Answered step by step

Verified Expert Solution

Question

1 Approved Answer

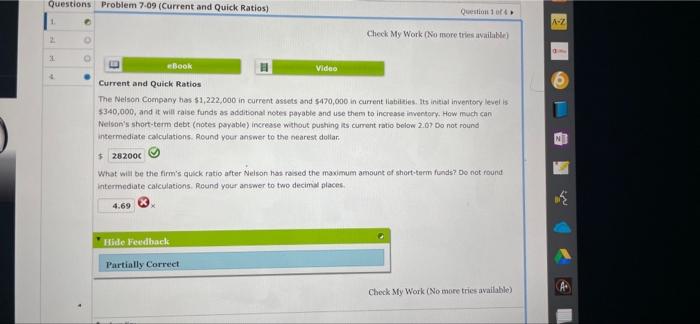

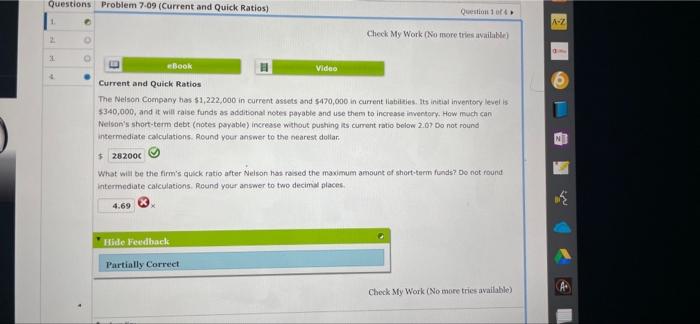

can you do the second part Questions Problem 7-09 (Current and Quick Ratios) 2 3 4 O eBook Current and Quick Ratios The Nelson Company

can you do the second part

Questions Problem 7-09 (Current and Quick Ratios) 2 3 4 O eBook Current and Quick Ratios The Nelson Company has $1,222,000 in current assets and $470,000 in current liabilities. Its initial inventory level is $340,000, and it will raise funds as additional notes payable and use them to increase inventory. How much can Nelson's short-term debt (notes payable) increase without pushing its current ratio below 2.07 Do not round intermediate calculations. Round your answer to the nearest dollar. $ 282000 What will be the firm's quick ratio after Nelson has raised the maximum amount of short-term funds? Do not round intermediate calculations. Round your answer to two decimal places. 4.69 Hide Feedback Partially Correct Check My Work (No more tries available) Video Check My Work (No more tries available) A-Z dife w P

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started