Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you just answer the first part to find Cash Flows please. The Mulligan company, a manufacturer of electrical parts, is evaluating several proposals for

Can you just answer the first part "to find Cash Flows" please.

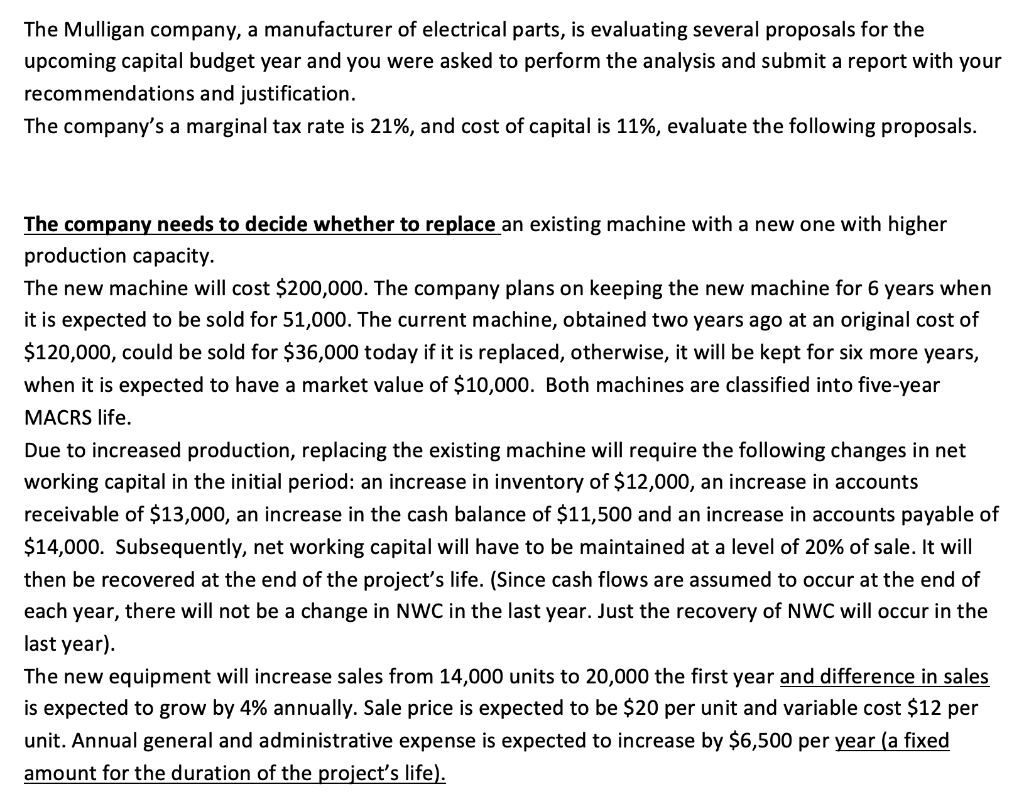

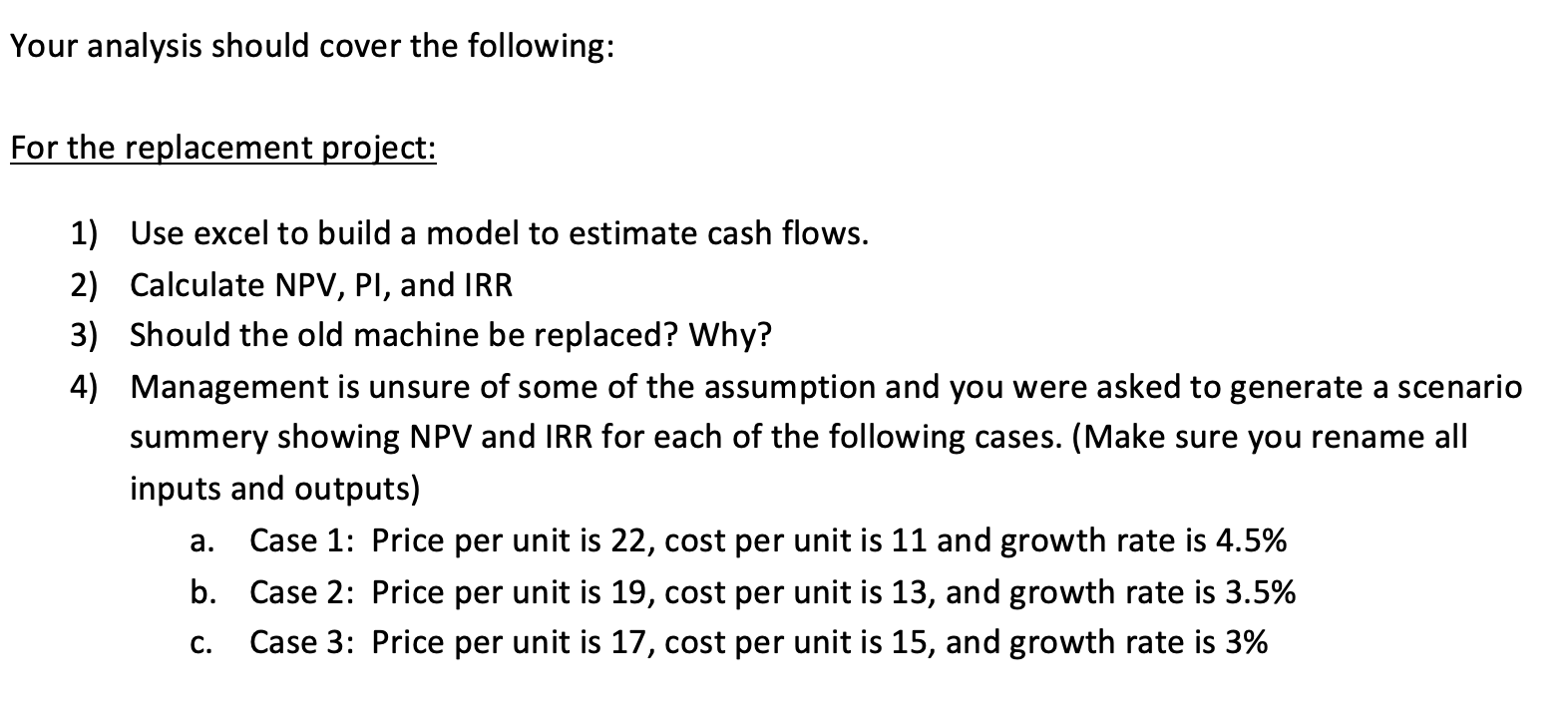

The Mulligan company, a manufacturer of electrical parts, is evaluating several proposals for the upcoming capital budget year and you were asked to perform the analysis and submit a report with your recommendations and justification. The company's a marginal tax rate is 21%, and cost of capital is 11%, evaluate the following proposals. The company needs to decide whether to replace an existing machine with a new one with higher production capacity. The new machine will cost $200,000. The company plans on keeping the new machine for 6 years when it is expected to be sold for 51,000. The current machine, obtained two years ago at an original cost of $120,000, could be sold for $36,000 today if it is replaced, otherwise, it will be kept for six more years, when it is expected to have a market value of $10,000. Both machines are classified into five-year MACRS life. Due to increased production, replacing the existing machine will require the following changes in net working capital in the initial period: an increase in inventory of $12,000, an increase in accounts receivable of $13,000, an increase in the cash balance of $11,500 and an increase in accounts payable of $14,000. Subsequently, net working capital will have to be maintained at a level of 20% of sale. It will then be recovered at the end of the project's life. (Since cash flows are assumed to occur at the end of each year, there will not be a change in NWC in the last year. Just the recovery of NWC will occur in the last year). The new equipment will increase sales from 14,000 units to 20,000 the first year and difference in sales is expected to grow by 4% annually. Sale price is expected to be $20 per unit and variable cost $12 per unit. Annual general and administrative expense is expected to increase by $6,500 per year (a fixed amount for the duration of the project's life). Your analysis should cover the following: For the replacement project: 1) Use excel to build a model to estimate cash flows. 