Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the pictures of the spreadsheet is the question and the one with blue boxes is where answers go. last three pictures are of the rubric

the pictures of the spreadsheet is the question and the one with blue boxes is where answers go. last three pictures are of the rubric and whats needed

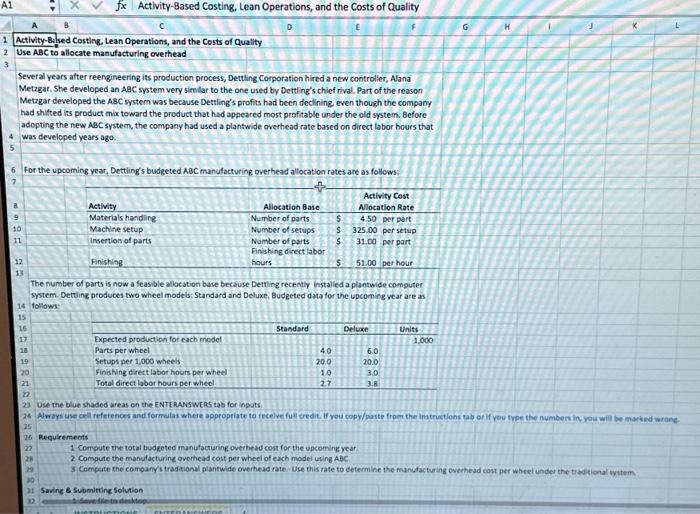

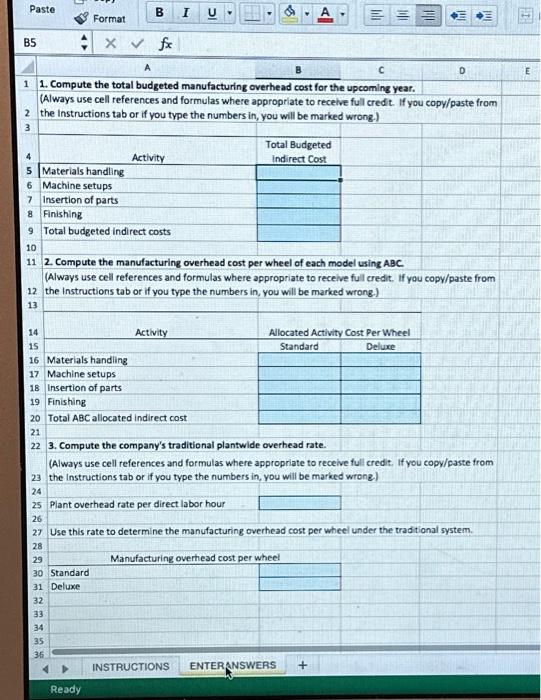

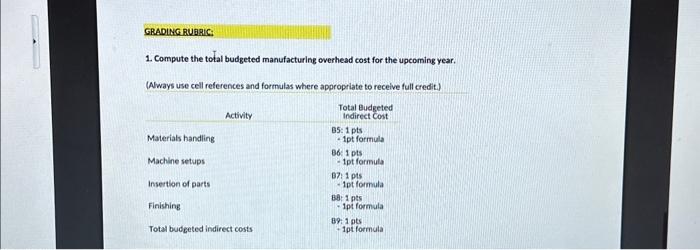

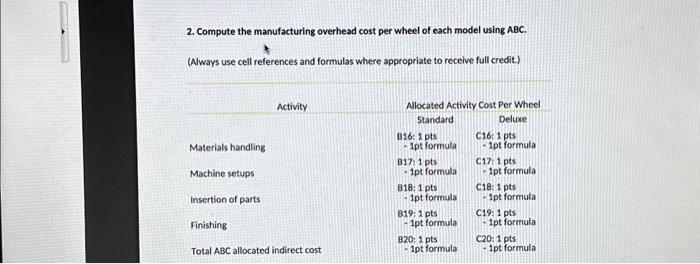

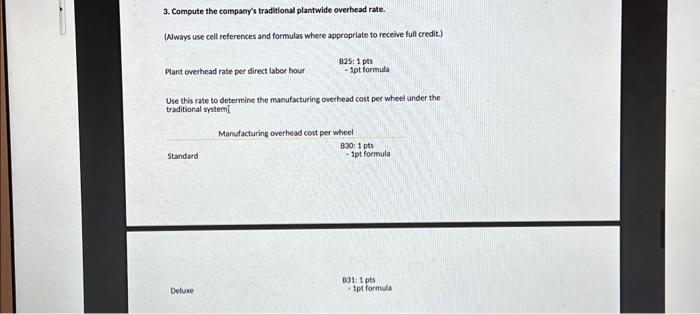

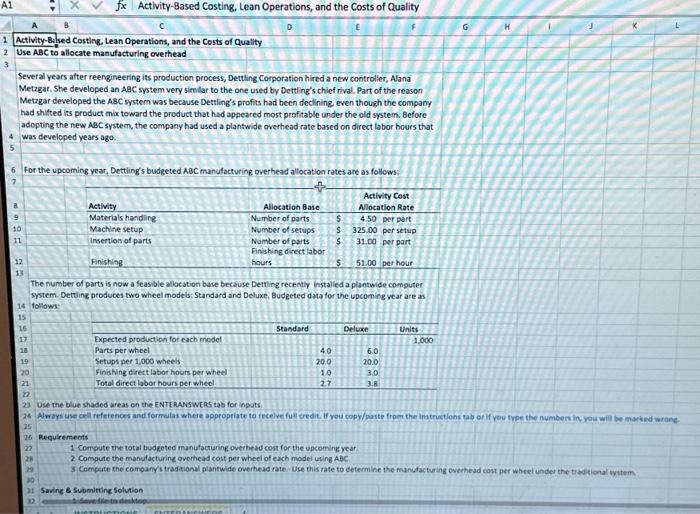

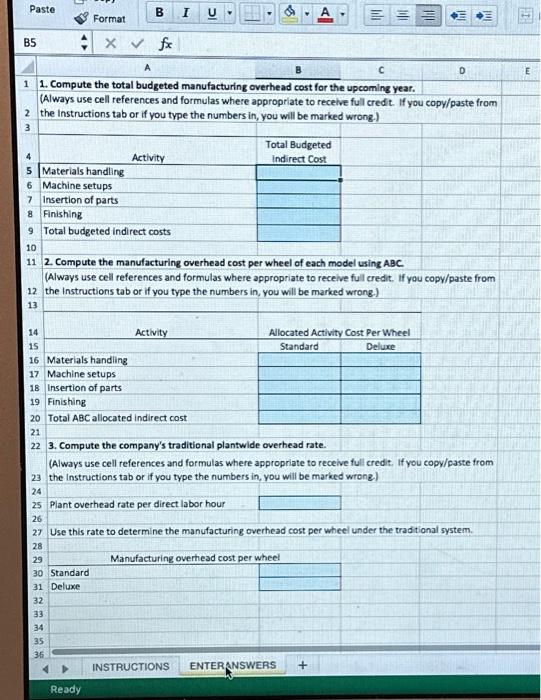

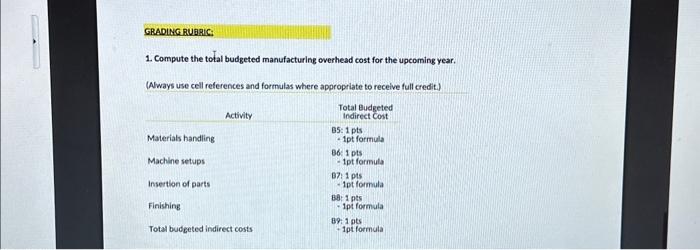

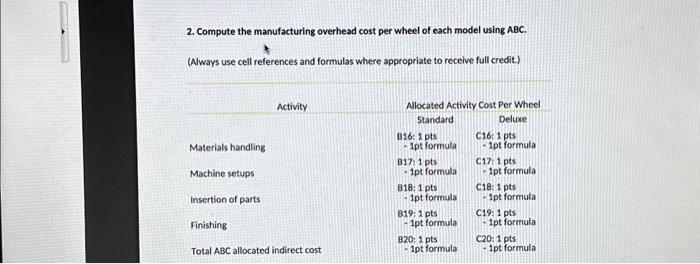

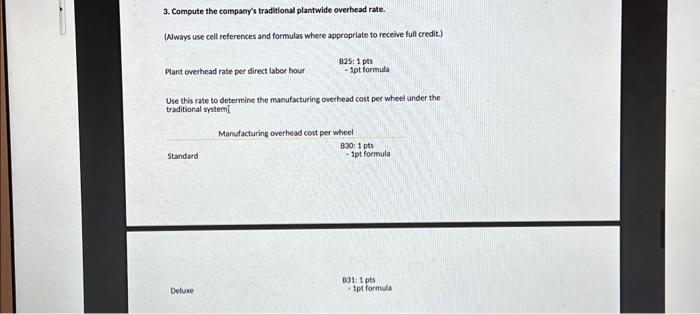

1. Compute the total budgeted manufacturing overhead cost for the upcoming year. (Aways use cell references and formulas where appropriate to receive full credit.) 2. Compute the manufacturing overhead cost per wheel of each model using ABC. (Always use cell references and formulas where appropriate to receive full credit) 3. Compute the company's traditional plantwide overhead rate. (Aways use cell references and formulas where appropriate to receive full credit.) Plant overhead nte per direct laboc hour B25: 1 pts - 1pt formula Use this rate to determine the manufacturing overhead cost per wheel under the traditional systemi 1. Compute the total budgeted manufacturing overhead cost for the upcoming year. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the instructions tab or if you type the numbers in, you will be marked wrong.) 11 2. Compute the manufacturing overhead cost per wheel of each model using ABC. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from 12 the instructions tab or if you type the numbers in, you will be marked wrong.) 