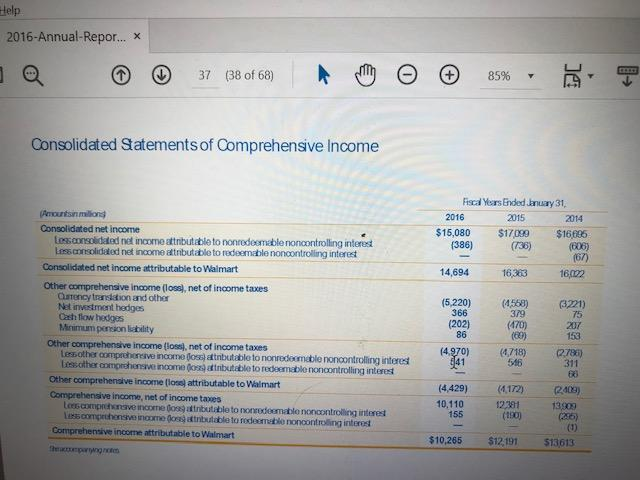

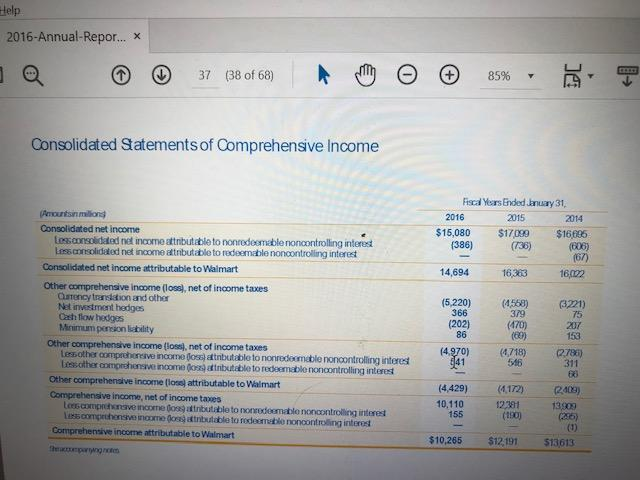

Can you please help answer the below question so that I can understand? What was the gain or loss from foreign currency translation for the year ended January 31, 2016 (below) ? Where was it reported, and what is the rationale for reporting it there?

