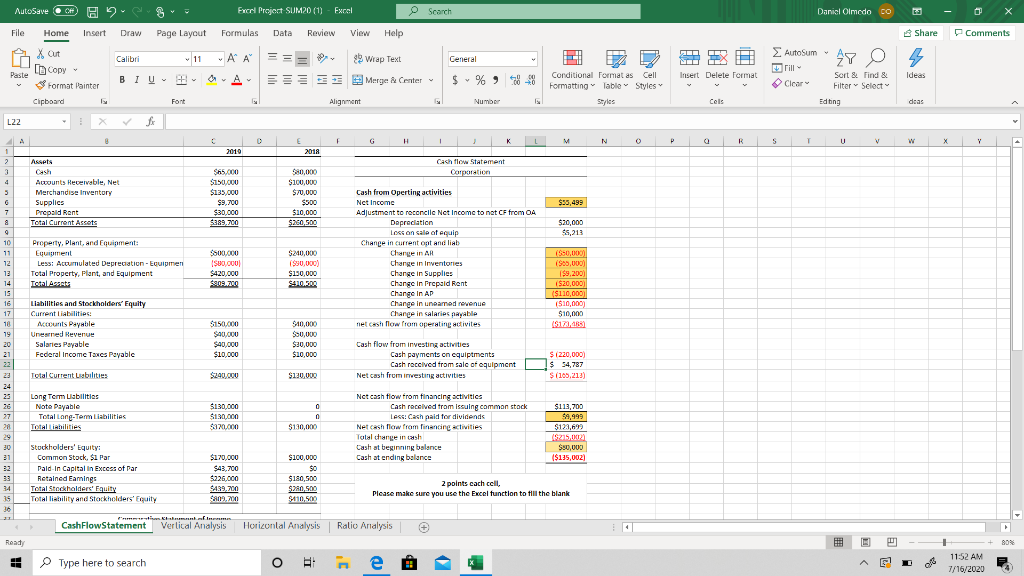

Can you guys do it on excel please I want to check if my answers are right.

