Answered step by step

Verified Expert Solution

Question

1 Approved Answer

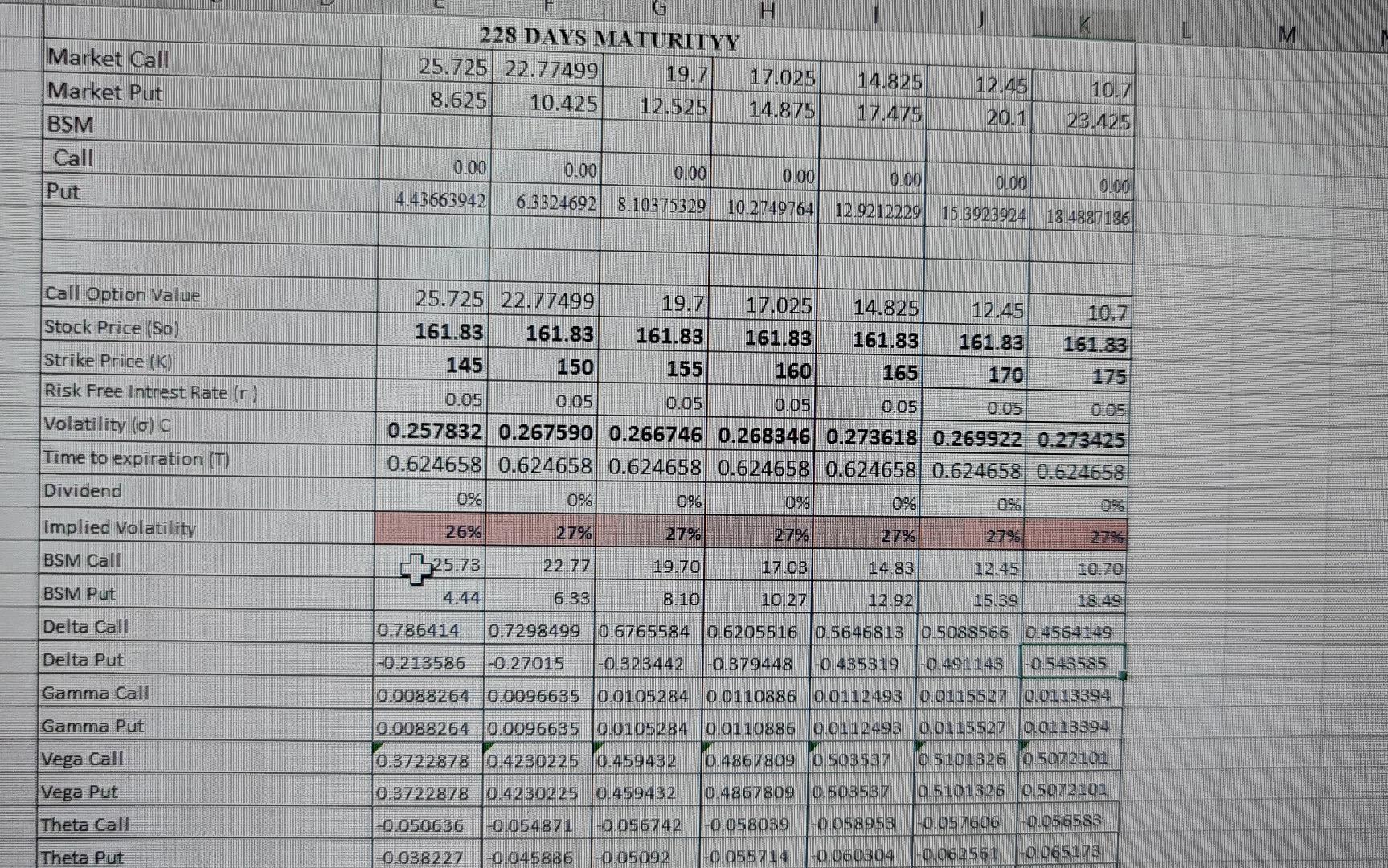

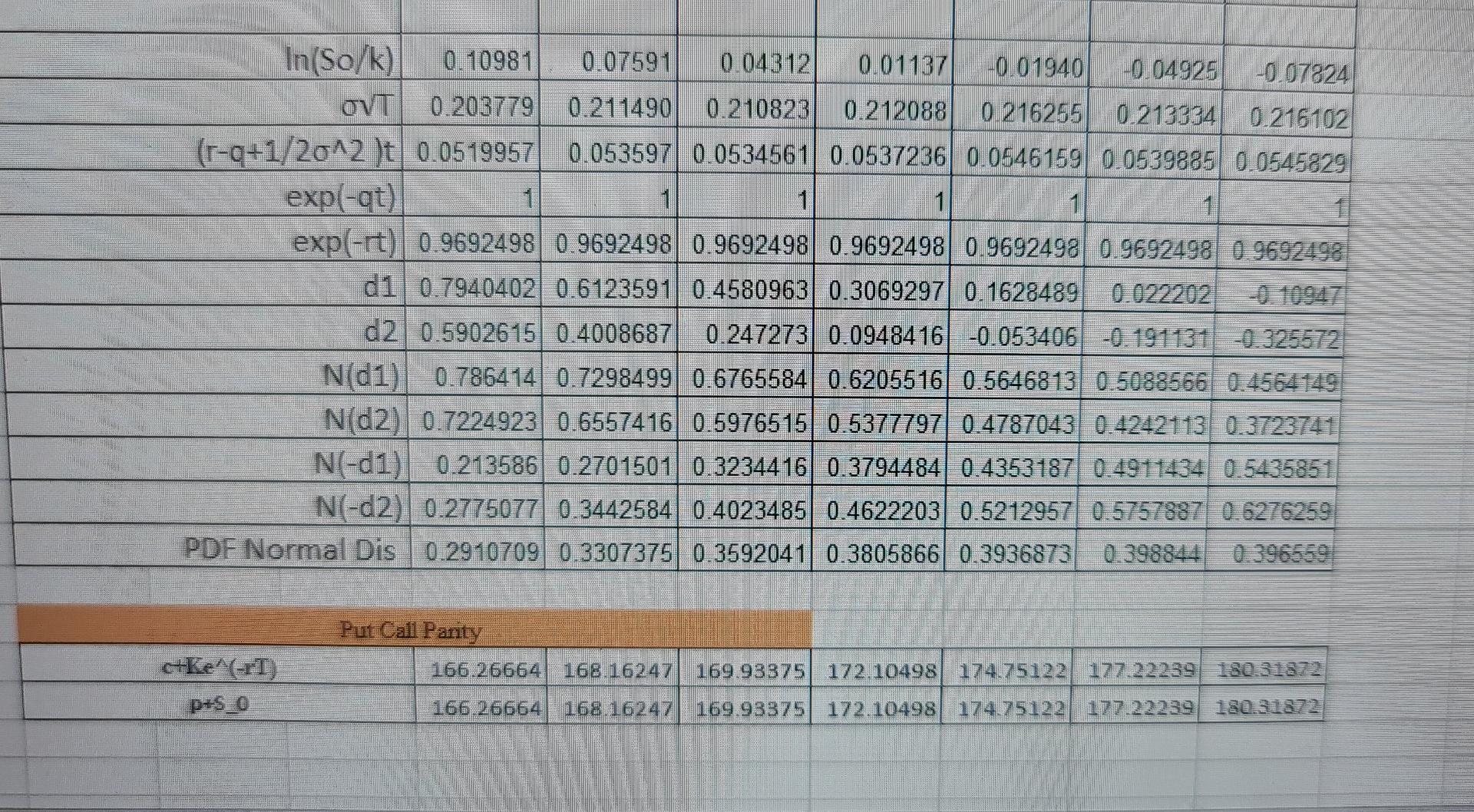

can you please explain the pattern and findings of these Greeks and can you tell what is bad or not with definitions of these Greeks?

can you please explain the pattern and findings of these Greeks and can you tell what is bad or not with definitions of these Greeks?

