Question

Considering the following information, Original amount of the existing loan: $300,000 Term of the original mortgage: 15 years Contract interest rate on existing mortgage: 7%

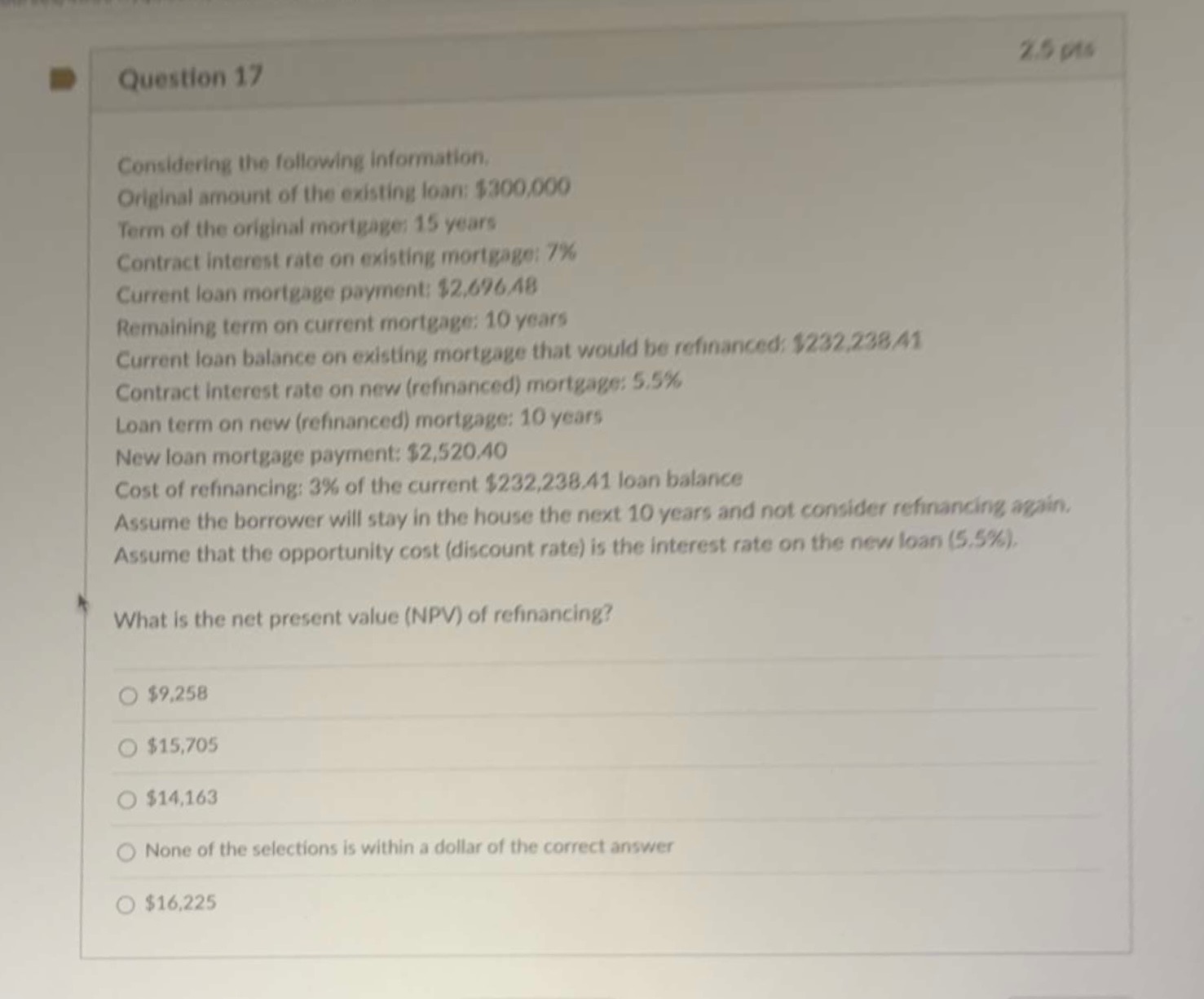

- Considering the following information,

Original amount of the existing loan: $300,000

Term of the original mortgage: 15 years

Contract interest rate on existing mortgage: 7%

Current loan mortgage payment: $2,696.48

Remaining term on current mortgage: 10 years

Current loan balance on existing mortgage that would be refinanced: $232,238.41

Contract interest rate on new (refinanced) mortgage: 5.5%

Loan term on new (refinanced) mortgage: 10 years

New loan mortgage payment: $2,520.40

Cost of refinancing: 3% of the current $232,238.41 loan balance

What is the net present value (NPV) of refinancing?

A) $9,258

B) $15,705

C) $14,163

D) None of the selections is within a dollar of the correct answer

E) $16,225

PLEASE HELP!!

Considering the following information. Original amount of the existing loan: $300,000 Term of the original mortgagen 15 years Contract interest rate on existing mortgage: 7% Current loan mortgage payment: \$2,696, 48 Remaining term on current mortgage: 10 years Current loan balance on existing mortgage that would be refinanced: 1232,238,41 Contract interest rate on new (refinanced) mortgage: 5.5% Loan term on new (refinanced) mortgage: 10 years New loan mortgage payment: $2,520,40 Cost of refinancing: 3% of the current $232,238,41 loan balance Assume the borrower will stay in the house the next 10 years and not consider refinancing again. Assume that the opportunity cost (discount rate) is the interest rate on the new loan (5.5\%). What is the net present value (NPV) of refinancing? $9,258 $15,705 $14,163 None of the selections is within a dollar of the correct answer $16,225Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started