Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please answer these auestions 1.) What is the change in net working capital during year 2? (Current Assets-Current Liabilities) 3.76 million 0.46 million

can you please answer these auestions

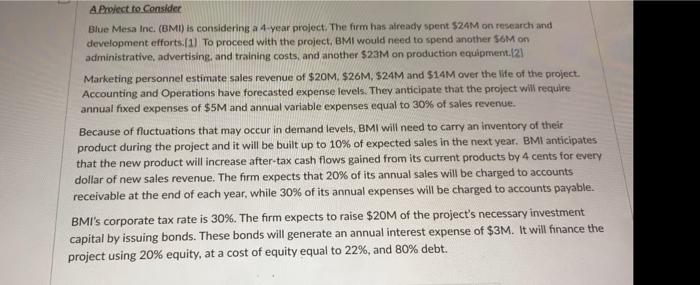

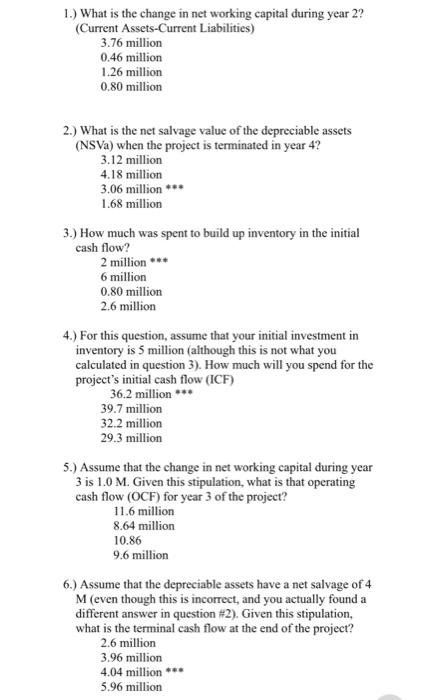

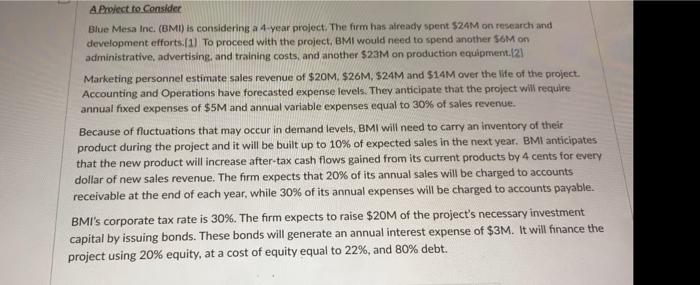

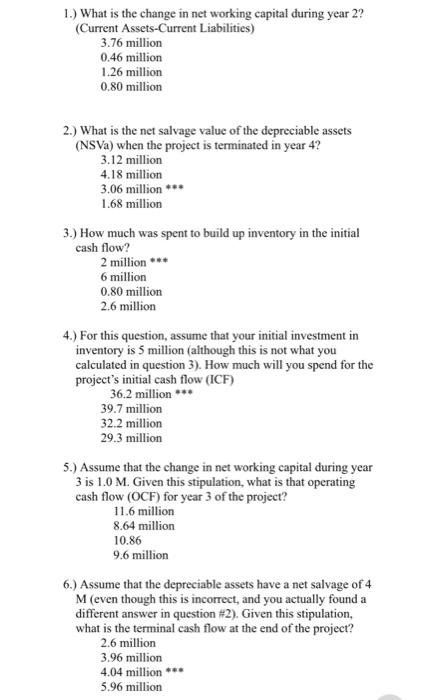

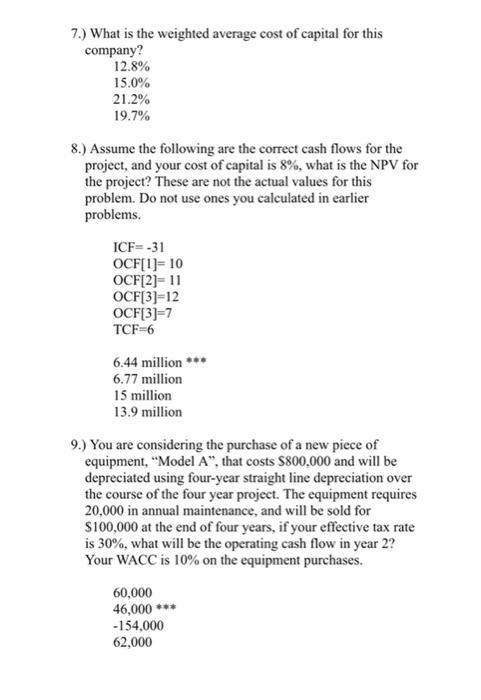

1.) What is the change in net working capital during year 2? (Current Assets-Current Liabilities) 3.76 million 0.46 million 1.26 million 0.80 million 2.) What is the net salvage value of the depreciable assets (NSVa) when the project is terminated in year 4? 3.12 million 4.18 million 3.06 million *** 1.68 million 3.) How much was spent to build up inventory in the initial cash flow? 2 million *** 6 million 0.80 million 2.6 million 4.) For this question, assume that your initial investment in inventory is 5 million (although this is not what you calculated in question 3). How much will you spend for the project's initial cash flow (ICF) 36.2 million ** 39.7 million 32.2 million 29.3 million 5.) Assume that the change in net working capital during year 3 is 1.0 M. Given this stipulation, what is that operating cash flow (OCF) for year 3 of the project? 11.6 million 8.64 million 10.86 9.6 million 6.) Assume that the depreciable assets have a net salvage of 4 M (even though this is incorrect, and you actually found a different answer in question #2). Given this stipulation, what is the terminal cash flow at the end of the project? 2.6 million 3.96 million 4.04 million 5.96 million 7.) What is the weighted average cost of capital for this company? 12.8% 15.0% 21.2% 19.7% 8.) Assume the following are the correct cash flows for the project, and your cost of capital is 8%, what is the NPV for the project? These are not the actual values for this problem. Do not use ones you calculated in earlier problems. ICF=-31 OCF[1]=10 OCF[2]-11 OCF[3)=12 OCF[3]=7 TCF-6 6.44 million ** 6.77 million 15 million 13.9 million 9.) You are considering the purchase of a new piece of equipment, "Model A", that costs $800,000 and will be depreciated using four-year straight line depreciation over the course of the four year project. The equipment requires 20,000 in annual maintenance, and will be sold for $100,000 at the end of four years, if your effective tax rate is 30%, what will be the operating cash flow in year 2? Your WACC is 10% on the equipment purchases. 60,000 46,000 *** -154,000 62,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started