Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me as much as possible on how to get this solution. I am very confused and need the excel formulas for

Can you please help me as much as possible on how to get this solution. I am very confused and need the excel formulas for me to get the solution this question. I have no idea how to go about doing this. Below is the question given and the solution that was provided.

Solution

Google Solution

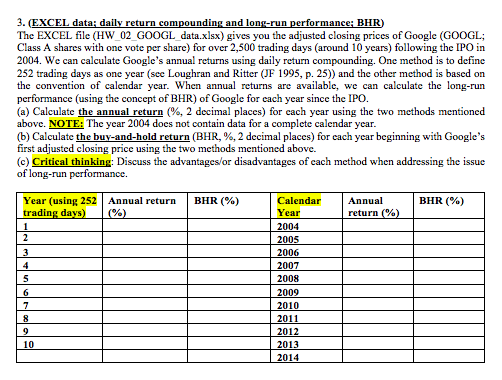

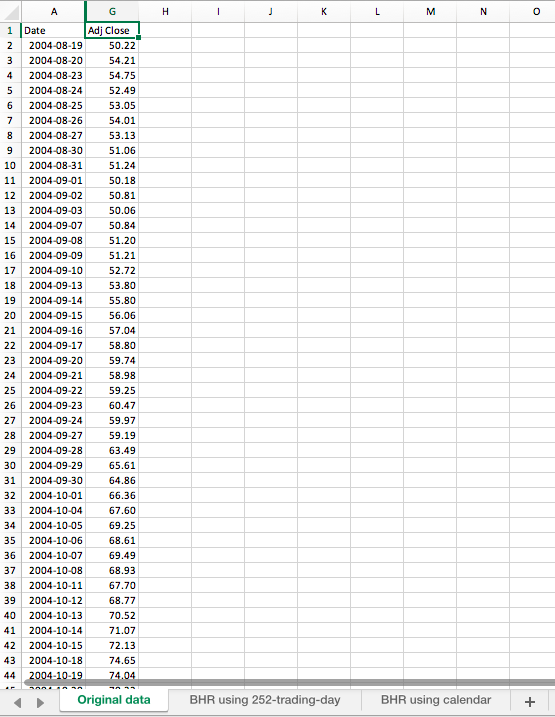

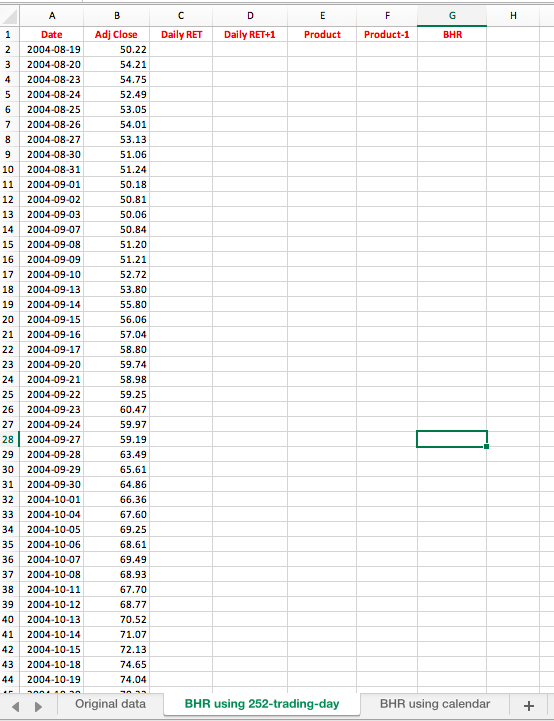

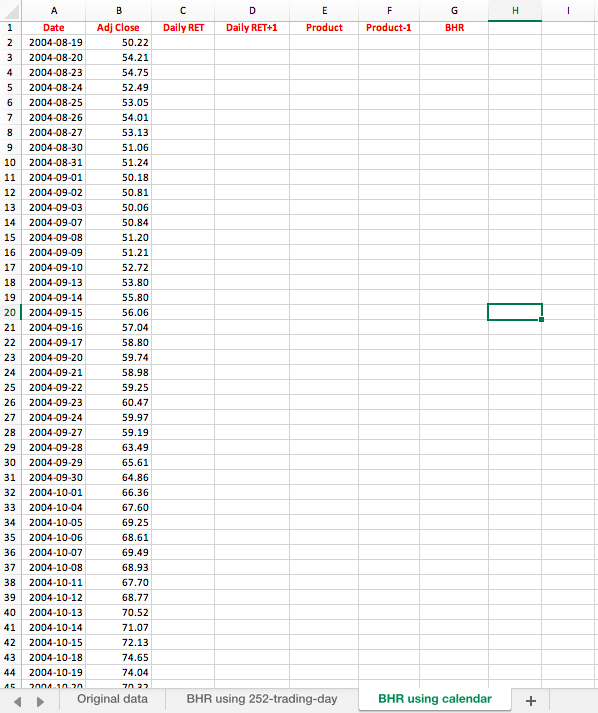

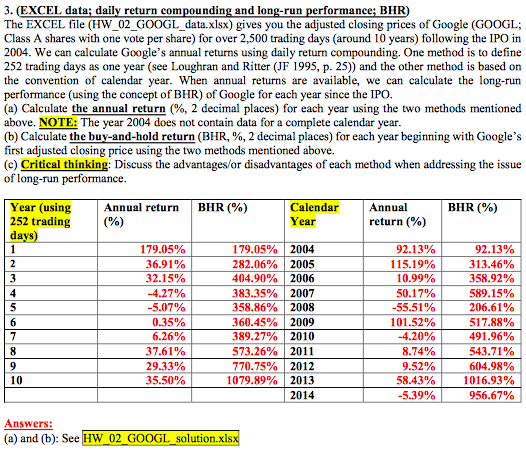

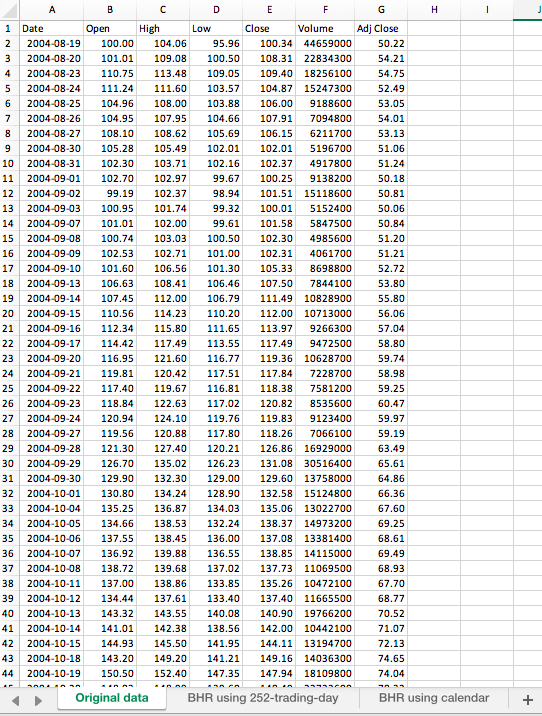

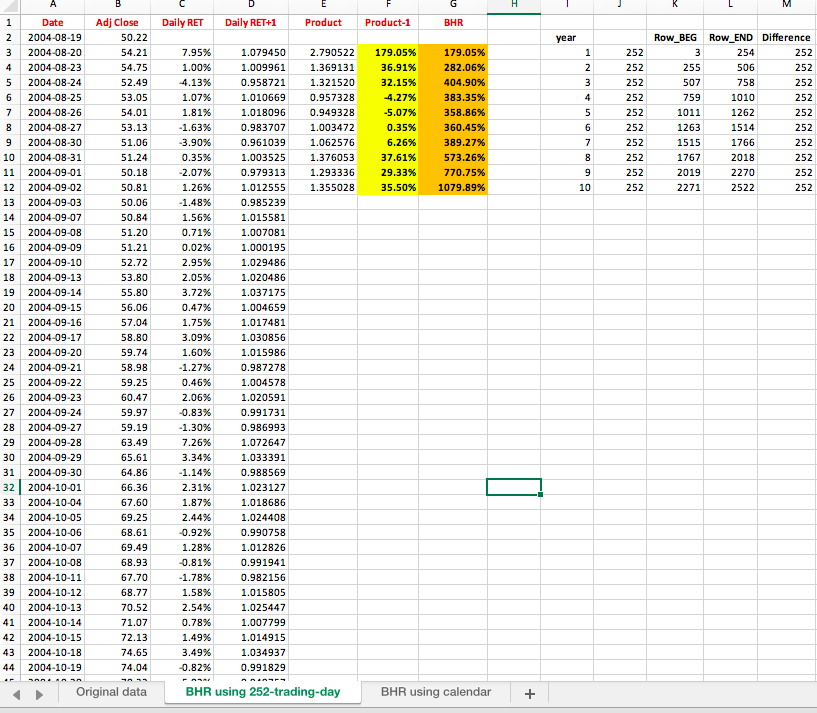

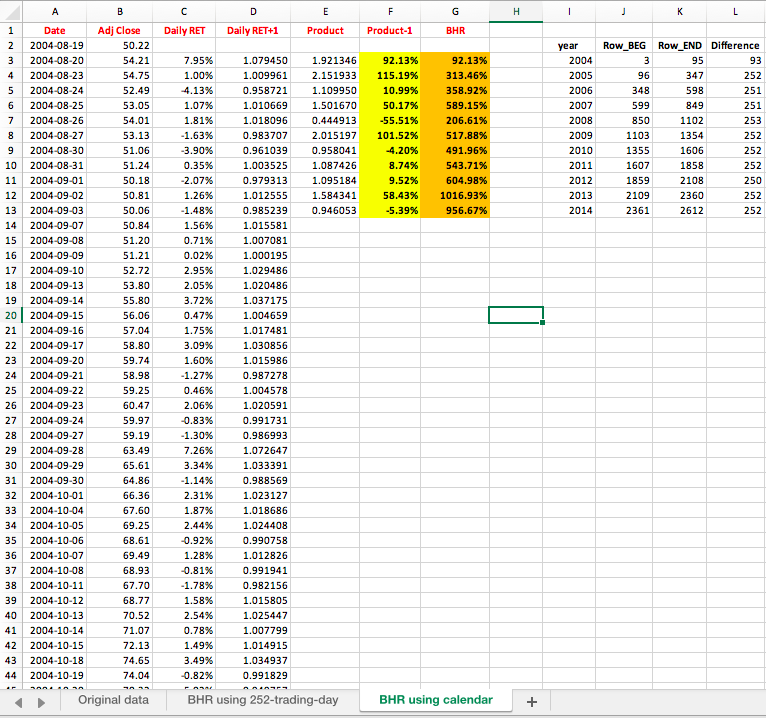

3. EXCEL data: daily return com The EXCEL file (HW 02 GOOGL data.xlsx) gives you the adjusted closing prices of Google (GOOGL; Class A shares with one vote per share) for over 2,500 trading days (around 10 years) following the IPO in 2004. We can calculate Google's annual returns using daily