Answered step by step

Verified Expert Solution

Question

1 Approved Answer

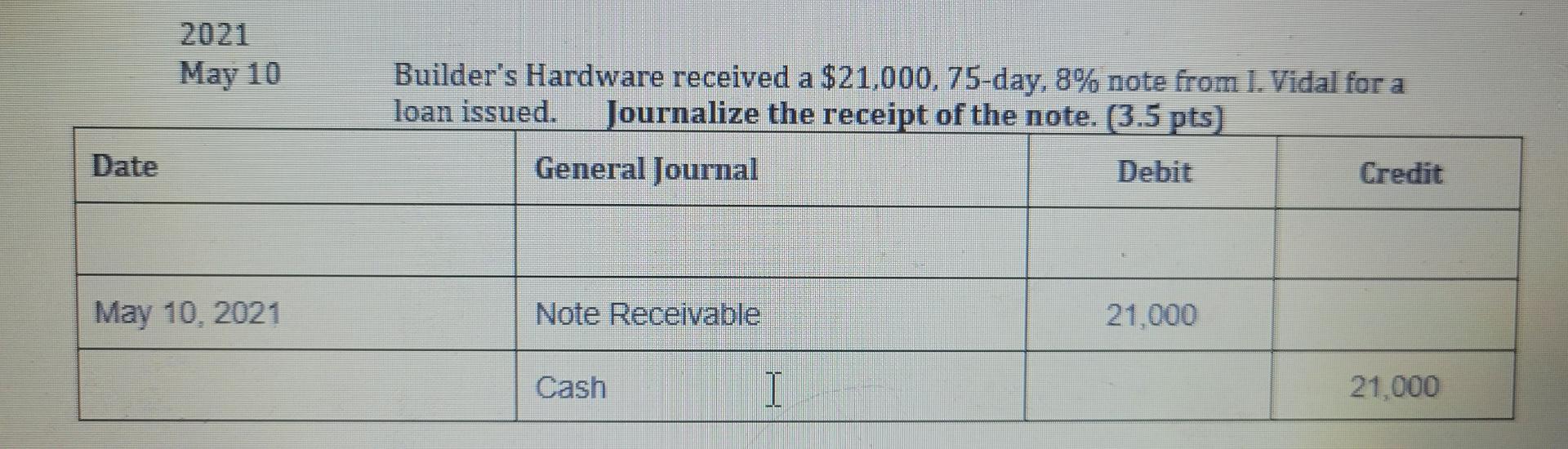

* can you assist me in adding a summary to each adjusting entry, thanks. 2021 May 10 Builder's Hardware received a $21,000,75-day, 8% note from

* can you assist me in adding a summary to each adjusting entry, thanks.

