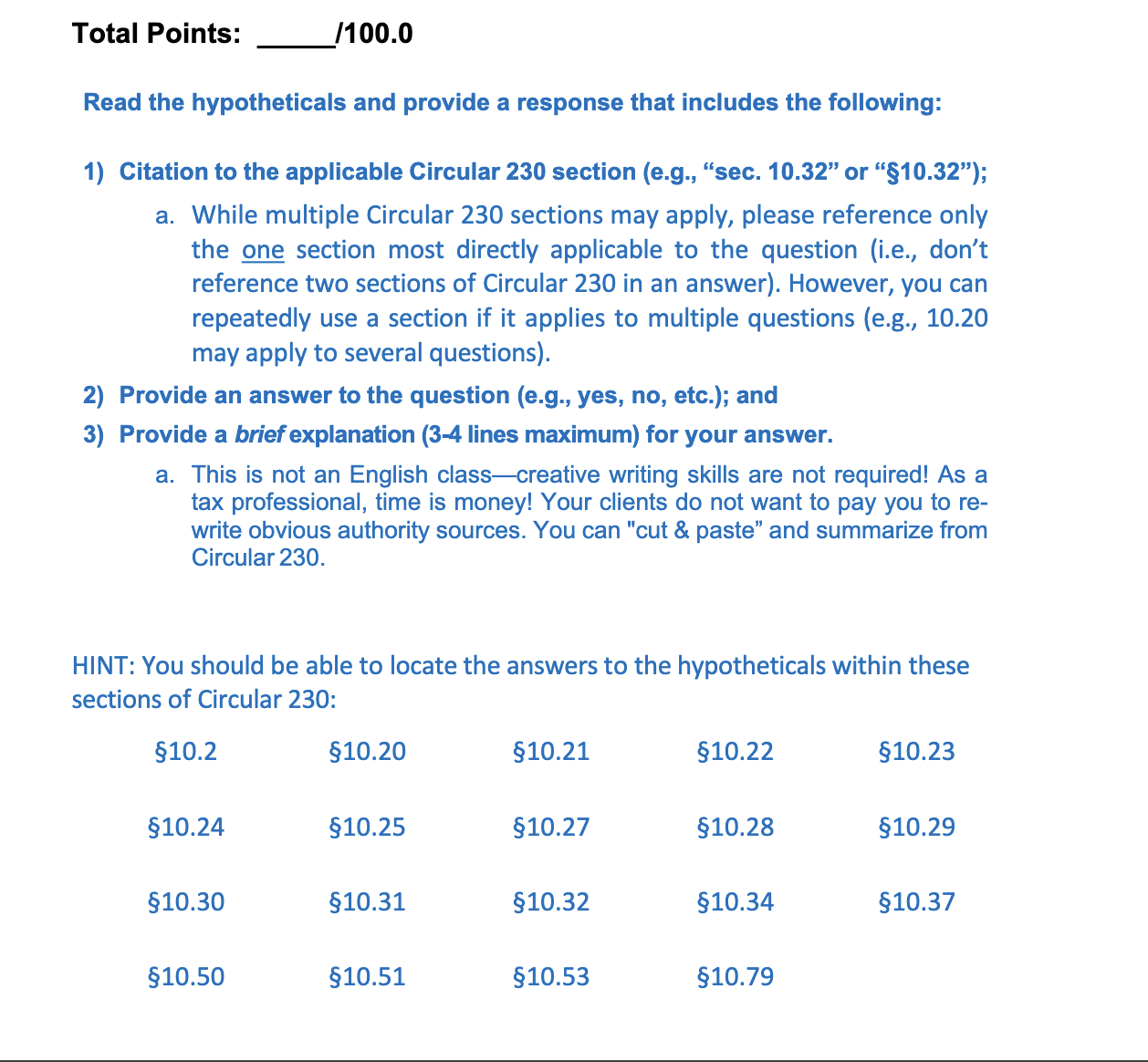

Question

Can you please answer those 10 questions below with simple and clear sentences. And with Circular 230 section. 11. A tax return preparer used one

Can you please answer those 10 questions below with simple and clear sentences. And with Circular 230 section.

