can you help me solve so i can prep for test pleae? The last two pictures is for the same question.

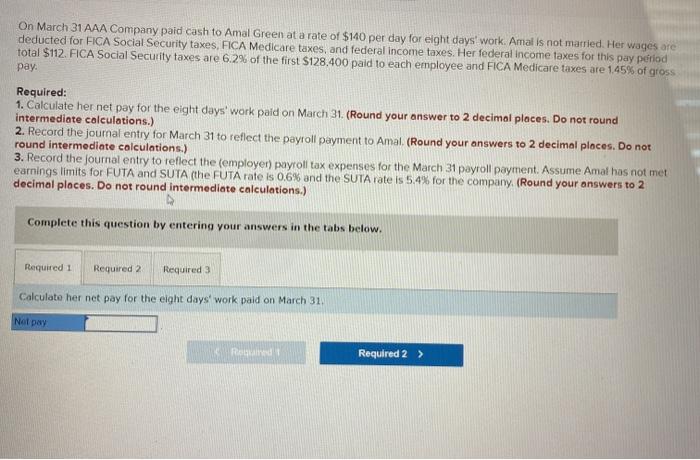

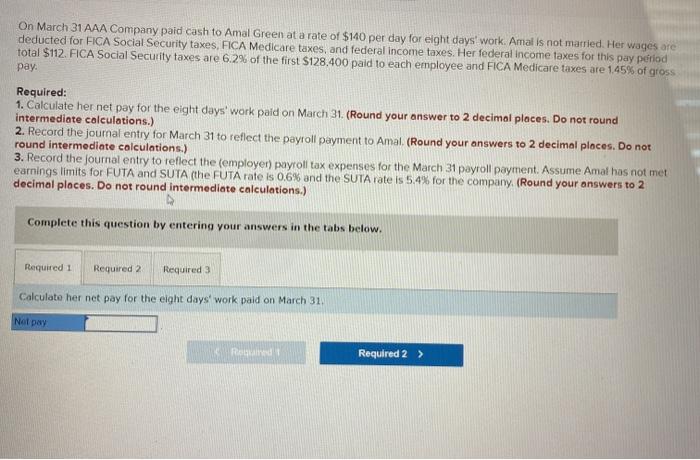

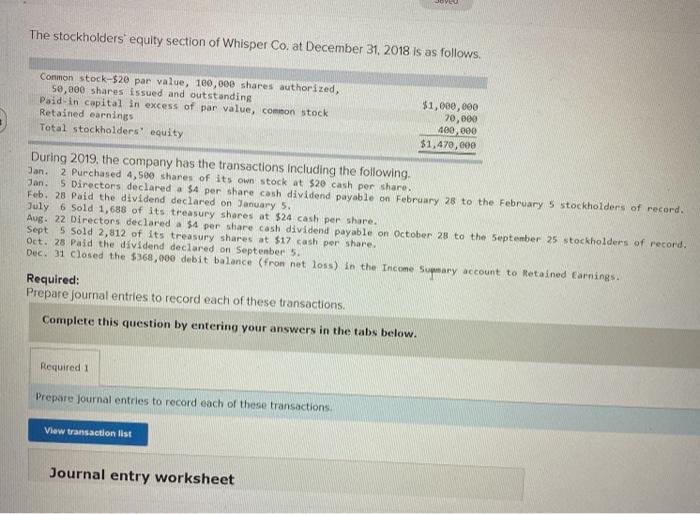

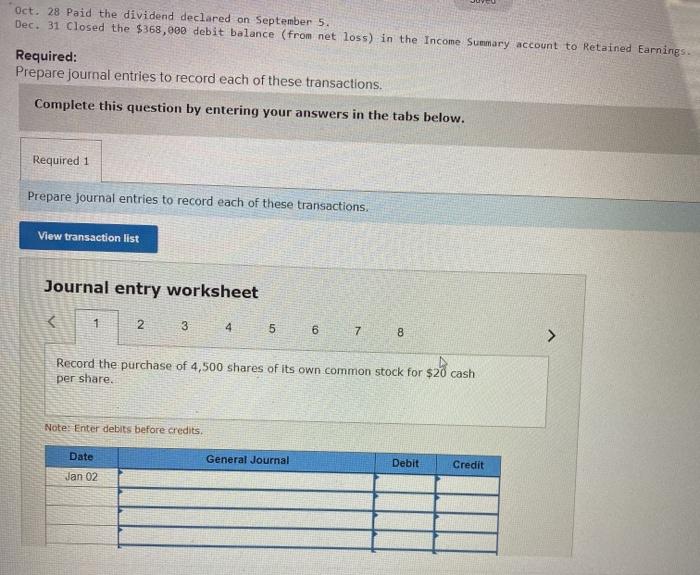

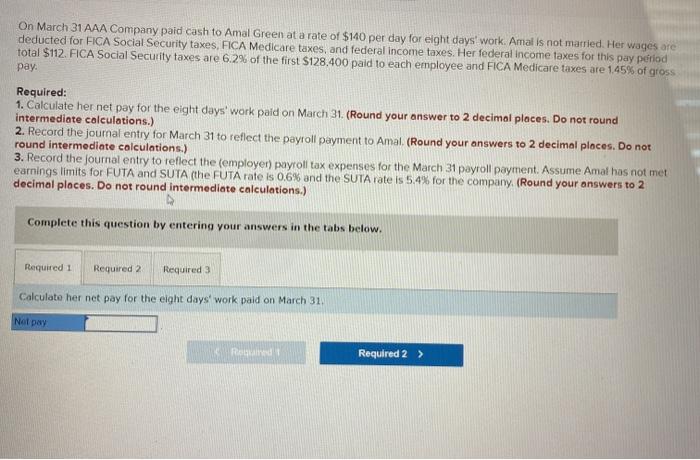

On March 31 AAA Company paid cash to Amal Green at a rate of $140 per day for eight days' work. Amal is not married. Her wages are deducted for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $112. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee and FICA Medicare taxes are 145% of gross pay. Required: 1. Calculate her net pay for the eight days' work paid on March 31. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 2. Record the journal entry for March 31 to reflect the payroll payment to Amal. (Round your answers to 2 decimal places. Do not round intermediate calculations.) 3. Record the journal entry to reflect the employer) payroll tax expenses for the March 31 payroll payment. Assume Amal has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5,4% for the company. (Round your answers to 2 decimal places. Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate her net pay for the eight days' work paid on March 31 No pay Read Required 2 > The stockholders equity section of Whisper Co. at December 31, 2018 is as follows Common stock-$20 par value, 100,000 shares authorized 50,200 shares issued and outstanding Paid in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,000,000 70,000 400,000 $1,470,000 During 2019, the company has the transactions including the following, Jan. 2 Purchased 4,500 shares of its own stock at $20 cash per share. Jan 5 Directors declared a 54 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 1,688 of its treasury shares at $24 cash per share. Aug. 22 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. Sept 5 Sold 2,812 of its treasury shares at $17 cash per share. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the 5368,000 debit balance (fron net loss) in the Income Supmary account to Retained Earnings Required: Prepare journal entries to record each of these transactions Complete this question by entering your answers in the tabs below. Required 1 Prepare Journal entries to record each of these transactions. View transaction list Journal entry worksheet Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $368,000 debit balance (from net loss) in the Income Summary account to Retained Earnings. Required: Prepare journal entries to record each of these transactions, Complete this question by entering your answers in the tabs below. Required 1 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet C 1 2 3 4 5 6 8 Record the purchase of 4,500 shares of its own common stock for $20 cash per share. Note: Enter debits before credits General Journal Date Jan 02 Debit Credit