Can you please do this on an excel spreadsheet.

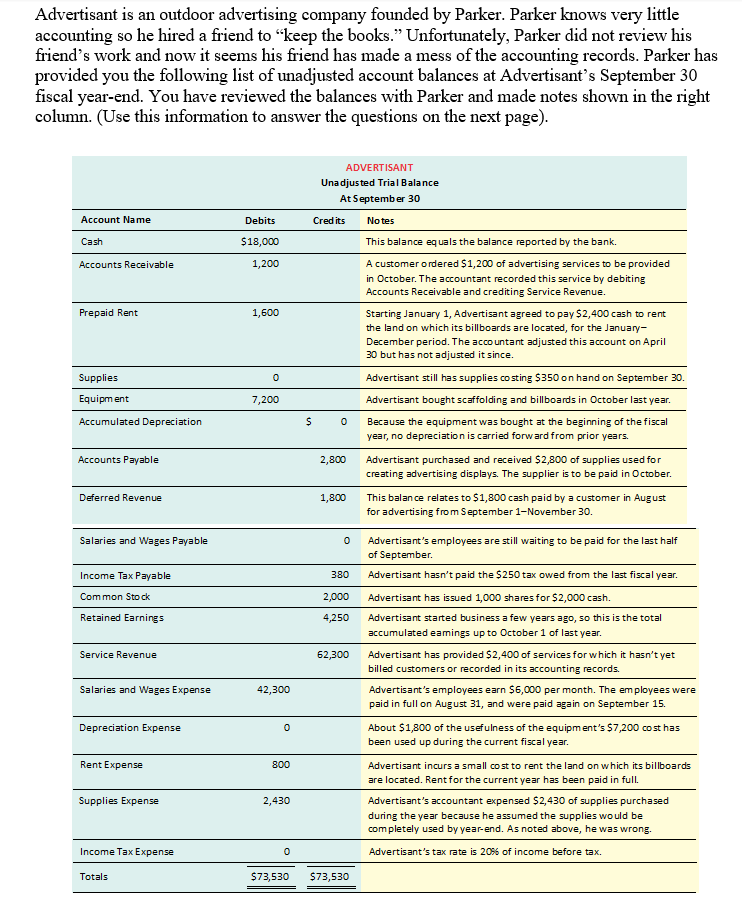

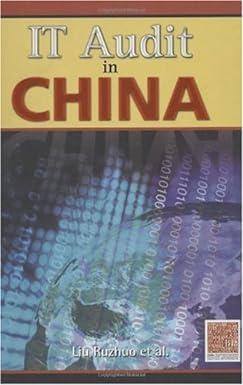

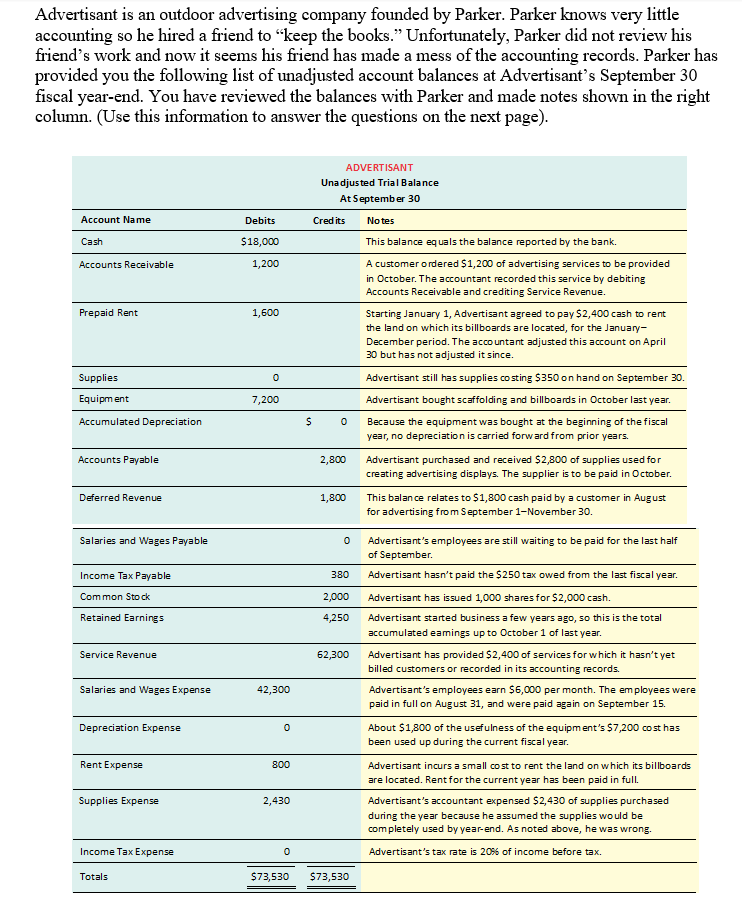

Advertisant is an outdoor advertising company founded by Parker. Parker knows very little accounting so he hired a friend to keep the books. Unfortunately, Parker did not review his friend's work and now it seems his friend has made a mess of the accounting records. Parker has provided you the following list of unadjusted account balances at Advertisant's September 30 fiscal year-end. You have reviewed the balances with Parker and made notes shown in the right column. (Use this information to answer the questions on the next page). Account Name Debits Cash $18,000 Accounts Receivable 1,200 Prepaid Rent 1,600 Supplies 0 Equipment 7,200 Accumulated Depreciation S 0 Accounts Payable Deferred Revenue ADVERTISANT Unadjusted Trial Balance At September 30 Credits Notes This balance equals the balance reported by the bank. A customer ordered $1,200 of advertising services to be provided in October. The accountant recorded this service by debiting Accounts Receivable and crediting Service Revenue. Starting January 1, Advertisant agreed to pay $2,400 cash to rent the land on which its billboards are located, for the January- December period. The accountant adjusted this account on April 30 but has not adjusted it since. Advertisant still has supplies costing $350 on hand on September 30. Advertisant bought scaffolding and billboards in October last year. Because the equipment was bought at the beginning of the fiscal year, no depreciation is carried forward from prior years. 2,800 Advertisant purchased and received $2,800 of supplies used for creating advertising displays. The supplier is to be paid in October. 1,800 This balance relates to $1,800 cash paid by a customer in August for advertising from September 1-November 30. 