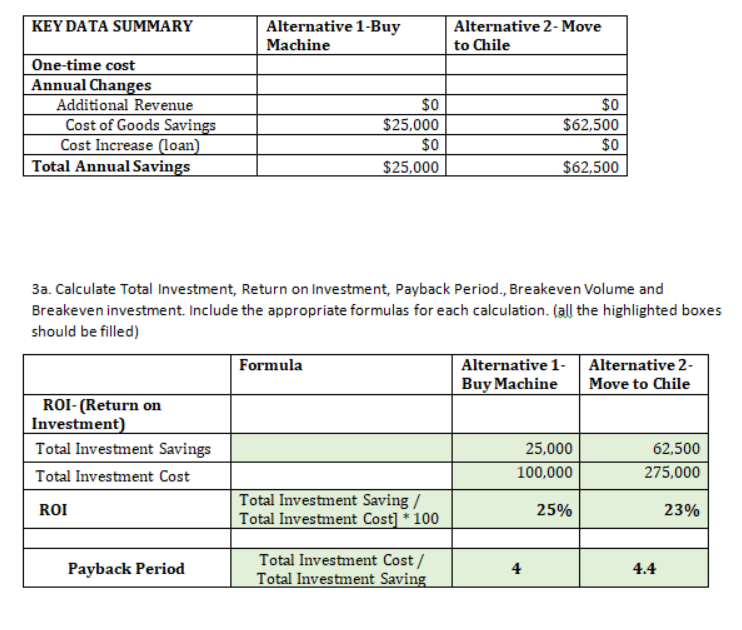

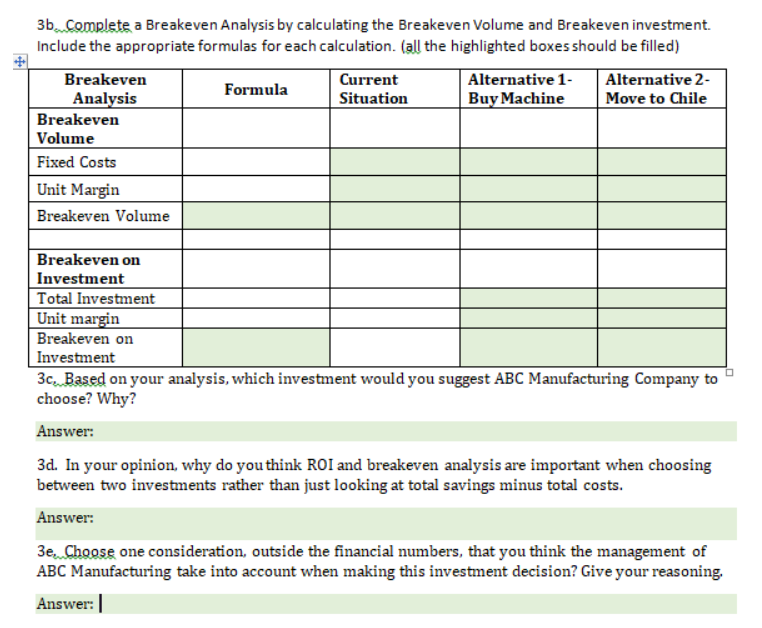

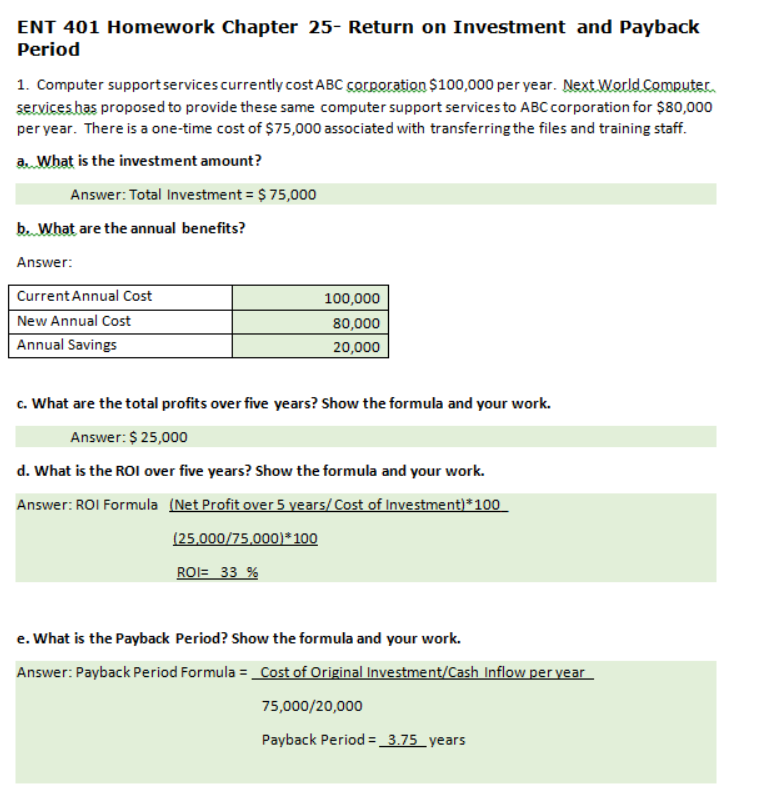

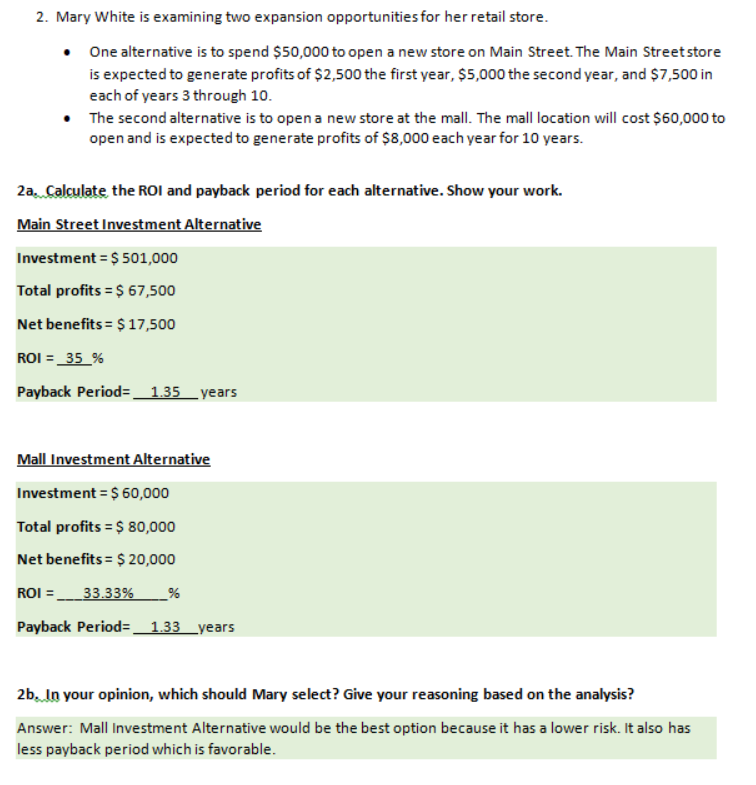

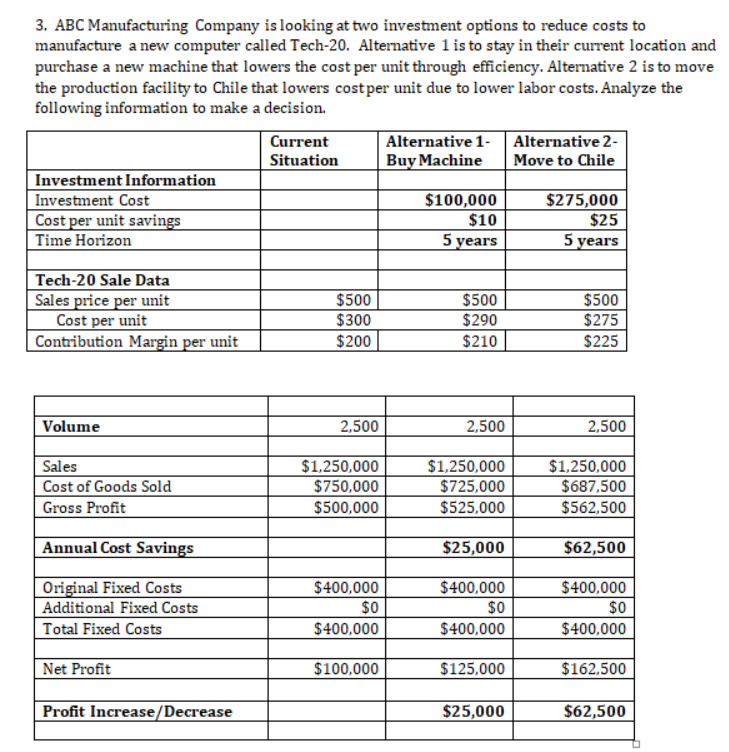

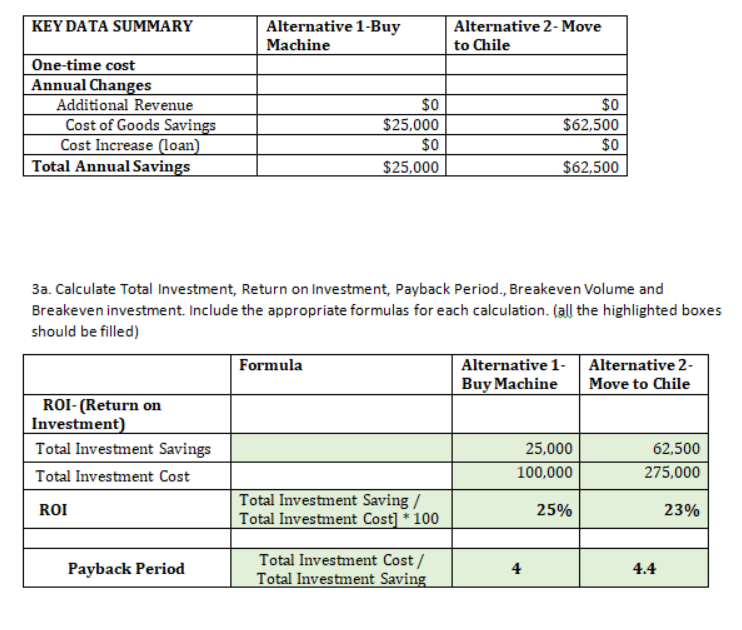

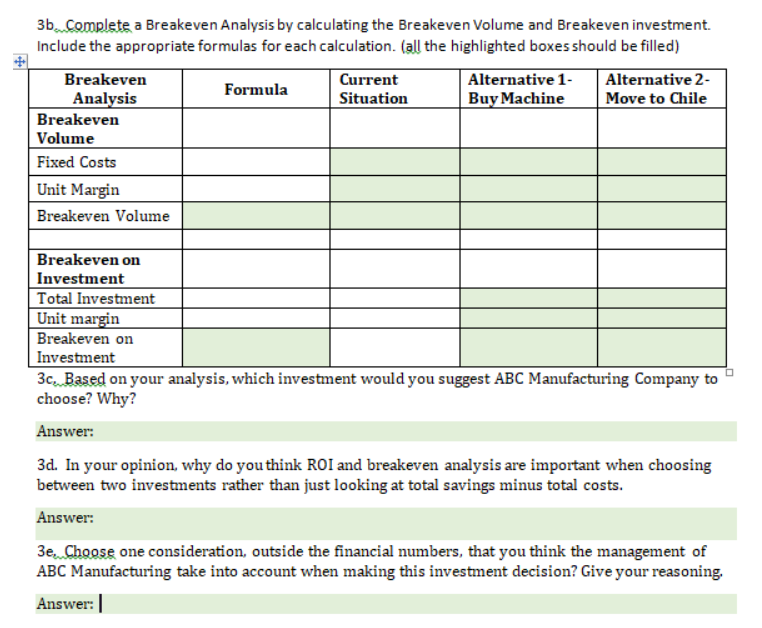

ENT 401 Homework Chapter 25- Return on Investment and Payback Period 1. Computer support services currently cost ABC corporation $100,000 per year. Next World Computer. services has proposed to provide these same computer support services to ABC corporation for $80,000 per year. There is a one-time cost of $75,000 associated with transferring the files and training staff. a. What is the investment amount? Answer: Total Investment =$75,000 b. What are the annual benefits? Answer: c. What are the total profits over five years? Show the formula and your work. Answer: $25,000 d. What is the ROI over five years? Show the formula and your work. e. What is the Payback Period? Show the formula and your work. Answer:PaybackPeriodFormula=CostofOriginalInvestment/CashInflowperyear75,000/20,000PaybackPeriod=3.75years 2. Mary White is examining two expansion opportunities