Question

can you please explain how to answer these Melbourne Ltd. announces a fully franked cash dividend of $1 per share in a market where the

can you please explain how to answer these

Melbourne Ltd. announces a fully franked cash dividend of $1 per share in a market where the applicable corporate tax rate is 30%. Henry is a resident shareholder in Melbourne Ltd. (holding just one share) and pays tax at a marginal tax rate of 50%.

Which of the following statements is correct with respect to the situation described above?

(a) The franking credit received by Henry will be $1.16 (to the nearest cent).

(b) Henrys personal tax payment will be $0.50 (to the nearest cent).

(c) Henrys after-tax net return from the dividend will be close to $0.71.

(d) More than one statement is correct

(e) None of the statements is correct

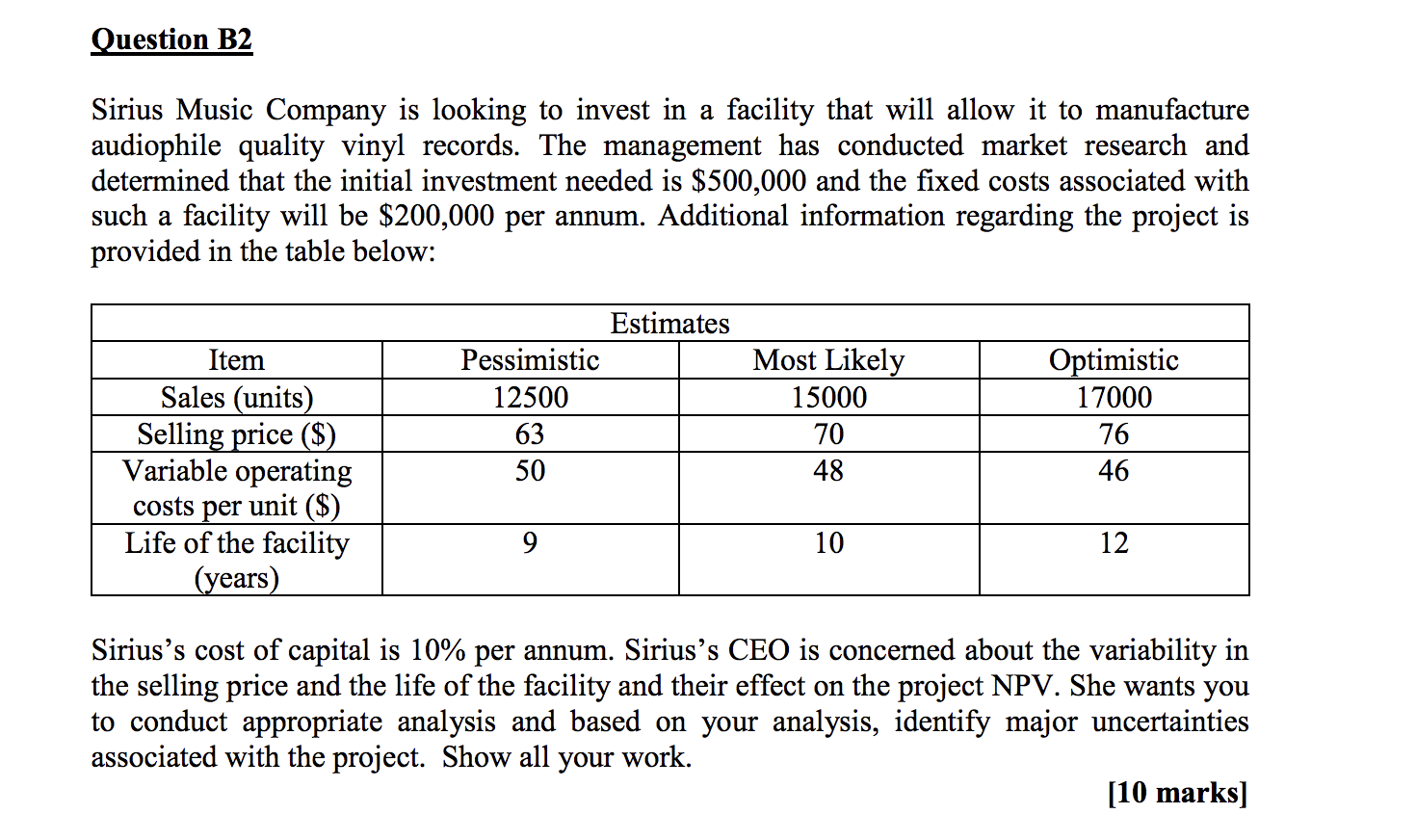

Question B2 Sirius Music Company is looking to invest in a facility that will allow it to manufacture audiophile quality vinyl records. The management has conducted market research and determined that the initial investment needed is $500,000 and the fixed costs associated with such a facility will be $200,000 per annum. Additional information regarding the project is provided in the table below: Item Sales (units) Selling price ($) Variable operating costs per unit ($) Life of the facility (years) Estimates Pessimistic 12500 63 50 Most Likely 15000 70 48 Optimistic 17000 76 46 9 10 12 Sirius's cost of capital is 10% per annum. Sirius's CEO is concerned about the variability in the selling price and the life of the facility and their effect on the project NPV. She wants you to conduct appropriate analysis and based on your analysis, identify major uncertainties associated with the project. Show all your work. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started