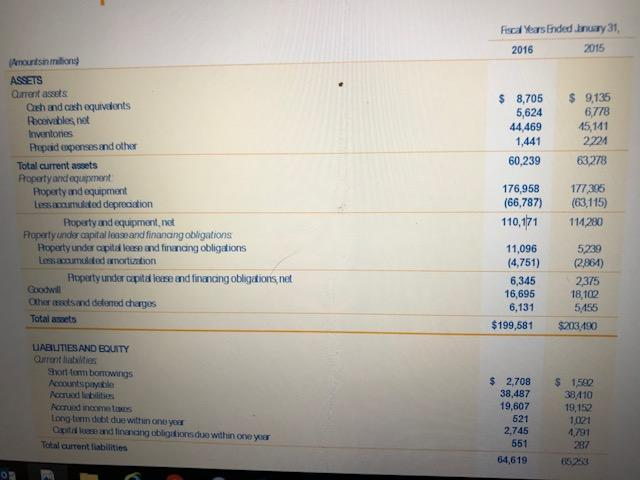

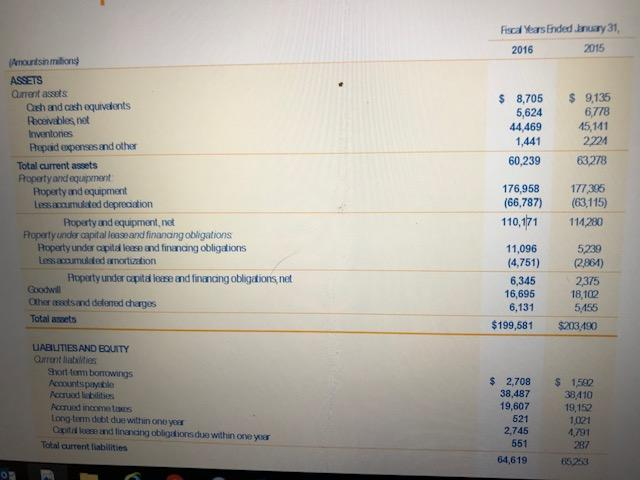

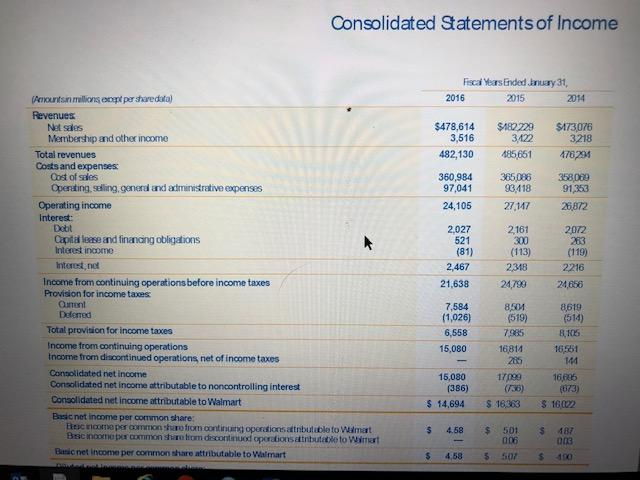

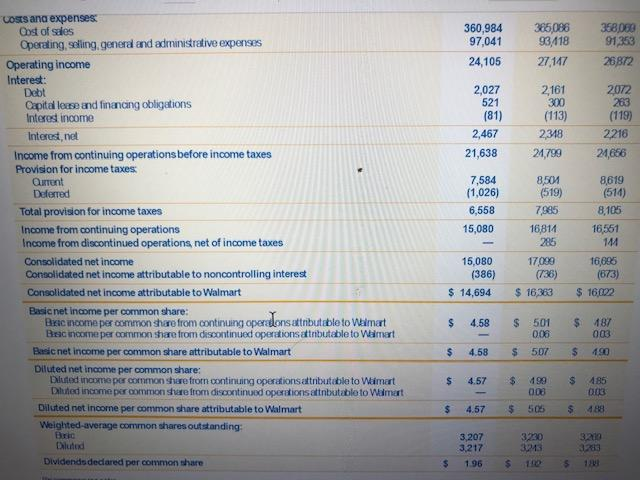

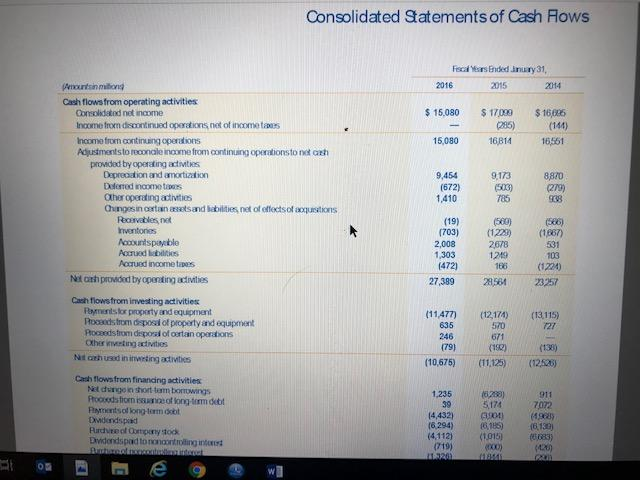

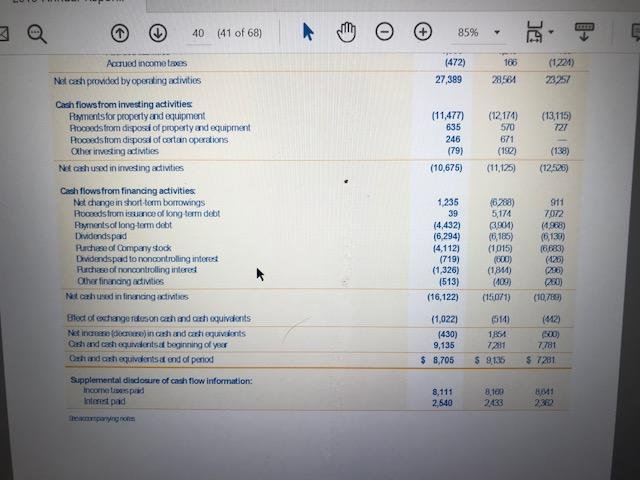

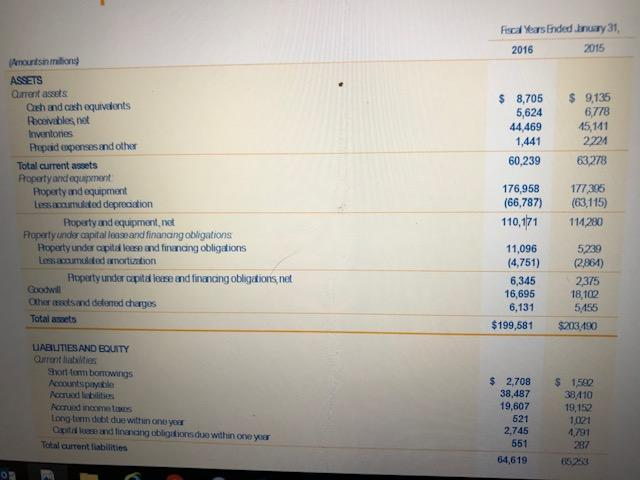

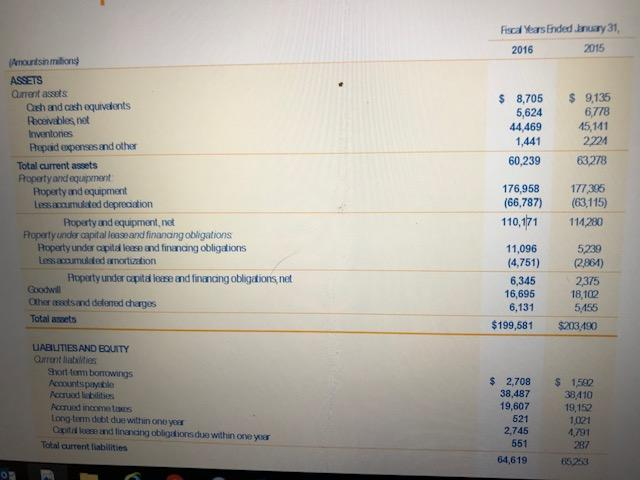

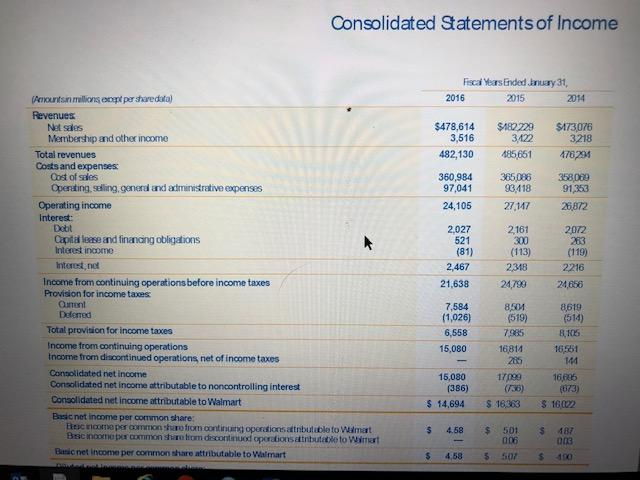

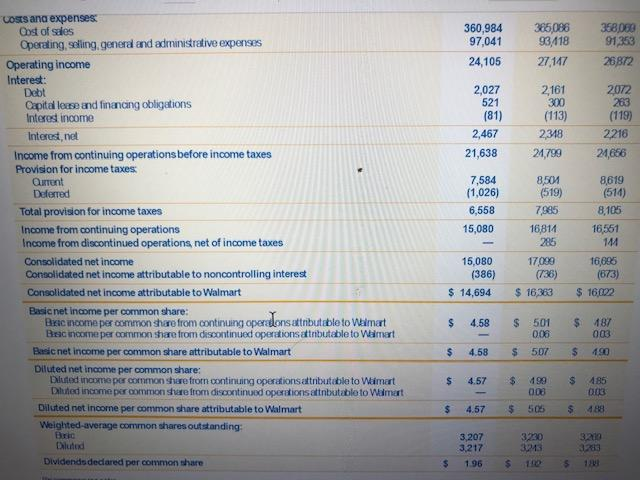

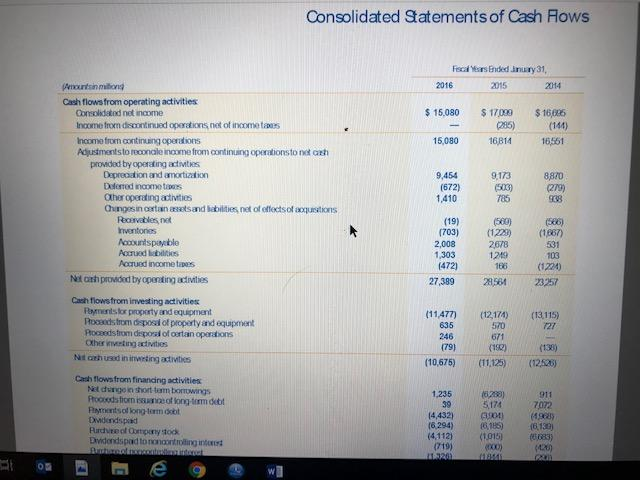

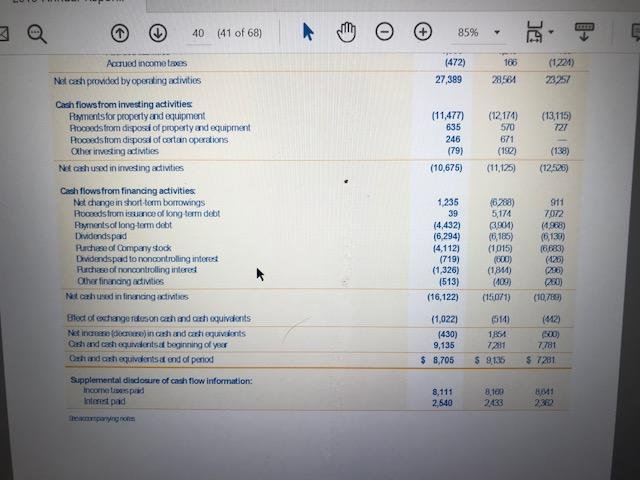

Fiscal Years Ended linusy 31, 2016 2015 $ 8,705 5,624 44,469 1,441 60,239 $ 9,135 6,778 45,141 2724 63278 Amountsin milions ASSETS Qurrent assets Cith and ash oquivalents Receivables not Inventones Prepaid expenses and other Total current assets Property and equipment Roperty and equipment less acumulated depreciation Poparty and equipment, not Property under capital lease and finanang obligations Poperty under capital lease and financing obligations less accumulated amortization Aparty under capitalore and finanang obligations net Goodwill Other adsand detened charges Total asets 176,958 (66,787) 110,171 177396 (63.115) 114280 11,096 (4,751) 6,345 16,695 6.131 $199,581 5,239 (2881) 2375 18,102 5,455 $203 490 $ LABILITIES AND EQUITY Quarantaines Stott tom bonowings Amountspeile Audibilities Portued income Long term deb due within one year Co m e and financing obligations due within one you Total current liabilities $ 2,708 38,487 19,607 521 2.745 551 54,619 1,592 38,410 19,152 1021 4,/91 Fiscal Years Ended linusy 31, 2016 2015 $ 8,705 5,624 44,469 1,441 60,239 $ 9,135 6,778 45,141 2724 63278 Amountsin milions ASSETS Qurrent assets Cith and ash oquivalents Receivables not Inventones Prepaid expenses and other Total current assets Property and equipment Roperty and equipment less acumulated depreciation Poparty and equipment, not Property under capital lease and finanang obligations Poperty under capital lease and financing obligations less accumulated amortization Aparty under capitalore and finanang obligations net Goodwill Other adsand detened charges Total asets 176,958 (66,787) 110,171 177396 (63.115) 114280 11,096 (4,751) 6,345 16,695 6.131 $199,581 5,239 (2881) 2375 18,102 5,455 $203 490 $ LABILITIES AND EQUITY Quarantaines Stott tom bonowings Amountspeile Audibilities Portued income Long term deb due within one year Co m e and financing obligations due within one you Total current liabilities $ 2,708 38,487 19,607 