Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you confirm if E is rhe correct answer A firm wishes to issue new shares of its stock, which already trades in the market.

can you confirm if E is rhe correct answer

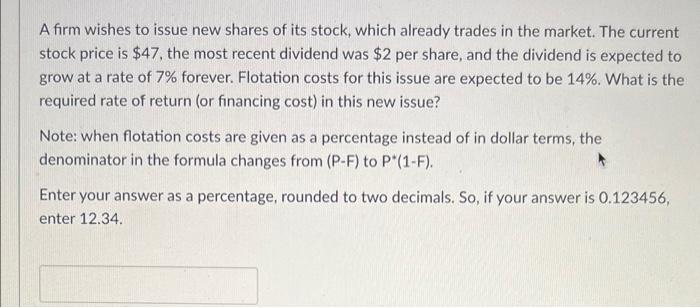

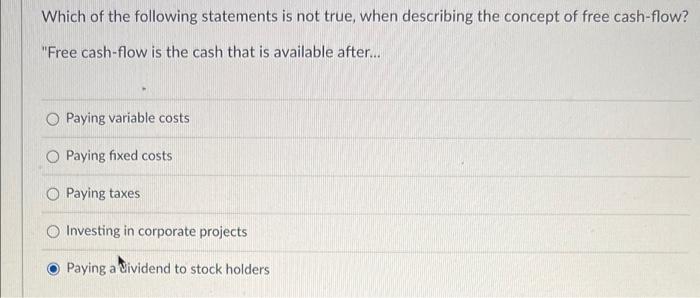

A firm wishes to issue new shares of its stock, which already trades in the market. The current stock price is $47, the most recent dividend was $2 per share, and the dividend is expected to grow at a rate of 7% forever. Flotation costs for this issue are expected to be 14%. What is the required rate of return (or financing cost) in this new issue? Note: when flotation costs are given as a percentage instead of in dollar terms, the denominator in the formula changes from (P-F) to P*(1-F). Enter your answer as a percentage, rounded to two decimals. So, if your answer is 0.123456, enter 12.34. Which of the following statements is not true, when describing the concept of free cash-flow? "Free cash-flow is the cash that is available after... O Paying variable costs O Paying fixed costs Paying taxes Investing in corporate projects Paying a dividend to stock holders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started