for her retail store. - One alternative is to spend $50,000 to open a new store on Main Street. The Main Streetstore is expected to generate profits of $2,500 the first year, $5,000 the second year, and $7,500 in each of years 3 through 10 . - The second alternative is to open a new store at the mall. The mall location will cost $60,000 to open and is expected to generate profits of $8,000 each year for 10 years. 2a. Calculate the ROI and payback period for each alternative. Show your work. Main Street Investment Alternative Investment =$501,000 Total profits =$67,500 Net benefits =$17,500 ROI =35% Payback Period =1.35 years Mall Investment Alternative Investment =$60,000 Total profits =$80,000 Net benefits =$20,000 ROI=33.33%% Payback Period= 1.33 years 2b. In your opinion, which should Mary select? Give your reasoning based on the analysis? Answer: Mall Investment Alternative would be the best option because it has a lower risk. It also has less payback period which is favorable. 3. ABC Manufacturing Company is looking at two investment options to reduce costs to manufacture a new computer called Tech-20. Alternative 1 is to stay in their current location and purchase a new machine that lowers the cost per unit through efficiency. Alternative 2 is to move the production facility to Chile that lowers cost per unit due to lower labor costs. Analyze the following information to make a decision. 3a. Calculate Total Investment, Return on Investment, Payback Period., Breakeven Volume and Breakeven investment. Include the appropriate formulas for each calculation. (all the highlighted boxes should be filled) 3b. Complete a Breakeven Analysis by calculating the Breakeven Volume and Breakeven investment. Include the appropriate formulas for each calculation. (all the highlighted boxes should be filled) 3c. Based on your analysis, which investment would you suggest ABC Manufacturing Company to choose? Why? Answer: 3d. In your opinion, why do you think ROI and breakeven analysis are important when choosing between two investments rather than just looking at total savings minus total costs. Answer: 3ee Choose one consideration, outside the financial numbers, that you think the management of ABC Manufacturing take into account when making this investment decision? Give your reasoning