Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you do this question please (a) You i) the fosowine fiures have been extracted from the tinal accounts of Molinari pic a co mat

can you do this question please

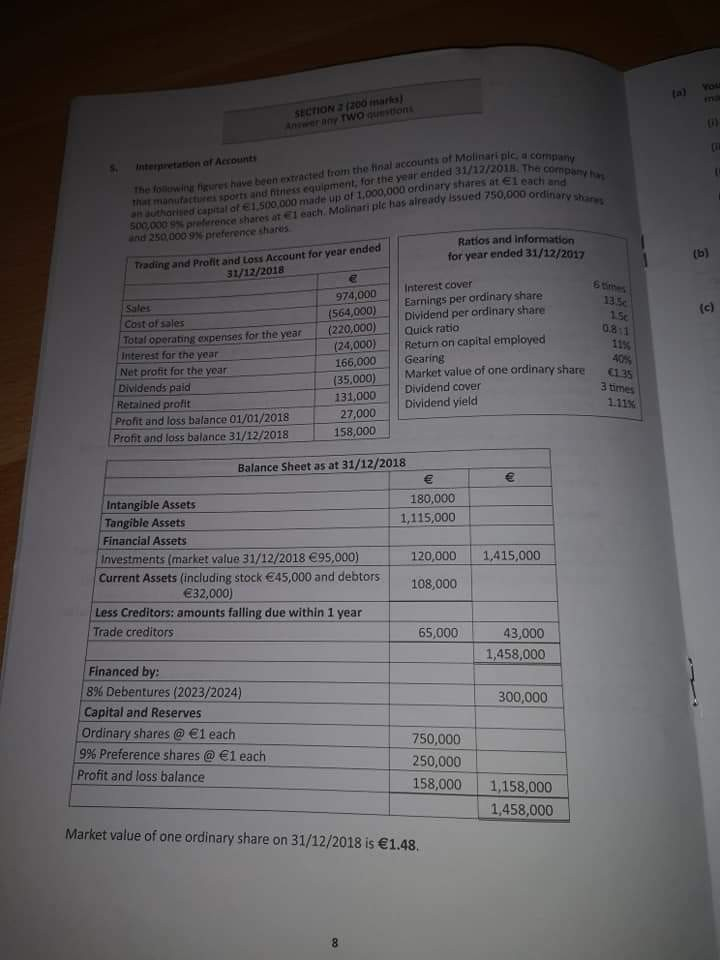

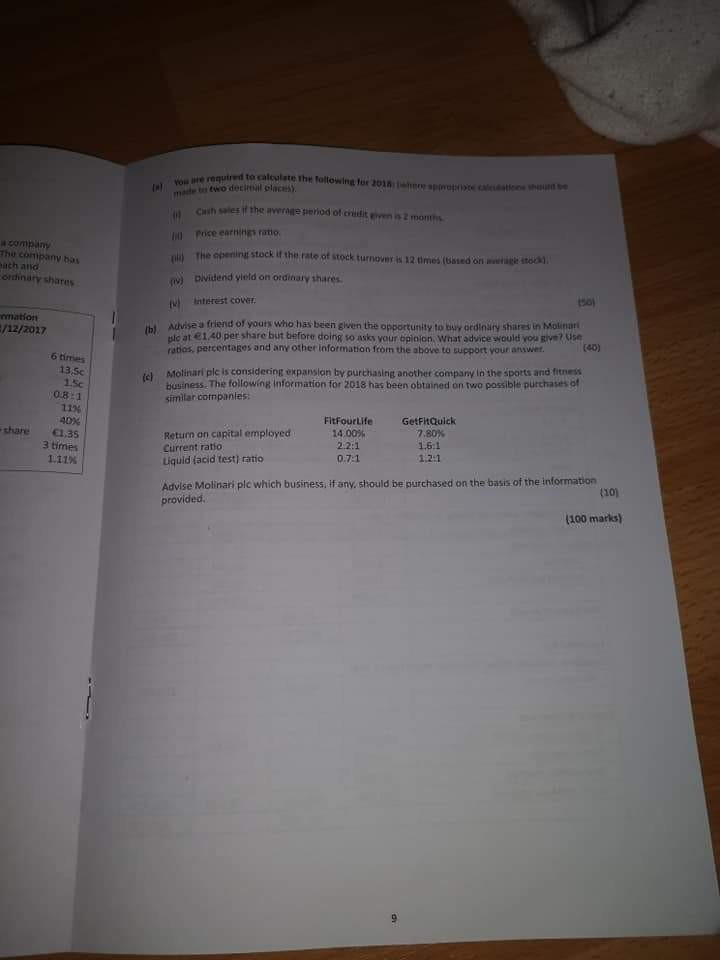

(a) You i) the fosowine fiures have been extracted from the tinal accounts of Molinari pic a co mat manufactures sports and ftness equipment, for the year ernded 31/12/2018 The an suthorised capital of 1.500,000 made up of 1,000,000 ordinary shares at El eachnany ha Interpretation of Account soo,005% preterence shares at1 each. Molinari ple has alreadyissued 750,000 and 250,000 9% preference shares ordinary Ratios and information for year ended 31/12/2017 trading and Profit and Loss Account for year ended 31/12/2018 6 Ses Earnings per ordinary share Quick ratio 974,000 Interest cover 135 Sales Cost of sales Total operating expe Interest for the year Net profit for the year Dividends pald Retained profit 0811 11% 405 135 3 times 1.11% nses for the year (220,000) (24,000) Return on capital employed 166,000 Gearing (35,000) Market value of one ordinary share 131,000 Dividend cover 27,000 Dividend yield 158,000 Profit and loss balance 01/01/2018 Profit and loss balance 31/12/2018 Balance Sheet as at 31/12/2018 180,000 1,115,000 Intangible Assets Tangible Assets Financial Assets 120,000 I 1.415,000 108,000 Investments (market value 31/12/2018 95,000) Current Assets (including stock 45,000 and debtors 32,000) Less Creditors: amounts falling due within 1 year Trade creditors 65,000 43,000 1,458,000 Financed by I 896 Debentures (2023/202a) Capital and Reserves 300,000 Ordinary shares @ 1 each 9% Preference shares @ 1 each 750,000 250,000 158,0001,158,000 Profit and loss balance 1,458,000 Market value of one ordinary share on 31/12/2018 is 1.48. e required to calculate The ollowlng tor 201 ere pooprietios mae t two decimial places cath sales it the average period of cristit even s 2 mont i Price earnings ratio ul The apening The company bas ach and ordinary shares stock if the rate of stock turnover is 12 times (based on erage stock) pividend vield on ordinary shares v Interest cower mation /12/2017 bl Advise a friend of yours who has been given the opportunity to buy ordinary shares in Molinari plc at 1,40 per share but before doing so asks your opinion, What advice would you sive? Use ratios, percentages and any other information from the above to support your answer. 6 tmes ic) Molinari plc is considering expansion by purchasing another company in the ports and fitness 1.5c 08:1 11% business The following information for 2018 has been obtained on two possible prchases of similar cormpanles: share13s 3 times 1.11% Return on capital employed Current ratio Liquid facid test) ratio 1400% Current atiitemployed Fitfourife 7.80% 1.6:1 1.21 0.7:1 Advise Molinari plc which business, if any, should be purchased on the basis of the information (10) (100 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started