Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain me how to find the correct answer with the full workings for this question? 44.3A The following trial balance has been

Can you please explain me how to find the correct answer with the full workings for this question?

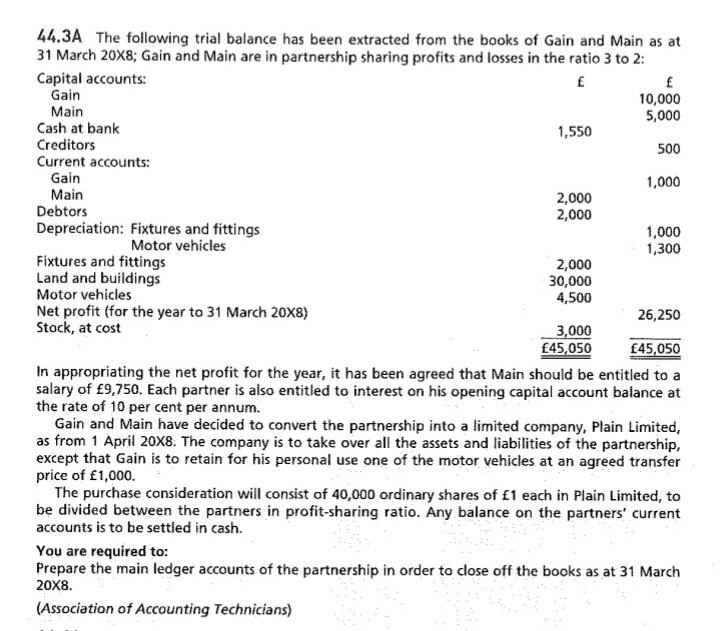

44.3A The following trial balance has been extracted from the books of Gain and Main as at 31 March 20x8; Gain and Main are in partnership sharing profits and losses in the ratio 3 to 2: Capital accounts: Gain 10,000 Main 5,000 Cash at bank 1,550 Creditors 500 Current accounts: Gain 1,000 Main 2,000 Debtors 2,000 Depreciation: Fixtures and fittings 1,000 Motor vehicles 1,300 Fixtures and fittings 2,000 Land and buildings 30,000 Motor vehicles 4,500 Net profit (for the year to 31 March 20x8) 26,250 Stock, at cost 3,000 45,050 45,050 In appropriating the net profit for the year, it has been agreed that Main should be entitled to a salary of 9,750. Each partner is also entitled to interest on his opening capital account balance at the rate of 10 per cent per annum. Gain and Main have decided to convert the partnership into a limited company, Plain Limited, as from 1 April 20X8. The company is to take over all the assets and liabilities of the partnership, except that Gain is to retain for his personal use one of the motor vehicles at an agreed transfer price of 1,000. The purchase consideration will consist of 40,000 ordinary shares of 1 each in Plain Limited, to be divided between the partners in profit-sharing ratio. Any balance on the partners' current accounts is to be settled in cash. You are required to: Prepare the main ledger accounts of the partnership in order to close off the books as at 31 March 20X8. (Association of Accounting Technicians)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started