2) Calculate NPV, PI, and IRR 3) Should the old machine be replaced? Why? 4) Management is unsure of some of the assumption and you were asked to generate a scenario summery showing NPV and IRR for each of the following cases. (Make sure you rename all inputs and outputs) Case 1: Price per unit is 22, cost per unit is 11 and growth rate is 4.5% b. Case 2: Price per unit is 19, cost per unit is 13, and growth rate is 3.5% Case 3: Price per unit is 17, cost per unit is 15, and growth rate is 3% a. C. The Mulligan company, a manufacturer of electrical parts, is evaluating several proposals for the upcoming capital budget year and you were asked to perform the analysis and submit a report with your recommendations and justification. The company's a marginal tax rate is 21%, and cost of capital is 11%, evaluate the following proposals. The company needs to decide whether to replace an existing machine with a new one with higher production capacity. The new machine will cost $200,000. The company plans on keeping the new machine for 6 years when it is expected to be sold for 51,000. The current machine, obtained two years ago at an original cost of $120,000, could be sold for $36,000 today if it is replaced, otherwise, it will be kept for six more years, when it is expected to have a market value of $10,000. Both machines are classified into five-year MACRS life. Due to increased production, replacing the existing machine will require the following changes in net working capital in the initial period: an increase in inventory of $12,000, an increase in accounts receivable of $13,000, an increase in the cash balance of $11,500 and an increase in accounts payable of $14,000. Subsequently, net working capital will have to be maintained at a level of 20% of sale. It will then be recovered at the end of the project's life. (Since cash flows are assumed to occur at the end of each year, there will not be a change in NWC in the last year. Just the recovery of NWC will occur in the last year). The new equipment will increase sales from 14,000 units to 20,000 the first year and difference in sales is expected to grow by 4% annually. Sale price is expected to be $20 per unit and variable cost $12 per unit. Annual general and administrative expense is expected to increase by $6,500 per year (a fixed amount for the duration of the project's life). Your analysis should cover the following: For the replacement project: 1) Use excel to build a model to estimate cash flows. 2) Calculate NPV, PI, and IRR 3) Should the old machine be replaced? Why? 4) Management is unsure of some of the assumption and you were asked to generate a scenario summery showing NPV and IRR for each of the following cases. (Make sure you rename all inputs and outputs) Case 1: Price per unit is 22, cost per unit is 11 and growth rate is 4.5% b. Case 2: Price per unit is 19, cost per unit is 13, and growth rate is 3.5% Case 3: Price per unit is 17, cost per unit is 15, and growth rate is 3% a. C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started