Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you help me for solving that question ? The question also have 2nd requirement but first, Requirement 1 should be solved. Thanks. John Watson,

Can you help me for solving that question ? The question also have 2nd requirement but first, Requirement 1 should be solved.

Thanks.

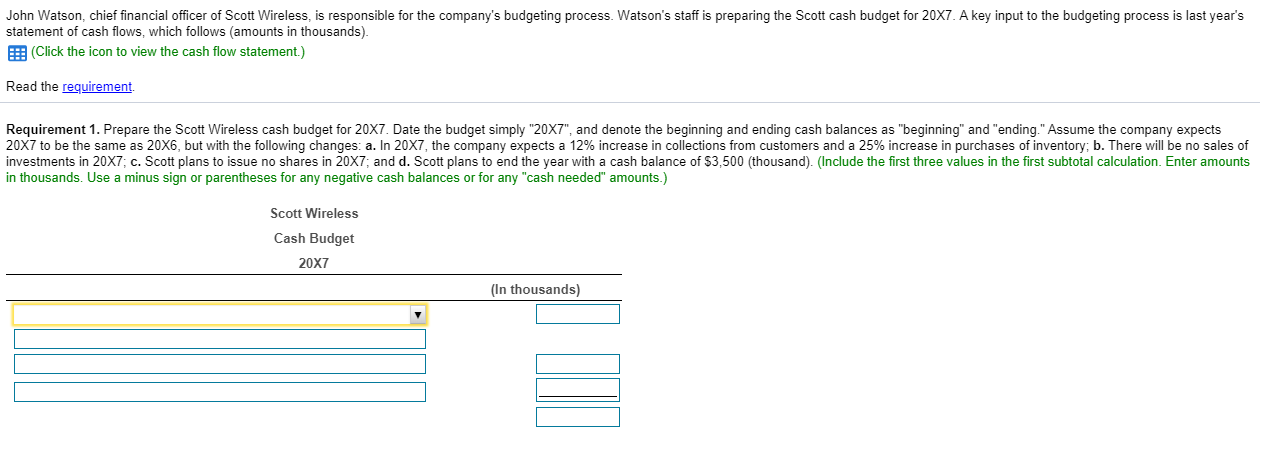

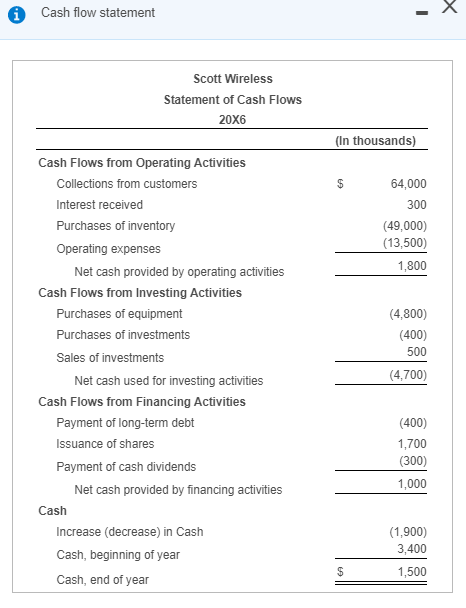

John Watson, chief financial officer of Scott Wireless, is responsible for the company's budgeting process. Watson's staff is preparing the Scott cash budget for 20X7. A key input to the budgeting process is last year's statement of cash flows, which follows (amounts in thousands) E: (Click the icon to view the cash flow statement.) Read the requirement. Requirement 1. Prepare the Scott Wireless cash budget for 20X7. Date the budget simply "20X7", and denote the beginning and ending cash balances as "beginning" and "ending." Assume the company expects 20X7 to be the same as 20X6, but with the following changes: a. In 20X7, the company expects a 12% increase in collections from customers and a 25% increase in purchases of inventory; b. There will be no sales of investments in 20X7, c. Scott plans to issue no shares in 20X7, and d. Scott plans to end the year with a cash balance of $3,500 (thousand). (Include the first three values in the first subtotal calculation. Enter amounts in thousands. Use a minus sign or parentheses for any negative cash balances or for any "cash needed" amounts.) Scott Wireless Cash Budget 20X7 (In thousands) A Cash flow statement Scott Wireless Statement of Cash Flows 20X6 (In thousands) 64,000 300 (49,000) (13,500) 1,800 Cash Flows from Operating Activities Collections from customers Interest received Purchases of inventory Operating expenses Net cash provided by operating activities Cash Flows from Investing Activities Purchases of equipment Purchases of investments Sales of investments Net cash used for investing activities Cash Flows from Financing Activities Payment of long-term debt Issuance of shares Payment of cash dividends Net cash provided by financing activities Cash Increase (decrease) in Cash Cash, beginning of year (4,800) (400) 500 (4,700) (400) 1,700 (300) 1,000 (1,900) 3,400 1,500 Cash, end of yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started