Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you lease assist with a and c. Wishbone (Pty) Ltd is a holding company with investments in various industries. Its Directors are Currently considering

can you lease assist with a and c.

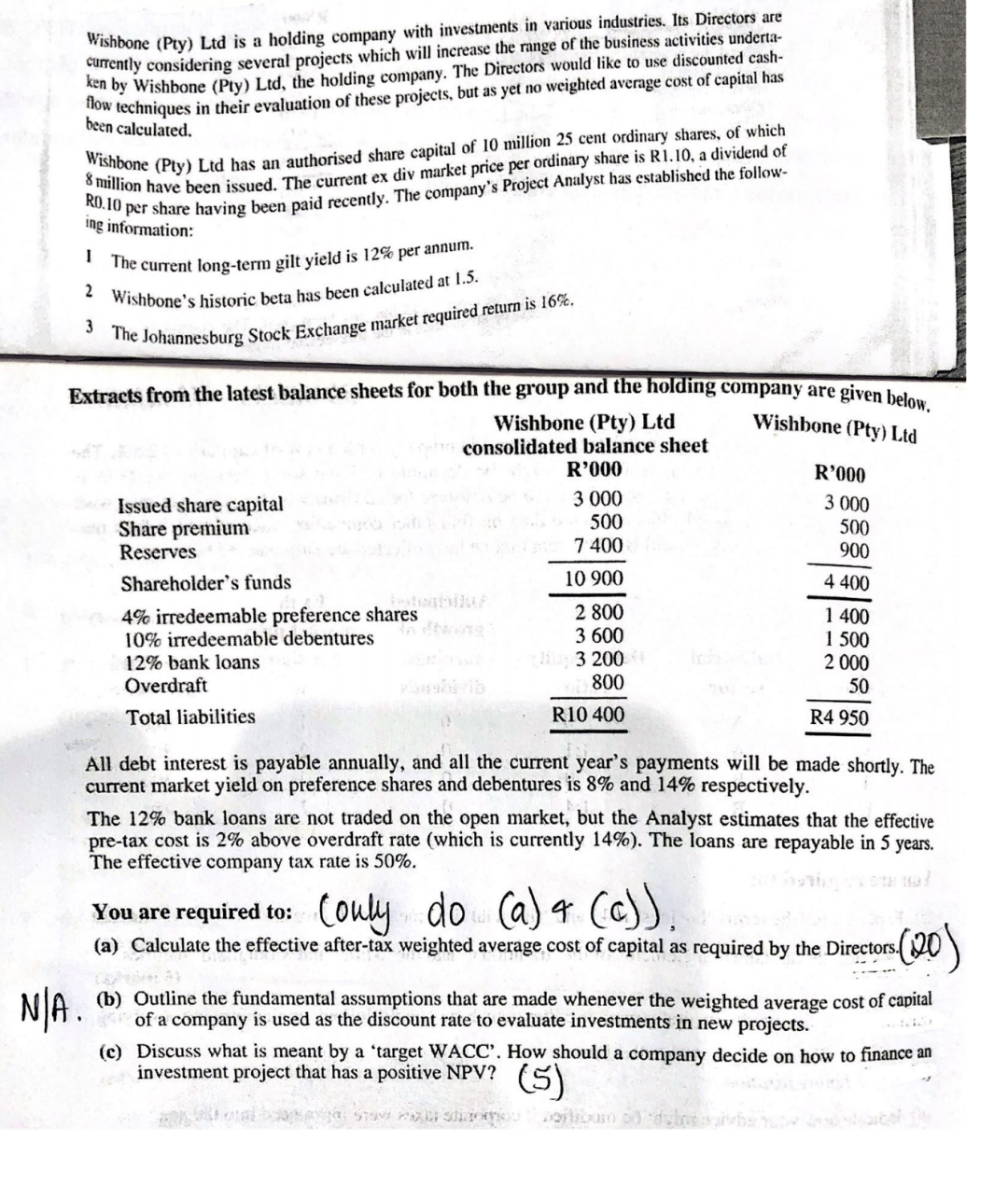

Wishbone (Pty) Ltd is a holding company with investments in various industries. Its Directors are Currently considering several projects which will increase the range of the business activities underta- ken by Wishbone (Pty) Ltd, the holding company. The Directors would like to use discounted cash- flow techniques in their evaluation of these projects , but as yet no weighted average cost of capital has been calculated. Wishbone (Pty) Ltd has an authorised share capital of 10 million 25 cent ordinary shares, of which 8 million have been issued. The current ex div market price per ordinary share is R1.10, a dividend of R ing information: 1 The current long-term gilt yield is 12% per annum. 2 Wishbone's historic beta has been calculated at 1.5. 3 The Johannesburg Stock Exchange market required return is 16%. Extracts from the latest balance sheets for both the group and the holding company are given below. Wishbone (Pty) Ltd Wishbone (Pty) Ltd consolidated balance sheet R'000 3 000 500 7400 R'000 3000 500 900 10 900 4 400 Issued share capital Share premium Reserves Shareholder's funds 4% irredeemable preference shares 10% irredeemable debentures 12% bank loans Overdraft Total liabilities 2 800 3 600 3 200 800 R10 400 1 400 1 500 2000 50 R4 950 All debt interest is payable annually, and all the current year's payments will be made shortly. The current market yield on preference shares and debentures is 8% and 14% respectively. The 12% bank loans are not traded on the open market, but the Analyst estimates that the effective pre-tax cost is 2% above overdraft rate (which is currently 14%). The loans are repayable in 5 years. The effective company tax rate is 50%. You are required to: Conly do (a) & (C)). (a) Calculate the effective after-tax weighted average cost of capital as required by the Directors.(20 sam (20 NJA. (b) Outline the fundamental assumptions that are made whenever the weighted average cost of capital of a company is used as the discount rate to evaluate investments in new projects. (c) Discuss what is meant by a 'target WACC". How should a company decide on how to finance an investment project that has a positive NPV? (5) SinaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started