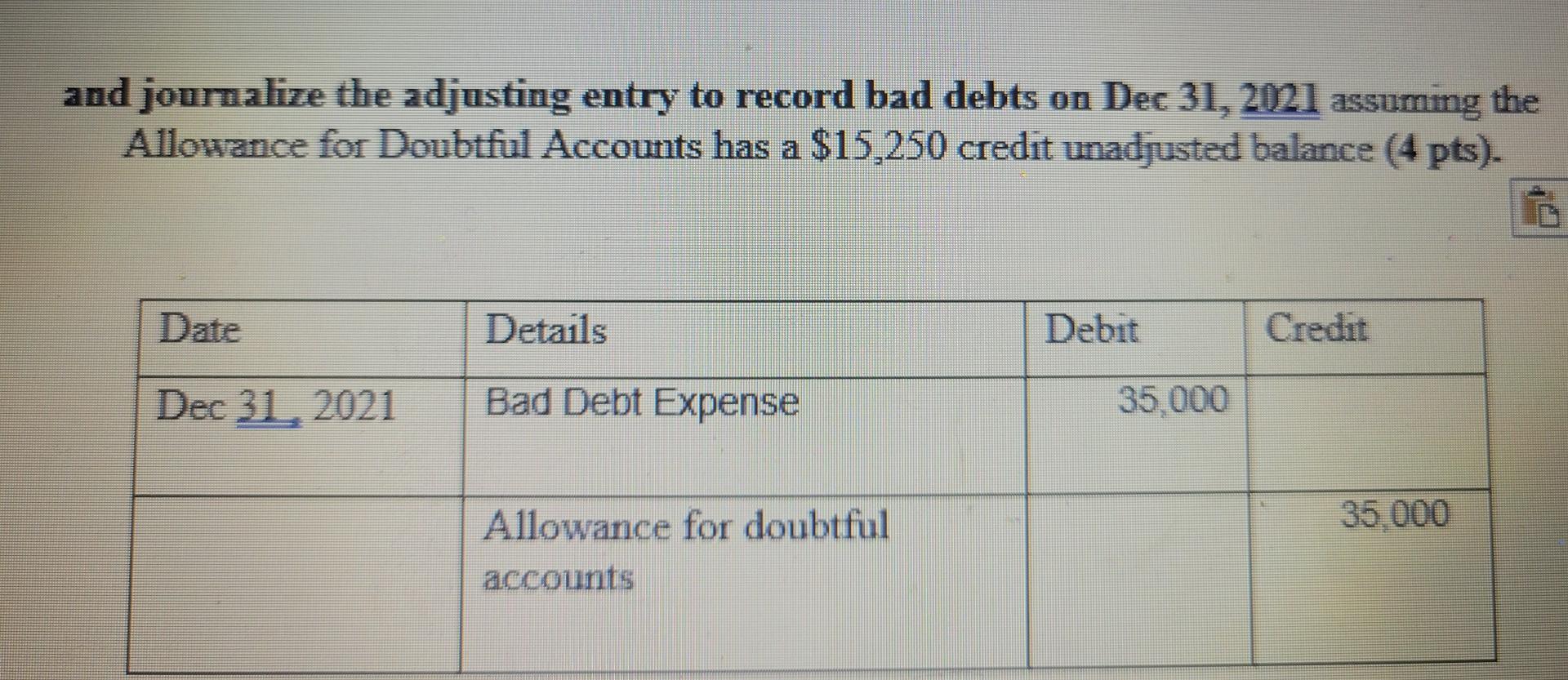

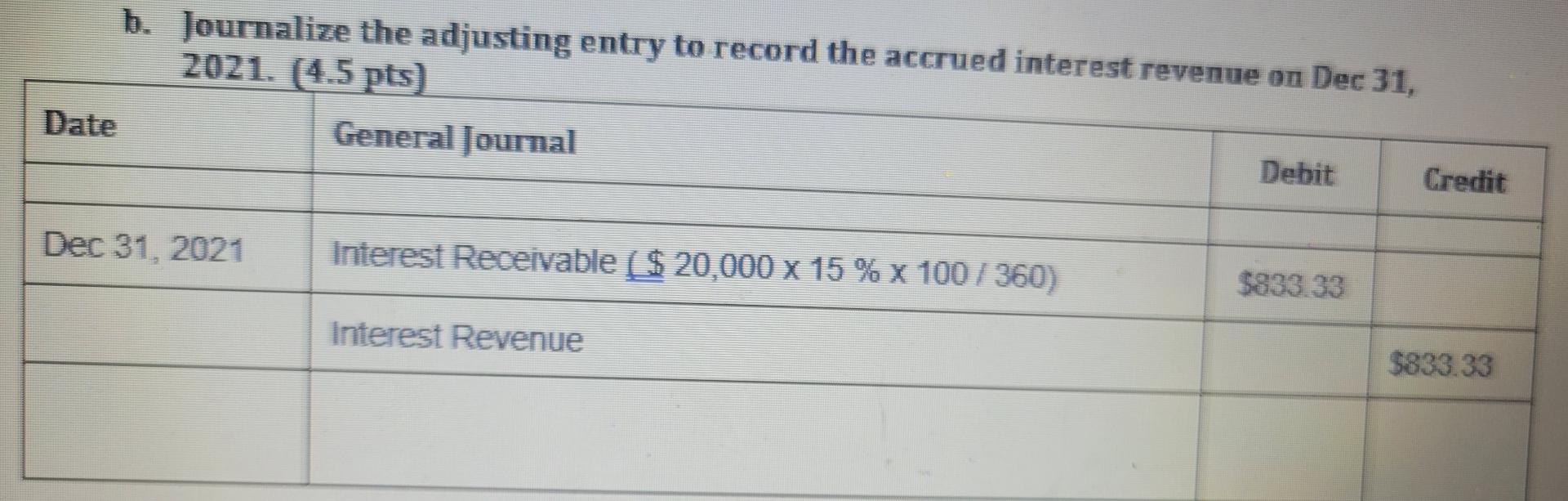

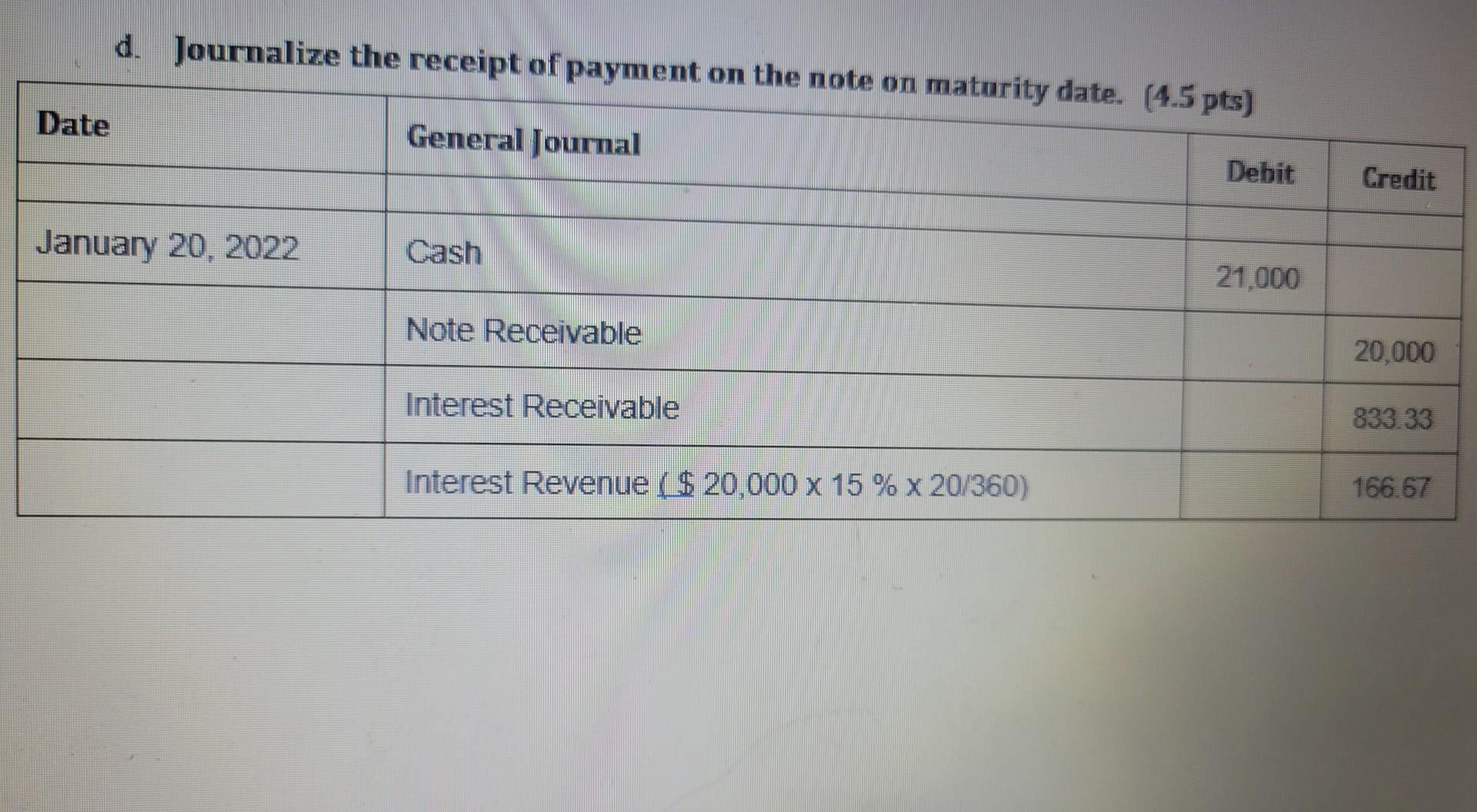

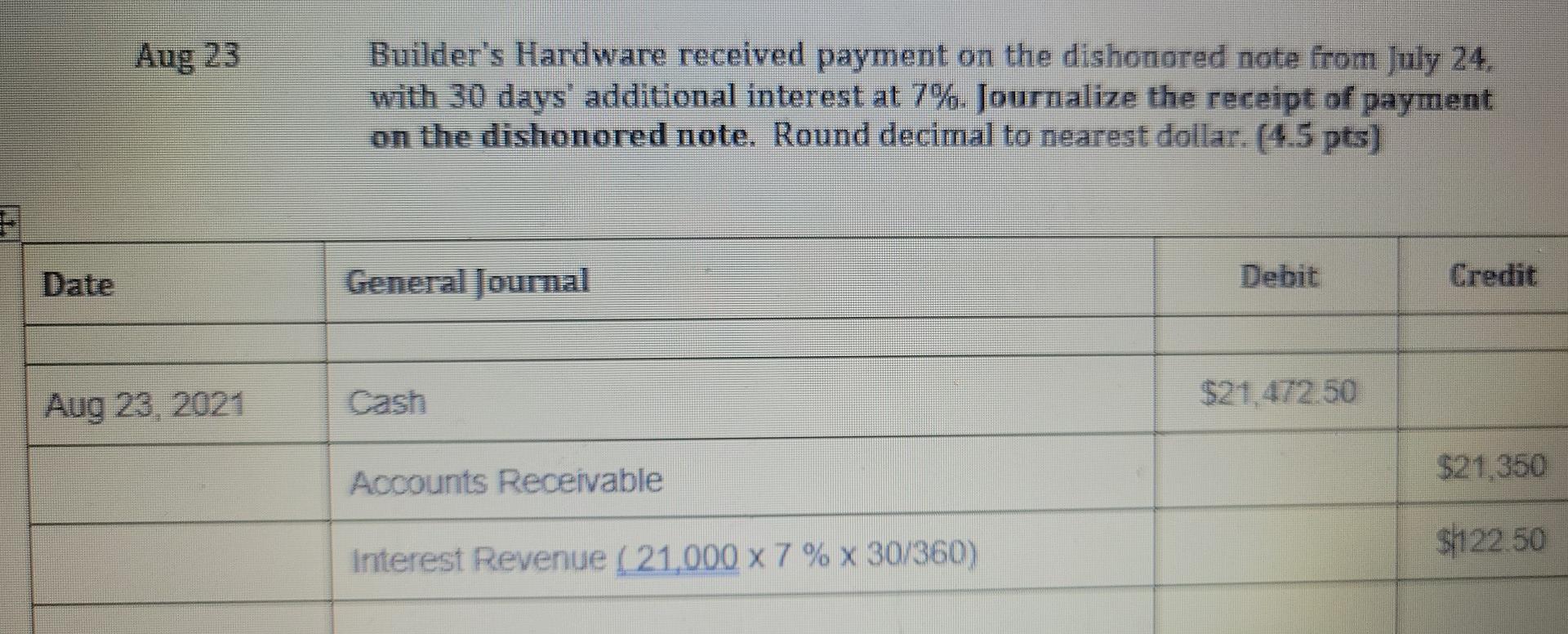

2021 May 10 Builder's Hardware received a $21,000,75-day, 8% note from 1. Vidal for a loan issued. Journalize the receipt of the note. (3.5 pts) General Journal Debit Credit Date May 10, 2021 Note Receivable 21,000 Cash I 21,000 and journalize the adjusting entry to record bad debts on Dec 31, 2021 assuming the Allowance for Doubtful Accounts has a $15,250 credit unadjusted balance (4 pts). Date Details Debit Credit Dec 31, 2021 Bad Debt Expense 35,000 35.000 Allowance for doubtful accounts b. Journalize the adjusting entry to record the accrued interest revenue on Dec 31, 2021. (4.5 pts) Date General Journal Debit Credit Dec 31, 2021 Interest Receivable ($ 20,000 x 15 % x 100 / 360) $833 33 interest Revenue $833.33 d. Journalize the receipt of payment on the note on maturity date. (4.5 pts) Date General Journal Debit Credit January 20, 2022 Cash 21.000 Note Receivable 20.000 Interest Receivable 833.33 Interest Revenue $ 20,000 x 15 % x 20/360) 166.67 Aug 23 Builder's Hardware received payment on the dishonored note from July 24, with 30 days' additional interest at 7%. Journalize the receipt of payment on the dishonored note. Round decimal to nearest dollar. (4.5 pts) Date General Journal Debit Credit Aug 23, 2021 Cash $21.472.50 Accounts Receivable $21.350 $122.50 Interest Revenue ( 21.000 x 7 % x 30/360)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started