Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me with this please!!! I appreciate it thanks Manufacturing Process Information Dan started a small manufacturing plant that fabricates small drones. The

can you help me with this please!!! I appreciate it thanks

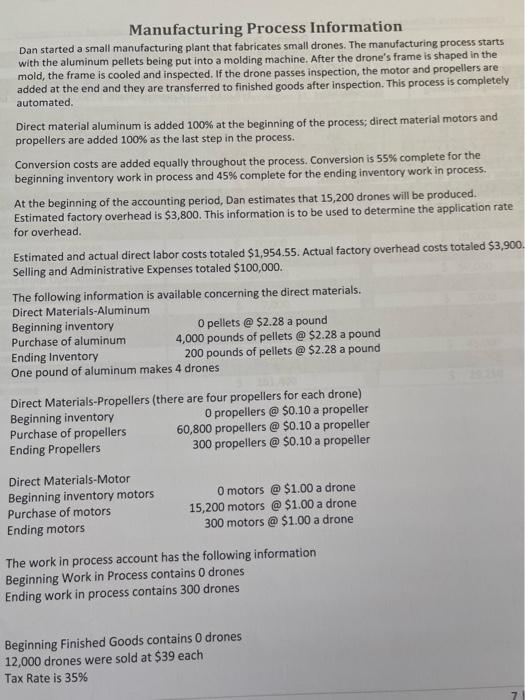

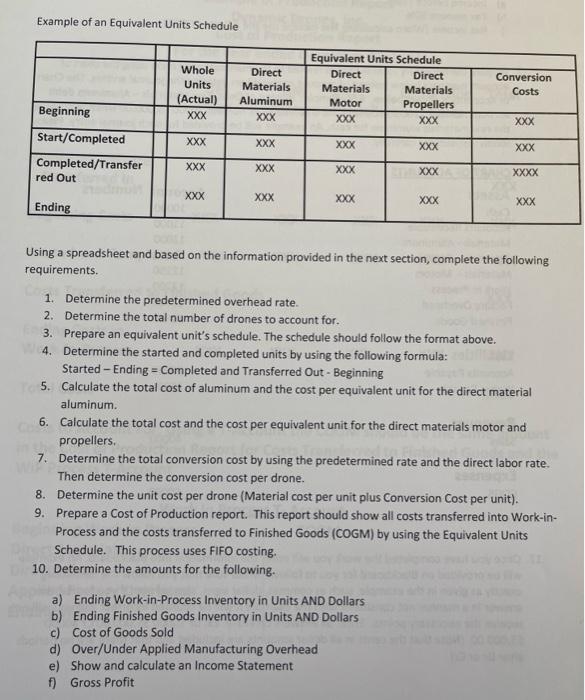

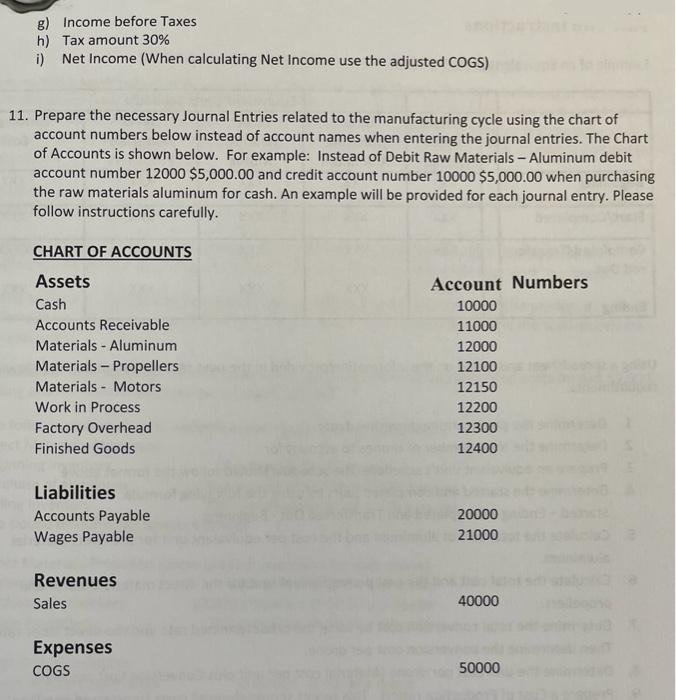

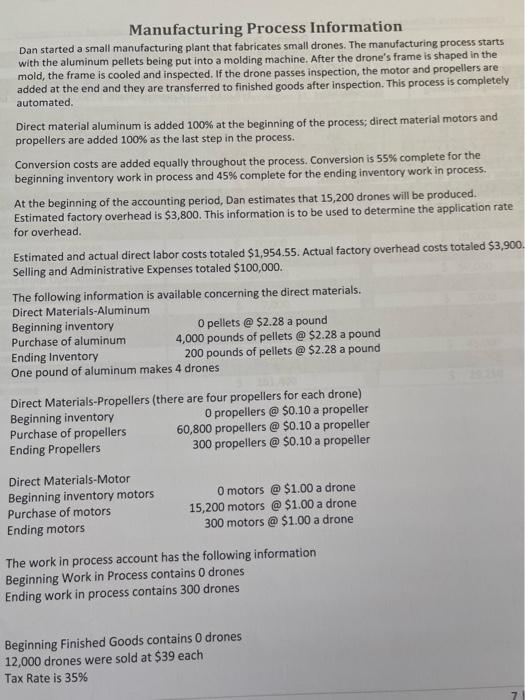

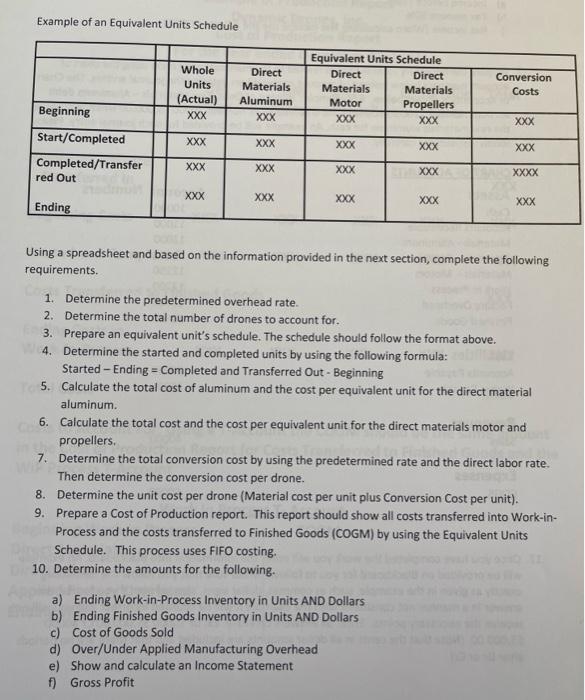

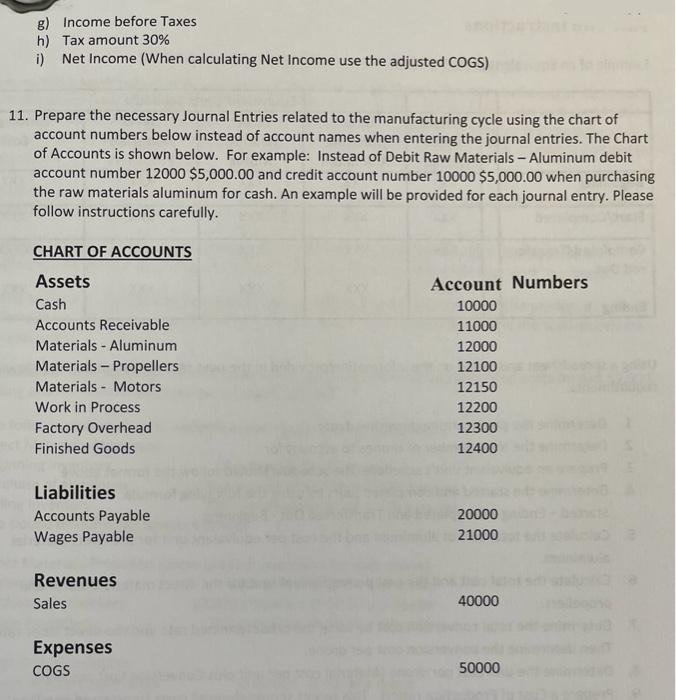

Manufacturing Process Information Dan started a small manufacturing plant that fabricates small drones. The manufacturing process starts with the aluminum pellets being put into a molding machine. After the drone's frame is shaped in the mold, the frame is cooled and inspected. If the drone passes inspection, the motor and propellers are added at the end and they are transferred to finished goods after inspection. This process is completely automated. Direct material aluminum is added 100% at the beginning of the process; direct material motors and propellers are added 100% as the last step in the process. Conversion costs are added equally throughout the process. Conversion is 55% complete for the beginning inventory work in process and 45% complete for the ending inventory work in process. At the beginning of the accounting period, Dan estimates that 15,200 drones will be produced. Estimated factory overhead is $3,800. This information is to be used to determine the application rate for overhead. Estimated and actual direct labor costs totaled $1,954.55. Actual factory overhead costs totaled $3,900 Selling and Administrative Expenses totaled $100,000. The following information is available concerning the direct materials. The work in process account has the following information Beginning Work in Process contains 0 drones Ending work in process contains 300 drones Beginning Finished Goods contains 0 drones 12,000 drones were sold at $39 each Tax Rate is 35% Example of an Equivalent Units Schedule Using a spreadsheet and based on the information provided in the next section, complete the following requirements. 