521 2.745 551 54,619 1,592 38,410 19,152 1021 4,/91 Consolidated Statements of Income Fiscal Years Ended.January 31, 2016 2015 2014 (Annountsin rrullions ecet per sharedata) Revenues Notes Membership and other income Total revenues Costs and expenses Cost of les Operating selling general and administrative expenses Operating income Interest: $478,614 3,516 482,130 $187.229 3122 485651 $173,076 3218 476294 360,984 97.041 365086 93,418 27,147 358.00 91 353 26,872 24,105 Dot 2,161 Capitalease and financing obligations Interest income 300 2,027 521 (81) 2,467 21,638 2012 263 (119) 2216 (113) 2318 24,799 Internet 7,584 (1,026) 6,558 15,080 881 (519) 7.985 16814 285 Income from continuing operations before income taxes Provision for income taxes Cel Deted Total provision for income taxes Income from continuing operations Income from discontinued operations net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Businet income per common share: E ncontro per common to from continu operasions anbutable to Walmart Bacinom pr o storom discontinued operations at but to W at Businet income per common share attributable to Walmart 8619 (514) 8,105 16551 144 16.035 15.080 (386) $ 14,694 17 099 (136) $ 16,363 S 16002 $ 4.58 3 $ 501 006 5 507 487 03 400 $ 4.58 360,984 97,041 24,105 365,086 93,418 27.147 368,080 91353 26872 2 161 300 2,027 521 (81) 2,467 21,638 (113) 2348 24,799 2072 283 (119) 2216 24,656 costs and expenses Cost of sales Operating, selling general and administrative expenses Operating income Interest: Debt Capital lease and financing obligations Interest income Interest, net Income from continuing operations before income taxes Provision for income taxes Quent Deferred Total provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Basic net income per common share: Bec income per common share from continuing operdons attributable to Walmart Racincome per common share from discontinued operations attributable to Walmart Basic net income per common share attributable to Walmart Diluted net income per common share: Dited income per common share from continuing operations attributable to Walmart Duted income por common share from discontinued operations anbutable to Walmart Diluted net income per common share attributable to Walmart Weighted average common shares outstanding: 7,584 (1,026) 6,558 15,080 8,500 (519) 7,985 16,814 285 8619 (514) 8,105 16,561 144 15,080 (386) $ 14,694 17099 (736) $ 16,363 16,685 (573) $16022 $ 4.58 $ 501 $ 487 006003 $ 507 $490 $ 4.58 $ 4.57 $ 499 $ 485 000003 $ 505 $ 488 $ 4.57 3230 3.210 Diluted Dividends dedared per common share 3,207 3.217 1.96 $ $ 10 $ 1 Consolidated Statements of Cash Rows F rided.inry 31, 2015 2014 2016 $ 15.080 $ 17,099 (285) 16,814 $ 18,026 (146) 16,551 15,080 turining Cash flows from operating activities Corrolidated net income Income from discontinued operations not of income tas Income from continuing coerdions Adjustments to reconale income from continuing operations to neath provided by operating activities Deprecation and amortization Decoding Other operating activities Chungesin c a nd abilities of affects of acquations Receivables De entones Accounts payable Acudits Accrued income tes Natash provided by operating activities 9,454 1672) 9.173 (505 785 8,870 2799 968 1.410 (19) (703) 2008 1.303 (472) 27,389 (580) (1228) 2678 1249 (506) (1687) 531 103 (1.724) 23257 28581 (11,477) 635 Cash flows from investing activities Payments for property and equipment Rossestrom disposal of property and equipment Podstrom deporal of Ortin operations Other activities N ach used in i ting activities (12,174) 570 (13.115) 727 246 79) 671 (1922) (11.125) (10,675) (12826) 1,235 Cash flows from firanding activities Nel d in short term bonowings Prostorninoflong-term dot Puso kong lommt Omonds Patrol Company stock Didondspad to noncontingin 14,432) 16.294) (4 112) 719) 10289 5174 32001 HS (1.015) XX 911 7072 ge 10130 683) 20) 2 Q 40 4410f68) A cthy o 85% Accrued incometes Net cash provided by operating activities (472) 27,389 166 28,564 (122) 73257 (11,477) (12174) Cash flows from investing activities Rayments for property and equipment Poobeds from diposal of property and equipment Hooaeds from disposal of certan operations Oxher testing activities (13,115) 727 570 635 246 (79) (10,675) 671 (192) (11,125) (138) (1226) Necah used in investing activities Cashflows from financing activities Net change in short or brows Poceeds from i nd of long term det Paments of long-term debt Dividendspad Purchase of Company stock Dividendspad to noncontrolling interest Racha n ocontrolling interest Other finang activities Natched in financing activities 1 235 39 14,432) (6 294) (4,112) (719) (1,326) (513) (16,122) 16.288) 5174 3904) (6.185) (1015) 800) (1864) 1400 911 7072 (4.968) (6137) (8683) (425) (236) 080) (150/1) (107) (514) Blect of change rateson cah and othequivalents Net incredere a and cash