Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you do parts 3 and 4!!!! Geary Company is considering an investment costing $110,000. The investment would return $40,000 per year in each of

can you do parts 3 and 4!!!!

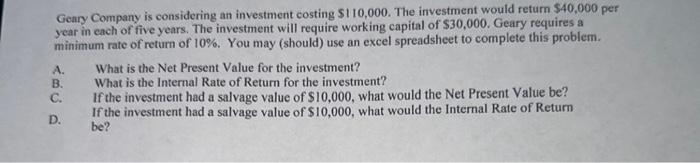

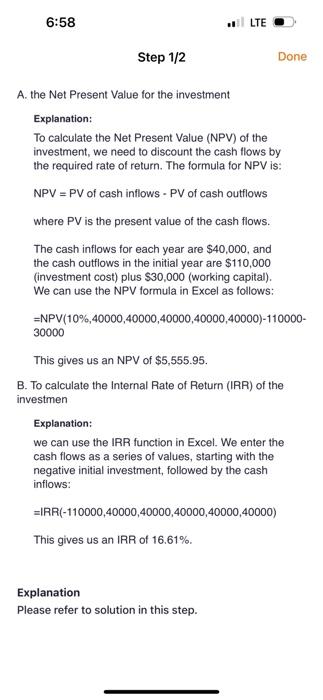

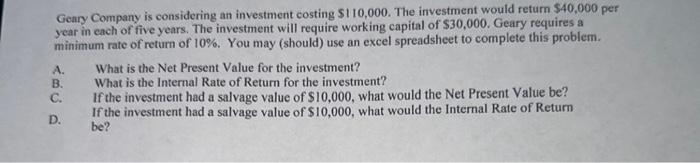

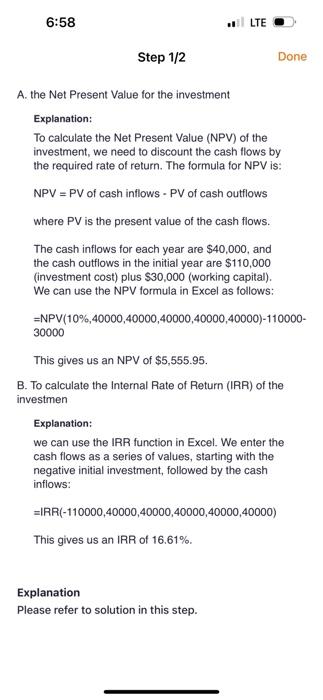

Geary Company is considering an investment costing $110,000. The investment would return $40,000 per year in each of five years. The investment will require working capital of $30,000. Geary requires a minimum rate of return of 10%. You may (should) use an excel spreadsheet to complete this problem. A. What is the Net Present Value for the investment? B. What is the Internal Rate of Return for the investment? C. If the investment had a salvage value of $10,000, what would the Net Present Value be? D. If the investment had a salvage value of $10,000, what would the Internal Rate of Return be? A. the Net Present Value for the investment Explanation: To calculate the Net Present Value (NPV) of the investment, we need to discount the cash flows by the required rate of return. The formula for NPV is: NPV = PV of cash inflows - PV of cash outflows where PV is the present value of the cash flows. The cash inflows for each year are $40,000, and the cash outflows in the initial year are $110,000 (investment cost) plus $30,000 (working capital). We can use the NPV formula in Excel as follows: =NPV(10%,40000,40000,40000,40000,40000)11000030000 This gives us an NPV of $5,555.95. B. To calculate the Internal Rate of Return (IRA) of the investmen Explanation: we can use the IRR function in Excel. We enter the cash flows as a series of values, starting with the negative initial investment, followed by the cash inflows: =IRR(110000,40000,40000,40000,40000,40000) This gives us an IRR of 16.61%. Explanation Please refer to solution in this step

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started