0 Advertisant's employees are still waiting to be paid for the last half of September Advertisant hasn't paid the $250 tax owed from the last fiscal year. 2,000 Advertisant has issued 1,000 shares for $2,000 cash. 4,250 Advertisant started business a few years ago, so this is the total accumulated eamings up to October 1 of last year. 62,300 Advertisant has provided $2,400 of services for which it hasn't yet billed customers or recorded in its accounting records. Advertisant's employees earn $6,000 per month. The employees were paid in full on August 31, and were paid again on September 15. About $1,800 of the usefulness of the equipment's $7,200 cost has been used up during the current fiscal year. Advertisant incurs a small cost to rent the land on which its billboards are located. Rent for the current year has been paid in full. Advertisant's accountant expensed $2,430 of supplies purchased during the year because he assumed the supplies would be completely used by year-end. As noted above, he was wrong. Salaries and Wages Payable 380 Income Tax Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense 42,300 Depreciation Expense 0 Rent Expense 800 Supplies Expense 2,430 Income Tax Expense 0 Advertisant's tax rate is 20% of income before tax. Totals $73,530 $73,530 Required: 1. Use the notes to determine and record the adjusting journal entries needed on September 30 to (a) fix the premature recording of advertising revenue, (b) update the rent accounts, (c) account for the use of equipment, (d) update deferred revenue, (e) accrue revenue not yet billed, (f) accrue unpaid wages, (g) correct the supplies accounts, and (h) accrue income taxes for the year. 2. Post the adjusting journal entries from requirement 1 to T-accounts to determine new adjusted balances, and prepare an adjusted trial balance. 3. Using the adjusted account balances from requirement 2, prepare an income statement, statement of retained earnings, and classified balance sheet