can you answer these questions please

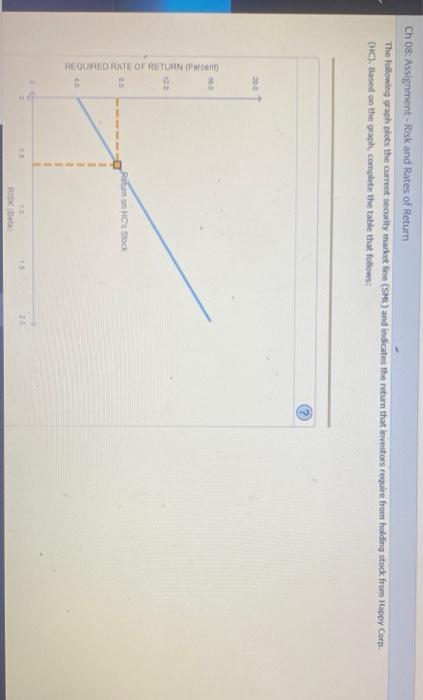

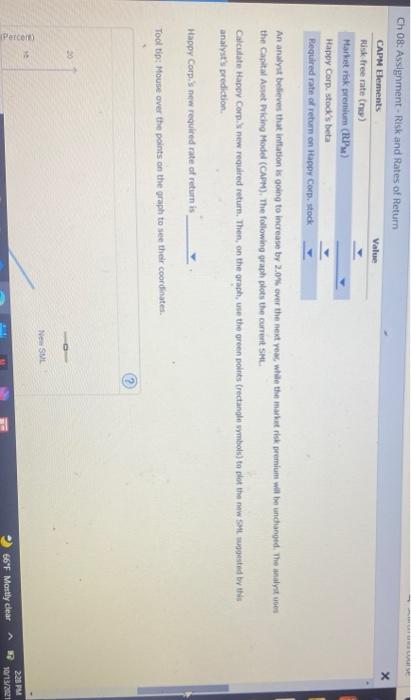

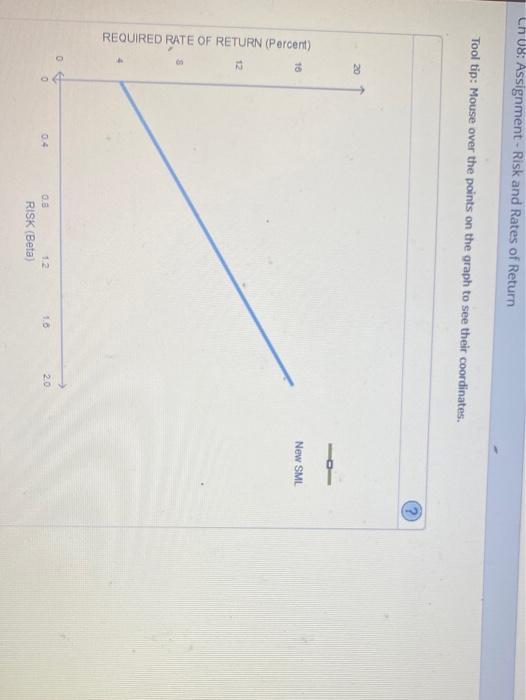

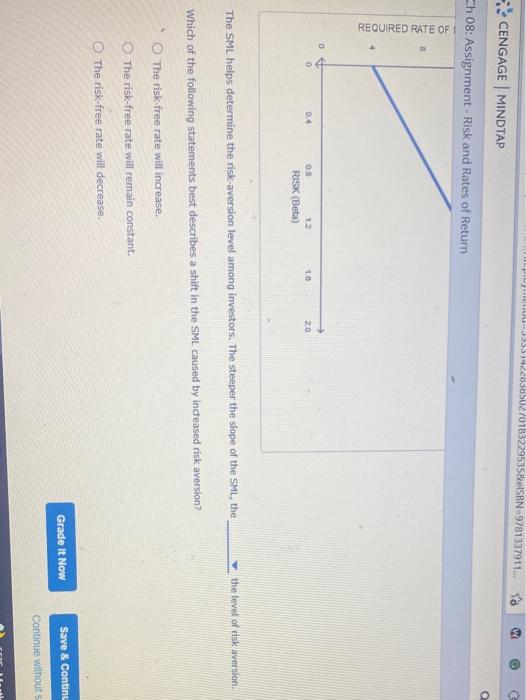

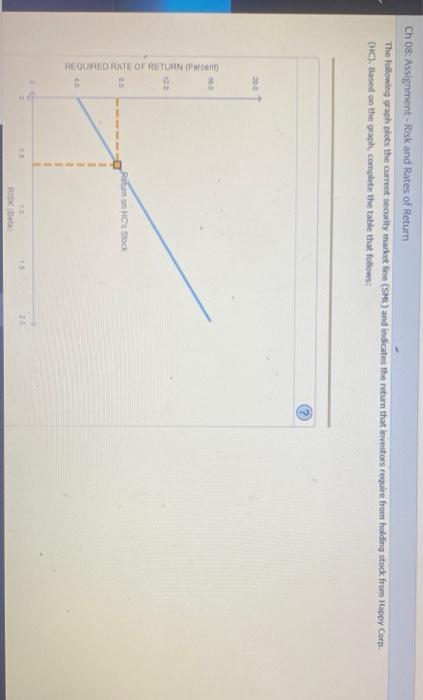

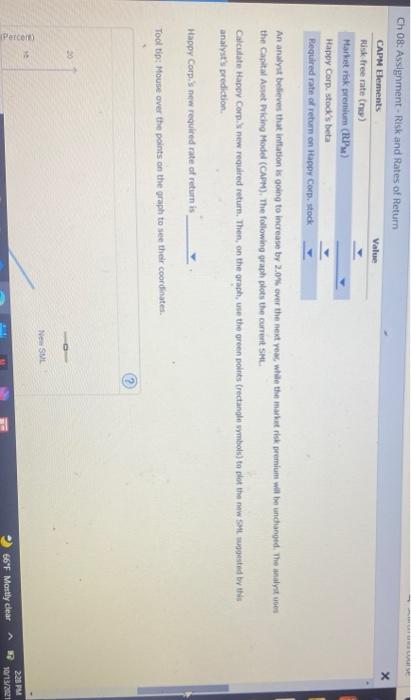

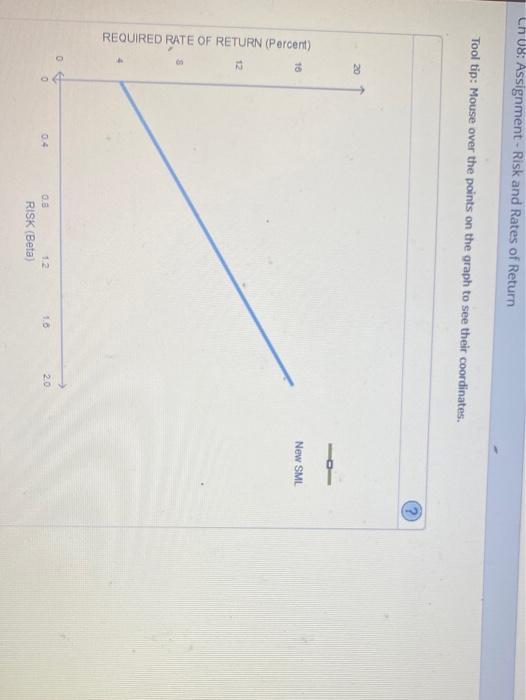

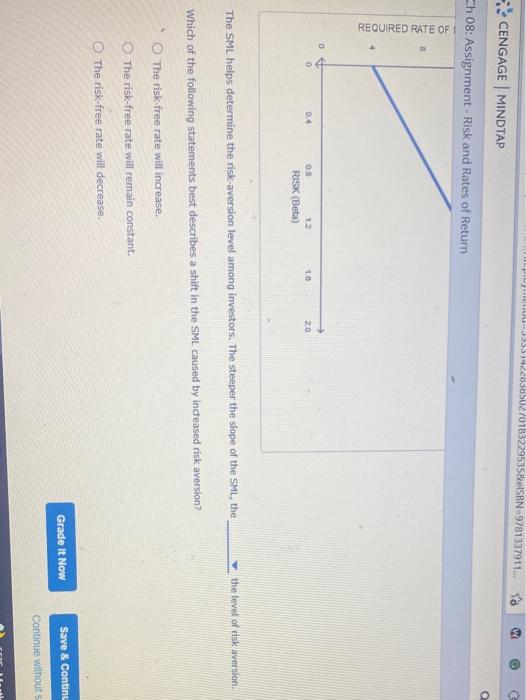

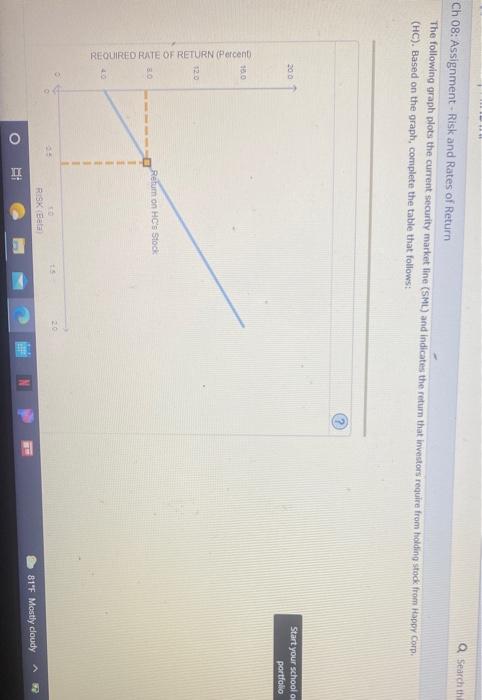

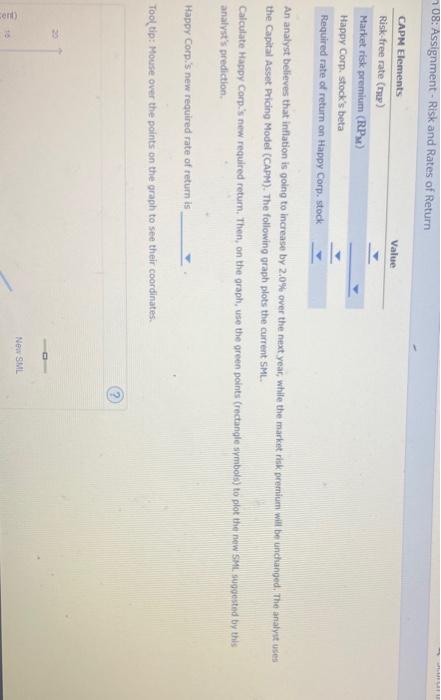

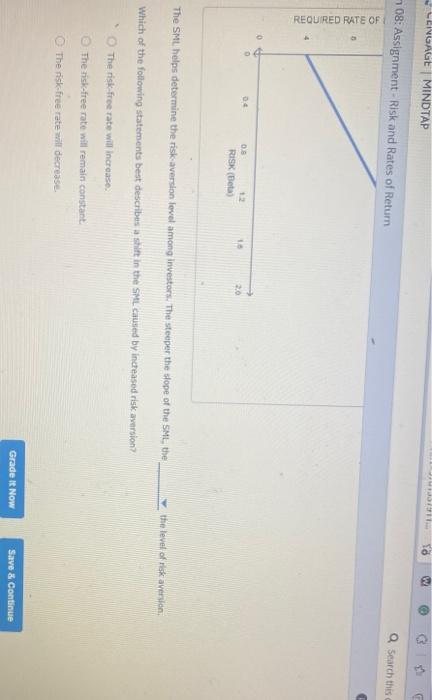

Ch 08: Assignment - Risk and Rates of Return The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp CHC). Based on the graph, complete the table that follows: REQURED RATE OF RETURN Parcon Renon HC Stock RSK B Value Ch 08: Assignment - Risk and Rates of Return CAPM Elements Risk free rate) Markt risk premium (BP) Happy Corp. stock's beta Required rate of return on Happy Corp, stock An analyst believes that inflation is going to increase by 2.0% over the next year, while the market rik premium will be unchanged. The malyst vers the Capital Amet riding Model (CAPM). The following graph plots the current SM. Calculate Happy Corps new required return. Then, on the grach, use the green points rectangle wymbols) to let the new Shoppested by this analyst's prediction Happy Corps new required rate of return is Tooltip: Mouse over the points on the graph to see their coordinates. NSUL Percom 66F Mostly dear 228 PM 10/13/2021 Lh 08: Assignment - Risk and Rates of Return Tool tip: Mouse over the points on the graph to see their coordinates. ? 