22 3. Compute the company's traditional plantwide overhead rate. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from 23 the instructions tab or if you type the numbers in, you will be marked wrone) 24 25 26 27 Use this rate to determine the manufacturing overhead cost per wheel under the traditional system. Several years after reengineering its production process, Dettling Corporation hired a new controlier, Alana Metagar, She developed an AaC system very simflar to the one used by Dettling's chicf rival. Part of the reason Metagar developed the ABC system was because Dettling's profits had been declining even though the company had shifted its product mix toward the product that had appeared most profitable under the old system. Before adopting the new ABC system, the company had used a plantwide overhead rate based on direct labor hours that was developed years ago. For the upcoming year, Dettling's budgeted ABC manufacturing overhead allocation rates are as follows: 7 a 9 10 11 12. 13 The number of parts is now a feasible allocation buse because Detting recently instalied a plantwide computer system. Dettlinc produces two wheel models: Standard and Deluxe, Budgeted data for the upcoming vear are as 14. follows: is 16. 1) 18 19 20 21 22 23 Use the blue shaded areas on the ENTERANSWERS tas for inputs. 25 26 Requirements 22 1 Compute the total budigeted manufactiering overhead cost for the upcoming year: 2 Compule the manutacturing overhead cost per wheel of each model using ABC. 3 Compate the company/s traditional olantwide overhesd rate. Use this rate to determine the manifacturing overhead cost per wheel under the tradsional ivitem

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started