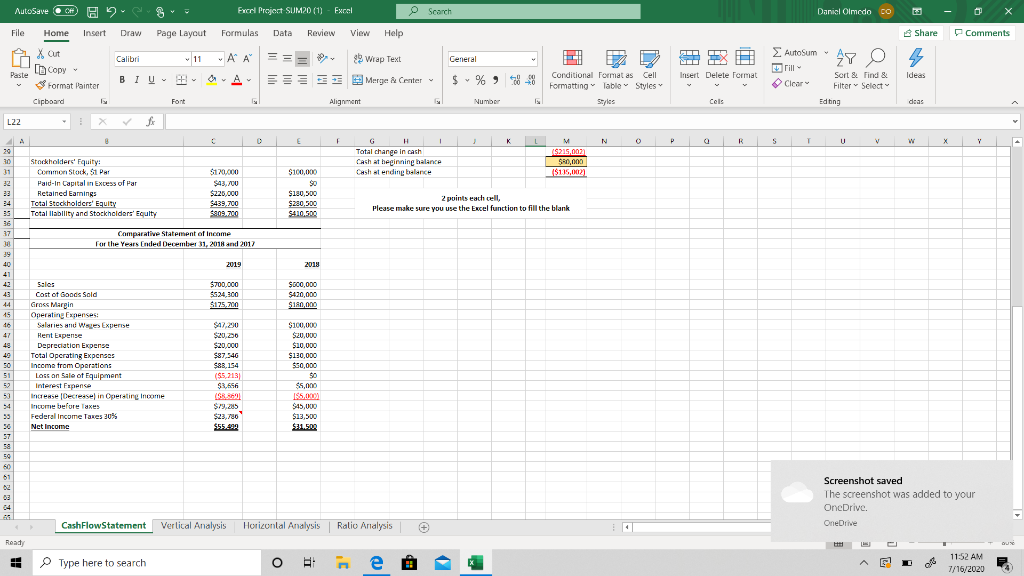

AutoSave OH Excel Project SUM20 (1) Excel Search Daniel Olmodo co File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments X Out [Copy Calibri 11 AutoSum - A A 82 Wrap Text General 29 4 NI Brill Peste Insert Delete format Idees BIU Merge Center $ % -8 Format Painter Clear Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Eding Clipboard Font Alignment Number Cels daas L22 F H K M N R T U v W X Y 2019 2018 1 21 3 4 3 Cash flow Statement Corporation Assets Cash Awounts Receivable, Net Merchandise Inventory Supplies Prepaid Rent Total Curront Ascots $150.00 $135.000 $9.700 $30.000 $389.700 $100,000 $70,000 $500 $10,000 $200 500 $55,499 7 8 $20,000 $5,213 Property, Plant, and Equipment Equipment Less: Acumulated Depreciation - Equipmen Total Property, plant, and Equipment Tohle $800,000 IS20.00) $420,000 $900 $240,000 (S0,000) $150,000 $40.500 10 11 12 12 14 IS 16 17 10 19 Cash from Operting activities Nct Income Adjustment to reconcile Net Income to not CF from OA Depreciation Loss on sale of equip Change in current opt and liab Change in AH Change in Inventores Change in Supplies Change in Prepaid Rent Change in AP Change in uneamed revenue Change in salaries payable net cash flow from operating sitivites (950,000 (S80,000) $9,200) $20,000) ($110,000) ($10,000) $10,000 ($171, RS Liabilities and Stockholders' Equity Current liabilities: Accounts Payable Unesnedevenue Salaries Payable Federal income Taxes Payable $50,00 $40,000 $40,000 $10,000 $40,000 S60,000 $30,000 $20,000 21 22 Cash flow from investing activities Cash payments on equipments Cash received from sale of equipment Net cash from investing activities $ 1220,000 $ 54,787 $(100,2133 Total Current Liabilities $240/000 $130,000 24 Long Term Liabilities Nota Payable Total Long-Term Liabilities TotAliahilities 27 $130,000 $130,000 $320.000 0 0 $130,000 Net cash flow from financing activities Cash received from Issuing common stock Less! Cach paid for dividends Net cash flow from Financing activities Total change in cash Cash at beginning balance Cash at ending balance 29 $113,700 $4,999 $123,699 $225,000 $50,000 ($135,002) 31 Stockholders' Equity: Common Stock $1. Par Pald-In Capital in Excess of Par Retained Earnings TotalStackholders' Faulty Total liability and Stockholders' Equity 33 34 35 36 $170,000 $43,700 $226,000 $439.700 an 200 $100,000 $0 $180,500 5280,500 $410,500 2 points cach cell Please make sure you use the Excel function to fill the blank CashFlowStatement malam Verlical Analysis Horizontal Analysis Ralio Analysis + Read 80% Type here to search O EH e E 11:52 AM 7/16/2020 AutoSave OH Excel Project SUM20 (1) Excel Search Daniel Olmodo co File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments Calibri 11 A A 89 Wrap Text AutoSum General 27 4 NI Brill Peste X Out [Copy Format Painter Clipboard Insert Delete format Idees BIU H Merge & Center $ % -8 Clear Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Eding Font Alignment Number Cels daas L22 E L N R T U V W X Y 30 G H Total change in cash Cash atheginning halance Cash atending balance $21.002) $80,000 ($135,002) 31 32 Stockholders' quity: Common Stock IP Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total liability and Stockholders' Equity 201200 $43,700 $225,000 $439.700 $909.700 $100,000 SO $180,500 $280,500 $410,500 2 points each cell Please make sure you use the Excel function to fill the blank 34 35 36 37 Comparative statement of Income For the Years Ended December 31, 2018 and 2017 2019 2018 40 41 42 43 44 45 $700.000 $524,300 $175.700 $600,000 $420,000 $180,000 47 49 49 50 51 52 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wes Experise Hent Lapense Depreciation Expense Total Operating Expenses Income from Operations Loss on sale of Equipment Interest Fapers Increase Decrease in Operating income Income before Taxes Federal Income Taxes 30% Net Income $47,200 $20,20 $20,000 $87,346 S&R 154 (SS2131 $3,656 $100,000 $20,000 $10,000 $130,000 $50,000 50 $5,000 SS. $45,000 $13,500 5 50 $79,285 $23.780 $55.292 57 58 50 60 51 62 Screenshot saved The screenshot was added to your OneDrive. OneDrive CashFlowStatement Vertical Analysis Horizontal Analysis Ralio Analysis + Read - Type here to search O e 11:52 AM 7/16/2020