Answered step by step

Verified Expert Solution

Question

1 Approved Answer

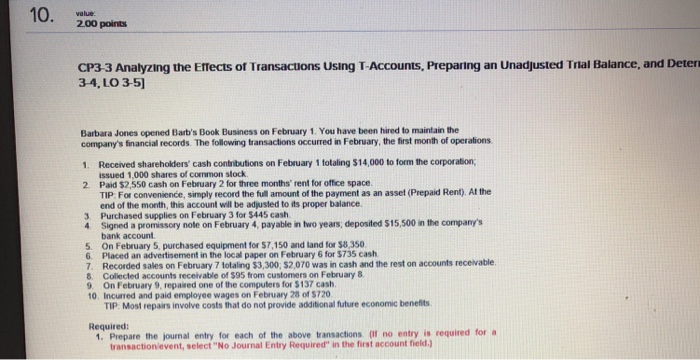

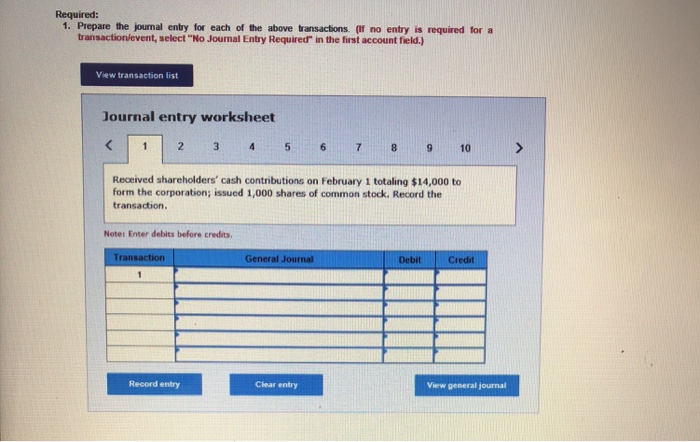

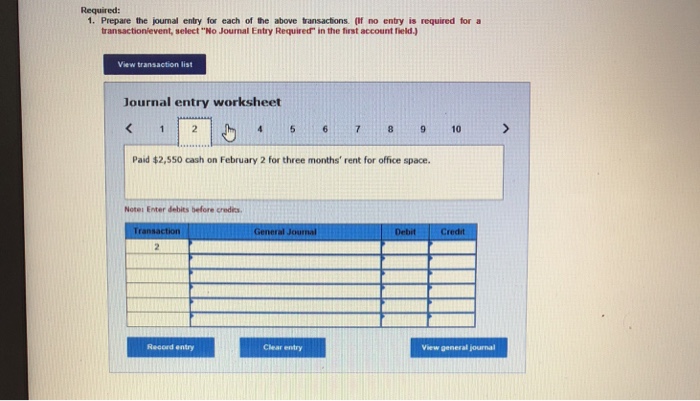

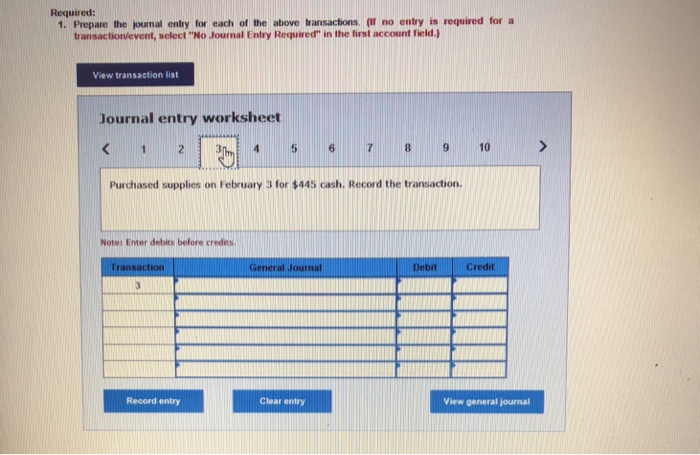

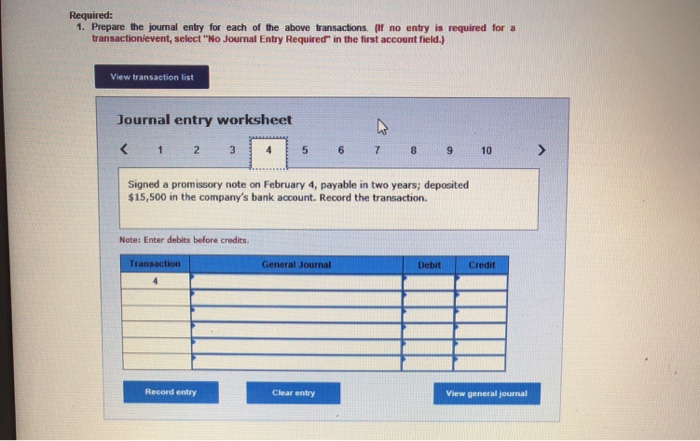

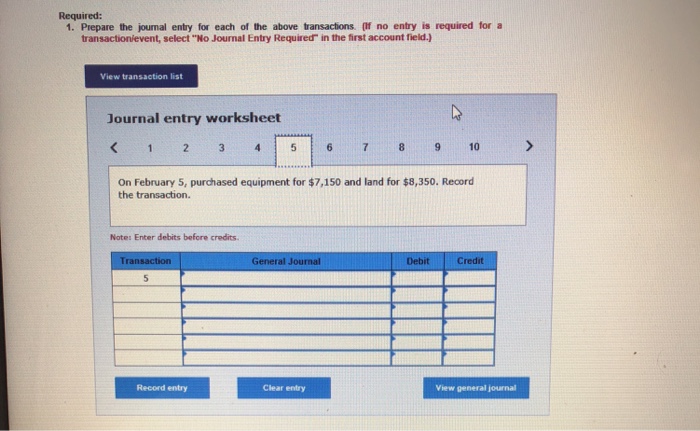