20 15 New SML REQUIRED RATE OF RETURN (Percent) $ . 1.0 20 03 12 RISK (Beta) HUU-355 422855502701832 BeISBN 9781337911.. B CENGAGE MINDTAP a Ch 08: Assignment - Risk and Rates of Return REQUIRED RATE OF 0 0 04 1.6 20 08 12 RISK (Beta) the level of risk aversion The SML helps determine the risk-aversion level among investors. The steeper the slope of the SML, the Which of the following statements best describes a shift in the SML caused by increased risk aversion? The risk-free rate will increase. The risk-free rate will remain constant. The risk-free rate will decrease. Grade it Now Save & Continu Continue withouts Q Search the Ch 08: Assignment - Risk and Rates of Return The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp (HC). Based on the graph, complete the table that follows: 200 Start your school o portfolio 120 REQUIRED RATE OF RETURN (Percent Refum on HC's Stock RISK Bata 81F Mostly cloudy O 708: Assignment - Risk and Rates of Return Value CAPM Elements Risk-free rate() Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp, stock An analyst believes that inflation is going to increase by 2.0% over the next year, while the market rak premium will be unchanged. The analyst utes the Capital Asset Pricing Model (CAPM). The following graph plots the current SML Calculate Happy Corp's new required retum. Then, on the grach, use the green points rectangle symbols) to plot the new SM suggested by this analyst's prediction Happy Corp's new required rate of return is Tooltip: mouse over the points on the graph to see their coordinates. Now SML cent) Ch 08: Assignment - Risk and Rates of Return The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp CHC). Based on the graph, complete the table that follows: REQURED RATE OF RETURN Parcon Renon HC Stock RSK B Value Ch 08: Assignment - Risk and Rates of Return CAPM Elements Risk free rate) Markt risk premium (BP) Happy Corp. stock's beta Required rate of return on Happy Corp, stock An analyst believes that inflation is going to increase by 2.0% over the next year, while the market rik premium will be unchanged. The malyst vers the Capital Amet riding Model (CAPM). The following graph plots the current SM. Calculate Happy Corps new required return. Then, on the grach, use the green points rectangle wymbols) to let the new Shoppested by this analyst's prediction Happy Corps new required rate of return is Tooltip: Mouse over the points on the graph to see their coordinates. NSUL Percom 66F Mostly dear 228 PM 10/13/2021 Lh 08: Assignment - Risk and Rates of Return Tool tip: Mouse over the points on the graph to see their coordinates. ? 20 15 New SML REQUIRED RATE OF RETURN (Percent) $ . 