Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me to explain how you get questions 2, 3, 4? And what does 1. Impairment allowance 2. Impairment losses for unrecoverable receivable

can you help me to explain how you get questions 2, 3, 4?

And what does 1. Impairment allowance

2. Impairment losses for unrecoverable receivable 3. Amount written off as uncollectible mean?

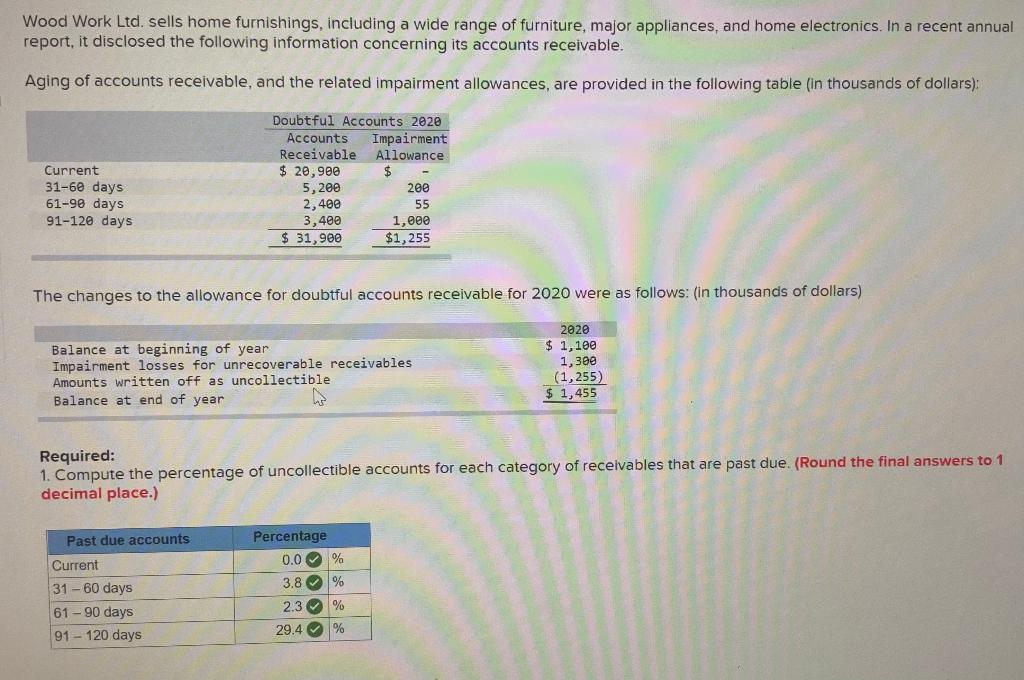

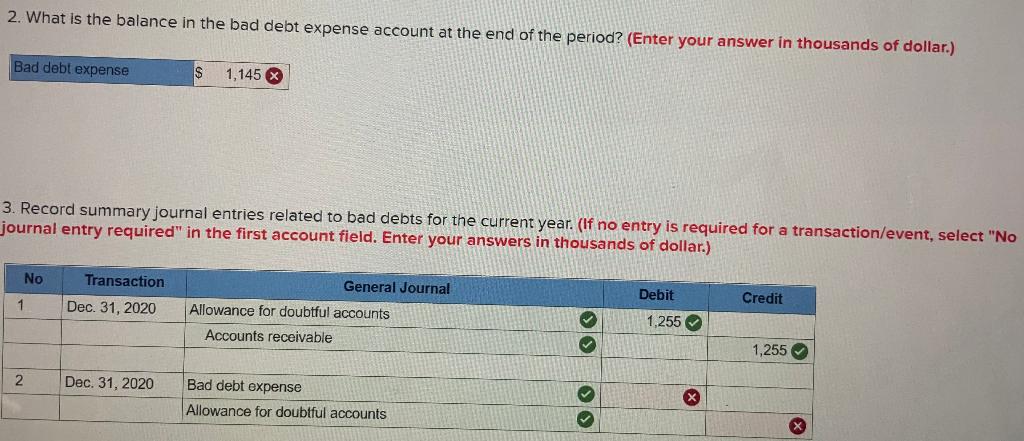

Wood Work Ltd. sells home furnishings, including a wide range of furniture, major appliances, and home electronics. In a recent annual report, it disclosed the following information concerning its accounts receivable. Aging of accounts receivable, and the related impairment allowances, are provided in the following table in thousands of dollars): Current 31-60 days 61-90 days 91-120 days Doubtful Accounts 2020 Accounts Impairment Receivable Allowance $ 20,900 $ 5,200 200 2,400 55 3,400 1,000 $ 31,900 $1,255 The changes to the allowance for doubtful accounts receivable for 2020 were as follows: (in thousands of dollars) Balance at beginning of year Impairment losses for unrecoverable receivables Amounts written off as uncollectible Balance at end of year 2020 $ 1,100 1,300 (1,255) $ 1,455 final answers to 1 Required: 1. Compute the percentage of uncollectible accounts for each category of receivables that are past due. decimal place.) Past due accounts Current 31 -60 days 61 - 90 days 91 - 120 days Percentage 0.0 % 3.8 % OOOO 2.3 % % 29.4 2. What is the balance in the bad debt expense account at the end of the period? (Enter your answer in thousands of dollar.) Bad debt expense $ 1,145 X 3. Record summary journal entries related to bad debts for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands of dollar.) No Transaction Dec. 31, 2020 Debit Credit 1 General Journal Allowance for doubtful accounts Accounts receivable 1,255 1,255 2 Dec. 31, 2020 Bad debt expense Allowance for doubtful accounts x X ho 4. If Wood Work had written off an amount of an additional $10,000 in accounts receivable during the period, how would net accounts receivable and net earnings have been affected? Increase Decrease O No effectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started