Question: The Table below shows a hypothetical benchmark yield curve for value as of 16 January 2020. The observed yields of the benchmark bonds that compose

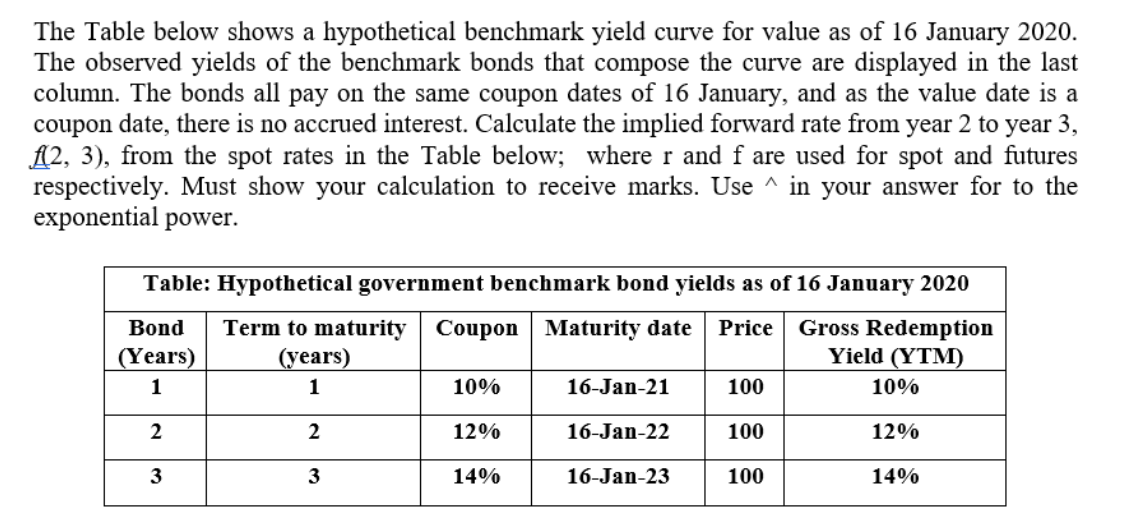

The Table below shows a hypothetical benchmark yield curve for value as of 16 January 2020. The observed yields of the benchmark bonds that compose the curve are displayed in the last column. The bonds all pay on the same coupon dates of 16 January, and as the value date is a coupon date, there is no accrued interest. Calculate the implied forward rate from year 2 to year 3, (2, 3), from the spot rates in the Table below; where r and f are used for spot and futures respectively. Must show your calculation to receive marks. Use^ in your answer for to the exponential power. Table: Hypothetical government benchmark bond yields as of 16 January 2020 Bond Term to maturity Coupon Maturity date Price Gross Redemption (Years) (years) Yield (YTM) 1 1 10% 16-Jan-21 100 10% 2 2 12% 16-Jan-22 100 12% 3 3 14% 16-Jan-23 100 14% The Table below shows a hypothetical benchmark yield curve for value as of 16 January 2020. The observed yields of the benchmark bonds that compose the curve are displayed in the last column. The bonds all pay on the same coupon dates of 16 January, and as the value date is a coupon date, there is no accrued interest. Calculate the implied forward rate from year 2 to year 3, (2, 3), from the spot rates in the Table below; where r and f are used for spot and futures respectively. Must show your calculation to receive marks. Use^ in your answer for to the exponential power. Table: Hypothetical government benchmark bond yields as of 16 January 2020 Bond Term to maturity Coupon Maturity date Price Gross Redemption (Years) (years) Yield (YTM) 1 1 10% 16-Jan-21 100 10% 2 2 12% 16-Jan-22 100 12% 3 3 14% 16-Jan-23 100 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts