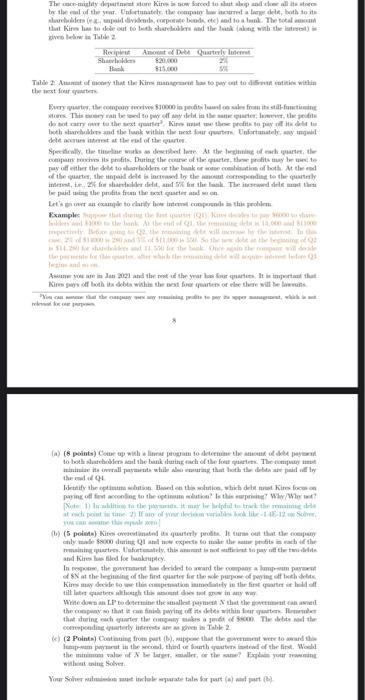

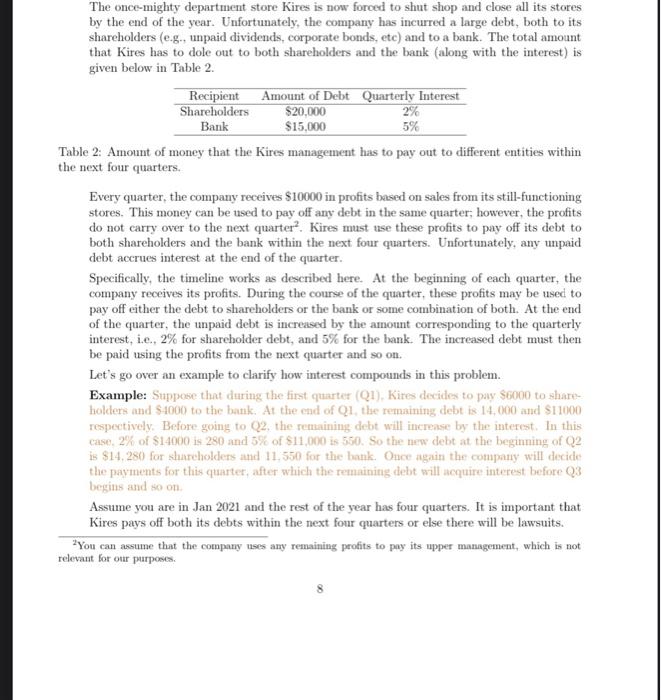

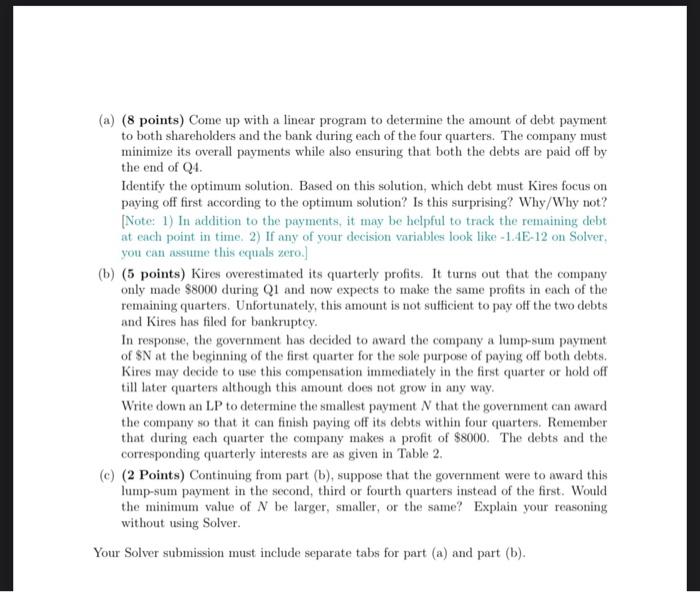

Therm-mi dan Kiowanced to set it be the other not the candle, but to it urbem , dvede, corporada de cand tolk The total that in to out to the share and the with the Neciprst Anot be rustellutert Tile 2 Actory that time to post to do it within This year of the terme te perdita de tu theater in the loth and the use within the form Untunately wil det er here at the rol of the te Specialty there was a dece Attor the company whispit. During the course of the presto py of the the date to adders the book or chain of both At the end of the gates, the dele sinto the topding to the quarterly int te. 26 finder det, and then the decat the w puding the parts from the atten Lance to clarity how to compare the problem Examples Awe are the your area. It is it that Kied the debts with the water of the will be love () (s points) Cup with produce the to both sides the bukurich of the for. The the letify the episode tautics, which dem Kirefoc prinodonting to the optimal is the price? Wh/Wher Neutral with 2) If no film 112 cm, (5 polata) kitested que protetti out that the company milyon during QI expect to take the wind the tutto this entitled and Ke Bled for buskey. In the earth decided to the comme of the line of the fint quarter the purpose of pain the Kisu decide to compete in the first quarter Windows Podere the state that the the thout writtes within that curine whether on the the ponding dress in Table 2 (c) (2 Point Cong from part) pe that the towards Import is the wealth of the list. We the valleys, they wie i Soler Your Schellent tale for purt() The once-mighty department store kires is now forced to shut shop and close all its stores by the end of the year. Unfortunately, the company has incurred a large debt, both to its shareholders (e.g., unpaid dividends, corporate bonds, etc) and to a bank. The total amount that Kires has to dole out to both shareholders and the bank (along with the interest) is given below in Table 2. Recipient Amount of Debt Quarterly Interest Shareholders $20.000 2% Bank $15,000 Table 2: Amount of money that the Kires management has to pay out to different entities within the next four quarters. Every quarter, the company receives $10000 in profits based on sales from its still-functioning stores. This money can be used to pay off any debt in the same quarter, however, the profits do not carry over to the next quarter?. Kires must use these profits to pay off its debt to both shareholders and the bank within the next four quarters. Unfortunately, any unpaid debt accrues interest at the end of the quarter. Specifically, the timeline works as described here. At the beginning of each quarter, the company receives its profits. During the course of the quarter, these profits may be used to pay off either the debt to shareholders or the bank or some combination of both. At the end of the quarter, the unpaid debt is increased by the amount corresponding to the quarterly interest, i.e., 2% for shareholder debt, and 5% for the bank. The increased debt must then be paid using the profits from the next quarter and so on. Let's go over an example to clarify how interest compounds in this problem. Example: Suppose that during the first quarter (21), Kites decides to pay $6000 to share holders and $4000 to the bank. At the end of Q1, the remaining debt is 14,000 and $11000 respectively. Before going to Q2, the remaining debt will increase by the interest. In this case 2% of $14000 is 280 and 5% of $11,000 is 550. So the new debt at the beginning of Q2 is $14,280 for shareholders and 11,550 for the bank. Once again the company will decide the payments for this quarter, after which the remaining debt will acquire interest before Q3 begins and so on. Assume you are in Jan 2021 and the rest of the year has four quarters. It is important that Kires pays off both its debts within the next four quarters or else there will be lawsuits. ? You can assume that the company uses any remaining profits to pay its upper management, which is not relevant for our purposes. (a) (8 points) Come up with a linear program to determine the amount of debt payment to both shareholders and the bank during each of the four quarters. The company must minimize its overall payments while also ensuring that both the debts are paid off by the end of Q4. Identify the optimum solution. Based on this solution, which debt must kires focus on paying off first according to the optimum solution? Is this surprising? Why/Why not? (Note: 1) In addition to the payments, it may be helpful to track the remaining debt at each point in time 2) If any of your decision variables look like - 1.4E-12 on Solver, you can assume this equals zero.] (b) (5 points) Kires overestimated its quarterly profits. It turns out that the company only made $8000 during Q1 and now expects to make the same profits in each of the remaining quarters. Unfortunately, this amount is not sufficient to pay off the two debts and Kires has filed for bankruptcy. In response, the government has decided to award the company a lump-sum payment of SN at the beginning of the first quarter for the sole purpose of paying off both debts. Kires may decide to use this compensation immediately in the first quarter or hold off till later quarters although this amount does not grow in any way. Write down an LP to determine the smallest payment N that the government can award the company so that it can finish paying off its debts within four quarters. Remember that during each quarter the company makes a profit of $8000. The debts and the corresponding quarterly interests are as given in Table 2. () (2 Points) Continuing from part (b), suppose that the government were to award this lump-sum payment in the second third or fourth quarters instead of the first. Would the minimum value of N be larger, smaller, or the same? Explain your reasoning without using Solver Your Solver submission must include separate tabs for part (a) and part (b). Therm-mi dan Kiowanced to set it be the other not the candle, but to it urbem , dvede, corporada de cand tolk The total that in to out to the share and the with the Neciprst Anot be rustellutert Tile 2 Actory that time to post to do it within This year of the terme te perdita de tu theater in the loth and the use within the form Untunately wil det er here at the rol of the te Specialty there was a dece Attor the company whispit. During the course of the presto py of the the date to adders the book or chain of both At the end of the gates, the dele sinto the topding to the quarterly int te. 26 finder det, and then the decat the w puding the parts from the atten Lance to clarity how to compare the problem Examples Awe are the your area. It is it that Kied the debts with the water of the will be love () (s points) Cup with produce the to both sides the bukurich of the for. The the letify the episode tautics, which dem Kirefoc prinodonting to the optimal is the price? Wh/Wher Neutral with 2) If no film 112 cm, (5 polata) kitested que protetti out that the company milyon during QI expect to take the wind the tutto this entitled and Ke Bled for buskey. In the earth decided to the comme of the line of the fint quarter the purpose of pain the Kisu decide to compete in the first quarter Windows Podere the state that the the thout writtes within that curine whether on the the ponding dress in Table 2 (c) (2 Point Cong from part) pe that the towards Import is the wealth of the list. We the valleys, they wie i Soler Your Schellent tale for purt() The once-mighty department store kires is now forced to shut shop and close all its stores by the end of the year. Unfortunately, the company has incurred a large debt, both to its shareholders (e.g., unpaid dividends, corporate bonds, etc) and to a bank. The total amount that Kires has to dole out to both shareholders and the bank (along with the interest) is given below in Table 2. Recipient Amount of Debt Quarterly Interest Shareholders $20.000 2% Bank $15,000 Table 2: Amount of money that the Kires management has to pay out to different entities within the next four quarters. Every quarter, the company receives $10000 in profits based on sales from its still-functioning stores. This money can be used to pay off any debt in the same quarter, however, the profits do not carry over to the next quarter?. Kires must use these profits to pay off its debt to both shareholders and the bank within the next four quarters. Unfortunately, any unpaid debt accrues interest at the end of the quarter. Specifically, the timeline works as described here. At the beginning of each quarter, the company receives its profits. During the course of the quarter, these profits may be used to pay off either the debt to shareholders or the bank or some combination of both. At the end of the quarter, the unpaid debt is increased by the amount corresponding to the quarterly interest, i.e., 2% for shareholder debt, and 5% for the bank. The increased debt must then be paid using the profits from the next quarter and so on. Let's go over an example to clarify how interest compounds in this problem. Example: Suppose that during the first quarter (21), Kites decides to pay $6000 to share holders and $4000 to the bank. At the end of Q1, the remaining debt is 14,000 and $11000 respectively. Before going to Q2, the remaining debt will increase by the interest. In this case 2% of $14000 is 280 and 5% of $11,000 is 550. So the new debt at the beginning of Q2 is $14,280 for shareholders and 11,550 for the bank. Once again the company will decide the payments for this quarter, after which the remaining debt will acquire interest before Q3 begins and so on. Assume you are in Jan 2021 and the rest of the year has four quarters. It is important that Kires pays off both its debts within the next four quarters or else there will be lawsuits. ? You can assume that the company uses any remaining profits to pay its upper management, which is not relevant for our purposes. (a) (8 points) Come up with a linear program to determine the amount of debt payment to both shareholders and the bank during each of the four quarters. The company must minimize its overall payments while also ensuring that both the debts are paid off by the end of Q4. Identify the optimum solution. Based on this solution, which debt must kires focus on paying off first according to the optimum solution? Is this surprising? Why/Why not? (Note: 1) In addition to the payments, it may be helpful to track the remaining debt at each point in time 2) If any of your decision variables look like - 1.4E-12 on Solver, you can assume this equals zero.] (b) (5 points) Kires overestimated its quarterly profits. It turns out that the company only made $8000 during Q1 and now expects to make the same profits in each of the remaining quarters. Unfortunately, this amount is not sufficient to pay off the two debts and Kires has filed for bankruptcy. In response, the government has decided to award the company a lump-sum payment of SN at the beginning of the first quarter for the sole purpose of paying off both debts. Kires may decide to use this compensation immediately in the first quarter or hold off till later quarters although this amount does not grow in any way. Write down an LP to determine the smallest payment N that the government can award the company so that it can finish paying off its debts within four quarters. Remember that during each quarter the company makes a profit of $8000. The debts and the corresponding quarterly interests are as given in Table 2. () (2 Points) Continuing from part (b), suppose that the government were to award this lump-sum payment in the second third or fourth quarters instead of the first. Would the minimum value of N be larger, smaller, or the same? Explain your reasoning without using Solver Your Solver submission must include separate tabs for part (a) and part (b)