Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me this homework thank you! Ereen D1MSM6 2 Would you let Mocht de bromet Topper Interiors purchaunt a delivery truck is csak

can you help me this homework thank you!

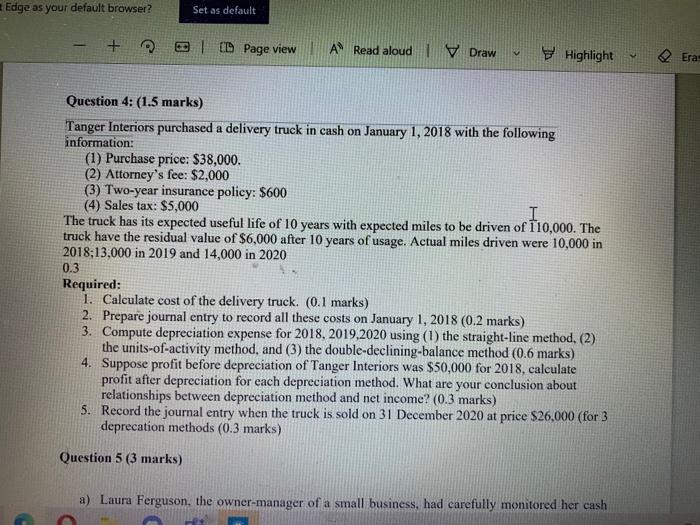

Ereen D1MSM6 2 Would you let Mocht de bromet Topper Interiors purchaunt a delivery truck is csak shefing (1) 49 ) 11 tar99 (4) 11 6 armon The trust 30 Weys 60 oem s Raptc p 2 2 28 mosal 10 22 15 4 (nrts // R M M == Edge as your default browser? Set as default + ET D Page view A Read aloud | Draw Highlight Era Question 4: (1.5 marks) Tanger Interiors purchased a delivery truck in cash on January 1, 2018 with the following information: (1) Purchase price: $38,000. (2) Attorney's fee: $2,000 (3) Two-year insurance policy: $600 (4) Sales tax: $5,000 I The truck has its expected useful life of 10 years with expected miles to be driven of 110,000. The truck have the residual value of $6,000 after 10 years of usage. Actual miles driven were 10,000 in 2018;13,000 in 2019 and 14,000 in 2020 0.3 Required: 1. Calculate cost of the delivery truck. (0.1 marks) 2. Prepare journal entry to record all these costs on January 1, 2018 (0.2 marks) 3. Compute depreciation expense for 2018, 2019,2020 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method (0.6 marks) 4. Suppose profit before depreciation of Tanger Interiors was $50,000 for 2018, calculate profit after depreciation for each depreciation method. What are your conclusion about relationships between depreciation method and net income? (0.3 marks) 5. Record the journal entry when the truck is sold on 31 December 2020 at price $26,000 (for 3 deprecation methods (0.3 marks) Question 5 (3 marks) a) Laura Ferguson. the owner-manager of a small business, had carefully monitored her cash Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started