Answered step by step

Verified Expert Solution

Question

1 Approved Answer

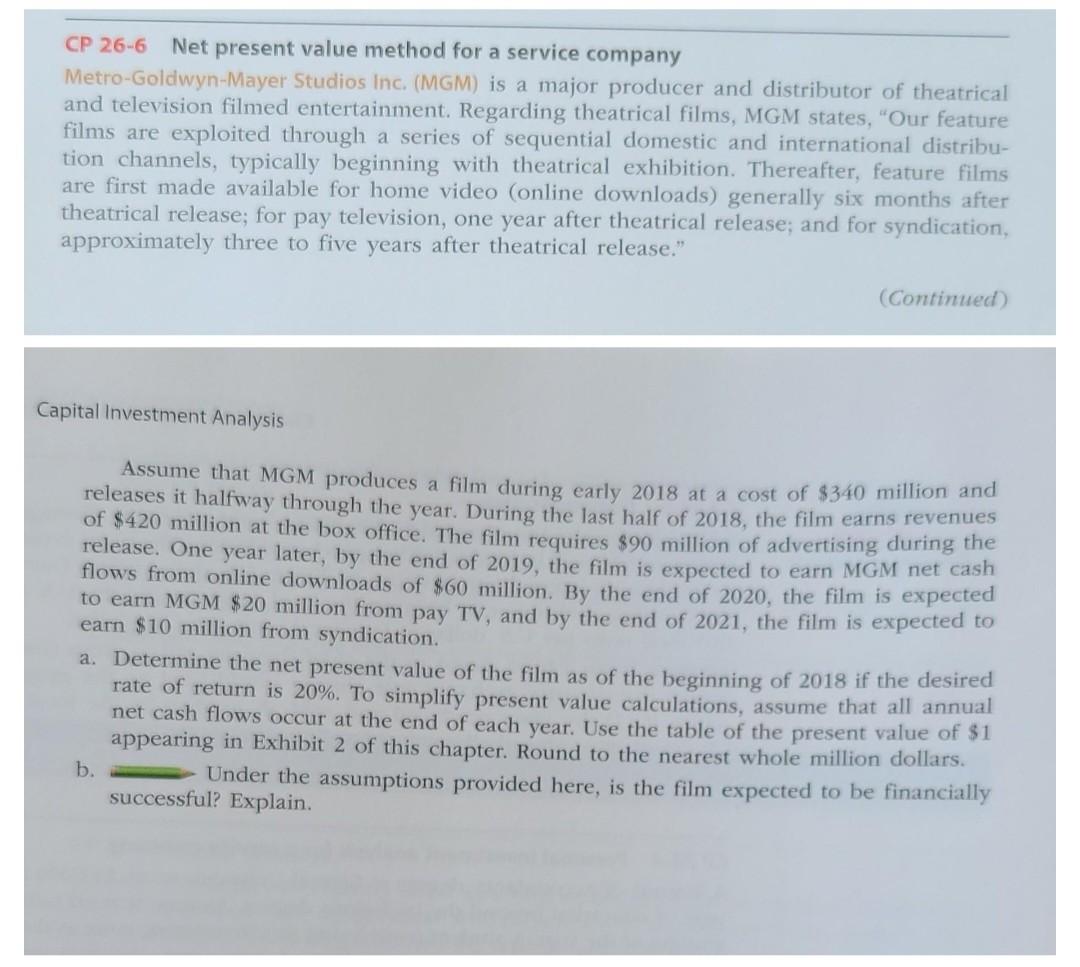

can you help me break down the net present value for four years from 2018? CP 26-6 Net present value method for a service company

can you help me break down the net present value for four years from 2018?

CP 26-6 Net present value method for a service company Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of theatrical and television filmed entertainment. Regarding theatrical films, MGM states, Our feature films are exploited through a series of sequential domestic and international distribu- tion channels, typically beginning with theatrical exhibition. Thereafter, feature films are first made available for home video (online downloads) generally six months after theatrical release; for pay television, one year after theatrical release; and for syndication, approximately three to five years after theatrical release." (Continued Capital Investment Analysis Assume that MGM produces a film during early 2018 at a cost of $340 million and releases it halfway through the year. During the last half of 2018, the film earns revenues of $420 million at the box office. The film requires 890 million of advertising during the release. One year later, by the end of 2019, the film is expected to earn MGM net cash flows from online downloads of $60 million. By the end of 2020, the film is expected to earn MGM $20 million from pay TV, and by the end of 2021, the film is expected to earn $10 million from syndication. a. Determine the net present value of the film as of the beginning of 2018 if the desired rate of return is 20%. To simplify present value calculations, assume that all annual net cash flows occur at the end of each year. Use the table of the present value of $1 appearing in Exhibit 2 of this chapter. Round to the nearest whole million dollars. Under the assumptions provided here, is the film expected to be financially successful? Explain. b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started