can you please expalin step by step how you get div

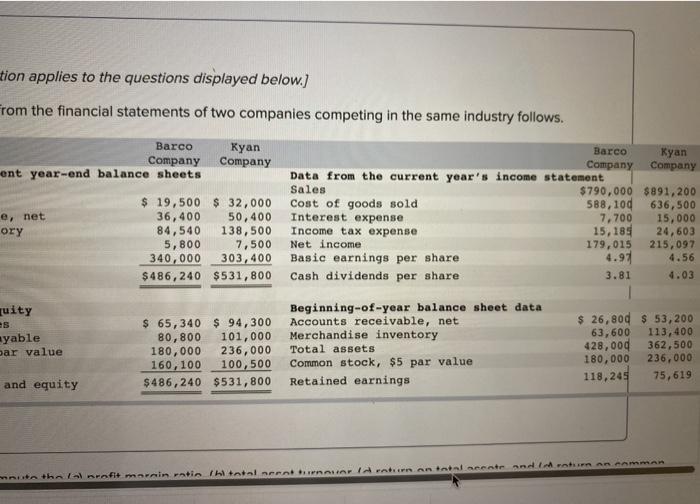

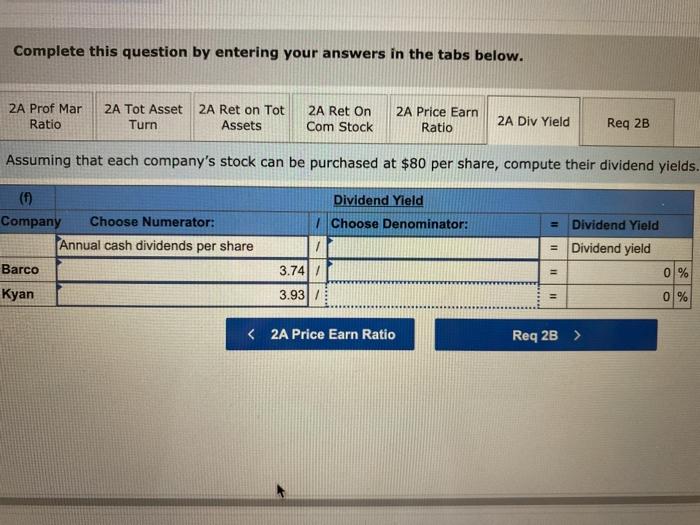

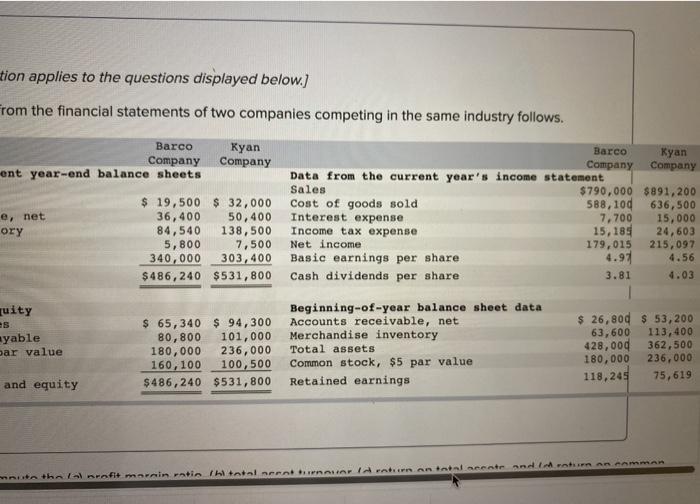

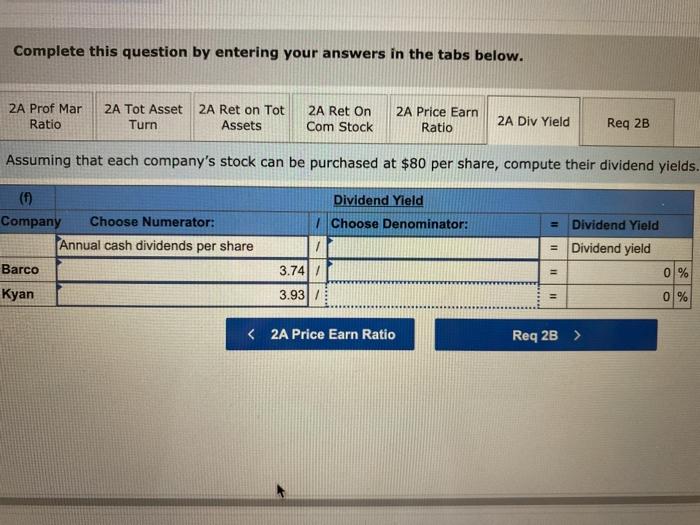

tion applies to the questions displayed below.) From the financial statements of two companies competing in the same industry follows. Barco Company ent year-end balance sheets Kyan Company e, net Barco Kyan Company Company Data from the current year's income statement Sales $790,000 $891,200 Cost of goods sold 588,100 636,500 Interest expense 7.700 15,000 Income tax expense 15,185 24,603 Net income 179,015 215,097 Basic earnings per share 4.56 Cash dividends per share 3.81 4.03 $ 19,500 $ 32,000 36,400 50,400 84,540 138,500 5,800 7,500 340,000 303, 400 $486,240 $531,800 ory quity ayable ar value $ 65,340 $ 94,300 80, 800 101,000 180,000 236,000 160,100 100,500 $486,240 $531,800 Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings $ 26,800 $ 53,200 63,600 113, 400 428,000 362,500 180,000 236,000 118,245 75,619 and equity niit the lanfit marrin ratio intal centuriArt antal ment and that comman Complete this question by entering your answers in the tabs below. ZA Prof Mar Ratio 2A Tot Asset Turn 2A Ret on Tot Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Req 2B Assuming that each company's stock can be purchased at $80 per share, compute their dividend yields. () Company Choose Numerator: Annual cash dividends per share Dividend Yield Choose Denominator: = Dividend Yield = Dividend yield 0 % Barco 3.74 / Kyan 3.93/ 0 % tion applies to the questions displayed below.) From the financial statements of two companies competing in the same industry follows. Barco Company ent year-end balance sheets Kyan Company e, net Barco Kyan Company Company Data from the current year's income statement Sales $790,000 $891,200 Cost of goods sold 588,100 636,500 Interest expense 7.700 15,000 Income tax expense 15,185 24,603 Net income 179,015 215,097 Basic earnings per share 4.56 Cash dividends per share 3.81 4.03 $ 19,500 $ 32,000 36,400 50,400 84,540 138,500 5,800 7,500 340,000 303, 400 $486,240 $531,800 ory quity ayable ar value $ 65,340 $ 94,300 80, 800 101,000 180,000 236,000 160,100 100,500 $486,240 $531,800 Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings $ 26,800 $ 53,200 63,600 113, 400 428,000 362,500 180,000 236,000 118,245 75,619 and equity niit the lanfit marrin ratio intal centuriArt antal ment and that comman Complete this question by entering your answers in the tabs below. ZA Prof Mar Ratio 2A Tot Asset Turn 2A Ret on Tot Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Req 2B Assuming that each company's stock can be purchased at $80 per share, compute their dividend yields. () Company Choose Numerator: Annual cash dividends per share Dividend Yield Choose Denominator: = Dividend Yield = Dividend yield 0 % Barco 3.74 / Kyan 3.93/ 0 %