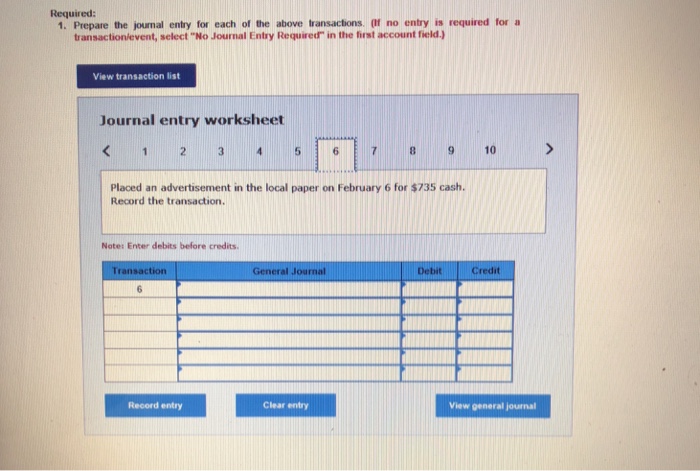

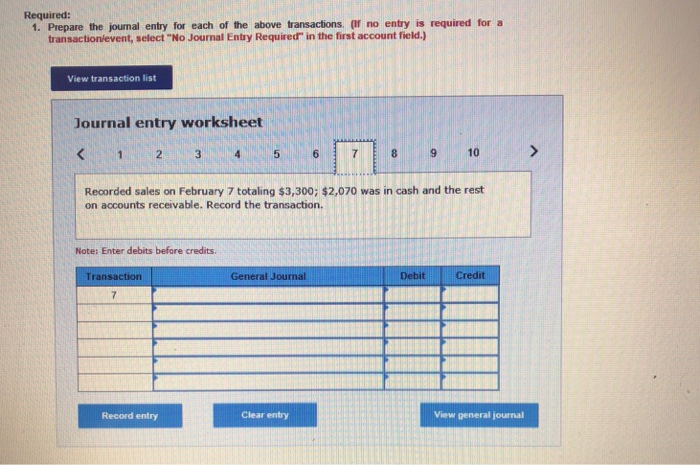

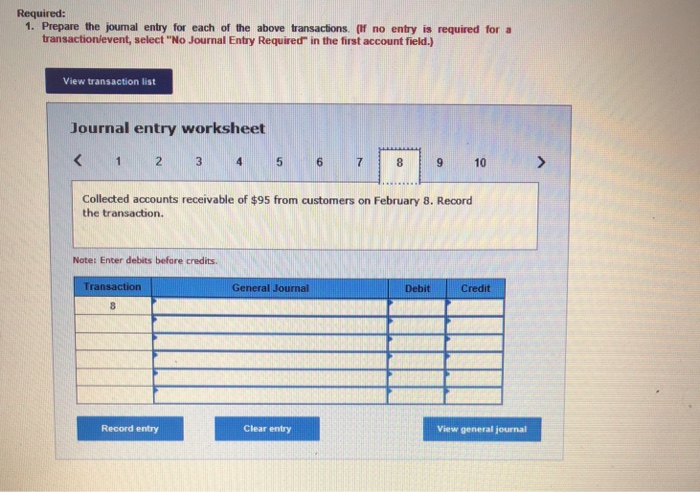

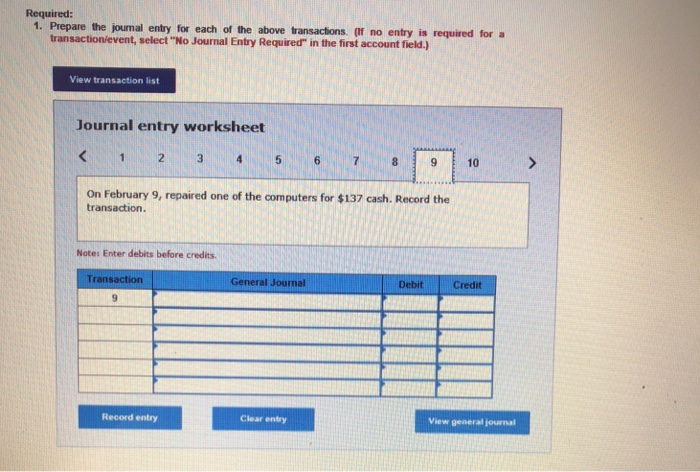

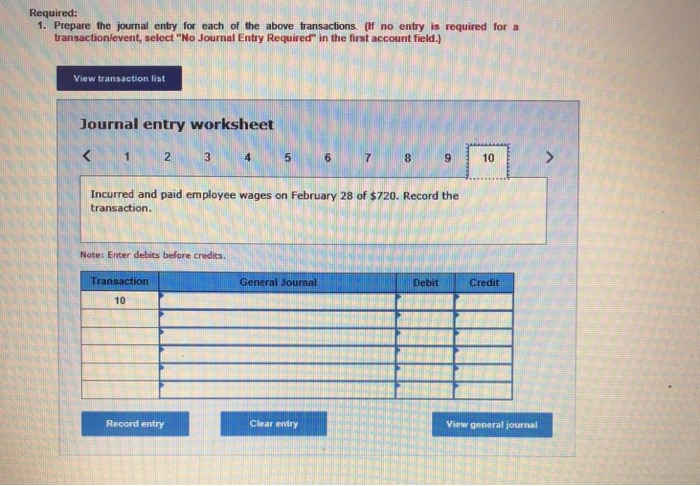

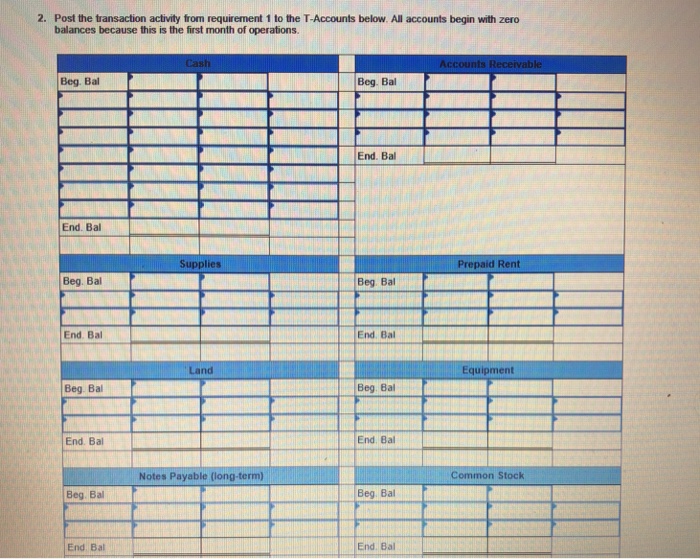

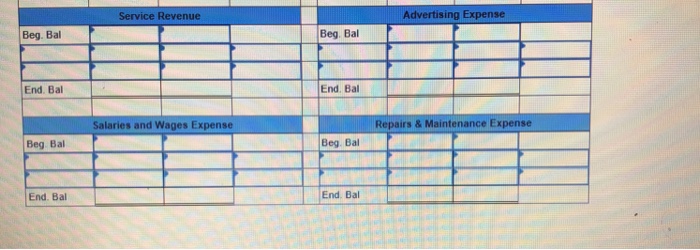