H 228 DAYS MATURITYY 25.725 22.77499 19.7 17.025 8.625 10.425 12.525 14.875 14.825 12.45 Market Call Market Put BSM Call 10.7 17.475 20.1 23.425 0.00 4.43663942 0.00 0.00 0.00 0.00 6.3324692 8.10375329 0.00 Put 0.00 DOEL 10.2749764 8S 12.9212229 15.3923924 13.4887186 Call Option Value 25.725 22.77499 19.7 17.025 14.825 12.45 161.83 161.83 161.83 161.83 161.83 161.83 161.83 145 150 155 160 165 170 Stock Price (So) Strike Price (K) Risk Free Intrest Rate (r) Volatility (o) c Time to expiration (T) 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.257832 0.267590 0.266746 0.268346 0.273618 0.269922 0.273425 0.624658 0.624658 0.624658 0.624658 0.624658 0.624658 0.624658 Dividend 0% 0% 096 0% 0% Implied Volatility 26% 27% 27% 27% 27% 2795 2795 BSM Call -}25.73 22.77 19.70 17.03 14.83 12.45 10.70 BSM Put 4.44 6.33 8.10 10.27 12.92 15.39 18.49 Delta Call 0.786414 0.7298499 0.6765584 0.6205516 0.5646813 0.5088566 0.4564149 Delta Put -0.213586 -0.27015 -0.323442 -0.379448 -0.485319 -0.491143 -0.545585 Gamma Call 0.0088264 0.0096635 0.0105284 0.0110886 0.0112493 0.0115527 0.0113394 Gamma Put Vega Call 0.0088264 0.0096635 0.0105284 0.0110886 0.0112493 0.0115527 0.0113394 0.3722878 10.4230225 10.459432 0.4867809 0.503537 10.5101826 10.5072101 0.3722878 0.4230225 0.459432 0.4867 809 0.503587 0.5101326 0.5072101 0050636 0.054871 -0.056742 -0.058039 0.058953 -0.057606 -0.056583 Vega Put Theta Call Theta Put -0.038227 -0.045886 0.05092 -0.055714 -0.060304 -0.062561 -0.06518 In(So/k) 0.10981 0.07591 0.04312 0.01137 -0.01940 -0.04925 -0.07824 OVT 0.203779 0.211490 0.2 10823 0.212088 0.216255 0.213334 0.216102 (r-q+1/2012 )t 0.0519957 0.053597 0.0534561 0.0537236 0.0546159| 0.0639885 0.0545829 exp(-qt) 1 1 1 1 1 exp(-rt) 0.9692498 0.9692498 0.9692498 0.9692498 0.9692498 0.9692498 0.9692498 d1 0.7940402 0.6123591 0.4580963| 0.3069297 0.1628489 0.022202 -0.10947 d2| 0.5902615| 0.4008687 0.247273 0.0948416 -0.053406 -0.191131 -0.325572 N(d1) 0.786414 0.7298499 0.6765584 0.6205516 0.5646813 0.5088566 0.4564 149 N(D2) 0.7224923 0.6557416 0.5976515 0.5377797 0.4787043 0.4242113 0.3723741 N(-d1)] 0.213586 0.2701501 0.3234416 0.3794484 0.4353187 0.4911434 0.5435351 N(-d2) 0.2775077 0.3442584 0.4023485 0.4622203 0.5212957 0.5757887 0.6276259 PDF Normal Dis 0.2910709 0.3307375 0.3592041 0.3805866 0.3936873 0.398844 0.396559 Put Cali Parity 166.26664 168.16247 169 93875 172.10498 174.75122 177.22239 180.31372 Ke^(-rT) p+s_0 155.25564 168 16247 169 93375 172.10498 174.75122 177.22239 180.31872 H 228 DAYS MATURITYY 25.725 