return compounding. One method is to define 252 trading days as one year (sec Loughran and Ritter (JF 1995, p. 25)) and the other method is based on the convention of calendar year. When annual returns are available, we can calculate the long-run performance (using the concept of BHR) of Google for each year since the IPO. (a) Calculate the annual return %, 2 decimal places) for cach year using the two methods mentioned above. NOTE: The year 2004 does not contain data for a complete calendar year (b) Calculate the buy-and-hold return (BHR, % 2 decimal places) for each year beginning with Google's first adjusted closing price using the two methods mentioned above. (c) Critical thinking: Discuss the advantages/or disadvantages of cach method when addressing the issue of long-run performance. Year (using 252 | Annual return tradin | BHR (%) Calendar Year Annual return BHR (%) 2005 2008 2009 01 3. EXCEL data: daily return com The EXCEL file (HW 02 GOOGL data.xlsx) gives you the adjusted closing prices of Google (GOOGL; Class A shares with one vote per share) for over 2,500 trading days (around 10 years) following the IPO in 2004. We can calculate Google's annual returns using daily return compounding. One method is to define 252 trading days as one year (sec Loughran and Ritter (JF 1995, p. 25)) and the other method is based on the convention of calendar year. When annual returns are available, we can calculate the long-run performance (using the concept of BHR) of Google for each year since the IPO. (a) Calculate the annual return %, 2 decimal places) for cach year using the two methods mentioned above. NOTE: The year 2004 does not contain data for a complete calendar year (b) Calculate the buy-and-hold return (BHR, % 2 decimal places) for each year beginning with Google's first adjusted closing price using the two methods mentioned above. (c) Critical thinking: Discuss the advantages/or disadvantages of cach method when addressing the issue of long-run performance. Year (using 252 | Annual return tradin | BHR (%) Calendar Year Annual return BHR (%) 2005 2008 2009 01

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started