equivalents Cash and catch e vents beginning of your Chandast equivalentsat end of period (1,022) (430) 9,135 $ 8,705 (412) 200) 7 781 $ 7281 7231 $ 9.135 Supplemental disclosure of cash flow information: Incorpopad rad 8,111 2.540 8.180 2433 1941 222 margo Fiscal Years Ended linusy 31, 2016 2015 $ 8,705 5,624 44,469 1,441 60,239 $ 9,135 6,778 45,141 2724 63278 Amountsin milions ASSETS Qurrent assets Cith and ash oquivalents Receivables not Inventones Prepaid expenses and other Total current assets Property and equipment Roperty and equipment less acumulated depreciation Poparty and equipment, not Property under capital lease and finanang obligations Poperty under capital lease and financing obligations less accumulated amortization Aparty under capitalore and finanang obligations net Goodwill Other adsand detened charges Total asets 176,958 (66,787) 110,171 177396 (63.115) 114280 11,096 (4,751) 6,345 16,695 6.131 $199,581 5,239 (2881) 2375 18,102 5,455 $203 490 $ LABILITIES AND EQUITY Quarantaines Stott tom bonowings Amountspeile Audibilities Portued income Long term deb due within one year Co m e and financing obligations due within one you Total current liabilities $ 2,708 38,487 19,607 521 2.745 551 54,619 1,592 38,410 19,152 1021 4,/91 Fiscal Years Ended linusy 31, 2016 2015 $ 8,705 5,624 44,469 1,441 60,239 $ 9,135 6,778 45,141 2724 63278 Amountsin milions ASSETS Qurrent assets Cith and ash oquivalents Receivables not Inventones Prepaid expenses and other Total current assets Property and equipment Roperty and equipment less acumulated depreciation Poparty and equipment, not Property under capital lease and finanang obligations Poperty under capital lease and financing obligations less accumulated amortization Aparty under capitalore and finanang obligations net Goodwill Other adsand detened charges Total asets 176,958 (66,787) 110,171 177396 (63.115) 114280 11,096 (4,751) 6,345 16,695 6.131 $199,581 5,239 (2881) 2375 18,102 5,455 $203 490 $ LABILITIES AND EQUITY Quarantaines Stott tom bonowings Amountspeile Audibilities Portued income Long term deb due within one year Co m e and financing obligations due within one you Total current liabilities $ 2,708 38,487 19,607 521 2.745 551 54,619 1,592 38,410 19,152 1021 4,/91 Consolidated Statements of Income Fiscal Years Ended.January 31, 2016 2015 2014 (Annountsin rrullions ecet per sharedata) Revenues Notes Membership and other income Total revenues Costs and expenses Cost of les Operating selling general and administrative expenses Operating income Interest: $478,614 3,516 482,130 $187.229 3122 485651 $173,076 3218 476294 360,984 97.041 365086 93,418 27,147 358.00 91 353 26,872 24,105 Dot 2,161 Capitalease and financing obligations Interest income 300 2,027 521 (81) 2,467 21,638 2012 263 (119) 2216 (113) 2318 24,799 Internet 7,584 (1,026) 6,558 15,080 881 (519) 7.985 16814 285 Income from continuing operations before income taxes Provision for income taxes Cel Deted Total provision for income taxes Income from continuing operations Income from discontinued operations net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Businet income per common share: E ncontro per common to from continu operasions anbutable to Walmart Bacinom pr o storom discontinued operations at but to W at Businet income per common share attributable to Walmart 8619 (514) 8,105 16551 144 16.035 15.080 (386) $ 14,694 17 099 (136) $ 16,363 S 16002 $ 4.58 3 $ 501 006 5 507 487 03 400 $ 4.58 360,984 97,041 24,105 365,086 93,418 27.147 368,080 91353 26872 2 161 300 2,027 521 (81) 2,467 21,638 (113) 2348 24,799 2072 283 (119) 2216 24,656 costs and expenses Cost of sales Operating, selling general and administrative expenses Operating income Interest: Debt Capital lease and financing obligations Interest income Interest, net Income from continuing operations before income taxes Provision for income taxes Quent Deferred Total provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Basic net income per common share: Bec income per common share from continuing operdons attributable to Walmart Racincome per common share from discontinued operations attributable to Walmart Basic net income per common share attributable to Walmart Diluted net income per common share: Dited income per common share from continuing operations attributable to Walmart Duted income por common share from discontinued operations anbutable to Walmart Diluted net income per common share attributable to Walmart Weighted average common shares outstanding: 7,584 (1,026) 6,558 15,080 8,500 (519) 7,985 16,814 285 8619 (514) 8,105 16,561 144 15,080 (386) $ 14,694 17099 (736) $ 16,363 16,685 (573) $16022 $ 4.58 $ 501 $ 487 006003 $ 507 $490 $ 4.58 $ 4.57 $ 499 $ 485 000003 $ 505 $ 488 $ 4.57 3230 3.210 Diluted Dividends dedared per common share 3,207 3.217 1.96 $ $ 10 $ 1 Consolidated Statements of Cash Rows F rided.inry 31, 2015 2014 2016 $ 15.080 $ 