11. A tax return preparer used one of their clients' social security numbers to obtain Medicare benefits for their elderly father, who is very sick. The client did not suffer any detrimental effect from the use of their social security number. The preparer was convicted of theft by deception (i.e., a theft crime where an individual uses false pretenses to gain control of someone's property). However, due to hardship, the preparer is only sentenced to 2-years' probation. Under Circular 230, were the preparer's actions regarding the use of their client's social security number disreputable?

12. Andrea is getting a divorce and she has been referred to you by her divorce attorney to prepare Andrea's current year's return. In the past, Andrea prepared her and her spouse's joint tax returns. To get a better understanding of your new client's tax matters, you review Andrea's prior three years' returns. You discover that Andrea has failed to report income of at least $75,000 for each of the past three years. Under Circular 230, what are your ethical responsibilities to Andrea?

13. Mary receives an IRS notice of audit for her 20XX return and has come to you for help. An enrolled agent (EA) prepared Mary's 20XX tax return and you need the EA's work papers to assist you in defending Mary in the audit. The EA refuses to turn over the records because Mary still owes him money on an outstanding bill. Under Circular 230, is the EA in violation of Circular 230?

14. Your client, SMAL Business, asks you to submit to the IRS a Form W-4, Employee's Withholding Allowance Certificate, that it received from one of its employees. On the Form W-4, the employee claims ten dependents. Although the employee has made no oral or written statement to SMAL Business indicating the Form W-4 is false, SMAL Business tells you it has reason to believe the Form W-4 is incorrect. Under Circular 230, can you submit the Form W-4 to the IRS?

15. In a collection case (the IRS is seeking to collect a tax owed), you tell your client you will delay the IRS, so the client does not have to start making payments. Under Circular 230, have you violated your duties?

16. Rick recently retired from the US Attorney's Office (federal prosecutor's office). Six months later, Rick now works for a large law firm. Just before Rick left the US attorney's office, he was involved in reviewing some criminal tax matters involving a taxpayer named Phillip Blake. Mr. Blake has come to Rick's law firm seeking legal representation in the criminal tax matter. Under Circular 230, can the law firm represent Mr. Blake?

17. As a practitioner, you knowingly submit false documents to a Revenue Agent during an audit. The Revenue Agent discovers the false information and refers the matter to the Office of Professional Responsibility (OPR). The Secretary of the Treasury has delegated authority to OPR to determine alleged misconduct in violation of Circular 230. The OPR determines you violated your duties under Circular 230 through your disreputable conduct. Under Circular 230, can the OPR sanction you?

18. Your client loans $100,000 to his brother to invest in a travel agency business. While the brother will completely run the travel agency. One year after opening, the travel agency goes out of business leaving no funds for the brother to repay your client. You know your client never worked for the travel agency business. In fact, your client is a full-time physician with a very busy medical practice. Your client wants to take the position that the loan is a "business bad debt," which, under the Internal Revenue Code, requires your client to have been in the travel agency business. You tell your client this position is unreasonable, and you cannot file the return taking this position. Your client asks you instead to just prepare and sign the return, but he will file it with the IRS. Under Circular 230, can you prepare and sign the return reporting this position?

19. Jack and Jill are divorcing after Jack accuses Jill of pushing him down a hill. The IRS is auditing the couple's 20XX joint return, and their accountant represents both in the audit. Jack may qualify for the innocent spouse relief to any tax liabilities resulting from the audit. The Revenue Agent has asked the accountant if Jack intends to seek innocent spouse relief as the Revenue Agent believes Jack would qualify for such relief. The accountant tells the Revenue Agent he does not want to inform Jack of his innocent spouse rights because it will prolong the audit (which Jill wants to be closed soon) and that Jill will be paying any tax liability so Jack won't suffer any financial loss. Under Circular 230, what is the Revenue Agent expected to do?

20. Bob suffered a workplace injury that left him unable to work. He sued his former employer. Bob and his employer agreed to settle the lawsuit, and Bob received a large settlement last year. Bob's accountant did not report the settlement as taxable income on Bob's tax year for that year. The IRS disagreed with this position and adjusted Bob's return to include the settlement as taxable income. Bob has come to you to file a petition to the US Tax Court challenging the IRS' position regarding the taxability of the settlement. However, Bob can't afford to pay you and is asking you to take a contingency fee. Under Circular 230, can you charge a contingency fee for litigating the case in US Tax Court.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started