1.0 20 03 12 RISK (Beta) HUU-355 422855502701832 BeISBN 9781337911.. B CENGAGE MINDTAP a Ch 08: Assignment - Risk and Rates of Return REQUIRED RATE OF 0 0 04 1.6 20 08 12 RISK (Beta) the level of risk aversion The SML helps determine the risk-aversion level among investors. The steeper the slope of the SML, the Which of the following statements best describes a shift in the SML caused by increased risk aversion? The risk-free rate will increase. The risk-free rate will remain constant. The risk-free rate will decrease. Grade it Now Save & Continu Continue withouts Q Search the Ch 08: Assignment - Risk and Rates of Return The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp (HC). Based on the graph, complete the table that follows: 200 Start your school o portfolio 120 REQUIRED RATE OF RETURN (Percent Refum on HC's Stock RISK Bata 81F Mostly cloudy O 708: Assignment - Risk and Rates of Return Value CAPM Elements Risk-free rate() Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp, stock An analyst believes that inflation is going to increase by 2.0% over the next year, while the market rak premium will be unchanged. The analyst utes the Capital Asset Pricing Model (CAPM). The following graph plots the current SML Calculate Happy Corp's new required retum. Then, on the grach, use the green points rectangle symbols) to plot the new SM suggested by this analyst's prediction Happy Corp's new required rate of return is Tooltip: mouse over the points on the graph to see their coordinates. Now SML cent)