Question

Sheridan, Inc. has $500,000,$0.80 , no par value preferred shares ( 50,000 shares) and $1,000,000 of no par value common sharesOn September 15, 2023, the

Sheridan, Inc. has

$500,000,$0.80, no par value preferred shares ( 50,000 shares) and

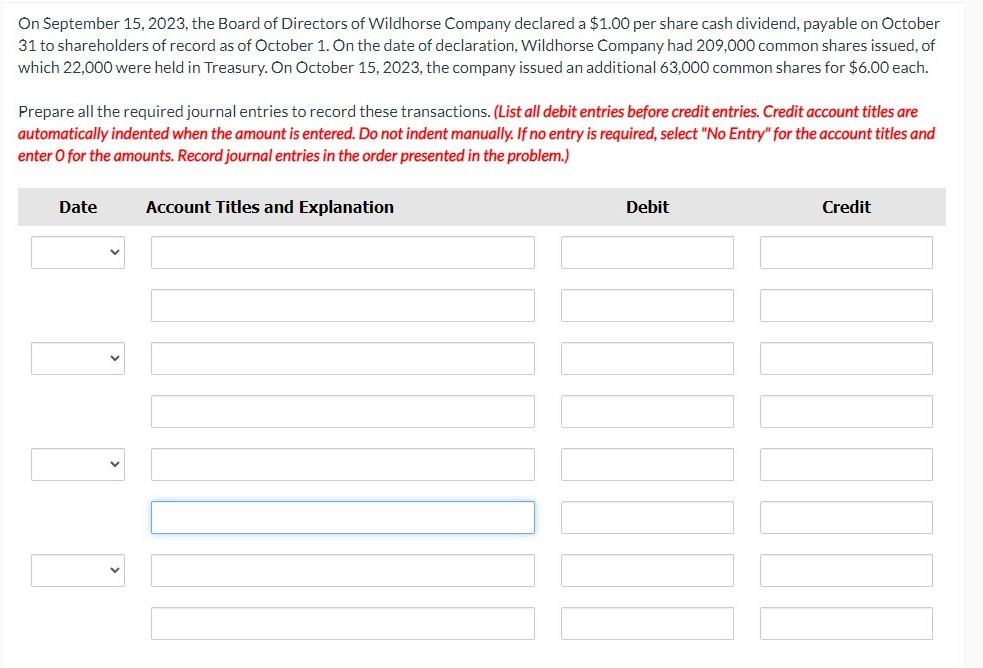

$1,000,000of no par value common sharesOn September 15, 2023, the Board of Directors of Wildhorse Company declared a

$1.00per share cash dividend, payable on October\ 31 to shareholders of record as of October 1. On the date of declaration, Wildhorse Company had 209,000 common shares issued, of\ which 22,000 were held in Treasury. On October 15, 2023, the company issued an additional 63,000 common shares for

$6.00each.\ Prepare all the required journal entries to record these transactions. (List all debit entries before credit entries. Credit account titles are\ automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and\ enter 0 for the amounts. Record journal entries in the order presented in the problem.)\ Date\ Account Titles and Explanation\ Debit\ Credit\ outstanding ( 80,000 shares). No dividends were paid or declared during 2021 and 2022 . The company wants to distribute

$524,000in\ dividends on December 31, 2023.\ (a)\ Calculate the amount of dividends to be paid to each group of shareholders (i.e., preferred and common), assuming the preferred\ shares are non-cumulative and non-participating.\ eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started