1. Determine the predetermined overhead rate. 2. Determine the total number of drones to account for. 3. Prepare an equivalent unit's schedule. The schedule should follow the format above. 4. Determine the started and completed units by using the following formula: Started - Ending = Completed and Transferred Out - Beginning 5. Calculate the total cost of aluminum and the cost per equivalent unit for the direct material aluminum. 6. Calculate the total cost and the cost per equivalent unit for the direct materials motor and propellers. 7. Determine the total conversion cost by using the predetermined rate and the direct labor rate. Then determine the conversion cost per drone. 8. Determine the unit cost per drone (Material cost per unit plus Conversion Cost per unit). 9. Prepare a Cost of Production report. This report should show all costs transferred into Work-inProcess and the costs transferred to Finished Goods (COGM) by using the Equivalent Units Schedule. This process uses FIFO costing. 10. Determine the amounts for the following. a) Ending Work-in-Process Inventory in Units AND Dollars b) Ending Finished Goods Inventory in Units AND Dollars c) Cost of Goods Sold d) Over/Under Applied Manufacturing Overhead e) Show and calculate an Income Statement f) Gross Profit g) Income before Taxes h) Tax amount 30% i) Net Income (When calculating Net Income use the adjusted COGS) 1. Prepare the necessary Journal Entries related to the manufacturing cycle using the chart of account numbers below instead of account names when entering the journal entries. The Chart of Accounts is shown below. For example: Instead of Debit Raw Materials - Aluminum debit account number 12000$5,000.00 and credit account number 10000$5,000.00 when purchasing the raw materials aluminum for cash. An example will be provided for each journal entry. Please follow instructions carefully

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started