Answered step by step

Verified Expert Solution

Question

1 Approved Answer

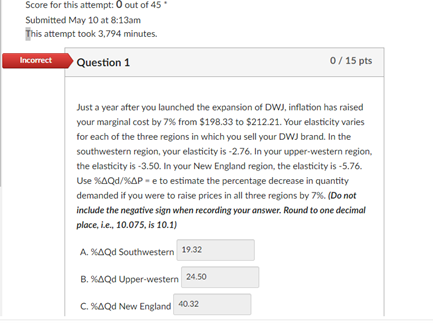

Can you help me with the correct answer? I followed a previous solution and it was wrong. Score for this attempt: 0 out of 45

Can you help me with the correct answer? I followed a previous solution and it was wrong.

Score for this attempt: 0 out of 45 Submitted May 10 at 8:13am This attempt took 3,794 minutes. Incorrect Question 1 0/15 pts Just a year after you launched the expansion of DWJ, inflation has raised your marginal cost by 7% from $198.33 to $212.21. Your elasticity varies for each of the three regions in which you sell your DWJ brand. In the southwestern region, your elasticity is -2.76. In your upper-western region. the elasticity is -3.50 . In your New England region, the elasticity is -5.76 . Use %Qd/%P= e to estimate the percentage decrease in quantity demanded if you were to raise prices in all three regions by 7%. (Do not include the negative sign when recording your answer. Round to one decimal ploce, ie.., 10.075, is 10.1) A. \%QQd Southwestern

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started