17,099 (285) 16,814 $ 18,026 (146) 16,551 15,080 turining Cash flows from operating activities Corrolidated net income Income from discontinued operations not of income tas Income from continuing coerdions Adjustments to reconale income from continuing operations to neath provided by operating activities Deprecation and amortization Decoding Other operating activities Chungesin c a nd abilities of affects of acquations Receivables De entones Accounts payable Acudits Accrued income tes Natash provided by operating activities 9,454 1672) 9.173 (505 785 8,870 2799 968 1.410 (19) (703) 2008 1.303 (472) 27,389 (580) (1228) 2678 1249 (506) (1687) 531 103 (1.724) 23257 28581 (11,477) 635 Cash flows from investing activities Payments for property and equipment Rossestrom disposal of property and equipment Podstrom deporal of Ortin operations Other activities N ach used in i ting activities (12,174) 570 (13.115) 727 246 79) 671 (1922) (11.125) (10,675) (12826) 1,235 Cash flows from firanding activities Nel d in short term bonowings Prostorninoflong-term dot Puso kong lommt Omonds Patrol Company stock Didondspad to noncontingin 14,432) 16.294) (4 112) 719) 10289 5174 32001 HS (1.015) XX 911 7072 ge 10130 683) 20) 2 Q 40 4410f68) A cthy o 85% Accrued incometes Net cash provided by operating activities (472) 27,389 166 28,564 (122) 73257 (11,477) (12174) Cash flows from investing activities Rayments for property and equipment Poobeds from diposal of property and equipment Hooaeds from disposal of certan operations Oxher testing activities (13,115) 727 570 635 246 (79) (10,675) 671 (192) (11,125) (138) (1226) Necah used in investing activities Cashflows from financing activities Net change in short or brows Poceeds from i nd of long term det Paments of long-term debt Dividendspad Purchase of Company stock Dividendspad to noncontrolling interest Racha n ocontrolling interest Other finang activities Natched in financing activities 1 235 39 14,432) (6 294) (4,112) (719) (1,326) (513) (16,122) 16.288) 5174 3904) (6.185) (1015) 800) (1864) 1400 911 7072 (4.968) (6137) (8683) (425) (236) 080) (150/1) (107) (514) Blect of change rateson cah and othequivalents Net incredere a and cash equivalents Cash and catch e vents beginning of your Chandast equivalentsat end of period (1,022) (430) 9,135 $ 8,705 (412) 200) 7 781 $ 7281 7231 $ 9.135 Supplemental disclosure of cash flow information: Incorpopad rad 8,111 2.540 8.180 2433 1941 222 margo