22.77499 19.7 17.025 8.625 10.425 12.525 14.875 14.825 12.45 Market Call Market Put BSM Call 10.7 17.475 20.1 23.425 0.00 4.43663942 0.00 0.00 0.00 0.00 6.3324692 8.10375329 0.00 Put 0.00 DOEL 10.2749764 8S 12.9212229 15.3923924 13.4887186 Call Option Value 25.725 22.77499 19.7 17.025 14.825 12.45 161.83 161.83 161.83 161.83 161.83 161.83 161.83 145 150 155 160 165 170 Stock Price (So) Strike Price (K) Risk Free Intrest Rate (r) Volatility (o) c Time to expiration (T) 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.257832 0.267590 0.266746 0.268346 0.273618 0.269922 0.273425 0.624658 0.624658 0.624658 0.624658 0.624658 0.624658 0.624658 Dividend 0% 0% 096 0% 0% Implied Volatility 26% 27% 27% 27% 27% 2795 2795 BSM Call -}25.73 22.77 19.70 17.03 14.83 12.45 10.70 BSM Put 4.44 6.33 8.10 10.27 12.92 15.39 18.49 Delta Call 0.786414 0.7298499 0.6765584 0.6205516 0.5646813 0.5088566 0.4564149 Delta Put -0.213586 -0.27015 -0.323442 -0.379448 -0.485319 -0.491143 -0.545585 Gamma Call 0.0088264 0.0096635 0.0105284 0.0110886 0.0112493 0.0115527 0.0113394 Gamma Put Vega Call 0.0088264 0.0096635 0.0105284 0.0110886 0.0112493 0.0115527 0.0113394 0.3722878 10.4230225 10.459432 0.4867809 0.503537 10.5101826 10.5072101 0.3722878 0.4230225 0.459432 0.4867 809 0.503587 0.5101326 0.5072101 0050636 0.054871 -0.056742 -0.058039 0.058953 -0.057606 -0.056583 Vega Put Theta Call Theta Put -0.038227 -0.045886 0.05092 -0.055714 -0.060304 -0.062561 -0.06518 In(So/k) 0.10981 0.07591 0.04312 0.01137 -0.01940 -0.04925 -0.07824 OVT 0.203779 0.211490 0.2 10823 0.212088 0.216255 0.213334 0.216102 (r-q+1/2012 )t 0.0519957 0.053597 0.0534561 0.0537236 0.0546159| 0.0639885 0.0545829 exp(-qt) 1 1 1 1 1 exp(-rt) 0.9692498 0.9692498 0.9692498 0.9692498 0.9692498 0.9692498 0.9692498 d1 0.7940402 0.6123591 0.4580963| 0.3069297 0.1628489 0.022202 -0.10947 d2| 0.5902615| 0.4008687 0.247273 0.0948416 -0.053406 -0.191131 -0.325572 N(d1) 0.786414 0.7298499 0.6765584 0.6205516 0.5646813 0.5088566 0.4564 149 N(D2) 0.7224923 0.6557416 0.5976515 0.5377797 0.4787043 0.4242113 0.3723741 N(-d1)] 0.213586 0.2701501 0.3234416 0.3794484 0.4353187 0.4911434 0.5435351 N(-d2) 0.2775077 0.3442584 0.4023485 0.4622203 0.5212957 0.5757887 0.6276259 PDF Normal Dis 0.2910709 0.3307375 0.3592041 0.3805866 0.3936873 0.398844 0.396559 Put Cali Parity 166.26664 168.16247 169 93875 172.10498 174.75122 177.22239 180.31372 Ke^(-rT) p+s_0 155.25564 168 16247 169 93375 172.10498 174.75122 177.22239 180.31872Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started