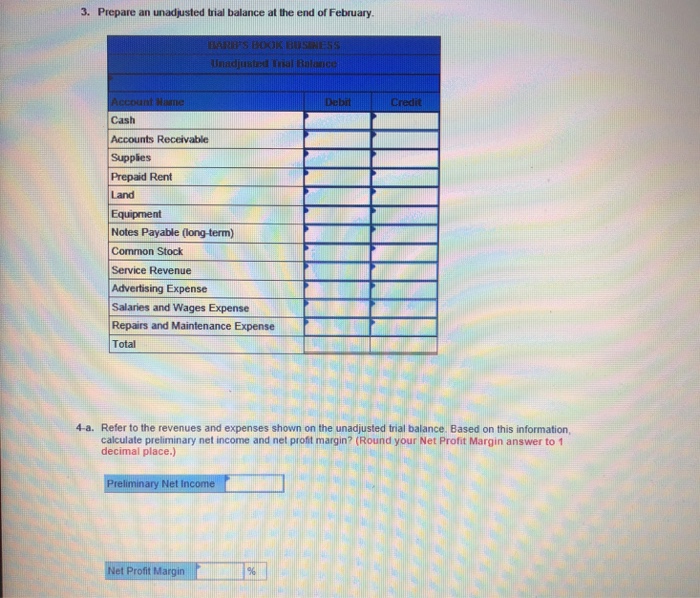

Can you please help me answering this question? I tried to, but I couldnt. Please! Thanks 2.00 points ? 3.3 Analyzing the Erects on ransactions

Can you please help me answering this question? I tried to, but I couldnt. Please!

Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started