Question: Can you help me figure out the steps? I know straight-line means the same amount of depreciation over the period of years. I just don't

Can you help me figure out the steps? I know straight-line means the same amount of depreciation over the period of years. I just don't know how to set it all up. And then I have no idea how to do the next 3 problems either..

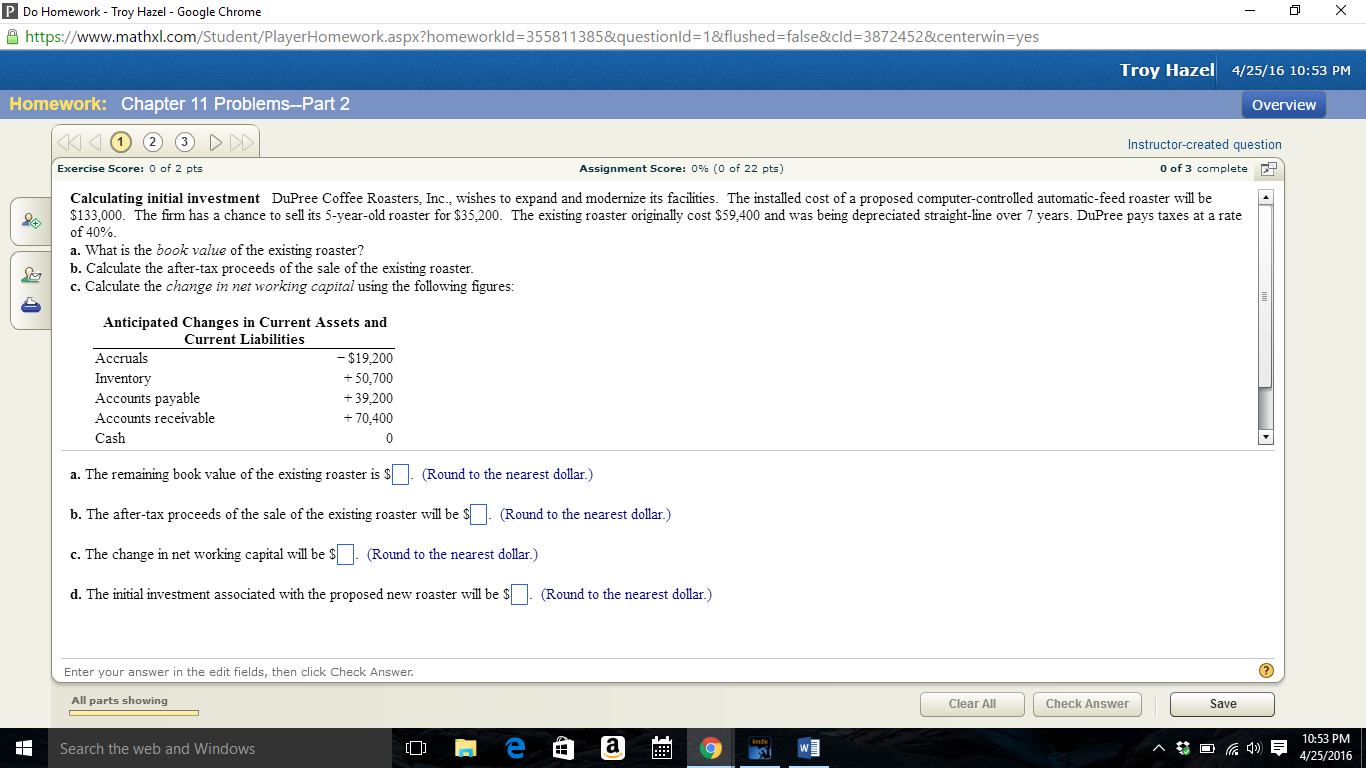

P Do Homework - Troy Hazel - Google Chrome https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkId=35581 1385&questionid=1&flushed-false&cld-3872452¢erwin=yes Troy Hazel 4/25/16 10:53 PM Homework: Chapter 11 Problems--Part 2 Overview Instructor-created question Exercise Score: 0 of 2 pts Assignment Score: 0% (0 of 22 pts) 0 of 3 complete Calculating initial investment DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be $133,000. The firm has a chance to sell its 5-year-old roaster for $35,200. The existing roaster originally cost $59,400 and was being depreciated straight-line over 7 years. DuPree pays taxes at a rate of 40% a. What is the book value of the existing roaster? b. Calculate the after-tax proceeds of the sale of the existing roaster c. Calculate the changg in net working cavital using the following figures: Anticipated Changes in Current Assets and Current Liabilities Accruals Inventory Accounts payable Accounts receivable Cash -$19,200 + 50,700 + 39,200 + 70,400 a. The remaining book value of the existing roaster is S (Round to the nearest dollar.) b. The after-tax proceeds of the sale of the existing roaster will be S (Round to the nearest dollar.) c. The change in net working capital will be (Round to the nearest dollar.) d. The initial investment associated with the proposed new roaster wl be (Round to the nearest dollar.) hange in net working capital wllbRound to the nearest dolla) Enter your answer in the edit fields, then click Check Answer. All parts showing Clear All Check Answer Save e 10:53 PM 4/25/2016 Search the web and Windows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts